By Jared S. Hopkins

More patients are turning to mail or courier to get their

prescription drugs during coronavirus lockdowns, a shift from the

traditional visit with a pharmacist that is expected to endure

after the pandemic subsides.

While waiting out California's stay-at-home order in March on

his brother's house boat near San Francisco, Rich Goldman exhausted

his supply of cholesterol and blood-pressure drugs. So he found an

online pharmacy that would ship the drugs to him.

"I didn't want to venture out if I could avoid it," said Mr.

Goldman, a 60-year-old marketing employee. He said the pharmacy,

Genius Rx, sent his prescriptions within several days.

During the last week of March, mail-order prescriptions grew 21%

from the previous year to bring their share of the prescription

drug market to 5.8%, the highest share in at least two years,

according to data from SunTrust Robinson Humphrey analyst Gregg

Gilbert.

Drugmaker Eli Lilly & Co., which sees about one-quarter of

its U.S. business ship by mail, said more of its products have been

processed that way during the pandemic. Pfizer Inc. said that for

patients in its assistance program, it is sending more medicines

directly and extending shipments from 30-day to 60-day

supplies.

"It's clear that the old model from three months ago probably

won't simply resume," said Stephen Eckel, an associate dean at the

University of North Carolina Eshelman School of Pharmacy.

The increase in mailed prescription drugs is among several

changes sweeping through medicine as a result of the coronavirus

pandemic, including expanded use of virtual doctor visits. Experts

predict many of the changes will become permanent, reshaping

care.

Filling prescriptions in person won't disappear, industry

experts said. A trip to the pharmacy has been a staple for decades,

and many patients with several prescriptions prefer to rely on

their neighborhood pharmacist. Whenever the pandemic ends, a

significant number of customers are expected to return to

stores.

Visits to the pharmacy account for the bulk of the 3.8 billion

prescriptions filled each year in the U.S. Prescription-drug sales

at pharmacies totaled $336 billion in 2018, according to the most

recent data from health-research firm Iqvia Holdings Inc.

Yet the longtime practice has been ripe for a makeover, just

like the one retail has experienced. Younger patients, with fewer

prescriptions and accustomed to ordering online, are likely to

embrace the change and stick with it, industry experts said.

Increased use of mail-order pharmacies could spell trouble for

independent bricks-and-mortar drugstores, they said.

Locally owned pharmacies have already been struggling to compete

against national chains, a situation made worse as some health

plans and drug-benefit managers steer patients to large mail-order

pharmacies.

To compete, many local pharmacies have ramped up their own

mail-order and home-delivery services during the pandemic, said

Douglas Hoey, Chief Executive Officer of the National Community

Pharmacists Association, a trade group. He said many patients

prefer interacting with pharmacists and worry about their medicines

arriving on time.

To protect their bricks-and-mortar stores, the big chains had

sought to discourage use of mail-order pharmacies by, among other

things, giving health plans discounts on drug prices. In recent

years the chains set up their own mail-order operations, which

stand to benefit now.

AllianceRx Walgreens Prime, a joint venture between retailer

Walgreens Boots Alliance Inc. and Prime Therapeutics LLC, a

pharmacy-benefits manager owned by health insurers, counts 15% more

home-delivery customers and 20% more volume since Jan. 1, with most

of the growth occurring after the coronavirus pandemic hit the

U.S.

The new customers wanted to try home delivery because they

weren't leaving their homes, while existing customers were stocking

up on medicines, AllianceRx Walgreens Prime CEO Joel Wright said.

He said the firm has hired about 200 new employees to meet the new

demand.

"I don't think we'll see the entire increase remain, but I do

think we've seen a notable shift in the business," Mr. Wright

said.

The shift could benefit new entrants to the pharmacy market such

as Amazon.com Inc., said Adam Fein, CEO of the Drug Channels

Institute, which provides research on the drug-supply chain. Amazon

bought the online pharmacy PillPack in 2018.

Honeybee Health Inc., a startup pharmacy in Culver City, Calif.,

that mails prescription drugs to patients who aren't using

insurance, is processing about 3,000 prescriptions a day, up 50%

since early March, said co-founder Jessica Nouhavandi.

Capsule Corp., which provides same-day delivery by courier in

New York City, is seeing a fivefold weekly increase in new

customers since early March, said CEO Eric Kinariwala. To keep up,

employee count has nearly doubled to more than 800, and the firm in

April accelerated expansion to Chicago and other cities.

"Doctors are saying to patients, 'Don't come in if you think you

have the flu, but also, 'Don't go into the pharmacy,'" he said.

Increased use of mail-order pharmacies has been a long time in

coming. Their primary customers have been patients with cancer and

other diseases who take drugs that are expensive, can't simply be

swallowed and may require special storage.

As use of cancer and other specialty drugs has increased, mail

pharmacies have started taking off, capturing more than half of the

industry's prescription revenue growth over the past six years,

said Mr. Fein of the Drug Channels Institute.

Mail-order prescriptions also found demand, as online pharmacies

used lower prices to appeal to patients concerned about drug

costs.

The coronavirus pandemic accelerated that increase. New

customers, forced to use more digital services, turned to

mail-order pharmacy apps and websites for prescriptions, while

pharmacies expanded their delivery areas.

Some states and health plans waived refill limits to encourage

patients to get 90 days of drug supplies, instead of 30 days. And

pharmacies waived delivery fees.

CVS Health Corp. saw a 10-fold increase in pharmacy home

deliveries during the first-three months of this year, mostly since

waiving fees in early March, a spokesman said. Express Scripts, a

subsidiary of insurer Cigna Corp., said it is processing more

home-delivery orders since stay-at-home measures began in March.

Walgreens is also seeing a boost in demand for prescription

delivery during the pandemic, a spokesman said.

Write to Jared S. Hopkins at jared.hopkins@wsj.com

(END) Dow Jones Newswires

May 12, 2020 07:14 ET (11:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

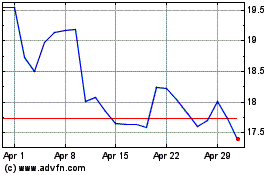

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

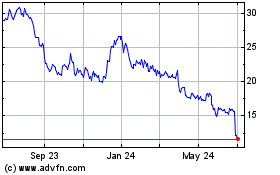

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Apr 2023 to Apr 2024