Current Report Filing (8-k)

March 26 2021 - 4:36PM

Edgar (US Regulatory)

0001463972

false

0001463972

2021-03-25

2021-03-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

March 25, 2021

VUZIX CORPORATION

(Exact name of registrant as specified in

its charter)

Delaware

(State or other jurisdiction of incorporation)

|

001-35955

|

04-3392453

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

25 Hendrix Road, Suite A,

West Henrietta, New York 14586

(Address of principal executive offices)(Zipcode)

(585) 359-5900

(Registrant’s Telephone Number, Including

Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered:

|

|

Common Stock, par value $0.001

|

|

VUZI

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On March 25, 2021, Vuzix Corporation (the “Company”) entered

into an underwriting agreement with BTIG, LLC, as representative of the underwriters identified therein (the “underwriters”),

pursuant to which the Company agreed to issue and sell to the underwriters, in an underwritten public offering 4,146,342 shares of common

stock, at a public offering price of $20.50 per share (the “Offering”), less underwriting discounts and commissions. The Company

has also granted to the underwriters a 30-day option to purchase up to 621,951 additional shares of common stock to cover over-allotments,

if any. The Company expects to receive approximately $85 million in gross proceeds from the Offering, before deducting underwriting discounts

and commissions and estimated offering expenses. The shares are being offered and sold pursuant to the Company’s effective registration

statement (the “Registration Statement”) on Form S-3 (Registration No. 333-252673), which was declared effective by the Securities

and Exchange Commission (the “SEC”) on February 9, 2021, and the base prospectus included therein, as supplemented by the

preliminary prospectus supplement filed with the SEC on March 25, 2021, and the final prospectus supplement expected to be filed with

the SEC on or about March 26, 2021. The Offering is expected to close on or about March 30, 2021, subject to satisfaction of customary

closing conditions. The Company intends to use net proceeds from the Offering for general corporate purposes, including working capital

to accelerate the building of finished goods inventory to address increasing customer demand, new technology development, new product

development, purchases of technology, expansion of the Company’s software offerings, and possible related acquisitions of other

firms.

The underwriting agreement contains customary representations, warranties

and covenants of the Company, customary conditions to closing, indemnification obligations of the Company and the underwriter, including

for liabilities under the Securities Act of 1933, as amended, and termination and other provisions customary for transactions of this

nature. All of the Company’s executive officers and directors have also agreed not to sell or transfer any securities of the Company

held by them for a period of 90 days from March 25, 2021, subject to limited exceptions.

The above description of the underwriting agreement is qualified in

its entirety by the underwriting agreement, which is attached to this report as Exhibit 1.1 and which is incorporated by reference into

the Registration Statement.

Sichenzia Ross Ference LLP, counsel to the Company, has issued an opinion

to the Company regarding the validity of the securities to be issued in the Offering. A copy of the opinion is filed as Exhibit 5.1 to

this Current Report on Form 8-K.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements

that involve risks and uncertainties, such as statements related to the anticipated closing of the Offering and the amount of proceeds

expected from the Offering. The risks and uncertainties involved include the Company’s ability to satisfy certain conditions to

closing on a timely basis or at all, as well as other risks detailed from time to time in the Company’s filings with the SEC. You

are cautioned not to place undue reliance on forward-looking statements, which are based on the Company’s current expectations and

assumptions and speak only as of the date of this report. The Company does not intend to revise or update any forward-looking statement

in this report to reflect events or circumstances arising after the date hereof, except as may be required by law.

Item 8.01 Other Events.

On March 26, 2021, the Company issued a press release regarding the

pricing of the underwritten public offering. A copy of the press release is attached as Exhibit 99.1 hereto.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Date: March 26, 2021

|

VUZIX CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ Grant Russell

|

|

|

|

Grant Russell

Chief Financial Officer

|

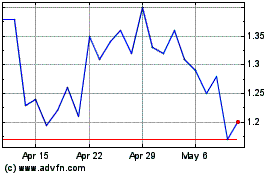

Vuzix (NASDAQ:VUZI)

Historical Stock Chart

From Mar 2024 to Apr 2024

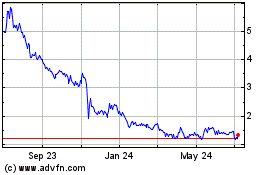

Vuzix (NASDAQ:VUZI)

Historical Stock Chart

From Apr 2023 to Apr 2024