VirTra, Inc.

(NASDAQ: VTSI) (“VirTra”), a global

provider of training simulators for the law enforcement, military,

educational and commercial markets, reported results for the first

quarter ended March 31, 2020. The financial statements are

available on VirTra’s website and here.

First Quarter 2020 and Recent Highlights:

- Received $1.6 million IDIQ (indefinite delivery/indefinite

quantity) contract from the Department of State for the Republic of

Mexico for use-of-force simulators and police driving

simulators

- Received $1.1 million order through new distributor in Europe

to provide European law enforcement and military personnel with

industry-leading technology and training methods

- Released new V-VICTA (VirTra Virtual Interactive Coursework

Training Academy) training curriculum to help law enforcement

communicate and interact more effectively and positively with

individuals with autism

- Launched a new website catered to both law enforcement and

military to better market products to prospective customers and

increase sales

- Secured contracts with new customers in Belleview, Orlando, and

other police departments and received maintenance renewal and

upgrades with existing customers, including multiple across

Australia

- Attended 23 events, demos and tradeshows in the first ten weeks

of the year

First Quarter 2020 Financial Highlights:

|

All figures in millions, except per share data |

Q1 2020 |

Q1 2019 |

% Δ |

|

Total Revenue |

$ |

3.3 |

|

$ |

3.1 |

|

9 |

% |

| |

|

|

|

|

Gross Profit |

$ |

1.6 |

|

$ |

1.8 |

|

-11 |

% |

|

Gross Margin |

|

47.8 |

% |

|

59.0 |

% |

-19 |

% |

| |

|

|

|

| Net

Income (Loss) |

$ |

(0.4 |

) |

$ |

(0.3 |

) |

24 |

% |

|

Diluted EPS |

$ |

(0.05 |

) |

$ |

(0.04 |

) |

25 |

% |

| |

|

|

|

Management Commentary

“During the first quarter of 2020, we continued to build upon

the momentum generated in the second half of last year, despite

impediments that arose at the end of March,” said Bob Ferris,

Chairman and Chief Executive Officer of VirTra. “Financially, the

quarter was highlighted by a 9% increase in revenues to $3.3

million from the first quarter of last year. Operationally, the

quarter was highlighted by a $1.1 million order from a new

distributor in Europe, which is helping expand VirTra’s reputation

as the leader in simulation training to more countries abroad. In

the last two weeks of March as stay-at-home policies were

instituted, some customers requested to delay delivery and

installation of orders, which cut into our first quarter results

but contributed to our record $11.3 million backlog.

“Despite the uncertain COVID-19 macro environment, we have not

seen evidence of sales declining or demand weakening as of today.

However, out of an abundance of caution, we have taken prudent

measures to fortify our balance sheet and ensure we have the

necessary resources to continue executing against our strategic

initiatives. Properly trained law enforcement and military

personnel is integral to the security and well-being of everyone,

and we plan to ensure our growing list of customers have access to

the best simulation training available throughout 2020 and

beyond.”

First Quarter 2020 Financial Results

Total revenue increased 9% to $3.3 million from $3.1 million in

the first quarter of 2019. The increase in total revenue was due to

increases in sales of simulators, accessories, curriculum and

training.

Gross profit decreased 11% to $1.6 million (47.8% of total

revenue) from $1.8 million (59.0% of total revenue) in the first

quarter of 2019. The decrease in gross profit was due to increases

in production staff to support larger volumes of sales in the

future as well as product mix with varying quantity of systems,

accessories and services sold.

Net operating expense decreased 7% to $2.1 million from $2.3

million in the first quarter of 2019. The decrease was mainly due

to reduced selling, general and administrative costs for labor,

benefits, travel, and professional services expense.

Loss from operations was $512,000, compared to a loss of

$457,000 in the first quarter of 2019.

Net loss totaled $389,000, or $(0.05) per diluted share,

compared to net loss of $313,000, or $(0.04) per diluted share, in

the first quarter of 2019.

Adjusted EBITDA loss was $326,000, compared to a loss of

$278,000 in the first quarter of 2019.

At March 31, 2020, backlog totaled approximately $11.3 million.

At March 31, 2020, accounts receivable and unbilled revenues

totaled approximately $5.2 million compared to $5.9 million at

December 31, 2019, a decrease of $695,000. Cash and cash

equivalents and certificates of deposit totaled $3.8 million at

March 31, 2020.

Subsequent Events

On May 8, 2020, VirTra received approval for a $1.3 million

Paycheck Protection Program (PPP) loan from Wells Fargo Bank under

the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The

loan, which is administered through the Small Business Association

(SBA), matures on May 8, 2022 and bears an interest rate of 1% per

annum. In accordance with the Paycheck Protection Program, VirTra

intends to use the funds for designated expenses, which may include

payroll costs, group healthcare benefits, and other permitted

expenses. Under the terms of the PPP loan, up to the entire amount

of principal and accrued interest may be forgiven to the extent PPP

loan proceeds are used for qualifying expenses. VirTra intends to

use its entire PPP loan amount for designated qualifying expenses

and to apply for forgiveness in accordance with the terms of the

PPP loan. No assurance can be given that VirTra will obtain

forgiveness of the PPP loan in whole or in part.

Conference Call

VirTra management will hold a conference call today (May 12,

2020) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss

these results. VirTra’s Chairman and CEO, Bob Ferris, and CFO, Judy

Henry, will host the call, followed by a question and answer

period.

U.S. dial-in number: 844-369-8770International number:

862-298-0840

Please call the conference telephone number 5-10 minutes prior

to the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact VirTra’s IR team at

949-574-3860.

The conference call will be broadcast live and available for

replay here and via the investor relations section of VirTra’s

website.

A replay of the conference call will be available after 7:30

p.m. Eastern time on the same day through May 26, 2020.

Toll-free replay number: 877-481-4010International replay

number: 919-882-2331Replay ID: 34580

About VirTra VirTra (NASDAQ: VTSI) is a global

provider of judgmental use of force training simulators, firearms

training simulators and driving simulators for the law enforcement,

military, educational and commercial markets. The company’s

patented technologies, software, and scenarios provide intense

training for de-escalation, judgmental use-of-force, marksmanship

and related training that mimics real-world situations. VirTra’s

mission is to save and improve lives worldwide through practical

and highly-effective virtual reality and simulator technology.

Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation

and amortization and before other non-operating costs and income

(“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted

EBITDA also includes non-cash stock option expense and other than

temporary impairment loss on investments. Other companies may

calculate Adjusted EBITDA differently. VirTra calculates its

Adjusted EBITDA to eliminate the impact of certain items it does

not consider to be indicative of its performance and its ongoing

operations. Adjusted EBITDA is presented herein because management

believes the presentation of Adjusted EBITDA provides useful

information to VirTra’s investors regarding VirTra’s financial

condition and results of operations and because Adjusted EBITDA is

frequently used by securities analysts, investors and other

interested parties in the evaluation of companies in VirTra’s

industry, several of which present a form of Adjusted EBITDA when

reporting their results. Adjusted EBITDA has limitations as an

analytical tool and should not be considered in isolation or as a

substitute for analysis of VirTra’s results as reported under

accounting principles generally accepted in the United States of

America (“GAAP”). Adjusted EBITDA should not be considered as an

alternative for net income, cash flows from operating activities

and other consolidated income or cash flows statement data prepared

in accordance with GAAP or as a measure of profitability or

liquidity. A reconciliation of net income to Adjusted EBITDA is

provided in the following table:

| |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

| |

|

|

|

|

|

|

Increase |

|

% |

|

Reconciliation of net loss to adjusted EBITDA |

March 31, 2020 |

|

March 31, 2019 |

|

(Decrease) |

|

Change |

| |

|

|

|

|

|

|

|

|

|

| |

Net Loss |

$ |

(389,410 |

) |

|

$ |

(312,902 |

) |

|

$ |

(76,508 |

) |

|

24 |

% |

| |

|

Adjustments: |

|

|

|

|

|

|

|

| |

|

Provision for income taxes |

|

(103,000 |

) |

|

|

(107,000 |

) |

|

|

4,000 |

|

|

-4 |

% |

| |

|

Depreciation and amortization |

|

89,676 |

|

|

|

71,794 |

|

|

|

17,882 |

|

|

25 |

% |

| |

EBITDA |

$ |

(402,734 |

) |

|

$ |

(348,108 |

) |

|

$ |

(54,626 |

) |

|

16 |

% |

| |

|

Right of use amortization |

|

72,843 |

|

|

|

69,989 |

|

|

|

2,854 |

|

|

4 |

% |

| |

|

Reserve for note receivable |

|

3,639 |

|

|

|

- |

|

|

|

3,639 |

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

Adjusted EBITDA |

$ |

(326,252 |

) |

|

$ |

(278,119 |

) |

|

$ |

(48,133 |

) |

|

17 |

% |

| |

|

|

|

|

|

|

|

|

|

Forward-Looking Statements

The information in this discussion contains forward-looking

statements and information within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, which are subject to

the “safe harbor” created by those sections. The words

“anticipates,” “believes,” “estimates,” “expects,” “intends,”

“may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,”

“potential,” “continue,” “would” and similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. We may

not actually achieve the plans, intentions or expectations

disclosed in our forward-looking statements and you should not

place undue reliance on our forward-looking statements. Actual

results or events could differ materially from the plans,

intentions and expectations disclosed in the forward-looking

statements that we make. The forward-looking statements are

applicable only as of the date on which they are made, and we do

not assume any obligation to update any forward-looking statements.

All forward-looking statements in this document are made based on

our current expectations, forecasts, estimates and assumptions, and

involve risks, uncertainties and other factors that could cause

results or events to differ materially from those expressed in the

forward-looking statements. In evaluating these statements, you

should specifically consider various factors, uncertainties and

risks that could affect our future results or operations. These

factors, uncertainties and risks may cause our actual results to

differ materially from any forward-looking statement set forth in

the reports we file with or furnish to the SEC. You should

carefully consider these risk and uncertainties described and other

information contained in the reports we file with or furnish to the

Securities and Exchange Commission before making any investment

decision with respect to our securities. All forward-looking

statements attributable to us or persons acting on our behalf are

expressly qualified in their entirety by this cautionary

statement.

Investor Relations Contact:

Matt Glover or Charlie Schumacher

VTSI@gatewayir.com949-574-3860

| VIRTRA,

INC. |

|

| CONDENSED

BALANCE SHEETS |

|

|

|

|

|

|

| |

|

March 31, 2020 |

|

December 31, 2019 |

| |

|

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

| |

Cash and

cash equivalents |

$

3,116,893 |

|

$

1,415,091 |

| |

Certificates

of deposit |

720,000 |

|

1,915,000 |

| |

Accounts

receivable, net |

3,371,034 |

|

2,307,972 |

| |

Interest

receivable |

6,752 |

|

7,340 |

| |

Inventory,

net |

2,145,086 |

|

1,949,414 |

| |

Unbilled

revenue |

1,821,636 |

|

3,579,942 |

| |

Prepaid

expenses and other current assets |

471,428 |

|

353,975 |

| |

|

|

|

|

| |

Total current assets |

11,652,829 |

|

11,528,734 |

| |

|

|

|

|

|

Long-term assets: |

|

|

|

| |

Property and

equipment, net |

1,137,641 |

|

1,028,198 |

| |

Operating

lease right-of-use asset, net |

1,318,030 |

|

1,390,873 |

| |

Intangible

assets, net |

238,895 |

|

217,930 |

| |

That's

Eatertainment note receivable, long term, net, related party |

291,110 |

|

291,110 |

| |

Security

deposits, long-term |

19,712 |

|

19,712 |

| |

Other

assets, long-term |

333,559 |

|

351,236 |

| |

Deferred tax

asset, net |

1,895,000 |

|

1,792,000 |

| |

Investment

in That's Eatertainment, related party |

840,000 |

|

840,000 |

| |

|

|

|

|

| |

Total long-term assets |

6,073,947 |

|

5,931,059 |

| |

|

|

|

|

|

Total assets |

$ 17,726,776 |

|

$ 17,459,793 |

| |

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS' EQUITY |

|

|

|

| |

|

|

|

|

|

Current liabilities: |

|

|

|

| |

Accounts

payable |

$

501,426 |

|

$

621,127 |

| |

Accrued

compensation and related costs |

734,336 |

|

611,487 |

| |

Accrued

expenses and other current liabilities |

474,308 |

|

334,751 |

| |

Operating

lease liability, short-term |

303,182 |

|

297,244 |

| |

Deferred

revenue, short-term |

2,956,486 |

|

2,490,845 |

| |

|

|

|

|

| |

Total current liabilities |

4,969,738 |

|

4,355,454 |

| |

|

|

|

|

|

Long-term liabilities: |

|

|

|

| |

Deferred

revenue, long-term |

1,863,921 |

|

1,748,257 |

| |

Operating

lease liability, long-term |

1,097,805 |

|

1,174,882 |

| |

|

|

|

|

| |

Total long-term liabilities |

2,961,726 |

|

2,923,139 |

| |

|

|

|

|

|

Total liabilities |

7,931,464 |

|

7,278,593 |

| |

|

|

|

|

|

Commitments and contingencies (See Note 10) |

|

|

|

| |

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

Preferred stock $0.0001 par value; 2,500,000 authorized; no

shares issued |

|

|

|

|

|

or

outstanding |

- |

|

- |

|

Common stock $0.0001 par value; 50,000,000 shares authorized;

7,752,530 shares |

|

|

|

|

|

issued and

outstanding as of March 31, 2020 and 7,745,030 shares issued |

776 |

|

775 |

|

|

and

outstanding as of December 31, 2019 |

|

|

|

|

Class A common stock $0.0001 par value; 2,500,000 shares

authorized; no shares |

|

|

|

|

|

issued or

outstanding |

- |

|

- |

|

Class B common stock $0.0001 par value; 7,500,000 shares

authorized; no shares |

|

|

|

|

|

issued or

outstanding |

- |

|

- |

|

Additional paid-in capital |

13,898,201 |

|

13,894,680 |

|

Accumulated deficit |

(4,103,665) |

|

(3,714,255) |

|

|

|

|

|

|

|

Total stockholders' equity |

9,795,312 |

|

10,181,200 |

| |

|

|

|

|

|

Total liabilities and stockholders' equity |

$ 17,726,776 |

|

$ 17,459,793 |

| |

|

|

|

|

| VIRTRA,

INC. |

|

| CONDENSED

STATEMENTS OF OPERATIONS |

|

(Unaudited) |

|

|

|

|

|

|

| |

|

Three Months Ended |

| |

|

March 31, 2020 |

|

March 31, 2019 |

|

Revenues: |

|

|

|

| |

Net

sales |

$

3,320,013 |

|

$

3,011,701 |

| |

That's

Eatertainment royalties/licensing fees, related party |

16,740 |

|

39,637 |

| |

Other

royalties/licensing fees |

1,410 |

|

- |

| |

Total

revenue |

3,338,163 |

|

3,051,338 |

| |

|

|

|

|

| |

Cost of

sales |

1,742,936 |

|

1,250,869 |

| |

|

|

|

|

| |

Gross

profit |

1,595,227 |

|

1,800,469 |

| |

|

48.0% |

|

59.8% |

|

Operating expenses: |

|

|

|

| |

General and

administrative |

1,777,376 |

|

1,901,931 |

| |

Research and

development |

329,755 |

|

355,641 |

| |

|

|

|

|

| |

Net

operating expense |

2,107,131 |

|

2,257,572 |

| |

|

|

|

|

| |

Loss from

operations |

(511,904) |

|

(457,103) |

| |

|

|

|

|

|

Other income (expense): |

|

|

|

| |

Other

income |

19,495 |

|

42,282 |

| |

Other

expense |

(1) |

|

(5,081) |

| |

|

|

|

|

| |

Net other

income |

19,494 |

|

37,201 |

| |

|

|

|

|

| |

Loss before

provision for income taxes |

(492,410) |

|

(419,902) |

| |

|

|

|

|

| |

|

|

|

|

| |

Benefit for

income taxes |

(103,000) |

|

(107,000) |

| |

|

|

|

|

|

Net loss |

$ (389,410) |

|

$ (312,902) |

| |

|

|

|

|

|

Net loss per common share: |

|

|

|

| |

Basic |

$ (0.05) |

|

$ (0.04) |

| |

Diluted |

$ (0.05) |

|

$ (0.04) |

| |

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

| |

Basic |

7,745,363 |

|

7,765,624 |

| |

Diluted |

7,745,363 |

|

7,765,624 |

| |

|

|

|

|

| VIRTRA,

INC. |

| CONDENSED

STATEMENTS OF CASH FLOWS |

|

(Unaudited) |

| |

|

|

|

Three Months Ended |

| |

|

|

March 31, 2020 |

|

March 31, 2019 |

| |

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

| |

Net loss |

$ |

(389,410 |

) |

|

$ |

(312,902 |

) |

| |

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: |

|

|

|

| |

|

Depreciation and amortization |

|

89,676 |

|

|

|

71,794 |

|

| |

|

Right of use

amortization |

|

72,843 |

|

|

|

69,989 |

|

| |

|

Reserve for

note receivable |

|

3,639 |

|

|

|

- |

|

| |

|

Deferred

taxes |

|

(103,000 |

) |

|

|

(107,000 |

) |

| |

Changes in operating assets and liabilities: |

|

|

|

| |

|

Accounts

receivable, net |

|

(1,063,062 |

) |

|

|

(37,235 |

) |

| |

|

That's

Eatertainment note receivable, net, related party |

|

(3,639 |

) |

|

|

(3,652 |

) |

| |

|

Trade note

receivable, net |

|

- |

|

|

|

4,304 |

|

| |

|

Interest

receivable |

|

588 |

|

|

|

(1,027 |

) |

| |

|

Inventory,

net |

|

(195,672 |

) |

|

|

(96,669 |

) |

| |

|

Unbilled

revenue |

|

1,758,306 |

|

|

|

(441,285 |

) |

| |

|

Prepaid

expenses and other current assets |

|

(117,453 |

) |

|

|

(434,684 |

) |

| |

|

Other

assets |

|

17,677 |

|

|

|

(56,163 |

) |

| |

|

Accounts

payable and other accrued expenses |

|

142,705 |

|

|

|

334,188 |

|

| |

|

Payments on

operating lease liability |

|

(71,139 |

) |

|

|

(57,818 |

) |

| |

|

Deferred

revenue |

|

581,305 |

|

|

|

167,562 |

|

| |

|

|

|

|

|

|

Net cash provided by (used in) operating activities |

|

723,364 |

|

|

|

(900,598 |

) |

| |

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

| |

Purchase of certificates of deposit |

|

- |

|

|

|

(1,880,000 |

) |

| |

Redemption of certificates of deposit |

|

1,195,000 |

|

|

|

2,080,000 |

|

| |

Purchase of intangible assets |

|

(23,187 |

) |

|

|

(160,000 |

) |

| |

Purchase of property and equipment |

|

(196,897 |

) |

|

|

(94,994 |

) |

| |

Proceeds from sale of property and equipment |

|

- |

|

|

|

2,631 |

|

| |

|

|

|

|

|

|

Net cash provided by (used in) investing activities |

|

974,916 |

|

|

|

(52,363 |

) |

| |

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

| |

Repurchase of stock options |

|

(2,778 |

) |

|

|

- |

|

| |

Stock options exercised |

|

6,300 |

|

|

|

- |

|

| |

Purchase of treasury stock |

|

- |

|

|

|

(260,842 |

) |

| |

|

|

|

|

|

|

Net cash provided by (used in) financing activities |

|

3,522 |

|

|

|

(260,842 |

) |

| |

|

|

|

|

|

|

Net increase (decrease) in cash |

|

1,701,802 |

|

|

|

(1,213,803 |

) |

|

Cash, beginning of period |

|

1,415,091 |

|

|

|

2,500,381 |

|

| |

|

|

|

|

|

|

Cash, end of period |

$ |

3,116,893 |

|

|

$ |

1,286,578 |

|

| |

|

|

|

|

|

|

Supplemental disclosure of cash flow information: |

|

|

|

| |

Cash paid: |

|

|

|

| |

Taxes (refunded) paid |

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

Supplemental disclosure of non-cash investing and financing

activities: |

|

|

|

| |

Treasury stock cancelled |

|

- |

|

|

|

298,150 |

|

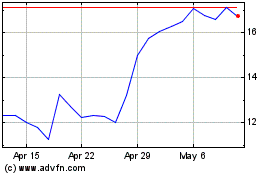

Virtra (NASDAQ:VTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

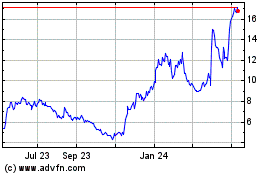

Virtra (NASDAQ:VTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024