UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

Report

of Foreign Private Issuer

Pursuant

to Rules 13a-16 or 15d-16 under

the

Securities Exchange Act of 1934

Dated

July 23, 2021

Commission

File Number: 001-10086

VODAFONE

GROUP

PUBLIC

LIMITED COMPANY

(Translation

of registrant’s name into English)

VODAFONE

HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE, RG14 2FN, ENGLAND

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

¨ No x

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.

This

Report on Form 6-K contains a Stock Exchange Announcement dated 22 July 2021 entitled ‘Change

in segmental reporting - Vantage Towers’.

22

July 2021

Change

in segmental reporting – updated for Vantage Towers

Following

the creation and successful IPO of Vantage Towers A.G. (“Vantage Towers”), one of Europe’s leading tower companies

that consolidates the ownership and operations of our passive mobile network infrastructure, we are updating our segmental reporting

structure to better reflect the way in which the Group now manages its operations.

Vantage

Towers will be reported as a new segment within Vodafone’s Group financial results. This change in reporting structure will take

effect from FY22 onwards and has no impact on service revenue.

The

tables below provide a proforma view of our FY20 and FY21 financial results under this new segmentation and should be used as the basis

of comparison for our FY22 results. However, there will be no change to our statutory information for comparative periods, which will

remain as previously disclosed.

New

segmental reporting structure

|

Proforma

FY211

|

|

Revenue

€m

|

|

|

Service

revenue

€m

|

|

|

Adjusted

EBITDAaL

€m

|

|

|

Adjusted

EBITDAaL margin

%

|

|

|

Capital

additions

€m

|

|

|

|

|

H1

21

|

|

|

FY21

|

|

|

H1

21

|

|

|

FY21

|

|

|

H1

21

|

|

|

FY21

|

|

|

H1

21

|

|

|

FY21

|

|

|

H1

21

|

|

|

FY21

|

|

|

Germany

|

|

|

6,371

|

|

|

|

12,984

|

|

|

|

5,723

|

|

|

|

11,520

|

|

|

|

2,685

|

|

|

|

5,323

|

|

|

|

42.1

|

%

|

|

|

41.0

|

%

|

|

|

1,110

|

|

|

|

2,504

|

|

|

Italy

|

|

|

2,506

|

|

|

|

5,014

|

|

|

|

2,249

|

|

|

|

4,458

|

|

|

|

800

|

|

|

|

1,597

|

|

|

|

31.9

|

%

|

|

|

31.9

|

%

|

|

|

297

|

|

|

|

773

|

|

|

UK

|

|

|

2,983

|

|

|

|

6,151

|

|

|

|

2,401

|

|

|

|

4,848

|

|

|

|

600

|

|

|

|

1,288

|

|

|

|

20.1

|

%

|

|

|

20.9

|

%

|

|

|

284

|

|

|

|

767

|

|

|

Spain

|

|

|

2,050

|

|

|

|

4,166

|

|

|

|

1,880

|

|

|

|

3,788

|

|

|

|

447

|

|

|

|

968

|

|

|

|

21.8

|

%

|

|

|

23.2

|

%

|

|

|

289

|

|

|

|

699

|

|

|

Other

Europe

|

|

|

2,720

|

|

|

|

5,549

|

|

|

|

2,411

|

|

|

|

4,859

|

|

|

|

794

|

|

|

|

1,613

|

|

|

|

29.2

|

%

|

|

|

29.1

|

%

|

|

|

350

|

|

|

|

840

|

|

|

Vodacom

|

|

|

2,423

|

|

|

|

5,181

|

|

|

|

1,949

|

|

|

|

4,083

|

|

|

|

891

|

|

|

|

1,873

|

|

|

|

36.8

|

%

|

|

|

36.2

|

%

|

|

|

333

|

|

|

|

703

|

|

|

Other

Markets

|

|

|

1,898

|

|

|

|

3,765

|

|

|

|

1,679

|

|

|

|

3,312

|

|

|

|

601

|

|

|

|

1,228

|

|

|

|

31.7

|

%

|

|

|

32.6

|

%

|

|

|

245

|

|

|

|

513

|

|

|

Vantage

Towers

|

|

|

576

|

|

|

|

1,165

|

|

|

|

-

|

|

|

|

-

|

|

|

|

304

|

|

|

|

603

|

|

|

|

52.8

|

%

|

|

|

51.8

|

%

|

|

|

98

|

|

|

|

229

|

|

|

Common

Functions

|

|

|

656

|

|

|

|

1,368

|

|

|

|

219

|

|

|

|

470

|

|

|

|

(119

|

)

|

|

|

(117

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

358

|

|

|

|

828

|

|

|

Eliminations

|

|

|

(729

|

)

|

|

|

(1,496

|

)

|

|

|

(93

|

)

|

|

|

(197

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Group

|

|

|

21,454

|

|

|

|

43,847

|

|

|

|

18,418

|

|

|

|

37,141

|

|

|

|

7,003

|

|

|

|

14,376

|

|

|

|

32.6

|

%

|

|

|

32.8

|

%

|

|

|

3,364

|

|

|

|

7,856

|

|

|

Proforma FY201,2

|

|

Revenue

€m

|

|

|

Service revenue

€m

|

|

|

Adjusted EBITDAaL

€m

|

|

|

Adjusted EBITDAaL

margin

%

|

|

|

Capital

additions

€m

|

|

|

|

|

FY20

|

|

|

FY20

|

|

|

FY20

|

|

|

FY20

|

|

|

FY20

|

|

|

Germany

|

|

|

12,076

|

|

|

|

10,696

|

|

|

|

4,738

|

|

|

|

39.2

|

%

|

|

|

2,114

|

|

|

Italy

|

|

|

5,529

|

|

|

|

4,833

|

|

|

|

2,068

|

|

|

|

37.4

|

%

|

|

|

697

|

|

|

UK

|

|

|

6,484

|

|

|

|

5,020

|

|

|

|

1,426

|

|

|

|

22.0

|

%

|

|

|

707

|

|

|

Spain

|

|

|

4,296

|

|

|

|

3,904

|

|

|

|

928

|

|

|

|

21.6

|

%

|

|

|

745

|

|

|

Other Europe

|

|

|

5,541

|

|

|

|

4,890

|

|

|

|

1,584

|

|

|

|

28.6

|

%

|

|

|

768

|

|

|

Vodacom

|

|

|

5,531

|

|

|

|

4,470

|

|

|

|

2,088

|

|

|

|

37.8

|

%

|

|

|

802

|

|

|

Other Markets

|

|

|

4,386

|

|

|

|

3,796

|

|

|

|

1,400

|

|

|

|

31.9

|

%

|

|

|

587

|

|

|

Vantage Towers

|

|

|

1,139

|

|

|

|

-

|

|

|

|

587

|

|

|

|

51.5

|

%

|

|

|

172

|

|

|

Common Functions

|

|

|

1,567

|

|

|

|

494

|

|

|

|

1

|

|

|

|

-

|

|

|

|

821

|

|

|

Eliminations

|

|

|

(1,517

|

)

|

|

|

(232

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Group

|

|

|

45,032

|

|

|

|

37,871

|

|

|

|

14,820

|

|

|

|

32.9

|

%

|

|

|

7,413

|

|

1.

Revenue, Adjusted EBITDAaL and capital additions for the Group as presented are different to those disclosed in the FY21 annual report

as a result of the inclusion of proforma effects for Wind Hellas and Vantage Towers incremental running costs.

2.

Only full year figures available

|

Proforma FY21

|

|

Non-current

assets(1)

€m

|

|

|

|

|

FY21

|

|

|

Germany

|

|

|

43,755

|

|

|

Italy

|

|

|

10,707

|

|

|

UK

|

|

|

6,529

|

|

|

Spain

|

|

|

6,609

|

|

|

Other Europe

|

|

|

8,361

|

|

|

Vodacom

|

|

|

5,839

|

|

|

Other Markets

|

|

|

2,988

|

|

|

Vantage Towers

|

|

|

7,859

|

|

|

Common Functions

|

|

|

2,145

|

|

|

Group

|

|

|

94,792

|

|

1.

Comprises goodwill, other intangible assets and property, plant and equipment in accordance with Note 2 to the consolidated financial

statements in our FY21 Annual Report.

Notes:

|

i.

|

|

Vodafone

owns 81.7% of the ordinary shares in Vantage Towers A.G.

|

|

ii.

|

|

The

Groups proforma segment for Vantage Towers reflects the relevant proforma information released

by Vantage Towers and is available at https://www.vantagetowers.com/investors/results-report-and-presentation,

together with the contribution from Cornerstone Technologies Infrastructure Limited (‘CTIL’;

the Groups 50:50 joint venture with Telefonica in the UK). CTIL is reported as a joint operation

in the Groups financial statements, but as a joint venture using the equity method in the

Vantage Towers financial statements.

|

|

iii.

|

|

The

proforma view of our FY20 and FY21 financial results has been prepared for illustrative purposes

only and shows a hypothetical situation and, therefore, does not represent the actual financial

position or results of the Group if the new segmentation had occurred on 1 April 2019 for

purposes of income statement line items and 31 March 2021 for purposes of non-current assets.

The proforma view of our FY20 and FY21 financial results is based on factually supportable

proforma adjustments, which we consider reasonable. Future results of operations may differ

materially from those presented. The proforma view of our FY20 and FY21 financial results

may not give a true picture of our financial results or non-current assets nor is it indicative

of the results that may, or may not, be expected to be achieved in the future. The proformas

have not been prepared in accordance with Regulation S-X under the United States Securities

Exchange Act of 1934 and the auditing standards generally accepted in the United States,

and accordingly should not be relied upon as if it had been carried out in accordance with

those standards or any other standards besides the standards mentioned above.

|

-ends-

For

more information, please contact:

|

Investor Relations

|

|

Media Relations

|

|

|

|

|

|

Investors.vodafone.com

|

|

Vodafone.com/media/contact

|

|

ir@vodafone.co.uk

|

|

GroupMedia@vodafone.com

|

Registered

Office: Vodafone House, The Connection, Newbury, Berkshire RG14 2FN, England. Registered in England No. 1833679

About

Vodafone

Vodafone is a leading telecommunications

company in Europe and Africa. Our purpose is to “connect for a better future” enabling an inclusive and sustainable digital

society. Our expertise and scale gives us a unique opportunity to drive positive change for society. Our networks keep family, friends,

businesses and governments connected and – as COVID-19 has clearly demonstrated – we play a vital role in keeping economies

running and the functioning of critical sectors like education and healthcare.

Vodafone

is the largest mobile and fixed network operator in Europe and a leading global IoT connectivity provider. Our M-Pesa technology platform

in Africa enables over 48m people to benefit from access to mobile payments and financial services. We operate mobile and fixed networks

in 21 countries and partner with mobile networks in 49 more. As of 31 March 2021, we had over 300m mobile customers, more than 28m fixed

broadband customers, over 22m TV customers and we connected more than 123m IoT devices.

We

support diversity and inclusion through our maternity and parental leave policies, empowering women through connectivity and improving

access to education and digital skills for women, girls, and society at large. We are respectful of all individuals, irrespective of

race, ethnicity, disability, age, sexual orientation, gender identity, belief, culture or religion.

Vodafone

is also taking significant steps to reduce our impact on our planet by reducing our greenhouse gas emissions by 50% by 2025 and becoming

net zero by 2040, purchasing 100% of our electricity from renewable sources by 2025 and by July 2021 in Europe, and reusing, reselling

or recycling 100% of our redundant network equipment.

For

more information, please visit www.vodafone.com, follow us on Twitter at @VodafoneGroup or connect with us on LinkedIn at www.linkedin.com/company/vodafone.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorised.

|

|

VODAFONE GROUP

|

|

|

PUBLIC LIMITED COMPANY

|

|

|

(Registrant)

|

|

Dated: July 23, 2021

|

By:

|

/s/ R E S MARTIN

|

|

|

Name: Rosemary E S Martin

|

|

|

Title: Group General Counsel and Company Secretary

|

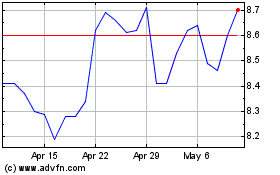

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

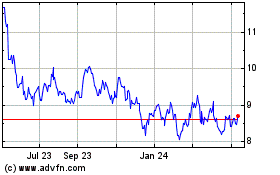

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024