Vislink Technologies Reports Q1 2020 Financial Results

May 27 2020 - 5:45PM

Vislink Technologies, Inc. (“Vislink” or the “Company”) (Nasdaq:

VISL), whose brands are recognized as the global leaders in live

video communications, announced its results for the first quarter

ended March 31, 2020.

First Quarter Highlights:

- Named Carleton Miller as chief

executive officer and Michael Bond as chief financial officer.

- Completed a capital raise of $6

million.

- Fulfilled delivery of the remaining

equipment on the $2.8 million U.S. Army contract the Company

received in 2019.

- Received a $1.3 million contract

from a European partner to supply equipment and services for border

protection.

- Received orders valued at over

$400,000 for satellite communications equipment from Airbus Defence

and Space Limited (“Airbus”).

- Received a $400,000 contract to

supply an airborne surveillance video downlink solution to a

government agency located in the MENA (Middle East and North

Africa) region.

- Was selected to to provide High

Definition ‘Live’ On-Board Video Systems for the prestigious

European Ferrari Challenge Race Series.

“In the first quarter, we took actions to put

the organization’s finances on a stable footing and provide a

pathway to future business success,” said Carleton Miller, CEO of

Vislink Technologies. “We implemented an OPEX cost reduction plan

with the goal of aligning costs with revenue, and have already

achieved appreciable savings, particularly in general and

administrative expenses through headcount and other cost

reductions. We expect to record additional cost savings in

subsequent quarters. We also optimized our supply chain, which has

improved our ability to capture and fulfill business. We continue

to have access to the capital we require to adequately fund our

operations, as shown by the $6 million public offering we

completed.”

Mr. Miller continued, “We also further

reorganized into the following four solution areas: Live Event

Production, Military/Government, Satellite Communications and

Managed Service. To that end, we made key new hires to lead these

areas of the business with an emphasis on targeted product

differentiation and customer-focused decision-making. Finally, we

have taken important steps to weather the economic slowdown caused

by the effects of COVID-19, including securing funding under the

Paycheck Protection Program and maintaining essential business

operations. We are confident this will allow us to seize new

opportunities as business activity begins to return and help us

achieve our goal of reaching sustainable and profitable

growth.”

Review of Results

- First quarter 2020 revenues were

$5.4 million compared to $8.2 million in the first quarter of

2019.

- Gross margins were 47% of revenue

in the first quarter of 2020, compared to 50% of revenue in the

first quarter of 2019.

- In the first quarter of 2020, net

loss attributable to common shareholders was $4.4 million, or

$(0.09) per share, compared to net loss of $3.1 million, or $(1.62)

per share in the first quarter of 2019.

- EBITDA (earnings before interest,

taxes depreciation and amortization) was a negative $3.9 million

for the three months ended March 31, 2020, compared to a negative

$2.1 million for the three months ended March 31, 2019.

- Ended the first quarter 2020 with

$2.5 million in cash compared to $1.7 million at December 31,

2019.

About Vislink Technologies,

Inc.

Vislink Technologies is a global leader in the

development and distribution of advanced communication solutions.

Driven by technical excellence that has led the industry for over

50 years, our innovative products and turnkey solutions provide

reliable connectivity in the toughest environments across the

global live production, military and government sectors. Our

solutions include high-definition communication links that reliably

capture, transmit and manage live event footage, as well as secure

video systems that support mission-critical applications. Vislink

Technologies shares are publicly traded on the Nasdaq Capital

Market under the ticker symbol VISL. For more information, visit

www.vislink.com.

Note on Forward-looking Statements

This press release may contain projections or

other forward-looking statements within the meaning of the Private

Securities Litigation Reform Act. These statements involve risks

and uncertainties, and actual events or results may differ

materially. Among the important factors that could cause actual

results to differ materially from those in the forward-looking

statements are the risk that our reduction in operating expenses

may impact our ability to meet our business objectives and achieve

our revenue targets and may not result in the expected improvement

in our profitability, the fact that our future growth depends in

part on further penetrating our addressable market and also growing

internationally, and we may not be successful in doing so; our

dependence on sales of certain products to generate a significant

portion of our revenue; the effect of a decrease in the sales or

change in sales mix of these products would harm our business; the

risks that an economic downturn or economic uncertainty in our key

U.S. and international markets may adversely affect demand for our

products; difficulty in accurately predicting our future customer

demand; the importance of maintaining the value and reputation of

our brand; and other factors detailed in the Risk Factors section

of our Registration Statement on Form S-1, as amended (No.

333-225975), which is on file with the Securities and Exchange

Commission. Additional information will also be set forth in our

Annual Report on Form 10-K for the year ended December 31, 2019.

These forward-looking statements speak only as of the date hereof

or as of the date otherwise stated herein. The Company disclaims

any obligation to update these forward-looking statements.

FOR MORE INFORMATION: investors@vislink.com

VISLINK TECHNOLOGIES, INC. AND

SUBSIDIARIES UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(IN THOUSANDS EXCEPT NET (LOSS) INCOME PER SHARE

DATA)

|

|

|

For the Three Months Ended |

|

|

|

|

March 31, |

|

|

|

|

2020 |

|

|

2019 |

|

| Revenue, net |

|

$ |

5,352 |

|

|

$ |

8,206 |

|

| Cost of revenue and

operating expenses |

|

|

|

|

|

|

|

|

|

Cost of components and personnel |

|

|

2,821 |

|

|

|

4,127 |

|

|

Inventory valuation adjustments |

|

|

25 |

|

|

|

47 |

|

|

General and administrative expenses |

|

|

6,200 |

|

|

|

5,183 |

|

|

Gain on lease termination |

|

|

(21 |

) |

|

|

— |

|

|

Research and development expenses |

|

|

656 |

|

|

|

926 |

|

|

Amortization and depreciation |

|

|

423 |

|

|

|

589 |

|

|

Total cost of revenue and operating expenses |

|

|

10,104 |

|

|

|

10,872 |

|

|

Loss from operations |

|

|

(4,752 |

) |

|

|

(2,666 |

) |

| Other (expense)

income |

|

|

|

|

|

|

|

|

|

Changes in fair value of derivative liabilities |

|

|

17 |

|

|

|

(74 |

) |

|

Gain on settlement of related party obligation |

|

|

331 |

|

|

|

— |

|

|

Interest expense |

|

|

(26 |

) |

|

|

(350 |

) |

|

Total other (expense) income |

|

|

322 |

|

|

|

(424 |

) |

| |

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(4,430 |

) |

|

$ |

(3,090 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted loss per

share |

|

$ |

(0.09 |

) |

|

$ |

(1.62 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average

number of shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

48,696 |

|

|

|

1,906 |

|

| |

|

|

|

|

|

|

|

|

| Comprehensive

loss: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(4,430 |

) |

|

$ |

(3,090 |

) |

| Unrealized gain (loss) on

currency translation adjustment |

|

|

277 |

|

|

|

(33 |

) |

| Comprehensive loss |

|

$ |

(4,153 |

) |

|

$ |

(3,123 |

) |

The accompanying notes are an integral part of

these condensed consolidated financial statements.

VISLINK TECHNOLOGIES, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS (IN THOUSANDS EXCEPT SHARE AND PER SHARE

DATA)

| |

|

March 31, |

|

|

December 31, |

|

| |

|

2020 |

|

|

2019 |

|

|

|

|

(unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

2,459 |

|

|

$ |

1,737 |

|

|

Accounts receivable, net |

|

|

3,988 |

|

|

|

6,714 |

|

|

Inventories, net |

|

|

8,374 |

|

|

|

7,674 |

|

|

Prepaid expenses and other current assets |

|

|

662 |

|

|

|

660 |

|

|

Total current assets |

|

|

15,483 |

|

|

|

16,785 |

|

|

Right of use assets, operating leases |

|

|

1,782 |

|

|

|

1,925 |

|

|

Property and equipment, net |

|

|

1,888 |

|

|

|

1,972 |

|

|

Intangible assets, net |

|

|

2,621 |

|

|

|

2,922 |

|

|

Total assets |

|

$ |

21,774 |

|

|

$ |

23,604 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

4,390 |

|

|

$ |

6,784 |

|

|

Accrued expenses |

|

|

2,449 |

|

|

|

1,912 |

|

|

Notes payable |

|

|

293 |

|

|

|

339 |

|

|

Operating lease obligations, current |

|

|

383 |

|

|

|

821 |

|

|

Due to related parties |

|

|

— |

|

|

|

505 |

|

|

Customer deposits and deferred revenue |

|

|

2,137 |

|

|

|

2,821 |

|

|

Derivative liabilities |

|

|

13 |

|

|

|

30 |

|

|

Total current liabilities |

|

|

9,665 |

|

|

|

13,212 |

|

|

Operating lease obligations, net of current portion |

|

|

1,332 |

|

|

|

1,163 |

|

|

Total liabilities |

|

|

10,997 |

|

|

|

14,375 |

|

| Commitments and contingencies

(See Note 9) |

|

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

|

Preferred stock – $0.00001 par value per share: 10,000,000 shares

authorized as of March 31, 2020, and December 31, 2019; 0 shares

issued and outstanding as of March 31, 2020, and December 31,

2019 |

|

|

— |

|

|

|

— |

|

|

Common stock – $0.00001 par value per share, 100,000,000 shares

authorized, 81,100,685 and 21,567,287 shares issued and 81,084,731

and 21,551,333 outstanding as of March 31, 2020 and December 31,

2019, respectively |

|

|

— |

|

|

|

— |

|

|

Additional paid in capital |

|

|

267,572 |

|

|

|

261,871 |

|

|

Accumulated other comprehensive income |

|

|

484 |

|

|

|

207 |

|

|

Treasury stock, at cost – 15,954 shares at March 31, 2020, and

December 31, 2019, respectively |

|

|

(277 |

) |

|

|

(277 |

) |

|

Accumulated deficit |

|

|

(257,002 |

) |

|

|

(252,572 |

) |

|

Total stockholders’ equity |

|

|

10,777 |

|

|

|

9,229 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

21,774 |

|

|

$ |

23,604 |

|

The accompanying notes are an integral part of

these condensed consolidated financial statements.

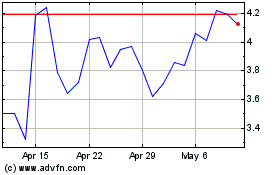

Vislink Technologies (NASDAQ:VISL)

Historical Stock Chart

From Mar 2024 to Apr 2024

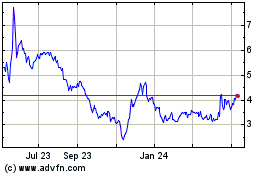

Vislink Technologies (NASDAQ:VISL)

Historical Stock Chart

From Apr 2023 to Apr 2024