Uxin Limited (“Uxin” or the “Company”) (Nasdaq: UXIN), the largest

used car e-commerce platform in China, today announced its

financial results unaudited for the fourth quarter and full year

ended December 31, 2018.

Fourth Quarter 2018 Operational

Highlights

- Transaction volume for the 2C business

increased to 168,395 units in the fourth quarter of 2018,

representing year-on-year growth of 93.6%.

- Transaction volume for the 2B business

decreased to 72,081 units in the fourth quarter of 2018,

representing year-on-year decline of 37.1%, due to the Company’s

change of approach in serving consumers with car-selling needs, as

well as dealers’ growing appetite for retail transactions through

Uxin’s 2C platform.

- GMV for the 2C business increased to RMB13,058

million in the fourth quarter of 2018, representing year-on-year

growth of 73.7%.

- GMV for the 2B business decreased to RMB3,349

million in the fourth quarter of 2018, representing year-on-year

decline of 40.2%.

- Loan facilitation continues to be an important

component of Uxin’s transaction services. Uxin facilitated

financing for 79,738 used car transactions on its platform in the

fourth quarter of 2018.

- M3+ delinquency rate by balance1 was 1.41% as

of December 31, 2018, improved from 1.43% as of September 30,

2018.

Fourth Quarter 2018 Financial

Highlights

- Total revenues in the fourth quarter were

RMB1,136.7 million (US$165.6 million), representing year-on-year

growth of 61.6%.º 2C transaction facilitation

revenue in the fourth quarter was RMB317.5 million

(US$46.3 million), representing year-on-year growth of

263.2%.º 2C loan facilitation revenue in the

fourth quarter was RMB619.8 million (US$90.3 million), representing

year-on-year growth of 81.3%.º 2B transaction facilitation

revenue in the fourth quarter was RMB145.7 million

(US$21.2 million), representing year-on-year decline of 16.4%.

- Gross profit was RMB783.3 million (US$114.1

million) in the fourth quarter of 2018. Gross margin increased to

68.9% in the fourth quarter of 2018, compared to 64.9% in the same

period last year.

- Loss from operations in the fourth quarter of

2018 was RMB266.0 million (US$38.8 million), compared to RMB483.1

million in the same period last year.

- Non-GAAP adjusted loss from operations in the

fourth quarter was RMB193.7 million (US$28.2 million), compared to

RMB454.9 million in the same period last year.

- Net loss in the fourth quarter was RMB314.6

million (US$45.8 million), compared to a net loss of RMB901.6

million in the same period last year. Net loss as a percentage of

total revenues was 27.7% in the fourth quarter of 2018, decreased

from 128.2% in the same period last year.

- Non-GAAP adjusted net loss in the fourth

quarter was RMB242.2 million (US$35.3 million), compared to

RMB488.7 million in the same period last year. Non-GAAP adjusted

net loss as a percentage of total revenues was 21.3% in the fourth

quarter of 2018, decreased from 69.5% in the same period last

year.

Full Year 2018 Operational

Highlights

- Transaction volume for the 2C business

increased to 494,826 units in the full year 2018, representing

year-on-year growth of 74.3%.

- Transaction volume for the 2B business

decreased to 319,672 units in the full year 2018, representing

year-on-year decline of 8.8%, due to the Company’s change of

approach in serving consumers with car-selling needs, as well as

dealers’ growing appetite for retail transactions through Uxin’s 2C

platform.

- GMV for the 2C business increased to RMB39,809

million in the full year 2018, representing year-on-year growth of

53.0%.

- GMV for the 2B business decreased to RMB15,253

million in the full year 2018, representing year-on-year decline of

12.2%.

- Loan facilitation continues to be an important

component of Uxin’s transaction services. Uxin facilitated

financing for 228,082 used car transactions on its platform in the

full year 2018.

- M3+ delinquency rate by balance was 1.41% as

of December 31, 2018, compared to 1.37% as of December 31,

2017.

Full Year 2018 Financial

Highlights

- Total revenues in the full year 2018 were

RMB3,315.4 million (US$483.1 million), representing year-on-year

growth of 69.9%.º 2C transaction facilitation

revenue in the full year 2018 was RMB645.3 million

(US$94.0 million), representing year-on-year growth of

180.3%.º 2C loan facilitation revenue in the full

year 2018 was RMB1,774.1 million (US$258.5 million), representing

year-on-year growth of 87.8%.º 2B transaction facilitation

revenue in the full year 2018 was RMB606.6 million

(US$88.4 million), representing year-on-year growth of 16.8%.

- Gross profit was RMB2,176.5 million (US$317.1

million) in the full year 2018. Gross margin increased to 65.6% in

the full year 2018, compared to 61.7% in the prior year.

- Loss from operations in the full year 2018 was

RMB2,565.9 million (US$373.9 million), compared to RMB1,823.2

million in the prior year.

- Non-GAAP adjusted loss from operations in the

full year 2018 was RMB1,513.9 million (US$220.6 million), compared

to RMB1,657.3 million in the prior year.

- Net loss in the full year 2018 was RMB1,538.3

million (US$224.1 million), compared to a net loss of RMB2,747.8

million in the prior year. Net loss as a percentage of total

revenues was 46.4% in the full year 2018, decreased from 140.8% in

the prior year.

- Non-GAAP adjusted net loss in the full year

2018 was RMB1,671.3 million (US$243.5 million), compared to

RMB1,696.1 million in the prior year. Non-GAAP adjusted net loss as

a percentage of total revenues was 50.4% in the full year 2018,

decreased from 86.9% in the prior year.

Mr. Kun Dai, Founder, Chairman and Chief

Executive Officer of Uxin, said, “We are pleased to end the year

with another set of strong results, with total revenues in the

fourth quarter exceeding the high-end of previous guidance. We

continued to attract consumers through Uxin’s unique value

proposition of a broad selection of used cars, digital transparency

and a one-stop solution. We facilitated over 160,000 used car

transactions on our 2C platform in the fourth quarter, representing

a year-on-year increase of 93.6%. More importantly, we experienced

an exponential growth in cross-regional transactions, with

transaction volume exceeding 10,000 used cars in December alone,

and over 22,000 in the fourth quarter. This reflects the

revolutionary impact of our business model on China’s used car

supply chain, as well as growing appreciation of Uxin’s brand and

services.”

Mr. Dai added, “Looking into 2019, we will

continue to increase our focus on the 2C business. From a

commercial perspective, we see much greater growth potential in the

2C business, especially in terms of cross-regional transactions. We

have identified a number of strategic initiatives to strengthen our

capabilities on this front. For example, we will adopt a franchise

model to complement our self-operated service centers, in order to

better penetrate lower-tier cities and expand coverage of our

offline network. Regarding our 2B business, while it may decline as

a proportion of total revenues as a result of our strategic shift

to the 2C business, it will continue to serve as an important arm

of our group, as it enables us to strengthen our relationships with

dealers and enhance the stickiness to our platform, thus

facilitating the growth of our 2C business. As we implement these

initiatives and continue to enhance our value proposition, we are

confident that we will solidify our position as China’s largest

used car e-commerce platform.”

Mr. Zhen Zeng, Chief Financial Officer of Uxin,

said, “Our strong execution across all business lines helped us

conclude the year on a strong footing. Total revenues increased by

61.6% year-on-year to RMB1.1 billion in the fourth quarter,

primarily driven by the robust growth of our 2C business, which

increased by 118.3% year-on-year. We also expanded our gross margin

to 68.9% in the fourth quarter from 64.9% in the same period last

year, reflecting the ongoing optimization of our business model and

effective cost control measures. Moreover, we continued to gain

operating leverage during the fourth quarter as we benefited from

greater scale and operating efficiency. In particular, we made

strong progress optimizing sales and marketing with related

expenses declining to 60.6% as a percentage of revenues in the

fourth quarter, compared to 87.5% in the prior quarter, and 98.7%

in the same period last year. Going forward, we will continue to

focus on driving the growth of our 2C business while increasing

operating efficiency to build a sustainable business and generate

long-term value for our shareholders.”

Fourth Quarter 2018 Financial

Results

Total revenues in the fourth

quarter of 2018 increased by 61.6% to RMB1,136.7 million (US$165.6

million) from RMB703.4 million in the same period last year,

primarily due to the increases in 2C transaction volume,

transaction facilitation take rate2 and amount of loans

facilitated.

2C Business: Revenue of the 2C

business increased to RMB937.3 million (US$136.6 million) in the

fourth quarter of 2018, representing growth of 118.3% from RMB429.3

million in the same period last year.

- 2C transaction facilitation revenue was RMB317.5 million

(US$46.3 million) in the fourth quarter of 2018, representing an

increase of 263.2% from RMB87.4 million in the same period last

year, primarily due to the increases in the transaction volume and

GMV of used cars sold through the 2C business. The transaction

volume for the 2C business increased to 168,395 units in the fourth

quarter of 2018, representing year-on-year growth of 93.6%. The GMV

for the 2C business increased to RMB13,058 million in the fourth

quarter of 2018, representing year-on-year growth of 73.7%. As a

result of the Company’s greater efforts to facilitate

cross-regional transactions and higher pricing power generated from

enhanced service and user experience, the take rate for 2C

transaction facilitation reached 2.4% during the quarter, compared

to 1.2% in the same period last year. As the main driver, the take

rate for cross-regional transactions exceeded 5% during the

quarter.

- 2C loan facilitation revenue increased to RMB619.8 million

(US$90.3 million) in the fourth quarter of 2018, representing an

increase of 81.3% from RMB341.9 million in the same period last

year, primarily due to the increases in the transaction volume and

amount of loans facilitated. The attach rate3 of the loan

facilitation services slightly increased to 47.4% in the fourth

quarter of 2018, mainly driven by the increasing volume of

cross-regional transactions. The average service fee rate for used

car loan facilitation, as measured by the used car loan

facilitation revenue divided by the total amount of used car loans

facilitated, was 7.0% in the fourth quarter of 2018, compared to

7.4% in the same period last year.

2B Business:

- 2B transaction facilitation revenue was RMB145.7 million

(US$21.2 million) in the fourth quarter of 2018, representing a

decrease of 16.4% from the same period last year, due to the

decline in transaction volume. The transaction volume for the 2B

business decreased to 72,081 units in the fourth quarter of 2018,

due to the Company’s change of approach in serving consumers with

car-selling needs as disclosed in the earnings release for the

second quarter of 2018, as well as dealers’ growing appetite for

retail transactions through the Company’s 2C platform. The GMV for

the 2B business decreased to RMB3,349 million in the fourth

quarter, representing year-on-year decrease of 40.2%. The take rate

for 2B transaction facilitation increased to 4.3% in the fourth

quarter, compared to 3.1% in the same period last year, as a result

of Uxin’s increasing pricing power.

Cost of revenues increased by

43.1% year-on-year to RMB353.3 million (US$51.5 million) in the

fourth quarter of 2018, primarily due to the increases in costs of

fulfillment, title transfer and registration which were

correspondingly driven by the increase in the transaction volume,

as well as the increase in salaries and benefits of employees

engaged in car inspection, quality control, customer service and

after-sales service.

Gross margin was 68.9% in the

fourth quarter of 2018, compared to 64.9% in the same period last

year.

Total operating expenses were

RMB1,049.4 million (US$152.9 million) in the fourth quarter of

2018. Total operating expenses excluding share-based compensation

expenses were RMB977.0 million.

- Sales and marketing expenses

slightly decreased by 0.8% year-on-year to RMB688.9 million

(US$100.4 million) in the fourth quarter of 2018. The well-managed

sales and marketing expenses reflects the Company’s continuous

efforts of enhancing operating efficiency and focus on conversion.

Sales and marketing expenses excluding share-based compensation

expenses as a percentage of total revenues was 60.6% during the

quarter, compared to 98.7% in the same period last year.

- General and administrative expenses increased

by 79.4% year-on-year to RMB272.1 million (US$39.6 million) in the

fourth quarter of 2018. The increase was mainly due to the

increases in salaries and benefits expenses, share-based

compensation expenses and professional service fees. The general

and administrative expenses, excluding share-based compensation

expenses of RMB71.6 million, were RMB200.5 million which

represented 17.6% of total revenues, compared to 17.6% in the same

period last year.

- Research and development expenses increased by

23.3% year-on-year to RMB96.6 million (US$14.1 million) in the

fourth quarter of 2018. The increase was primarily due to the

increase in salaries and benefits expenses. The research and

development expenses, excluding share-based compensation expenses

of RMB0.8 million, were RMB95.8 million which represented 8.4% of

total revenues, compared to 11.1% in the same period last

year.

Gains/Loss from guarantee

liability resulted in a gain of RMB8.2 million (US$1.2

million) in the fourth quarter of 2018. The gain was the result of

improved delinquency rate compared to that as of the third quarter

of 2018.

Loss from operations in the

fourth quarter of 2018 was RMB266.0 million (US$38.8 million),

compared to RMB483.1 million in the same period last year. Non-GAAP

adjusted loss from operations was RMB193.7 million (US$28.2

million) in the fourth quarter of 2018.

Fair value change of derivative

liabilities was nil in the fourth quarter of 2018,

compared to a loss of RMB384.7 million in the same period last

year. The impact of derivative liabilities would no longer exist

going forward as the preferred shares were converted into ordinary

shares at the time of IPO.

Net loss in the fourth quarter

of 2018 was RMB314.6 million (US$45.8 million), compared to a net

loss of RMB901.6 million in the same period last year. The narrowed

net loss was primarily due to greater operating leverage and

decrease of loss from fair value change of derivative

liabilities.

Non-GAAP adjusted net loss,

which excludes share-based compensation expenses of RMB72.4

million, was RMB242.2 million (US$35.3 million) in the fourth

quarter of 2018, compared to RMB488.7 million in the same period

last year.

As of December 31, 2018, the Company had cash

and cash equivalents of RMB801.0 million (US$116.7 million),

short-term investment in the form of time deposit and other

investment products of RMB596.1 million (US$86.9 million), and

restricted cash of RMB2,013.0 million (US$293.3 million).

Full Year 2018 Financial

Results

Total revenues in the full year

2018 increased by 69.9% to RMB3,315.4 million (US$483.1 million)

from RMB1,951.4 million in the prior year, primarily due to the

increases in transaction volume, take rate and amount of loans

facilitated.

2C Business: Revenue of the 2C

business increased to RMB2,419.4 million (US$352.5 million) in the

full year 2018, representing growth of 106.0% from RMB1,174.7

million in the prior year.

- 2C transaction facilitation revenue was RMB645.3 million

(US$94.0 million) in the full year 2018, representing an increase

of 180.3% from RMB230.3 million in the prior year, primarily due to

the increases in the transaction volume and GMV of used cars sold

through the 2C business. The transaction volume for the 2C business

increased to 494,826 units in the full year 2018, representing

year-on-year growth of 74.3%. The GMV for the 2C business increased

to RMB39,809 million in the full year 2018, representing

year-on-year growth of 53.0%. As a result of the Company’s greater

efforts to facilitate cross-regional transactions and higher

pricing power generated from enhanced service and user experience,

the take rate for 2C transaction facilitation increased to 1.6% in

the full year 2018, compared to 0.9% in the prior year.

- 2C loan facilitation revenue increased to RMB1,774.1 million

(US$258.5 million) in the full year 2018, representing an increase

of 87.8% from RMB944.4 million in the prior year, primarily due to

the increases in the transaction volume and amount of loans

facilitated. The attach rate of the loan facilitation services

slightly increased to 46.1% in the full year 2018, mainly driven by

the increasing volume of cross-regional transactions. The average

service fee rate for used car loan facilitation was 7.0% in the

full year 2018, compared to 6.2% in the prior year.

2B Business:

- 2B transaction facilitation revenue was RMB606.6 million

(US$88.4 million) in the full year 2018, representing an increase

of 16.8% from the prior year, due to the increase in take rate. The

transaction volume for the 2B business decreased to 319,672 units

in the full year 2018, due to the Company’s change of approach in

serving consumers with car-selling needs as disclosed in the

earnings release for the second quarter of 2018, as well as

dealers’ growing appetite for retail transactions through the

Company’s 2C platform. Despite the impact of the change in business

approach, B2B business experienced 8.9% year-on-year growth in

terms of number of transactions in the full year 2018. The GMV for

the 2B business decreased to RMB15,253 million in the full year

2018, representing year-on-year decrease of 12.2%. Excluding the

impact of the change in business approach, B2B business experienced

6.0% year-on-year growth in terms of GMV. The take rate for 2B

transaction facilitation increased to 4.0% in the full year 2018,

compared to 3.0% in the prior year, as a result of Uxin’s

increasing pricing power.

Cost of revenues increased by

52.3% year-on-year to RMB1,139.0 million (US$166.0 million) in the

full year 2018, primarily due to the increases in salaries and

benefits of employees engaged in car inspection, quality control,

customer service and after-sale service, as well as costs of

fulfillment, title transfer and registration which were

correspondingly driven by the increase in the transaction

volume.

Gross margin was 65.6% in the

full year 2018, compared to 61.7% in the prior year.

Total operating expenses were

RMB4,742.4 million (US$691.0 million) in the full year 2018. Total

operating expenses excluding share-based compensation expenses were

RMB3,690.5 million.

- Sales and marketing expenses increased by

22.0% year-on-year to RMB2,687.0 million (US$391.5 million) in the

full year 2018. The increase was primarily due to the increase in

salaries and benefits expenses. Sales and marketing expenses

excluding share-based compensation expenses as a percentage of

total revenues was 81.0% in the full year 2018, compared to 112.9%

in the prior year.

- General and administrative expenses increased

by 187.4% year-on-year to RMB1,724.1 million (US$251.2 million) in

the full year 2018. The increase was mainly due to the increases in

share-based compensation expenses and salaries and benefits

expenses. The general and administrative expenses, excluding

share-based compensation expenses of RMB1,033.5 million, were

RMB690.6 million which represented 20.8% of total revenues,

compared to 22.2% in the prior year.

- Research and development expenses increased by

45.8% year-on-year to RMB329.4 million (US$48.0 million) in the

full year 2018. The increase was primarily due to the increases in

salaries and benefits expenses, share-based compensation expenses

and rental expenses. The research and development expenses,

excluding share-based compensation expenses of RMB18.0 million,

were RMB311.4 million which represented 9.4% of total revenues,

compared to 11.6% in the prior year.

Gains/Loss from guarantee

liability resulted in a loss of RMB1.9 million (US$0.3

million) in the full year 2018. The loss was due to the slight

increase in delinquency rate as of the first quarter of 2018

compared to that as of the prior year.

Loss from operations in the

full year 2018 was RMB2,565.9 million (US$373.9 million), compared

to RMB1,823.2 million in the prior year. Non-GAAP adjusted loss

from operations was RMB1,513.9 million (US$220.6 million) in the

full year 2018.

Fair value change of derivative

liabilities was a gain of RMB1,185.1 million (US$172.7

million) in the full year 2018, compared to a loss of RMB885.8

million in the prior year.

Net loss in the full year 2018

was RMB1,538.3 million (US$224.1 million), compared to a net loss

of RMB2,747.8 million in the prior year. The narrowed net loss was

primarily due to the increase of revenues and gain from fair value

change of derivative liabilities.

Non-GAAP adjusted net loss,

which excludes share-based compensation expenses of RMB1,052.0

million and gain form fair value change of derivative liabilities

of RMB1,185.1 million, was RMB1,671.3 million (US$243.5 million) in

the full year 2018, compared to RMB1,696.1 million in the prior

year.

Recent UpdateWith the Company’s

great efforts in executing 2C business initiatives, cross-regional

transactions experienced exponential growth towards the end of

2018, and started to contribute an increasingly significant portion

of transaction volume as well as revenues.

Business Outlook

For the first quarter of 2019, Uxin expects

total revenues to be in the range of RMB900 million to RMB950

million. This forecast reflects the Company's current and

preliminary views on the market and operational conditions, which

are subject to change.

1M3+ delinquency rate is

defined as the outstanding principal balance of used car loans that

were 90 or more calendar days past due as a percentage of the sum

of total outstanding principal balance of the used car loans

facilitated through the Company’s 2C business (including the

principal of loans it paid financing partners under its guarantee

to financing partners) as of a specific date.2Take

rate is measured by the revenue of the 2C/2B used car

business divided by the GMV of the 2C/2B business.

3The attach rate of used car loan facilitation

services in the 2C business was measured by the number of used car

loans facilitated divided by the total number of 2C used car

transactions.

Conference Call

The Company’s management will host an earnings

conference call at 8:00 AM on March 14, 2019 U.S. Eastern Time

(8:00 PM on March 14, 2019 Beijing/Hong Kong time).

Dial-in details for the earnings conference call

are as follows:

| U.S.: |

+1 866 519 4004 or +1

845 675 0437 |

|

International: |

+65 6713 5090 |

| Mainland

China: |

400 620 8038 or 800 819

0121 |

| Hong Kong: |

800 906 601 or +852

3018 6771 |

| Conference ID: |

5079833 |

Additionally, a live and archived webcast of the

conference call will be available on the Company’s investor

relations website at http://ir.xin.com/.

A replay of the conference call will be

accessible approximately one hour after the conclusion of the live

call until March 29, 2019, by dialing the following telephone

numbers:

| U.S.: |

+1 646 254 3697 |

| International: |

+61 2 8199 0299 |

| Conference ID: |

5079833 |

About UxinUxin Limited (Nasdaq:

UXIN) is the largest used car e-commerce platform in China. Uxin’s

mission is to enable people to buy the car of their choice, no

matter where they are located or what their budget is. Uxin enables

consumers and dealers to buy and sell cars through an innovative

integrated online and offline platform that addresses each step of

the transaction and covers the entire value chain. Its online

presence is bolstered by an offline network of more than 670

service centers in over 270 cities throughout China.

Use of Non-GAAP Financial

Measures In evaluating the business, the Company considers

and uses a non-GAAP measure, adjusted loss from operations,

adjusted net loss and adjusted net loss per share, as a

supplemental measure to review and assess its operating

performance. The presentation of the non-GAAP financial measure is

not intended to be considered in isolation or as a substitute for

the financial information prepared and presented in accordance with

U.S. GAAP. The Company defines adjusted loss from operations

excluding share-based compensation. The Company defines adjusted

net loss as net (loss)/income excluding share-based compensation

and fair value change of derivative liabilities. The Company

presents the non-GAAP financial measure because it is used by the

management to evaluate the operating performance and formulate

business plans. Adjusted net loss enables the management to assess

the Company’s operating results without considering the impact of

share-based compensation and fair value change of derivative

liabilities, which are non-cash charges. The Company also believes

that the use of the non-GAAP measure facilitates investors'

assessment of its operating performance.

The non-GAAP financial measure is not defined

under U.S. GAAP and is not presented in accordance with

U.S. GAAP. The non-GAAP financial measure has limitations as

analytical tools. One of the key limitations of using adjusted net

loss is that it does not reflect all items of income and expense

that affect the Company’s operations. Share-based compensation and

fair value change of derivative liabilities have been and may

continue to be incurred in the business and is not reflected in the

presentation of adjusted net loss. Further, the non-GAAP measure

may differ from the non-GAAP information used by other companies,

including peer companies, and therefore their comparability may be

limited.

The Company compensates for these limitations by

reconciling the non-GAAP financial measure to the nearest

U.S. GAAP performance measure, all of which should be

considered when evaluating the Company’s performance. The Company

encourages you to review its financial information in its entirety

and not rely on a single financial measure.

Reconciliations of Uxin’s non-GAAP financial

measures to the most comparable U.S. GAAP measure are included at

the end of this press release.

Exchange Rate Information This

announcement contains translations of certain RMB amounts into U.S.

dollars (“US$”) at specified rates solely for the convenience of

the reader, except for those transaction amounts that were actually

settled in U.S. dollars. Unless otherwise stated, all translations

from RMB to US$ were made at the rate of RMB6.8632 to US$1.00,

representing the index rate as of the end of December 2018

stipulated by the People’s Bank of China. The Company makes no

representation that the RMB or US$ amounts referred could be

converted into US$ or RMB, as the case may be, at any particular

rate or at all.

Safe Harbor Statement This

announcement contains forward-looking statements. These statements

are made under the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates” and similar statements. Among other things,

the business outlook and quotations from management in this

announcement, as well as Uxin’s strategic and operational plans,

contain forward-looking statements. Uxin may also make written or

oral forward-looking statements in its periodic reports to the SEC,

in its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers,

directors or employees to third parties. Statements that are not

historical facts, including statements about Uxin’s beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: Uxin’s goal and strategies; its expansion

plans; its future business development, financial condition and

results of operations; Uxin’s expectations regarding demand for,

and market acceptance of, its services; its ability to provide

differentiated and superior customer experience, maintain and

enhance customer trust in its platform, and assess and mitigate

various risks, including credit; its expectations regarding

maintaining and expanding its relationships with business partners,

including financing partners; trends and competition in China’s

used car e-commerce industry; the laws and regulations relating to

Uxin’s industry; the general economic and business conditions; and

assumptions underlying or related to any of the foregoing. Further

information regarding these and other risks is included in Uxin’s

filings with the SEC. All information provided in this press

release and in the attachments is as of the date of this press

release, and Uxin does not undertake any obligation to update any

forward-looking statement, except as required under applicable

law.

For investor enquiries, please

contact:

Nancy SongUxin Investor RelationsTel: +86 10

5691-6765Email: ir@xin.com

For media enquiries, please

contact:

Yi-Ke HongBrunswick GroupTel: +86 10

5960-8600Email: uxin@brunswickgroup.com

Uxin Limited Unaudited

Consolidated Statements of Comprehensive Loss(In thousands

except for number of shares and per share data)

| |

|

Three months ended |

|

Year ended |

| |

December 31, 2017 |

December 31, 2018 |

|

December 31, 2017 |

December 31,2018 |

| |

|

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

|

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

| 2C

Transaction facilitation revenue |

|

87,410 |

|

317,493 |

|

46,260 |

|

|

230,250 |

|

645,335 |

|

94,028 |

|

| 2C Loan

facilitation revenue |

|

341,939 |

|

619,827 |

|

90,312 |

|

|

944,406 |

|

1,774,065 |

|

258,489 |

|

| 2B

Transaction facilitation revenue |

|

174,233 |

|

145,659 |

|

21,223 |

|

|

519,276 |

|

606,599 |

|

88,384 |

|

|

Others |

|

99,851 |

|

53,683 |

|

7,822 |

|

|

257,440 |

|

289,450 |

|

42,174 |

|

|

Total revenues |

|

703,433 |

|

1,136,662 |

|

165,617 |

|

|

1,951,372 |

|

3,315,449 |

|

483,075 |

|

|

Operating cost and expenses: |

|

|

|

|

|

|

|

|

| Cost of

revenue |

|

(246,983 |

) |

(353,335 |

) |

(51,483 |

) |

|

(747,788 |

) |

(1,138,995 |

) |

(165,957 |

) |

| Sales

and marketing |

|

(694,499 |

) |

(688,930 |

) |

(100,380 |

) |

|

(2,203,139 |

) |

(2,686,956 |

) |

(391,502 |

) |

| General

and administrative |

|

(151,695 |

) |

(272,077 |

) |

(39,643 |

) |

|

(599,905 |

) |

(1,724,060 |

) |

(251,204 |

) |

| Research

and development |

|

(78,345 |

) |

(96,585 |

) |

(14,073 |

) |

|

(226,010 |

) |

(329,430 |

) |

(47,999 |

) |

|

(Losses)/gains from guarantee liability |

|

(15,053 |

) |

8,230 |

|

1,199 |

|

|

2,284 |

|

(1,931 |

) |

(281 |

) |

|

Total operating cost and expenses |

|

(1,186,575 |

) |

(1,402,697 |

) |

(204,380 |

) |

|

(3,774,558 |

) |

(5,881,372 |

) |

(856,943 |

) |

|

Loss from operations |

|

(483,142 |

) |

(266,035 |

) |

(38,763 |

) |

|

(1,823,186 |

) |

(2,565,923 |

) |

(373,868 |

) |

| Interest

expenses |

|

(34,191 |

) |

(35,357 |

) |

(5,151 |

) |

|

(30,183 |

) |

(120,453 |

) |

(17,550 |

) |

| Other

expenses |

|

(1,433 |

) |

(10,911 |

) |

(1,590 |

) |

|

(12,112 |

) |

(16,813 |

) |

(2,450 |

) |

| Foreign

exchange gains/(losses) |

|

130 |

|

(710 |

) |

(103 |

) |

|

477 |

|

(8,232 |

) |

(1,199 |

) |

| Fair

value change of derivative liabilities |

|

(384,674 |

) |

- |

|

- |

|

|

(885,821 |

) |

1,185,090 |

|

172,673 |

|

|

Loss before income tax expense |

|

(903,310 |

) |

(313,013 |

) |

(45,607 |

) |

|

(2,750,825 |

) |

(1,526,331 |

) |

(222,394 |

) |

| Income

tax credit/(expense) |

|

1,703 |

|

(4,183 |

) |

(609 |

) |

|

(570 |

) |

(14,585 |

) |

(2,125 |

) |

| Equity

in gains of affiliates |

|

- |

|

2,631 |

|

383 |

|

|

3,597 |

|

2,631 |

|

383 |

|

|

Net loss |

|

(901,607 |

) |

(314,565 |

) |

(45,833 |

) |

|

(2,747,798 |

) |

(1,538,285 |

) |

(224,136 |

) |

| Less:

net loss attributable to non-controlling interests

shareholders |

|

(3,275 |

) |

(552 |

) |

(80 |

) |

|

(25,202 |

) |

(15,771 |

) |

(2,298 |

) |

|

Net loss attributable to UXIN LIMITED |

|

(898,332 |

) |

(314,013 |

) |

(45,753 |

) |

|

(2,722,596 |

) |

(1,522,514 |

) |

(221,838 |

) |

|

Accretion on redeemable preferred shares |

|

(142,485 |

) |

- |

|

- |

|

|

(555,824 |

) |

(318,951 |

) |

(46,473 |

) |

| Deemed

dividend to preferred shareholders |

|

(347,557 |

) |

- |

|

- |

|

|

(587,564 |

) |

(544,773 |

) |

(79,376 |

) |

| Deemed

dividend from preferred shareholders |

|

33,976 |

|

- |

|

- |

|

|

92,779 |

|

- |

|

- |

|

|

Net loss attributable to ordinary

shareholders |

|

(1,354,398 |

) |

(314,013 |

) |

(45,753 |

) |

|

(3,773,205 |

) |

(2,386,238 |

) |

(347,687 |

) |

| |

|

|

|

|

|

|

|

|

|

Net loss |

|

(901,607 |

) |

(314,565 |

) |

(45,833 |

) |

|

(2,747,798 |

) |

(1,538,285 |

) |

(224,136 |

) |

| Foreign

currency translation |

|

18,346 |

|

9,069 |

|

1,321 |

|

|

43,406 |

|

4,818 |

|

702 |

|

|

Total comprehensive loss |

|

(883,261 |

) |

(305,496 |

) |

(44,512 |

) |

|

(2,704,392 |

) |

(1,533,467 |

) |

(223,434 |

) |

| Less:

total comprehensive loss attributable to non-controlling interests

shareholders |

|

(3,462 |

) |

(2,009 |

) |

(293 |

) |

|

(27,861 |

) |

(22,359 |

) |

(3,258 |

) |

|

Total comprehensive loss attributable to Uxin’s

shareholders |

|

(879,799 |

) |

(303,487 |

) |

(44,219 |

) |

|

(2,676,531 |

) |

(1,511,108 |

) |

(220,176 |

) |

| |

|

|

|

|

|

|

|

| Net loss

attributable to ordinary shareholders |

|

(1,354,398 |

) |

(314,013 |

) |

(45,753 |

) |

|

(3,773,205 |

) |

(2,386,238 |

) |

(347,687 |

) |

| Weighted

average shares outstanding-basic |

|

49,318,860 |

|

877,898,987 |

|

877,898,987 |

|

|

49,318,860 |

|

477,848,763 |

|

477,848,763 |

|

| Weighted

average shares outstanding-diluted |

|

49,318,860 |

|

877,898,987 |

|

877,898,987 |

|

|

49,318,860 |

|

477,848,763 |

|

477,848,763 |

|

| Net loss

per share-basic |

|

(27.46 |

) |

(0.36 |

) |

(0.05 |

) |

|

(76.51 |

) |

(4.99 |

) |

(0.73 |

) |

| Net loss

per share-diluted |

|

(27.46 |

) |

(0.36 |

) |

(0.05 |

) |

|

(76.51 |

) |

(4.99 |

) |

(0.73 |

) |

* Share-based compensation charges included are as

follows:

| |

Three months ended |

|

Year ended |

| |

December 31, 2017 |

December 31, 2018 |

|

December 31, 2017 |

December 31,2018 |

| |

RMB’000 |

RMB’000 |

USD’000 |

|

RMB’000 |

RMB’000 |

USD’000 |

| |

|

|

|

|

|

|

|

| Cost of

revenue |

- |

- |

- |

|

- |

158 |

23 |

| Sales

and marketing |

- |

7 |

1 |

|

- |

411 |

60 |

| General

and administrative |

28,217 |

71,576 |

10,429 |

|

165,873 |

1,033,498 |

150,585 |

| Research

and development |

- |

789 |

115 |

|

- |

17,965 |

2,618 |

| |

|

|

|

|

|

|

|

Uxin LimitedUnaudited

Consolidated Balance Sheets (In thousands except for

number of shares and per share data)

| |

As of |

|

As of |

| |

December 31, |

|

December 31, |

| |

2017 |

|

2018 |

| |

RMB |

|

RMB |

|

USD |

|

ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

| Cash and

cash equivalents |

291,973 |

|

|

800,997 |

|

|

116,709 |

|

|

Restricted cash |

1,617,230 |

|

|

2,013,030 |

|

|

293,308 |

|

| Accounts

receivable |

40,155 |

|

|

51,610 |

|

|

7,520 |

|

|

Short-term investments |

1,000 |

|

|

596,078 |

|

|

86,851 |

|

| Amounts

due from related parties |

608,291 |

|

|

- |

|

|

- |

|

| Advance

to consumers on behalf of financing partners |

827,417 |

|

|

521,908 |

|

|

76,044 |

|

| Loan

recognized as a result of payment under the guarantee, net |

252,555 |

|

|

553,688 |

|

|

80,675 |

|

| Advance

to sellers |

246,287 |

|

|

692,714 |

|

|

100,932 |

|

| Other

receivables, net |

251,649 |

|

|

707,404 |

|

|

103,072 |

|

|

Inventory |

77,941 |

|

|

19,380 |

|

|

2,823 |

|

| Prepaid

expenses and other current assets |

249,769 |

|

|

417,314 |

|

|

60,805 |

|

|

Financial lease receivables, net |

438,693 |

|

|

294,511 |

|

|

42,912 |

|

|

Total current assets |

4,902,960 |

|

|

6,668,634 |

|

|

971,651 |

|

| |

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

Property, equipment and software, net |

156,625 |

|

|

199,271 |

|

|

29,035 |

|

|

Intangible assets, net |

9,949 |

|

|

21,179 |

|

|

3,086 |

|

|

Goodwill |

75,849 |

|

|

110,424 |

|

|

16,089 |

|

| Long

term investments |

40,628 |

|

|

349,882 |

|

|

50,979 |

|

| Other

non-current assets |

112,902 |

|

|

- |

|

|

- |

|

|

Total non-current assets |

395,953 |

|

|

680,756 |

|

|

99,189 |

|

| |

|

|

|

|

|

|

TOTAL ASSETS |

5,298,913 |

|

|

7,349,390 |

|

|

1,070,840 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

LIABILITIES, MEZZANINE EQUITY, AND SHAREHOLDERS’

(DEFICIT)/EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Short-term borrowings |

426,783 |

|

|

624,588 |

|

|

91,005 |

|

| Accounts

payable |

65,694 |

|

|

156,320 |

|

|

22,777 |

|

|

|

|

|

|

|

|

|

Guarantee liabilities |

173,907 |

|

|

321,255 |

|

|

46,808 |

|

| Deposit

of interests from consumers and payable to financing

partners—current |

732,273 |

|

|

482,827 |

|

|

70,350 |

|

| Advance

from buyers collected on behalf of sellers |

226,891 |

|

|

375,803 |

|

|

54,756 |

|

| Other

payables and accruals |

927,389 |

|

|

1,197,300 |

|

|

174,452 |

|

| Deferred

revenue |

27,598 |

|

|

115,160 |

|

|

16,779 |

|

| Other

current liabilities |

163,355 |

|

|

- |

|

|

- |

|

|

Derivative liabilities |

1,596,424 |

|

|

- |

|

|

- |

|

|

Convertible bonds |

- |

|

|

1,188,192 |

|

|

173,125 |

|

| |

|

|

|

|

|

|

Total current liabilities |

4,340,314 |

|

|

4,461,445 |

|

|

650,052 |

|

| |

|

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

|

|

Long-term borrowings |

374,104 |

|

|

481,801 |

|

|

70,201 |

|

| Deposit

of interests from consumers and payable to financing

partners—non-current |

343,823 |

|

|

29,742 |

|

|

4,334 |

|

| Deferred

tax liabilities |

1,653 |

|

|

4,759 |

|

|

693 |

|

| |

|

|

|

|

|

|

Total non-current liabilities |

719,580 |

|

|

516,302 |

|

|

75,228 |

|

| |

|

|

|

|

|

|

Total liabilities |

5,059,894 |

|

|

4,977,747 |

|

|

725,280 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

Mezzanine equity |

|

|

|

|

|

| |

|

|

|

|

|

| Series

A |

94,411 |

|

|

- |

|

|

- |

|

| Series

A-1 |

69,193 |

|

|

- |

|

|

- |

|

| Series

B |

180,294 |

|

|

- |

|

|

- |

|

| Series

C |

408,559 |

|

|

- |

|

|

- |

|

| Series

D |

1,703,667 |

|

|

- |

|

|

- |

|

| Series

E |

1,146,351 |

|

|

- |

|

|

- |

|

| Series

F |

1,563,657 |

|

|

- |

|

|

- |

|

| Series

G |

3,214,932 |

|

|

- |

|

|

- |

|

|

Redeemable non-controlling interests |

39,580 |

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

Total mezzanine equity |

8,420,644 |

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

Shareholders’ (deficit)/equity: |

|

|

|

|

|

| Ordinary

shares |

30 |

|

|

575 |

|

|

84 |

|

|

Additional paid-in capital |

- |

|

|

12,967,986 |

|

|

1,889,496 |

|

|

Accumulated other comprehensive income |

76,607 |

|

|

86,061 |

|

|

12,539 |

|

|

Accumulated deficit |

(8,207,801 |

) |

|

(10,680,489 |

) |

|

(1,556,197 |

) |

| |

|

|

|

|

|

|

Total Uxin’s shareholders’ (deficit)/equity |

(8,131,164 |

) |

|

2,374,133 |

|

|

345,922 |

|

|

Non-controlling interests |

(50,461 |

) |

|

(2,490 |

) |

|

(362 |

) |

|

Total shareholders' (deficit)/equity |

(8,181,625 |

) |

|

2,371,643 |

|

|

345,560 |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES, MEZZANINE EQUITY, AND SHAREHOLDERS’

(DEFICIT)/EQUITY |

5,298,913 |

|

|

7,349,390 |

|

|

1,070,840 |

|

| |

|

|

|

|

|

Uxin Limited

Unaudited Reconciliations of GAAP And

Non-GAAP Results (In thousands except for number of shares

and per share data)

| |

Three months ended |

|

Year ended |

| |

December 31, 2017 |

December 31, 2018 |

|

December 31, 2017 |

December 31,2018 |

| |

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

|

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

| |

|

|

|

|

|

|

|

| Loss from operations |

(483,142 |

) |

(266,035 |

) |

(38,763 |

) |

|

(1,823,186 |

) |

(2,565,923 |

) |

(373,868 |

) |

| Add: Share-based compensation expenses |

|

|

|

|

|

|

|

| - Cost of revenue |

- |

|

- |

|

- |

|

|

- |

|

158 |

|

23 |

|

| - Sales and marketing |

- |

|

7 |

|

1 |

|

|

- |

|

411 |

|

60 |

|

| - General and administrative |

28,217 |

|

71,576 |

|

10,429 |

|

|

165,873 |

|

1,033,498 |

|

150,585 |

|

| - Research and development |

- |

|

789 |

|

115 |

|

|

- |

|

17,965 |

|

2,618 |

|

| |

|

|

|

|

|

|

|

| Non-GAAP adjusted loss from operations |

(454,925 |

) |

(193,663 |

) |

(28,218 |

) |

|

(1,657,313 |

) |

(1,513,891 |

) |

(220,582 |

) |

| |

Three months ended |

|

Year ended |

| |

December 31, 2017 |

December 31, 2018 |

|

December 31, 2017 |

December 31,2018 |

| |

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

|

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

| |

|

|

|

|

|

|

|

| Net loss |

(901,607 |

) |

(314,565 |

) |

(45,833 |

) |

|

(2,747,798 |

) |

(1,538,285 |

) |

(224,136 |

) |

| |

|

|

|

|

|

|

|

| Add: Share-based compensation expenses |

|

|

|

|

|

|

|

| -

Cost of revenue |

- |

|

- |

|

- |

|

|

- |

|

158 |

|

23 |

|

| -

Sales and marketing |

- |

|

7 |

|

1 |

|

|

- |

|

411 |

|

60 |

|

| -

General and administrative |

28,217 |

|

71,576 |

|

10,429 |

|

|

165,873 |

|

1,033,498 |

|

150,585 |

|

| -

Research and development |

- |

|

789 |

|

115 |

|

|

- |

|

17,965 |

|

2,618 |

|

| |

|

|

|

|

|

|

|

|

Fair value change of derivative liabilities |

384,674 |

|

- |

|

- |

|

|

885,821 |

|

(1,185,090 |

) |

(172,673 |

) |

|

|

|

|

|

|

|

|

|

|

Non-GAAP adjusted net loss |

(488,716 |

) |

(242,193 |

) |

(35,288 |

) |

|

(1,696,104 |

) |

(1,671,343 |

) |

(243,523 |

) |

| |

|

|

|

|

|

|

|

| Non-GAAP

adjusted net loss per share—basic |

(9.84 |

) |

(0.27 |

) |

(0.04 |

) |

|

(33.83 |

) |

(3.45 |

) |

(0.50 |

) |

| Non-GAAP

adjusted net loss per share—diluted |

(9.84 |

) |

(0.27 |

) |

(0.04 |

) |

|

(33.83 |

) |

(3.45 |

) |

(0.50 |

) |

| Weighted

average shares outstanding—basic |

49,318,860 |

|

877,898,987 |

|

877,898,987 |

|

|

49,318,860 |

477,848,763 |

|

477,848,763 |

|

| Weighted

average shares outstanding—diluted |

49,318,860 |

|

877,898,987 |

|

877,898,987 |

|

|

49,318,860 |

477,848,763 |

|

477,848,763 |

|

Note: The conversion of Renminbi (RMB) into U.S. dollars (USD) is

based on the certified exchange rate of USD1.00=RMB6.8632 as of the

end of December 2018 stipulated by the People’s Bank of China.

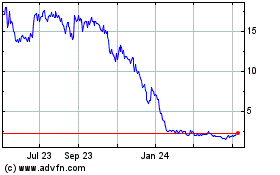

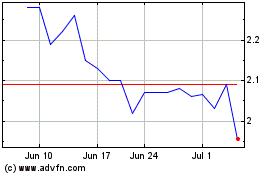

Uxin (NASDAQ:UXIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uxin (NASDAQ:UXIN)

Historical Stock Chart

From Apr 2023 to Apr 2024