United States Lime & Minerals, Inc. (NASDAQ: USLM) today

reported first quarter 2020 results: The Company’s revenues

in the first quarter 2020 were $38.4 million, compared to $37.8

million in the first quarter 2019, an increase of $0.6 million, or

1.7%. The increase in revenues in the first quarter 2020,

compared to the first quarter 2019, resulted from an increase in

the average selling price for the Company’s lime and limestone

products, partially offset by decreased demand principally from the

Company’s environmental and oil and gas services customers.

The Company’s gross profit was $9.9 million in the first quarter

2020, compared to $8.7 million in the first quarter 2019, an

increase of $1.2 million, or 13.6%. The increased gross

profit in the first quarter 2020, compared to the first quarter

2019, resulted primarily from the increased revenues described

above, lower fuel costs, and increased operating efficiencies

associated, in part, with the new kiln at the Company’s St. Clair

facility, which began producing commercially saleable quicklime in

the second quarter 2019.

Selling, general and administrative (“SG&A”) expenses were

$3.2 million in the first quarter 2020, compared to $2.7 million in

the first quarter 2019, an increase of $0.5 million, or

20.4%. The increase in SG&A expenses resulted primarily

from increased personnel expenses, including stock-based

compensation, and legal expenses in the first quarter 2020.

The Company’s revenues in the first quarter 2020 included $226

thousand from natural gas interests, compared to $334 thousand in

the first quarter 2019. The Company’s gross profit in the

first quarter 2020 included a loss of $162 thousand from natural

gas interests, compared to income of $7 thousand in the first

quarter 2019. In the fourth quarter 2019, the Company

assessed the recent trends of revenue, gross profit or loss, and

total assets of its natural gas interests and determined that those

interests no longer represented a reportable segment.

The Company reported net income of $5.5 million ($0.98 per share

diluted) in the first quarter 2020, compared to $5.1 million ($0.91

per share diluted) in the first quarter 2019, an increase of $0.4

million, or 8.1%.

Federal, state, and local governmental responses to the COVID-19

pandemic, including restrictions requiring social distancing, and

on business activities and movement of people, began to take effect

the last two weeks of March 2020 and, therefore, did not have a

material impact on the Company’s financial condition or results of

operations for the first quarter 2020. The Company expects,

however, a slowdown in the national economy beginning in the second

quarter, and a possibly greater impact in certain industries, such

as oil and gas drilling activities, roofing, and steel.

“As we respond to the unprecedented times brought upon us all by

the COVID-19 pandemic, we have not wavered in our commitment to the

safety of our employees and the other individuals at our facilities

that deliver lime and limestone products to the essential

businesses and communities we serve. In addition to our standard

health and safety protocols, we have implemented enhanced protocols

at all of our locations, including reduced access to facilities,

screening of individuals on all sites, and the enforcement of

social distancing and other practices that are consistent with, or

exceed, the guidelines of the Center for Disease Control,” said

Timothy W. Byrne, President and Chief Executive Officer.

“We are pleased with our first quarter 2020 results but

acknowledge that the significant amount of current economic

uncertainty will negatively impact our customers and their demand

for our lime and limestone products as we progress through the rest

of the year. We expect to see continued reduction in demand for

many of our products, particularly from the oil and gas services,

roofing, and steel sectors. We will consider cost-cutting

initiatives and ways to further increase operating efficiencies in

an effort to mitigate some of the effects of the expected economic

downturn,” added Mr. Byrne.

Dividend

The Company also announced today that the Board of Directors has

declared a regular quarterly cash dividend of $0.16 per share on

the Company’s common stock. This dividend is payable on June 12,

2020 to shareholders of record at the close of business on May 22,

2020.

United States Lime & Minerals, Inc., a

NASDAQ-listed public company with headquarters in Dallas, Texas, is

a manufacturer of lime and limestone products, supplying primarily

the construction (including highway, road and building

contractors), industrial (including paper and glass manufacturers),

environmental (including municipal sanitation and water treatment

facilities and flue gas treatment processes), metals (including

steel producers), oil and gas services, roof shingle manufacturers

and agriculture (including poultry and cattle feed producers)

industries. The Company operates lime and limestone plants

and distribution facilities in Arkansas, Colorado, Louisiana,

Oklahoma and Texas through its wholly owned subsidiaries, Arkansas

Lime Company, Colorado Lime Company, Texas Lime Company, U.S. Lime

Company, U.S. Lime Company – Shreveport, U.S. Lime Company – St.

Clair and U.S. Lime Company – Transportation. In addition,

the Company, through its wholly owned subsidiary, U.S. Lime Company

– O & G, LLC, has royalty and non-operating working

interests pursuant to an oil and gas lease and a drillsite

agreement on its Johnson County, Texas property, located in the

Barnett Shale Formation.

Any statements contained in this news release, including, but

not limited to, statements relating to the impact of the COVID-19

pandemic, that are not statements of historical fact are

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements, and investors are cautioned that such statements

involve risks and uncertainties that could cause actual results to

differ materially from expectations, including without limitation

those risks and uncertainties indicated from time to time in the

Company’s filings with the Securities and Exchange Commission.

| Contact: Timothy W. Byrne |

| (972) 991-8400 |

United States Lime &

Minerals, Inc.CONDENSED

CONSOLIDATED FINANCIAL DATA(In

thousands, except per share

amounts)(Unaudited)

| |

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2020 |

|

2019 |

|

INCOME STATEMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

38,440 |

|

|

$ |

37,799 |

|

| Cost of sales |

|

28,563 |

|

|

|

29,106 |

|

|

Gross profit |

$ |

9,877 |

|

|

$ |

8,693 |

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

$ |

3,219 |

|

|

$ |

2,673 |

|

|

Operating profit |

$ |

6,658 |

|

|

$ |

6,020 |

|

| Interest expense |

|

62 |

|

|

|

62 |

|

| Interest and other income,

net |

|

(247 |

) |

|

|

(492 |

) |

| Income tax expense |

|

1,299 |

|

|

|

1,322 |

|

|

Net income |

$ |

5,544 |

|

|

$ |

5,128 |

|

| |

|

|

|

|

|

| Income per share of common

stock: |

|

|

|

|

|

|

Basic |

$ |

0.99 |

|

|

$ |

0.91 |

|

|

Diluted |

$ |

0.98 |

|

|

$ |

0.91 |

|

| Weighted-average shares

outstanding: |

|

|

|

|

|

|

Basic |

|

5,624 |

|

|

|

5,609 |

|

|

Diluted |

|

5,634 |

|

|

|

5,615 |

|

| Cash dividends per share of

common stock |

$ |

0.160 |

|

|

$ |

0.135 |

|

| |

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

2020 |

|

2019 |

| BALANCE

SHEETS |

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

Current assets |

$ |

97,368 |

|

|

$ |

92,735 |

|

|

Property, plant and equipment, net |

|

151,289 |

|

|

|

150,687 |

|

|

Other non-current assets |

|

3,210 |

|

|

|

3,615 |

|

|

Total assets |

$ |

251,867 |

|

|

$ |

247,037 |

|

|

Liabilities and Stockholders’

Equity: |

|

|

|

|

|

|

Current liabilities |

$ |

8,565 |

|

|

$ |

9,459 |

|

|

Deferred tax liabilities, net |

|

18,198 |

|

|

|

17,218 |

|

|

Other long-term liabilities |

|

2,937 |

|

|

|

3,228 |

|

|

Stockholders’ equity |

|

222,167 |

|

|

|

217,132 |

|

|

Total liabilities and stockholders’ equity |

$ |

251,867 |

|

|

$ |

247,037 |

|

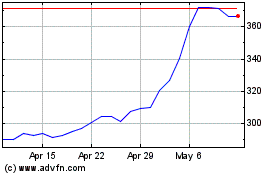

United States Lime and M... (NASDAQ:USLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

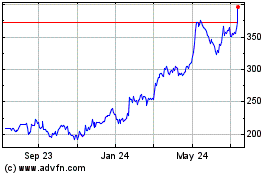

United States Lime and M... (NASDAQ:USLM)

Historical Stock Chart

From Apr 2023 to Apr 2024