Securities Registration: Employee Benefit Plan (s-8)

March 02 2020 - 4:04PM

Edgar (US Regulatory)

Table of Contents

As filed with the Securities and Exchange Commission on March 2, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S‑8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

UNITED STATES LIME & MINERALS, INC.

(Exact name of registrant as specified in its charter)

|

TEXAS

|

|

75‑0789226

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

|

|

5429 LBJ FREEWAY, SUITE 230

|

|

|

|

DALLAS, TEXAS

|

|

75240

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

UNITED STATES LIME & MINERALS, INC.

AMENDED AND RESTATED 2001 LONG-TERM INCENTIVE PLAN

(Full title of the plan)

TIMOTHY W. BYRNE

PRESIDENT AND CHIEF EXECUTIVE OFFICER

UNITED STATES LIME & MINERALS, INC.

5429 LBJ FREEWAY, SUITE 230

DALLAS, TEXAS 75240

(Name and address of agent for service)

(972) 991‑8400

(Telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

|

☐ Large accelerated filer

|

|

☒ Accelerated filer

|

|

|

|

☒ Smaller reporting company

|

|

☐ Non-accelerated filer

|

|

☐ Emerging growth company

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposed

|

|

Proposed

maximum

|

|

|

|

|

|

|

|

|

|

maximum

|

|

aggregate

|

|

Amount of

|

|

|

Title of securities

|

|

Amount to be

|

|

offering

|

|

offering

|

|

registration

|

|

|

to be registered

|

|

registered

|

|

price per share

|

|

price

|

|

fee

|

|

|

Common Stock, par value $0.10 per share

|

|

133,176

|

(1)

|

$

|

80.64

|

(2)

|

$

|

10,739,312.64

|

(2)

|

$

|

1,393.96

|

(2)

|

(1)Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), the number of shares of Common Stock being registered shall be adjusted to include any additional shares which may become issuable as a result of stock splits, stock dividends, or similar transactions, including in accordance with the anti-dilution provisions of the United States Lime & Minerals, Inc. Amended and Restated 2001 Long-Term Incentive Plan (the “2001 Plan”).

(2)Estimated in accordance with Rules 457(c) and (h) under the Securities Act, solely for the purpose of calculating the registration fee, on the basis of the average of the high and low per share sales prices of the Common Stock on February 27, 2020 as reported on the Nasdaq Global Market.

As permitted by Rule 429 under the Securities Act, the reoffer prospectus included in this Registration Statement serves as a combined reoffer prospectus for both this Registration Statement and the Registrant’s two previous registration statements on Form S‑8 with respect to the 2001 Plan filed with the Commission August 18, 2009 (File No. 333161410‑) and June 12, 2014 (File No. 333196697‑).

UNITED STATES LIME & MINERALS, INC.

120,000 SHARES

COMMON STOCK

($0.10 PAR VALUE PER SHARE)

This Prospectus relates to an aggregate of up to 120,000 shares (the “Shares”) of common stock, $0.10 par value per share (the “Common Stock”), of United States Lime & Minerals, Inc., a Texas corporation (the “Company,” “we,” or “our”), which may be offered for sale from time to time by the selling shareholders named herein or to be named in the future by means of supplements to this Prospectus. The Shares offered hereby have been or will have been acquired under the Company’s Amended and Restated 2001 Long-Term Incentive Plan (the “2001 Plan”).

The selling shareholders and certain broker-dealers that participate in the offer and sale of the Shares on behalf of the selling shareholders may be deemed to be “underwriters” for purposes of the Securities Act of 1933, as amended (the “Securities Act”), in which case commissions and discounts received by such broker-dealers may be deemed to be underwriting compensation under the Securities Act. See “PLAN OF DISTRIBUTION.” The Company will pay all expenses incident to the offering and sale of the Shares pursuant to this Prospectus other than commissions and discounts of underwriters, brokers, dealers, or agents. The Company will not receive any proceeds from any sale of the Shares by the selling shareholders.

There is no assurance that any of the selling shareholders will sell any of the Shares or that all of the Shares will be sold. The Common Stock is listed on the Nasdaq Global Market under the symbol USLM. On February 27, 2020, the closing price of the Common Stock was $80.26 per share.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURES IN THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is March 2, 2020

No person has been authorized in connection with the offering made hereby to give any information or to make any representation other than those contained in, or incorporated by reference into, this Prospectus and, if given or made, such information or representation must not be relied upon as having been authorized by the Company. This Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any of the Shares offered hereby, nor shall there be any sale of the Shares, to any person in any jurisdiction in which it is unlawful to make such offer, solicitation, or sale. Neither the delivery of this Prospectus nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in the information herein or the affairs of the Company since the date of this Prospectus.

TABLE OF CONTENTS

AVAILABLE INFORMATION

The Company files periodic reports, proxy statements, and other information with the Securities and Exchange Commission (the “Commission”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such documents concerning the Company are available online through the Commission’s website at http://www.sec.gov.

The Company has filed with the Commission registration statements on Form S‑8 (of which this Prospectus is a part) under the Securities Act with respect to the Shares offered hereby. This Prospectus does not contain all of the information set forth in the registration statements, certain parts of which are omitted in accordance with the rules and regulations of the Commission. Complete copies of the registration statements are available from the Commission.

DOCUMENTS INCORPORATED BY REFERENCE

The Commission allows the Company to incorporate by reference into this Prospectus some of the information that we have filed with the Commission pursuant to the Exchange Act. The following documents are incorporated by reference and are deemed to be a part of this Prospectus:

All documents that we file with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of this Prospectus and prior to the termination of the offering shall be deemed to be incorporated by reference into this Prospectus and to be a part hereof from the date of filing of such documents.

Any statement contained in this Prospectus or in a document incorporated by reference into this Prospectus will be modified or superseded for purposes of this Prospectus to the extent that it is modified or superseded by a statement contained in a subsequently filed document which also is incorporated by reference into this Prospectus. Any statement so modified or superseded will not, except as so modified or superseded, constitute a part of this Prospectus.

We will provide free of charge to each person to whom a copy of this Prospectus has been delivered, upon the oral or written request of such person, a copy of the documents that have been or may be incorporated by reference into this Prospectus (other than exhibits to such documents, unless the exhibits are specifically incorporated by reference into such documents). Requests should be directed to:

Timothy W. Byrne

President and Chief Executive Officer

United States Lime & Minerals, Inc.

5429 LBJ Freeway, Suite 230

Dallas, Texas 75240

(972) 991‑8400

GENERAL INFORMATION

The principal business of the Company is the production and sale of lime and limestone products. We also own certain royalty and non-operated working interests in natural gas wells. Our executive offices are located at 5429 LBJ Freeway, Suite 230, Dallas, Texas 75240, our telephone number is (972) 991‑8400, and our website is at http://www.uslm.com.

SELLING SHAREHOLDERS

This Prospectus relates to the Shares that the selling shareholders have acquired or will acquire under the 2001 Plan. Each of the selling shareholders will be a director or executive officer of the Company, or a donee, pledgee, transferee, or other successor in interest thereof. The Shares to which this Prospectus relates may be “control securities” within the meaning of General Instruction C to Form S‑8. Neither the statement in this Prospectus or in the related registration statements, nor the delivery of this Prospectus in connection with the disposition of Shares by any of the selling shareholders, will be an admission by the Company or any of the selling shareholders that the selling shareholder is in a control relationship with the Company.

The table attached as Annex A sets forth, with respect to the selling shareholders and based on the information available to us as of the date thereof, the name and position of each selling shareholder, the number of shares of Common Stock owned, the number of Shares available for resale under this Prospectus, and the number and percent of our outstanding shares of Common Stock that will be owned after giving effect to this offering. We do not know whether any of the selling shareholders will sell any or all of the Shares. The inclusion of Shares in the table in Annex A does not constitute a commitment to sell any Shares by any of the selling shareholders named therein.

USE OF PROCEEDS

The Company will not receive any of the proceeds from the sale of any of the Shares by the selling shareholders.

PLAN OF DISTRIBUTION

The Shares may be sold from time to time by the selling shareholders or by their respective donees, pledgees, transferees, or other successors in interest. Such sales may be made on the Nasdaq Global Market, in the over-the-counter market, or otherwise at prices and at terms then prevailing, at prices related to the then-current market price, or in negotiated transactions. The Shares may be sold by one or more of the following methods, without limitation:

|

|

·

|

|

Ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

|

A block trade in which the broker-dealer so engaged will attempt to sell the Shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

|

Purchases by a broker-dealer as principal and resale by such broker-dealer for its account;

|

|

|

·

|

|

An exchange distribution in accordance with the rules of such exchange; and

|

|

|

·

|

|

Face-to-face transactions between sellers and purchasers with or without a broker-dealer.

|

In effecting sales of the Shares, broker-dealers engaged by the selling shareholders may arrange for the participation of other broker-dealers. Broker-dealers may receive compensation in the form of commissions or discounts from the selling shareholders in amounts to be negotiated immediately prior to the sale. Such broker-dealers and any other participating broker-dealers may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales, in which case commissions and discounts received by such broker-dealers may be deemed to be underwriting compensation under the Securities Act.

Once the Company has been notified by a selling shareholder that any material arrangement has been entered into with a broker-dealer for the sale of Shares through a block trade, exchange or secondary distribution, or a purchase by a broker-dealer as principal, a supplement to this Prospectus will be filed, if required, pursuant to Rule 424(b) under the Securities Act, disclosing: the participating broker-dealer; the number of Shares involved; the price at which such Shares were sold; the commissions paid or discounts allowed to such broker-dealer, where applicable; that such broker-dealer did not conduct any investigation to verify the information set out or incorporated by reference in this Prospectus (as supplemented); and other facts material to the transaction.

In addition to any sales of the Shares under this Prospectus, the selling shareholders may, at the same time, sell any shares of Common Stock owned by them, including the Shares covered by this Prospectus, pursuant to Rule 144 under the Securities Act.

There is no assurance that the selling shareholders will sell any or all of the Shares offered hereby.

The Company will pay all expenses incident to the offering and sale of the Shares pursuant to this Prospectus other than commissions and discounts of underwriters, brokers, dealers, or agents.

EXPERTS

The consolidated financial statements and management's assessment of the effectiveness of internal control over financial reporting incorporated by reference in this registration statement have been incorporated by reference in reliance upon the reports of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

ANNEX A

SELLING SHAREHOLDERS

The following table sets forth, as of February 27, 2020, the name of each selling shareholder, the nature of any position, office, or other material relationship which the selling shareholder has had within the past three years with the Company and its affiliates, the number of shares of Common Stock owned by the selling shareholder prior to the offering described in this Prospectus, the number of Shares that may be offered and sold for the selling shareholder’s account pursuant to this Prospectus, and the number and percentage of shares of Common Stock to be owned by the selling shareholder after completion of the offering:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock Owned

|

|

Shares to be

|

|

Common Stock to be

Owned After This Offering

|

|

|

Name and

Position

|

|

Before This Offering

|

|

Sold in This

Offering

|

|

Number of

Shares

|

|

Percent of

Outstanding

|

|

|

Timothy W. Byrne,

President and Chief Executive Officer

|

|

90,284

|

(1)

|

90,284

|

(1)

|

0

|

(2)

|

0.0

|

%(3)

|

|

|

(1)

|

|

This number includes 45,000 Shares issuable upon exercise of outstanding options granted under the 2001 Plan.

|

|

|

(2)

|

|

This is the number of shares of Common Stock that the selling shareholder would own if all of the Shares being offered under this Prospectus were sold.

|

|

|

(3)

|

|

Percentage is based upon 5,625,185 shares of Common Stock outstanding as of February 27, 2020.

|

The selling shareholder named above may be deemed to be an “affiliate” of the Company, as that term is defined under the Securities Act.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

ITEM 1. PLAN INFORMATION.

Omitted pursuant to Rule 428 and Form S‑8.

ITEM 2. REGISTRANT INFORMATION AND EMPLOYEE PLAN ANNUAL INFORMATION.

Omitted pursuant to Rule 428 and Form S‑8.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

ITEM 3. INCORPORATION OF DOCUMENTS BY REFERENCE.

The following documents are incorporated by reference and are deemed to be a part of this Registration Statement:

All documents that we file with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all of the shares of Common Stock offered hereby have been sold or which deregisters all such shares then remaining unsold will be incorporated by reference into this Registration Statement and be a part hereof from the date of filing of such documents.

Any statement contained in this Registration Statement or in a document incorporated by reference into this Registration Statement will be modified or superseded for purposes of this Registration Statement to the extent that it is modified or superseded by a statement contained in a subsequently filed document which also is incorporated by reference into this Registration Statement. Any statement so modified or superseded will not, except as so modified or superseded, constitute a part of this Registration Statement.

ITEM 4. DESCRIPTION OF SECURITIES.

Not applicable.

ITEM 5. INTERESTS OF NAMED EXPERTS AND COUNSEL.

Not applicable.

ITEM 6. INDEMNIFICATION OF DIRECTORS AND OFFICERS.

Article 8 of the Texas Business Organizations Code authorizes the Company to indemnify our directors and officers and certain other persons in certain instances. In addition, Article 8 and our Amended and Restated Bylaws (the “Bylaws”) require that we indemnify any director or officer against reasonable expenses he incurs in connection with a wholly successful defense of a proceeding in which he is a named defendant or respondent because he is or was a director or officer. In other cases, indemnification will only occur with the determination that the person (i) conducted himself in good faith, (ii) reasonably believed, in the case of conduct in his official capacity as our director or officer, that his conduct was in our best interests and, in all other cases, that his conduct was at least not opposed to our best interests, and (iii) in the case of any criminal proceeding, had no reasonable cause to believe his conduct was unlawful. However, if the director or officer is found liable to us or is found liable on the basis that personal benefit was improperly received, the indemnification shall be limited to reasonable expenses actually incurred in connection with the proceeding and shall not be made in respect of any proceeding in which the person shall have been found liable for willful or intentional misconduct in the performance of his duty to the Company.

Article 8 and our Bylaws generally require determinations that the person to be indemnified has satisfied the prescribed conduct and belief standards, as determined by directors who are not themselves then named defendants or respondents in the proceeding, by a special legal counsel selected by the Board of Directors or a committee thereof, or by shareholders in a vote that excludes the shares held by directors and officers who are named defendants or respondents in the proceeding.

The Bylaws further require us to pay or reimburse expenses incurred by a director or officer in connection with his appearance as a witness or other participation in a proceeding at a time when he is not a named defendant or respondent in the proceeding. We must also advance reasonable expenses to a director or officer upon receipt of a good faith affirmation by him that he has met the standard of conduct necessary for indemnification and a written undertaking to repay such advances if it is ultimately determined that he has not met those requirements.

The Bylaws permit us to indemnify and advance expenses to an employee or agent to such extent as may be consistent with law, including persons serving another entity in various capacities at our request. The Bylaws also authorize us to purchase and maintain insurance or make other arrangements on behalf of directors, officers, employees, and agents against or in respect of liabilities.

Any indemnification of or advance of expenses to a director or officer under Article 8 or the Bylaws must be reported in writing to shareholders not later than the notice of the next shareholders’ meeting or the next submission to shareholders of a consent to action without a meeting and, in any event, within the 12‑month period immediately following the indemnification or advance.

ITEM 7. EXEMPTION FROM REGISTRATION CLAIMED.

Not applicable.

ITEM 8. EXHIBITS.

See the exhibit index below, which is incorporated by reference herein.

EXHIBIT INDEX

|

|

|

|

|

EXHIBIT

|

|

DESCRIPTION

|

|

|

|

|

|

4.1

|

|

Articles of Amendment to the Articles of Incorporation of Scottish Heritable, Inc. dated as of January 25, 1994 (incorporated by reference to Exhibit 3(a) to the Company’s Annual Report on Form 10‑K for the fiscal year ended December 31, 1993, File Number 000‑4197).

|

|

|

|

|

|

4.2

|

|

Restated Articles of Incorporation of the Company dated as of May 14, 1990 (incorporated by reference to Exhibit 3(b) to the Company’s Annual Report on Form 10‑K for the fiscal year ended December 31, 1993, File Number 000‑4197).

|

|

|

|

|

|

4.3

|

|

Amended and Restated Bylaws of the Company dated as of March 8, 2018 (incorporated by reference to Exhibit 3.1 of the Company’s Current Report on Form 8K filed on March 12, 2018, File Number 0004197).‑‑

|

|

|

|

|

|

4.4

|

|

United States Lime & Minerals, Inc. Amended and Restated 2001 Long-Term Incentive Plan (incorporated by reference to Exhibit A to the Company’s Definitive Proxy Statement for its 2019 Annual Meeting of Shareholders held on May 3, 2019, File Number 0004197).‑

|

|

|

|

|

|

5.1

|

|

Opinion of Morgan, Lewis & Bockius LLP.

|

|

|

|

|

|

23.1

|

|

Consent of Grant Thornton LLP.

|

|

|

|

|

|

23.2

|

|

Consent of Morgan, Lewis & Bockius LLP (included in its opinion filed as Exhibit 5.1 to this registration statement).

|

|

|

|

|

|

24.1

|

|

Power of Attorney (included on the signature pages of this Registration Statement).

|

ITEM 9. UNDERTAKINGS.

|

|

(a)

|

|

The undersigned Registrant hereby undertakes:

|

|

|

(1)

|

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

|

|

|

(i)

|

|

To include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

|

(ii)

|

|

To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement; and

|

|

|

(iii)

|

|

To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

|

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply to this Registration Statement on Form S‑8 if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

|

|

(1)

|

|

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

|

|

|

(2)

|

|

To remove from registration by means of post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(b)

|

|

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein and the offering of such securities at the time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(c)

|

|

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

|

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S‑8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Dallas, State of Texas, on the 2nd day of March, 2020.

|

|

|

|

|

|

UNITED STATES LIME & MINERALS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Timothy W. Byrne

|

|

|

|

Timothy W. Byrne

|

|

|

|

President and Chief Executive Officer

|

POWER OF ATTORNEY

Each person whose signature appears below hereby appoints Timothy W. Byrne and Michael L. Wiedemer, and each of them, as his true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution for him in his name, place and stead, with the authority to execute in the name of each such person, and to file with the Commission, together with any exhibits thereto and other documents therewith, any and all amendments to this Registration Statement (including post-effective amendments to this Registration Statement), necessary or advisable to enable the Registrant to comply with the Securities Act, and any rules, regulations and requirements of the Commission in respect thereof, which amendments or registration statements may make such other changes in the Registration Statement as the aforesaid attorneys-in-fact and agents executing the same deem appropriate, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing necessary or advisable to be done with respect to this Registration Statement or any such amendments or registration statements in the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or their or his substitute or substitutes, may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and on the date indicated:

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Timothy W. Byrne

|

|

President, Chief Executive Officer, and Director (Principal Executive Officer)

|

|

March 2, 2020

|

|

Timothy W. Byrne

|

|

|

|

|

|

|

|

|

|

|

/s/ Michael L. Wiedemer

|

|

Vice President and Chief Financial Officer (Principal Financial and Accounting Officer)

|

|

March 2, 2020

|

|

Michael L. Wiedemer

|

|

|

|

|

|

|

|

|

|

|

/s/ Antoine M. Doumet

|

|

Director and Chairman of the Board

|

|

March 2, 2020

|

|

Antoine M. Doumet

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Richard W. Cardin

|

|

Director

|

|

March 2, 2020

|

|

Richard W. Cardin

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Ray M. Harlin

|

|

Director

|

|

March 2, 2020

|

|

Ray M. Harlin

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Billy R. Hughes

|

|

Director

|

|

March 2, 2020

|

|

Billy R. Hughes

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Edward A. Odishaw

|

|

Director and Vice Chairman of the Board

|

|

March 2, 2020

|

|

Edward A. Odishaw

|

|

|

|

|

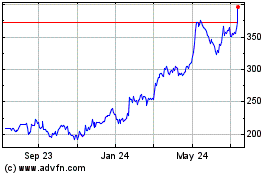

United States Lime and M... (NASDAQ:USLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

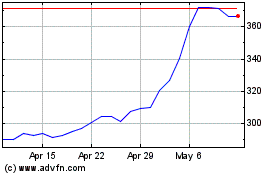

United States Lime and M... (NASDAQ:USLM)

Historical Stock Chart

From Apr 2023 to Apr 2024