UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment

No. )

|

Filed by the Registrant x

|

|

Filed by a Party other than the Registrant o

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a-12

|

|

UFP TECHNOLOGIES, INC.

|

(Name of Registrant as Specified In Its Charter)

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction

applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

UFP TECHNOLOGIES, INC.

100 HALE STREET

NEWBURYPORT, MASSACHUSETTS 01950-3504 USA

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

of

UFP TECHNOLOGIES, INC.

To Be Held on June 9, 2021

The Annual Meeting of Stockholders of UFP Technologies, Inc.

(“we,” “us,” “our,” or the “Company”) will be held on June 9, 2021, at 10:00 a.m.,

Eastern Daylight Time. There will be no physical meeting location. The Annual Meeting will be a virtual stockholder meeting, conducted

via live audio webcast, through which you can submit questions and vote online. The Annual Meeting can be accessed by visiting

www.virtualshareholdermeeting.com/UFPT2021 and entering your 16-digit control number included in your proxy materials or on your

proxy card. The Annual Meeting will be for the following purposes:

|

|

1.

|

To elect the five directors identified as standing for election in the accompanying proxy statement, each to serve until the

2022 Annual Meeting of Stockholders and until their successors are duly elected;

|

|

|

2.

|

To vote on a non-binding advisory resolution to approve the compensation of our named executive officers;

|

|

|

3.

|

To amend and restate our 2003 Equity Incentive Plan to ratify the continued issuance of incentive stock options under the plan

and conform the plan to certain changes in the U.S. Tax Code;

|

|

|

4.

|

To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year

ended December 31, 2021; and

|

|

|

5.

|

To transact such other business as may properly come before the 2021 Annual Meeting of Stockholders, and at any adjournment

or postponement thereof.

|

The Board of Directors has fixed April 12, 2021 as the record

date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting. It is expected that this proxy

statement and the accompanying proxy will be mailed to stockholders on or about May 3, 2021.

You are cordially invited to attend the virtual Annual Meeting.

|

|

By Order of the Board of Directors

|

|

|

Christopher P. Litterio

Secretary

|

Newburyport, Massachusetts

April 27, 2021

YOUR VOTE IS IMPORTANT

YOU ARE URGED TO VOTE, SIGN, DATE, AND RETURN THE ACCOMPANYING

ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN THE POSTAGE-PAID ENVELOPE ENCLOSED FOR THAT PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY,

THE PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE EXERCISE BY FILING WITH THE SECRETARY OF THE COMPANY A WRITTEN REVOCATION, BY

EXECUTING A PROXY WITH A LATER DATE, OR BY ATTENDING AND VOTING AT THE VIRTUAL ANNUAL MEETING.

IMPORTANT NOTICE REGARDING AVAILABILITY

OF PROXY MATERIALS FOR OUR ANNUAL MEETING OF STOCKHOLDERS TO BE HELD VIRTUALLY ON JUNE 9, 2021: This Proxy Statement,

our Annual Report for the fiscal year ended December 31, 2020 and the Proxy Card are available at our website, www.ufpt.com/investors/filings.html.

UFP TECHNOLOGIES, INC.

100 HALE STREET NEWBURYPORT, MASSACHUSETTS 01950-3504 USA

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 9, 2021

This proxy statement is furnished in connection with the solicitation

of proxies by the Board of Directors (the “Board”) of UFP Technologies, Inc., a Delaware corporation (“we,”

“us,” “our,” or the “Company”) with its principal executive offices at 100 Hale Street, Newburyport,

MA 01950-3504, for use at the Annual Meeting of Stockholders to be held on June 9, 2021, and at any adjournment or postponement

thereof (the “Meeting”). The enclosed proxy relating to the Meeting is solicited on behalf of our Board of Directors

and the cost of such solicitation will be borne by us. It is expected that this proxy statement and the accompanying proxy will

be mailed to stockholders on or about May 3, 2021. Certain of our officers and regular employees may solicit proxies by correspondence,

telephone or in person, without extra compensation. We may also pay to banks, brokers, nominees and certain other fiduciaries their

reasonable expenses incurred in forwarding proxy material to the beneficial owners of securities held by them.

Only stockholders of record at the close of business on April

12, 2021 will be entitled to receive notice of, and to vote at, the Meeting. As of that date, there were outstanding and entitled

to vote 7,524,479 shares of our Common Stock, $0.01 par value (the “Common Stock”). Each such stockholder is entitled

to one vote for each share of Common Stock so held and may vote such shares either in person or by proxy.

Due to the coronavirus (COVID-19) pandemic and out of an abundance

of caution to support the health and well-being of our employees, stockholders, and communities, the Meeting will be held as a

virtual meeting only, via a live audio webcast. There will be no physical meeting location. You will be able to attend the meeting

online and vote your shares electronically during the meeting by visiting www.virtualshareholdermeeting.com/UFPT2021 and entering

your 16-digit control number included in your proxy materials or on your proxy card. Even though the Meeting is being held virtually,

stockholders will have the ability to participate in, hear others, and ask questions during the Meeting.

The meeting webcast will begin promptly at 10:00 a.m. Eastern

Daylight Time on June 9, 2021. Online check-in will begin promptly at 9:45 a.m. Eastern Daylight Time on that date, and you should

allow ample time for the online check-in procedures. We will have technicians ready to assist you with any technical difficulties

you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or

during the meeting, please call the technical support number that will be posted on the virtual stockholder meeting login page

at www.virtualshareholdermeeting.com/UFPT2021.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At our 2020 Annual Meeting of Stockholders, we amended our certificate

of incorporation to eliminate our classified Board of Directors. Accordingly, all of our directors who are not designated as Class

II directors are standing for election at the Meeting. These five directors are to be elected to serve until the 2022 Annual Meeting

of Stockholders and until their successors have been duly elected and qualified. Effective as of and at the 2022 Annual Meeting

of Stockholders, all directors or nominees will stand for election for one-year terms.

Each nominee has indicated his or her willingness to serve, if elected.

It is the intention of the persons named as proxies to vote for the election of the nominees. If any of the nominees declines to

serve or becomes unavailable for any reason, or if a vacancy occurs before the election, the persons named as proxies will vote

the proxy for such substitutes, if any, as the present Board of Directors may designate. We have no reason to believe that any

of the nominees will be unable to serve if elected. The nominees have not been nominated pursuant to any arrangement or understanding

with any person.

The following table sets forth certain information with respect to each

of our current directors and nominees for director. When used below, positions held with us include positions held with our predecessors

and subsidiaries:

|

|

|

|

|

|

|

|

|

|

|

Board Committees

|

|

Name

|

|

Age

|

|

Position

|

|

Director

Since

|

|

Year Term

Expires/

Will Expire If

Elected, Class

|

|

Audit

Committee

|

|

Compensation

Committee

|

|

Nominating

Committee

|

|

R. Jeffrey Bailly

|

|

59

|

|

President, Chief Executive Officer and Chairman of the Board of Directors

|

|

1995

|

|

2022

|

|

|

|

|

|

|

|

Thomas Oberdorf

|

|

63

|

|

Director

|

|

2004

|

|

2022, Class II

|

|

X

|

|

|

|

X

|

|

Marc Kozin†

|

|

59

|

|

Director

|

|

2006

|

|

2022

|

|

|

|

X

|

|

X (Chair)

|

|

Robert W. Pierce, Jr.

|

|

67

|

|

Director

|

|

2008

|

|

2022

|

|

X

|

|

|

|

X

|

|

Lucia Luce Quinn

|

|

67

|

|

Director

|

|

2013

|

|

2022, Class II

|

|

|

|

X (Chair)

|

|

X

|

|

Daniel C. Croteau

|

|

55

|

|

Director

|

|

2015

|

|

2022

|

|

|

|

X

|

|

X

|

|

Cynthia L. Feldmann

|

|

68

|

|

Director

|

|

2017

|

|

2022

|

|

X (Chair)

|

|

|

|

X

|

|

|

†

|

Lead Independent Director

|

Mr. Bailly has served as our Chairman since October 2006

and as Chief Executive Officer, President, and a director since January 1, 1995. He joined the Company in 1988 and served

as a Division Manager (1989-1992), General Manager Northeast Operations (1992-1994), and as our Vice President of Operations (1994-1995).

From 1984 through 1988, Mr. Bailly, a former certified public accountant, was employed by Coopers & Lybrand. Mr. Bailly

is a member of Young Presidents’ Organization (YPO Gold). As a result of these and other professional experiences, Mr. Bailly

possesses particular knowledge and experience in operations, accounting, finance, mergers and acquisitions, and executive leadership

within a manufacturing environment that strengthen the Board’s collective qualifications, skills, and experience.

Mr. Oberdorf has served as one of our directors since 2004.

Mr. Oberdorf is a Class II director, not standing for election at the Meeting. Presently Mr. Oberdorf is Chief Executive Officer

and Chairman of SIRVA, Inc. a leading global provider of moving and relocation services to corporations, consumers and governments.

From August 2010 through March 2011, Mr. Oberdorf consulted for Orchard Brands, a multi-channel marketer of men’s and

women’s apparel for the 55+ market segment. From December 2008 through August 2010, Mr. Oberdorf was Executive

Vice President and Chief Financial Officer of infoGROUP, Inc., which provides business and consumer databases for sales leads

and mailing lists, database marketing services, data processing services, e-mail marketing, market research, and sales and marketing

solutions. From June 2006 through 2008, Mr. Oberdorf was Senior Vice President, Chief Financial Officer and Treasurer of Getty

Images Inc., the world’s leading creator and distributor of still imagery, footage and multi-media products, as well

as a recognized provider of other forms of premium digital content, including music. From March 2002 through June 2006, Mr. Oberdorf

was Senior Vice President, Chief Financial Officer and Treasurer of CMGI, Inc., a supply chain management, marketing distribution

and ecommerce solutions company, where he served as a consultant from November 2001 through February 2002. From February 1999 through

October 2001, Mr. Oberdorf was Senior Vice President and Chief Financial Officer of Bertelsmann AG’s subsidiary, BeMusic

Direct, a direct-to-consumer music sales company. From January 1981 through January 1999, Mr. Oberdorf served in various capacities

at Readers Digest Association, Inc., most recently as Vice President Global Books & Home Entertainment—Finance.

As a result of these and other professional experiences, Mr. Oberdorf possesses particular knowledge and experience in manufacturing

and accounting, finance, capital markets, and public company experience that strengthen the Board’s collective qualifications,

skills, and experience.

Mr. Kozin has served as a one of our directors since 2006. Mr.

Kozin served as President of L.E.K. Consulting from 1997 through 2011 and as a senior Advisor from 2011 through 2018. In January

2021, Mr. Kozin joined the board of Isleworth Healthcare Acquisition Corporation (Nasdaq: ISLE), a blank check company organized

to effect mergers and acquisitions with businesses in the healthcare industry. In December 2020, Mr. Kozin joined the Board of

Vascular Biogenics (Nasdaq: VBLT), a late stage oncology company, as Vice Chairman. In January 2019, Mr. Kozin joined the board

of Dicerna Pharmaceuticals (Nasdaq: DNRA), a leading developer of investigational ribonucleic acid interference (RNAi) therapeutics.

In 2012, Mr. Kozin joined the board of Endocyte (Nasdaq: ECYT), a small molecule targeted therapeutic company that has since been

sold to Novartis. In January 2014, Mr. Kozin joined the board of OvaScience, Inc. (Nasdaq: OVAS), a life sciences company focused

on new fertility treatments that has since merged with Millendo Therapeutics. In January 2013, Mr. Kozin joined the Strategic Advisory

Board of Healthcare Royalty Partners where he is Chairperson. Previously, Mr. Kozin served on the boards of directors of Dyax (sold

to Shire), Frequency Therapeutics, Flex Pharma, Crunchtime! Information Systems, Medical Simulation Corporation, Brandwise, Lynx

Therapeutics, Inc. and Assurance Medical, Inc. As a result of these and other professional experiences, Mr. Kozin possesses particular

knowledge and experience in strategic planning and leadership consulting of complex organizations that strengthen the Board’s

collective qualifications, skills, and experience.

Mr. Pierce has served as one of our directors since June

2008. Mr. Pierce serves as Chief Executive Officer, Chairman, and Co-Owner of Pierce Aluminum Companies, Inc. Pierce

Aluminum supplies aluminum raw stock and finished goods to the marine, aerospace, medical, transportation, and defense industries.

Over the last 40 years, Mr. Pierce has overseen the growth of the company from a small operating warehouse in Canton,

Massachusetts, to a state of the art 150,000 square foot production facility and distribution center in Franklin, Massachusetts

and eleven regional warehouses across the country. Mr. Pierce has served on the boards of directors of McLean Hospital since

2010, Crohn’s and Colitis Foundation of America—New England Chapter since 2010, Mass General Hospital for Children

Business Advisory Board since 2000, and Overseers Marine Biological Laboratory Woods Hole, Massachusetts since 2009. Mr. Pierce

is a past board member of the National Association of Aluminum Distributors. As a result of these and other professional experiences,

Mr. Pierce possesses particular knowledge and experience in manufacturing and design, innovation, engineering, sales and marketing,

organizational growth and executive leadership within a manufacturing environment that strengthen the Board’s collective

qualifications, skills, and experience.

Ms. Quinn has served as one of our directors since December 2013. Ms.

Quinn is a Class II director, not standing for election at the Meeting. Effective as of December 31, 2020, Ms. Quinn retired from

her position as Chief People Officer and Head of Corporate Communications of Genuity Science (formerly WuXi NextCODE), a leading

contract genomics and data-sourcing, analytics and insights organization providing global biopharma partners with services such

as population-scale, disease-specific data sourcing, high quality sequencing, robust analysis software tools for mining massive

datasets and statistical analysis, AI and quantum computing. Ms. Quinn continues work with Genuity Science as a consultant to its

Board of Directors. In October 2016, Ms. Quinn accepted the position of Strategic Advisor at Shepley Bulfinch, a national architecture

firm. Previously, Ms. Quinn served as Chief People Officer of Forrester Research, Inc. (Nasdaq: FORR), a $340 million global research

and advisory firm from June 2013 until 2018. From June 2012 through May 2013, Ms. Quinn consulted with Truepoint Partners, a strategic

planning and organization development consulting firm. From June 2010 through April 2012, Ms. Quinn was Senior Vice President,

Global Human Resources and Corporate Affairs for Convatec, Inc., a $1.6 billion medical device and products company. From March

2005 through September 2009 Ms. Quinn was Executive Vice President, Global Human Resources at Boston Scientific (NYSE: BSX), an

$8 billion medical solutions provider. Prior to that, Ms. Quinn served in various leadership and operations capacities at Quest

Diagnostics, Allied Signal/Honeywell, Digital Equipment Corp. and Westinghouse Electric Corp. Ms. Quinn also served as a trustee

of Simmons College from 1996 to 2011, including chairing the Technology and Executive Compensation committees and serving as Chair

of the Board of Trustees for five years. Ms. Quinn possesses particular knowledge and experience in human resources, strategic

planning and leadership consulting for complex organizations that strengthen the Board’s collective qualifications, skills,

and experience.

Mr. Croteau has served as one of our directors since December 2015. Presently

Mr. Croteau is the CEO of Corza Medical, a private equity-backed company that specializes in high performance wound closure products,

biosurgical products and surgical knives. Mr. Croteau's prior company, Surgical Specialties Corporation, was acquired in January

2021 and was simultaneously combined with the Tachosil Business from Takeda Pharmaceuticals to form Corza Medical. Corza Medical

has a global sales and marketing organization and operates manufacturing facilities in the United States, China, England, Germany,

and Mexico. Mr. Croteau was the Chief Executive Officer of Vention Medical from January 2011 until March 2017, when he resigned

in connection with the acquisition of Vention Medical by Nordson Corporation and the divestiture of the Vention Device Manufacturing

Services business unit to MedPlast Inc. Vention Medical provides component manufacturing, assembly and design services for disposable

medical devices, with fourteen facilities across the United States, Central America, Ireland and Israel. Prior to assuming his

role with Vention Medical, Mr. Croteau was President of FlexMedical from July 2005 through December 2010. FlexMedical is the medical

division of Flex (Nasdaq: FLEX), which provides manufacturing and supply chain services for disposable medical devices, medical

equipment, and drug delivery devices. From July 2004 to June 2005, Mr. Croteau served as the Executive Vice President and General

Manager of Orthopedics for Accellent (renamed Lake Region Medical in 2014 and now a division of Integer), a manufacturer of specialty

components and finished medical devices used in orthopedic, cardiology, and surgical devices. From August 1999 to June 2004, Mr.

Croteau served as an executive at MedSource Technologies, which was merged in June 2004 with UTI Corporation to form Accellent.

As Senior Vice President at MedSource Technologies, Mr. Croteau was responsible for sales, marketing, strategy and acquisitions.

Prior to entering the medical device industry in 1999, Mr. Croteau spent the majority of his career in various roles at General

Electric, and working as a consultant for Booz & Company in Sydney, Australia. Mr. Croteau has a Bachelor of Science degree

in mechanical engineering from the University of Vermont and a Master of Business Administration from Harvard Business School.

Since May 2019, Mr. Croteau has served on the board of directors of Resonetics, a privately held laser manufacturing services company

providing micro components to global medical device companies. From October 2014 to March 2018 and from July 2020 to present, Mr.

Croteau also served as a member of the board of directors of Inventus Power, a privately held, global manufacturer of custom battery

packs, chargers and portable power supply systems. As a result of these and other professional experiences, Mr. Croteau possesses

knowledge and experience in manufacturing and design, particularly in the medical device industry, that strengthen the Board’s

collective qualifications, skills and experience.

Ms. Feldmann has served as one of our directors since June 2017. In September

2020, Ms. Feldman joined the board of Frequency Therapeutics, Inc. (Nasdaq: FREQ), a clinical-stage biotechnology company focused

on harnessing the body’s innate biology to repair or reverse damage caused by a broad range of degenerative diseases. She

is a member of the Audit Committee. Since 2005, Ms. Feldmann has served on the board of directors of STERIS PLC (NYSE: STE), an

NYSE-listed $3.0 billion provider of infection prevention, decontamination, and health science technologies, products and services,

with a market cap of $16 billion. She is a member of STERIS’ Nominating & Governance Committee and Compliance Committee

and previously chaired and was a member of the Audit Committee. Ms. Feldmann also served from 2003 to January 1, 2018 on the board

of directors of Hanger Inc. (NYSE: HNGR), a $1.0 billion provider of orthotic and prosthetic services and products, and the largest

orthotic and prosthetic managed care network in the U.S., with a market cap of $900 million. Ms. Feldmann served on the Audit Committee,

including as Chair of the Audit Committee, the Compensation Committee and the Quality and Technology Committee of Hanger. Ms. Feldmann

currently serves on the board of directors and is the chair of the Finance Committee of Falmouth Academy, an academically rigorous,

co-ed college preparatory day school for grades 7 to 12. Ms. Feldmann previously served as a director (and chair of the Audit Committee

and as a member of the Nominating and Governance, Compensation, and Quality and Technology Committees) of Heartware International,

Inc., a Nasdaq-listed medical device company, from 2012 until its acquisition by Medtronic in August 2016. From 2012 to 2013, Ms.

Feldmann served on the board of and chaired the Audit and Compliance Committees of Atrius Health, a non-profit organization comprised

of six leading Boston area physician groups representing more than 1,000 physicians serving nearly 1 million adult and pediatric

patients. Ms. Feldmann was also a member of the board and served as Chair of the Audit Committee of Hayes Lemmerz International

Inc., a worldwide producer of aluminum and steel wheels for passenger cars, trucks and trailers and a supplier of brakes and powertrain

components from 2006 to 2009. She was the President and Founder of Jetty Lane Associates, a consulting firm, from 2005 until 2012.

Previously, Ms. Feldmann served as Business Development Officer at Palmer & Dodge LLP, a Boston based law firm, with a specialty

in serving life sciences companies. From 1994 to 2002, she was a Partner at KPMG LLP, holding various leadership roles in the firm’s

Medical Technology and Health Care & Life Sciences industry groups. Ms. Feldmann also was National Partner-in-Charge of the

Life Sciences practice for Coopers & Lybrand (now PricewaterhouseCoopers LLP) from 1989 to 1994, among other leadership positions

she held during her 19-year career there. Ms. Feldmann was a founding board member of Mass Medic, a Massachusetts trade association

for medical technology companies, where she also served as treasurer and as a member of the board's Executive Committee during

her tenure from 1997 to 2001. Ms. Feldmann is a retired CPA and holds a Masters Professional Director Certification from the American

College of Corporate Directors. As a result of these and other professional experiences, Ms. Feldmann possesses particular knowledge

and experience in accounting, finance, and capital markets, and public company experience particularly in the medical device industry,

that strengthen the Board’s collective qualifications, skills and experience.

Vote Required

Directors are elected by a plurality of the votes cast by stockholders

entitled to vote at the Meeting. Votes withheld and broker non-votes will not have any effect on this proposal. Accordingly, the

nominees receiving the highest number of “for” votes at the Meeting will be elected as directors. Proxies solicited

by the Board will be voted “for” the nominees listed above unless a stockholder has indicated otherwise in the proxy.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR”

THE NOMINEES LISTED ABOVE AS STANDING FOR ELECTION AT THE MEETING, TO SERVE UNTIL THE ANNUAL MEETING OF OUR STOCKHOLDERS IN 2022,

AS DESCRIBED ABOVE.

EXECUTIVE OFFICERS

The names of our current executive officers, who are not also

members of our Board of Directors, and certain biographical information furnished by them, are set forth below:

|

Name

|

|

Age

|

|

Title

|

|

Ronald J. Lataille

|

|

59

|

|

Senior Vice President, Treasurer, and Chief Financial Officer

|

|

Mitchell C. Rock

|

|

53

|

|

Senior Vice President and General Manager of Medical

|

|

Christopher P. Litterio

|

|

58

|

|

General Counsel, Secretary, and Senior Vice President of Human Resources

|

|

Daniel J. Shaw, Jr.

|

|

60

|

|

Vice President of Research and Development

|

Mr. Lataille joined the Company in November 1997 as our Chief

Financial Officer. Prior to joining us, Mr. Lataille served as Vice President, Treasurer and Chief Financial Officer of Little

Switzerland, Inc., from 1991 through October 1997. He also served as interim President and Chief Executive Officer of Little

Switzerland from October 1994 through October 1995. From 1984 to 1991, Mr. Lataille, a former certified public accountant,

was employed by Coopers & Lybrand.

Mr. Rock initially joined the Company in 1991 and served

as Director, Sales and Marketing of our Moulded Fibre division (now “Molded Fiber”). From May 1999 through October

2000, Mr. Rock served as Vice President Sales and Business Development of Esprocket, an internet start-up company. Mr. Rock

rejoined us in April 2001 as Vice President, Sales and Marketing of our Moulded Fibre division and served as our Vice President

of Sales and Marketing from May 2002 to June 2014. Since June 2014, Mr. Rock has served as our Senior Vice President of Sales

and Marketing. Since January1, 2020 Mr. Rock also serves as General Manager, Medical. Since 2016, Mr. Rock has also served on the

board of directors of Outlook Amusements, Inc., an entertainment company specializing in advice-based products and services.

Mr. Litterio joined the Company in November 2017 as our first

General Counsel and Senior Vice President of Human Resources. From 1989 until 2017, Mr. Litterio was engaged in the private practice

of law at Ruberto, Israel & Weiner, PC, a Boston-based law firm, where he focused on complex business litigation and employment

law. From 2005 until 2017, he served as the firm’s managing partner, and from 2000 until 2005, he was the chair of the firm’s

litigation department.

Mr. Shaw joined the Company in 1983 and served as a Corporate

Industrial Engineer through September 1992. From October 1992 through September 1996 Mr. Shaw served as Manager of Product

Development and from October 1996 through May 2000 as Director of Product Development. From June 2000 through May 2002 Mr. Shaw

served as a Divisional Vice President of the Specialty Components Division and from May 2002 through June 2014 Mr. Shaw served

as our corporate Vice President, Engineering. Since June 2014, Mr. Shaw has served as Vice President of Research and Development.

Executive officers are chosen by and serve at the discretion of

our Board of Directors.

CORPORATE GOVERNANCE

Meetings of the Board of Directors

Our Board of Directors held four meetings during 2020. Each director

attended at least 75% of the aggregate of all meetings of the Board of Directors and each committee each such director served on

during 2020. All our directors are encouraged to attend our Annual Meeting of Stockholders. All our directors were in attendance

at our 2020 Annual Meeting.

Independence, Diversity, Leadership Structure and Board Committees

Independence

Our Common Stock is listed on the NASDAQ Stock Market LLC,

or Nasdaq, and Nasdaq’s listing standards relating to director independence apply to us. The Board of Directors has determined

that the following current directors are independent under applicable Nasdaq listing standards: Messrs. Croteau, Kozin, Oberdorf

and Pierce, as well as Mses. Quinn and Feldmann. In making its independence determination with respect to Mr. Croteau,

the Board of Directors determined that Mr. Croteau’s position as Chief Executive Officer of one of our customers, Corza

Medical (formerly Surgical Specialties Corporation), also did not impair his independence.

Diversity

We strive to have the members of our Board of Directors possess

a diverse set of skills and background so as to best provide guidance to the management team and oversight to the Company. While

the Nominating Committee does not have a formal policy in this regard, the Nominating Committee views diversity broadly to include

a diversity of experience, skills and viewpoint, as well as diversity of gender and race. The Nominating Committee does not assign

specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. Skills

sought include financial, capital markets, manufacturing, engineering, executive leadership, sales and marketing, organizational

growth, human resources and strategic planning. We believe our Board of Directors has a minimum of one director for each of these

skills.

Leadership Structure

As noted above, our Board of Directors is currently comprised

of seven directors, six of whom are independent under applicable standards.

Mr. Bailly has served as Chief Executive Officer and member

of the Board since January 1, 1995. He has served as Chairman of the Board since 2006.

We recognize that different board leadership structures may be

appropriate for companies in different situations and believe that no one structure is suitable for all companies. We believe our

current board leadership structure is optimal for us because it demonstrates to our employees, suppliers, customers, and other

stakeholders that we are under strong leadership, with a single person setting the tone and having primary responsibility for managing

our operations. A single leader for both the Company and the Board of Directors eliminates the potential for confusion or duplication

of efforts and provides us with clear leadership.

Because the positions of Chairman of the Board and Chief Executive

Officer are held by the same person, the Board also believes it is appropriate for the independent directors to elect one independent

director to serve as a Lead Independent Director. In addition to presiding at executive sessions of independent directors, the

Lead Independent Director has the responsibility to: (1) coordinate with the Chairman of the Board and Chief Executive Officer

in establishing the agenda and topic items for Board meetings; (2) retain independent advisors on behalf of the Board as the

Board may determine is necessary or appropriate; and (3) perform such other functions as the independent directors may designate

from time to time. Mr. Kozin currently serves as the Lead Independent Director, a position he has held since January 2015.

Our overall leadership structure consists of a single individual

serving as Chief Executive Officer and Chairman of the Board, with independent and experienced directors making up the majority

of our Board and independent oversight provided by our Lead Independent Director. We believe that this structure is beneficial

to us and our stockholders.

Risk Oversight

Our Board of Directors is responsible for overseeing our risk

management process. The Board focuses on our general risk management strategy, the most significant risks facing us, and ensures

that appropriate risk mitigation strategies are implemented by management. The Board is also apprised of particular risk management

matters in connection with its general oversight and approval of corporate matters.

The Board of Directors has delegated to the Audit Committee oversight

of certain aspects of our risk management process. Among its duties, the Audit Committee reviews with management (a) our policies

with respect to risk assessment and risk management as well as our significant areas of financial risk exposure and (b) our

system of disclosure controls and procedures and system of internal controls over financial reporting. Our Compensation Committee

also considers and addresses risk as it performs its committee responsibilities. Both committees report to the full Board as appropriate,

including when a matter rises to the level of a material or enterprise level risk.

Our management is responsible for day-to-day risk management.

Our Treasury, Finance, and Internal Audit functions serve as the primary monitoring and testing function for company-wide policies

and procedures and manage the day-to-day oversight of the risk management strategy for the ongoing business. This oversight includes

identifying, evaluating, and addressing potential risks that may exist at the enterprise, strategic, financial, operational, and

compliance and reporting levels.

We believe the division of risk management responsibilities described

above is an effective approach for addressing the risks we face, and our Board leadership structure supports this approach.

Code of Ethics

Pursuant to Section 406 of the Sarbanes-Oxley Act of 2002,

we have adopted a Code of Ethics for Senior Financial Officers that applies to our principal executive officer, principal financial

officer, principal accounting officer, controller, and other persons performing similar functions. We also have in place a Code

of Business Conduct and Ethics that is applicable to all of our directors, officers and employees. We require all of our directors,

officers and employees to adhere to this code in addressing legal and ethical issues that they encounter in the course of doing

their work. This code requires our directors, officers, and employees to avoid conflicts of interest, comply with all laws and

regulations, conduct business in an honest and ethical manner and otherwise act with integrity. The Code of Ethics for Senior Financial

Officers, as amended, is available at our website, www.ufpt.com/investors/governance.html as an attachment to our Code of

Business Conduct and Ethics. We intend to satisfy the disclosure requirement under Item 5.05 of Current Report on Form 8-K

regarding an amendment to, or waiver from, a provision of this code by posting such information on our website, at the address

specified above.

Nominating Committee

The Board of Directors has a Nominating Committee, which met on

one occasion in 2020, and is currently composed of Messrs. Kozin, Oberdorf, Croteau and Pierce, as well as Mses. Quinn and

Feldmann, each of whom is an independent director under applicable Nasdaq standards. Mr. Kozin serves as Chair. Director nominees

are selected by the Nominating Committee. The Nominating Committee operates pursuant to a written charter (the “Nominating

Committee Charter”) that was adopted by the Board of Directors and that complies with applicable Nasdaq listing standards.

The Nominating Committee Charter is available at our website, www.ufpt.com/investors/governance.html. The Nominating Committee

may consider candidates recommended by stockholders as well as from other sources such as other directors or officers, third party

search firms or other appropriate sources. For all potential candidates, the Nominating Committee may consider all factors it deems

relevant, such as a candidate’s independence, character, ability to exercise sound judgment, diversity, age, demonstrated

leadership, skills, including financial literacy and experience in the context of the needs of the Board, and concern for the long-term

interests of the stockholders. The Nominating Committee does not assign any particular weight or importance to any one of these

factors but rather considers them as a whole. In general, persons recommended by stockholders will be considered on the same basis

as candidates from other sources. If a stockholder wishes to recommend a candidate for election as a director at the 2021 Annual

Meeting of Stockholders, it must follow the procedures described in “Stockholder Proposals and Nominations for Director”

below.

Compensation Committee

The Board of Directors has a Compensation Committee, which met

on ten occasions in 2020, and is currently composed of Messrs. Kozin and Croteau and Ms. Quinn, each of whom is an independent

director under applicable Nasdaq standards. Ms. Quinn serves as the Chair. The Compensation Committee operates pursuant to a written

charter (the “Compensation Committee Charter”) that was adopted by the Board of Directors and that complies with applicable

Nasdaq listing standards. The Compensation Committee Charter is available at our website, www.ufpt.com/investors/governance.html.

Under the provisions of the Compensation Committee Charter, the primary functions of the Compensation Committee include determining

salaries and bonuses for our executive officers, individuals to whom stock options, and other equity-based awards are granted,

and the terms upon which such grants and awards are made, adopting incentive plans, overseeing risks associated with our compensation

policies and practices, evaluating the performance of our executive officers, reviewing with management compensation disclosures

to be included in our filings with the Securities and Exchange Commission (“SEC”), and determining director compensation,

benefits and overall compensation. The Compensation Committee has the sole discretion and express authority to retain and terminate

any compensation consultant, including sole authority to approve the consultant’s fees and other retention terms.

For a further description of our determination of executive and

director compensation, see “Executive Compensation” below.

Audit Committee

The Board of Directors has an Audit Committee, which met on eight

occasions in 2020, and is currently composed of Ms. Feldmann and Messrs. Pierce and Oberdorf, each of whom meets the enhanced

independence standards for audit committee members set forth in applicable SEC rules and Nasdaq listing standards. Ms. Feldmann

serves as Chair. The Board of Directors had determined that each of Ms. Feldmann and Mr. Oberdorf qualifies as an “audit

committee financial expert”, as defined by applicable SEC rules. The Audit Committee operates pursuant to a written charter

(the “Audit Committee Charter”) that was adopted by the Board of Directors and that complies with currently applicable

SEC rules and Nasdaq listing standards. The Audit Committee Charter is available at our website, www.ufpt.com/investors/governance.html.

Under the provisions of the Audit Committee Charter, the primary functions of the Audit Committee are to assist the Board of Directors

with oversight of (i) the integrity of our financial statements, (ii) our compliance with legal and regulatory requirements

and (iii) the qualifications, independence, appointment, retention, compensation and performance of our registered public

accounting firm. The Audit Committee is also responsible for the maintenance of “whistle-blowing” procedures, and the

oversight of certain other compliance matters. See “Report of the Audit Committee” below.

Report of the Audit Committee

The Audit Committee has:

|

|

•

|

Reviewed and discussed with management our audited financial statements as of and for the year ended December 31, 2020;

|

|

|

•

|

Discussed with Grant Thornton, our independent registered public accounting firm, the matters required to be discussed by the

applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC;

|

|

|

•

|

Received and reviewed the written disclosures and the letter from Grant Thornton required by applicable requirements of the

PCAOB regarding Grant Thornton’s communications with the Audit Committee concerning independence, and discussed with Grant

Thornton Grant Thornton’s independence; and

|

|

|

•

|

Based on the review and discussions referred to above, recommended to the Board of Directors that the audited financial statements

referred to above be included in our Annual Report on Form 10-K for the year ended December 31, 2020 for filing with

the SEC.

|

|

|

By the Audit Committee of the Board of Directors:

|

|

|

Cynthia L. Feldmann, Chair

Thomas Oberdorf

Robert W. Pierce, Jr.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of April

12, 2021, with respect to the beneficial ownership of our Common Stock by each director, each nominee for director, each named

executive officer in the Summary Compensation Table under “Executive Compensation” below, all executive officers and

directors as a group, and each person known by us to be the beneficial owner of 5% or more of our Common Stock. This information

is based upon information received from or on behalf of the named individuals. Unless otherwise indicated, (i) each person

identified possesses sole voting and investment power with respect to the shares listed and (ii) the address for each person

named below is: c/o UFP Technologies, Inc., 100 Hale Street, Newburyport, Massachusetts, 01950.

|

Name

|

|

Shares of Common Stock

Beneficially Owned

|

|

Percentage of

Class(1)

|

|

R. Jeffrey Bailly

|

|

426,675

|

|

5.67%

|

|

Daniel Croteau(2) (3)

|

|

17,296

|

|

*

|

|

Mitchell C. Rock

|

|

8,727

|

|

*

|

|

Ronald J. Lataille

|

|

68,061

|

|

*

|

|

Daniel J. Shaw

|

|

8,242

|

|

*

|

|

Thomas Oberdorf(2)(3)

|

|

71,028

|

|

*

|

|

Marc Kozin(2)(3)

|

|

32,638

|

|

*

|

|

Cynthia L. Feldmann(2)(3)

|

|

11,929

|

|

*

|

|

Robert W. Pierce, Jr.(2)(3)

|

|

81,026

|

|

1.07%

|

|

Lucia Luce Quinn(2)(3)

|

|

22,944

|

|

*

|

|

Christopher P. Litterio(2)

|

|

11,624

|

|

*

|

|

|

|

|

|

|

|

All executive officers and directors as a group (11 persons)(2)(3)(4)

|

|

760,190

|

|

9.98%

|

|

|

|

|

|

|

|

Renaissance Technologies LLC(5)

800 Third Avenue

New York, NY 10022

|

|

518,875

|

|

6.90%

|

|

Blackrock, Inc (6)

55

East 52nd Street

New York, NY 10055

|

|

452,806

|

|

6.02%

|

|

Thrivent Financial For Lutherans(7)

901 Marquette Avenue, Suite 2500

Minneapolis, Minnesota 55402

|

|

636,824

|

|

8.46%

|

|

|

|

|

|

|

|

|

(1)

|

Based upon 7,524,479 shares of Common Stock outstanding as of April 12, 2021.

|

|

|

(2)

|

Includes shares issuable pursuant to stock options currently exercisable or exercisable within 60 days after April 12,

2021, as follows: 13,200 for Daniel Croteau, 21,471 for Thomas Oberdorf, 5,238 for Marc Kozin, 9,018 for Cynthia L. Feldmann, 18,118

for Robert W. Pierce, Jr., 17,468 for Lucia Luce Quinn, and 5,500 for Christopher P. Litterio.

|

|

|

(3)

|

Includes 796 shares issuable to each non-employee director within 60 days of April 12, 2021 pursuant to the vesting of stock

unit awards.

|

|

|

(4)

|

Includes an aggregate of 94,789 shares that the executive officers and directors have the right to acquire within 60 days after

April 12, 2021 pursuant to the exercise of options and the vesting of stock unit awards.

|

|

|

(5)

|

Shares of Common Stock beneficially owned and the information in this footnote are based solely upon information contained

in a Schedule 13G/A filed with the SEC by Renaissance Technologies LLC on February 11, 2021. As of December 31, 2020, Renaissance

Technologies LLC had sole voting power over 514,873 shares, and sole dispositive power over 518,875 shares.

|

|

|

(6)

|

Shares of Common Stock beneficially owned and the information in this footnote are based solely upon information contained

in a Schedule 13G filed with the SEC by Blackrock, Inc. on February 1, 2021. As of December 31, 2020, Blackrock, Inc. had sole

voting power over 446,479 shares, and sole dispositive power over 452,806 shares.

|

|

|

(7)

|

Shares of Common Stock beneficially owned and the information in this footnote are based solely upon information contained

in a Schedule 13G/A filed with the SEC by Thrivent Financial For Lutherans on February 16, 2021. As of December 31, 2020, Thrivent

Financial For Lutherans had sole voting power over 29,335 shares, shared voting power over 607,489 shares, sole dispositive power

over 29,335 shares, and shared dipositive power over 607,489 shares.

|

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION

Compensation Discussion and Analysis

Introduction and Scope

This Compensation Discussion and Analysis (“CD&A”)

is intended to provide a context for the disclosures contained in this Proxy Statement with respect to our “named executive

officers.” Our named executive officers are determined in accordance with SEC rules. Under such rules, our named executive

officers for fiscal 2020 were Messrs. R. Jeffrey Bailly, Ronald J. Lataille, Mitchell C. Rock, William David Smith, Christopher

P. Litterio and Daniel J. Shaw, Jr. The 2020 compensation of our named executive officers is detailed in the tables that follow

this section.

Our compensation programs are determined by the Compensation Committee

of the Board of Directors, which has the ongoing responsibility for establishing, implementing, and monitoring our executive compensation

programs. The Compensation Committee operates in accordance with the Compensation Committee Charter that was adopted by the Board

of Directors and that complies with applicable Nasdaq listing standards. The Compensation Committee Charter is available at our

website, www.ufpt.com/investors/governance.html.

Executive Summary

We are an innovative designer and custom manufacturer of components,

subassemblies, products and packaging utilizing highly specialized foams, films, and plastics primarily for the medical market.

We manufacture our products by converting raw materials using laminating, molding, radio frequency and impulse welding and fabricating

manufacturing techniques. We are an important link in the medical device supply chain and a valued outsource partner to many of

the top medical device manufacturers in the world. Our single-use and single-patient devices and components are used in a wide

range of medical devices, disposable wound care products, infection prevention, minimally invasive surgery, wearables, orthopedic

soft goods, and orthopedic implant packaging.

We are diversified by also providing highly engineered products and components

to customers in the automotive, aerospace and defense, consumer, electronics and industrial markets. Typical applications of its

products include military uniform and gear components, automotive interior trim, athletic padding, environmentally friendly protective

packaging, air filtration, abrasive nail files, and protective cases and inserts.

Our industry is fragmented across numerous competing entities.

Our ability to compete effectively depends to a large extent on our ability to identify, recruit, develop and retain key management

personnel. We believe this requires a competitive compensation structure as compared to other companies of a similar size in the

same or similar industries.

The compensation programs for our named executive officers are

designed to align compensation objectives with our business strategies and to encourage our executives to focus on creating stockholder

value. While it is critical that our compensation programs allow for the recruitment and retention of highly qualified executives,

it is also important that these programs are variable in nature such that performance is a key factor in realizing value. Accordingly,

our programs combine competitive base salaries with annual cash incentives and long-term equity incentives. Specifically, we structure

our named executive officer compensation to include:

|

|

•

|

Competitive base salary;

|

|

|

•

|

Stock grant (Chief Executive Officer only);

|

|

|

•

|

Performance-based cash incentive bonus;

|

|

|

•

|

Long-term incentives in the form of time-based and time- and performance-based restricted stock awards; and

|

|

|

•

|

Other common perquisites.

|

The compensation programs for the named executive officers provide

equity incentives for a fixed dollar value with the number of shares being variable. The intent of this approach is to limit the

amount of compensation variability resulting solely from fluctuations in our stock price while still providing variability in pay

based upon the achievement of financial and individual objectives.

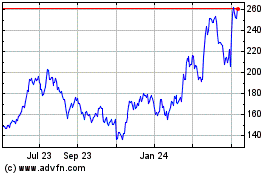

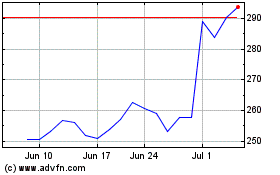

Stock Performance Graph

The following graph compares cumulative total stockholder return

on our Common Stock since December 31, 2015 with the cumulative total return of the (1) NASDAQ Stock Market (US Companies),

(2) SIC Code 3841 Surgical and Medical Instruments and Apparatus, (3) GICS 15103020 Paper Packaging and (4) our peer group,

as determined by Radford, a national compensation consulting company engaged by our Compensation Committee in 2018 to perform a

comprehensive comparative market study of the compensation programs offered to peer company executives and directors, as described

in “Use of Compensation Consultants” below. This graph assumes the investment of $100 on December 31, 2015 in

our Common Stock, and for comparison the companies that comprise each of (1) the NASDAQ Stock Market, (2) SIC Code 3841 Surgical

and Medical Instruments and Apparatus, (3) GICS 15103020 Paper Packaging and (4) our peer group, as described above, and that

all dividends were reinvested. Measurement points are the last trading day of each respective fiscal year.

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

December 2020

Governance Developments

The Compensation Committee and/or the Board of Directors has taken the following steps

to promote good corporate governance:

|

|

•

|

Expiration of Rights Plan—Through March, 2019, we had a stockholder rights

plan designed to protect and enhance the value of our outstanding equity interests in the event of an unsolicited attempt to acquire

us in a manner or on terms not approved by our Board of Directors and that would prevent stockholders from realizing the full value

of their shares of our common stock. However, the rights may have had the effect of rendering more difficult or discouraging an

acquisition; the rights may have caused substantial dilution to a person or group that attempted to acquire us on terms or in a

manner not approved by our Board of Directors. On March 13, 2019, our Board of Directors voted not to replace the rights when they

expired on March 19, 2019.

|

|

|

•

|

Declassification of our Board of Directors—In 2020, our Board of Directors

and our stockholders approved an amendment to our Certificate of Incorporation to eliminate the classified structure of the Board

of Directors and provide for the annual election of directors.

|

|

|

•

|

No Tax Gross-ups—We do not provide tax gross-ups to our named executive officers.

|

|

|

•

|

Anti-Hedging Policy—We established a policy prohibiting insider trading practices including the hedging of our

stock by our employees, including our executive officers, and directors.

|

|

|

•

|

Anti-Pledging and Margin Account Policy—We established a policy prohibiting employees from holding our securities

in a margin account or pledging our securities as collateral for a loan.

|

|

|

•

|

No Repricing of Stock Options—Our equity incentive plans prohibit the repricing of stock options or other equity

awards without the consent of our stockholders.

|

|

|

•

|

Buyouts of Underwater Options—Our equity incentive plans prohibit us from buying out underwater stock options

from our executive officers.

|

|

|

•

|

Stock Ownership Guidelines—We have adopted stock ownership guidelines for the named executive officers and independent

directors that are described in more detail below.

|

|

|

•

|

Clawback Policy—We have adopted a clawback policy that is described in more detail below.

|

|

|

•

|

Independent Compensation Committee—Our Compensation Committee is comprised exclusively of independent directors.

|

|

|

•

|

Independent Consultants—The independent consultants who provided benchmarking data with respect to the named executive

officers do not provide services to us other than at the direction of the Compensation Committee.

|

Philosophy and Objectives of our Compensation Programs

The primary objectives of our compensation programs are to:

|

|

•

|

Retain executive talent by offering compensation that is commensurate with pay at other companies of a similar size in similar

industries, as adjusted for individual factors, and considering the complexity of our business;

|

|

|

•

|

Safeguard our interests and those of our stockholders;

|

|

|

•

|

Drive executive performance by having certain components of pay at risk and/or tied to our entity-wide and individual goal

performance;

|

|

|

•

|

Be fair to employees, management and stockholders; and

|

|

|

•

|

Be well communicated and understood by program participants and stockholders.

|

The Compensation Committee believes that the most effective compensation

program is one that provides a reasonable level of fixed income through competitive base salaries, equity grants and retirement

benefits as well as additional rewards for achieving performance targets. The Compensation Committee also believes that these rewards

should be in the form of both cash and non-cash and have some component subject to time-based vesting as a retention measure. Incentive

cash bonuses are included to drive executive performance by having pay at risk so that a significant portion of potential annual

cash compensation is tied to profitability targets. We also include time-based and time- and performance-based restricted stock

awards as a significant element of prospective executive compensation, so that the value of a portion of an executive’s compensation

is dependent upon both continued, long-term employment and company-wide performance measures.

Our Decision-Making Process

The Role of the Compensation

Committee—The Compensation Committee oversees the compensation and benefit programs for the named executive officers.

The Compensation Committee is comprised solely of independent directors of the Board. The Compensation Committee works closely

with management to examine the effectiveness of our executive compensation program. Details of the Compensation Committee’s

authority and responsibilities are specified in the Compensation Committee Charter, which is available at our website, www.ufpt.com/investors/governance.html.

The Role of Management—The

Chief Executive Officer also makes recommendations to the Compensation Committee about the compensation of our other named executive

officers. The Compensation Committee considers the Chief Executive Officer’s recommendations before making a final determination

of the compensation programs for the named executive officers. The Chief Executive Officer and the other named executive officers

may not be present during voting or deliberations on his or her compensation.

Use of Compensation Consultants—In

2018, the Compensation Committee engaged Radford, a national compensation consulting firm (“Radford”), to perform an

updated comprehensive comparative market study of the compensation programs offered to peer company executives and directors. The

Compensation Committee used this information to evaluate and adjust executive and director compensation for fiscal 2020 and plans

to use this information thereafter, as well. The competitive assessment done by Radford included a survey of the following 15 companies:

|

• Accuray Inc.

• Atrion Corporation

• CECO Environmental

• Cutera, Inc.

• DMC Global, Inc.

|

• Graham Corporation

• Harvard Bioscience, Inc.

• Hurco Companies, Inc.

• Lantheus Holdings, Inc.

• Lydall, Inc.

|

• Meridian Bioscience, Inc.

• OraSure Technologies, Inc.

• RTI Surgical, Inc.

• SeaSpine Holdings Corporation

• Surmodics, Inc.

|

Principal Elements of the 2020 Compensation Program

There were five principal elements of compensation for the named

executive officers during fiscal 2020:

|

|

•

|

Stock grant (Chief Executive Officer only);

|

|

|

•

|

Performance-based cash incentive bonus;

|

|

|

•

|

Long-term incentives in the form of time-based and time- and performance-based restricted stock awards; and

|

|

|

•

|

Other common perquisites.

|

Base Salary—The

base salaries established by the Compensation Committee for our named executive officers for fiscal 2020 are set forth below.

|

Named Executive Officer

|

|

Annual Base

Salary ($)

|

|

R. Jeffrey Bailly

|

|

$600,000

|

|

Ronald J. Lataille

|

|

$360,000

|

|

Mitchell C. Rock

|

|

$345,000

|

|

William David Smith*

|

|

$310,000

|

|

Christopher P. Litterio

|

|

$285,000

|

|

Daniel J. Shaw, Jr.

|

|

$230,000

|

* Mr. Smith’s employment with us terminated during September 2020

and he was no longer one of our executive officers as of December 31, 2020. Mr. Smith is included in the proxy statement in accordance

with Item 402(a)(3)(iv) of Regulation S-K. Mr. Smith has been omitted from the discussion of bonus payouts; long term incentives

for 2020; estimated possible payouts of long-term incentive awards and outstanding equity awards at December 31, 2020 year end

because he was ineligible for a 2020 bonus, his 2020 stock unit grants terminated without vesting and he held no outstanding equity

awards at December 31, 2020.

Base salaries were reviewed by the Compensation Committee in light

of the market competitive assessment done by Radford in 2018 and our philosophy of positioning executive compensation at or about

the 50% percentile as compared to our peer group companies. Base salaries are reviewed by the Compensation Committee annually and,

if appropriate, are adjusted. As detailed below under “Summary Compensation Table,” on February 22, 2021, the

Compensation Committee approved increases to each of the above base salaries effective January 1, 2021.

Stock Grant—

In accordance with the terms of his employment agreement, we annually grant to Mr. Bailly, our Chief Executive Officer, an

award of Common Stock as a component of his overall compensation. The objective of this equity component is to greater align the

Chief Executive Officer’s interests with those of our stockholders. The stock is typically issued to the Chief Executive

Officer in the last two weeks of the fiscal year, assuming we continue to employ the Chief Executive Officer on that date. In 2020,

consistent with the terms of his employment agreement, the Chief Executive Officer was granted shares valued at $400,000. See “Employment

Contract” below.

Cash Incentive Bonus—In

the beginning of each fiscal year, following approval by the Board of Directors of our strategic plan and budget, the Compensation

Committee establishes, at its discretion, performance targets for the named executive officers’ cash incentive bonus. This

performance-based cash bonus is based on the achievement of a combination of financial and individual objectives. Targeted payout

levels were expressed as a percentage of base salary and established for each participant. An individual’s bonus components

were determined by such individual’s title and/or role. Typically, the financial performance portion of the bonus fluctuates

down and up based upon a degree by which our actual results fall short of or exceed the financial objective.

For 2020, the financial objectives, which were established by

the Compensation Committee at its meeting on February 24, 2020, were based upon targeted Adjusted Operating Income of $26,100,000.

Adjusted Operating Income is operating income as adjusted to disregard (i) non-recurring restructuring charges related to

plant closings and consolidations and (ii) the impact of acquired or disposed of operations during the fiscal year ended December 31,

2020. Actual Adjusted Operating Income was $16,731,467 for 2020.

Individual bonus objectives for the named executive officers,

other than Mr. Bailly, were designed to reward the achievement of goals related to, among other things, the following: regulatory

compliance, achievement of sales targets from both new and base business, acquisition execution, improved employee engagement,

research and development, safety and quality compliance, return on invested capital and investor relations. Individual bonus objectives

for Mr. Bailly were designed to reward the achievement of goals related to acquisitions, reduced manufacturing costs, safety

and quality compliance and return on invested capital.

Given the unprecedented and unforeseeable impact of the COVID-19 pandemic

on the general economy, and on our operations and financial performance during the final three quarters of calendar year 2020,

the Compensation Committee felt that it was necessary to use its discretion to consider a number of factors in establishing calendar

year 2020 cash incentive bonus amounts, including the formulaic assessment of performance against the Adjusted Operating Income

targets established during February 2020, the performance against our revised performance expectations as the COVID-19 pandemic

continued through calendar year 2020, and a qualitative assessment of our and our management performance during the unprecedented

challenges we faced during calendar year 2020. In order to provide linkage between cash incentive bonuses and the quality of our

management’s performance throughout calendar year 2020, the Compensation Committee weighted individual performance for each

of the named executive officer’s more heavily than performance against the formulaic Adjusted Operating Income targets. The

Compensation Committee believes this analysis reflects management's strong performance in calendar year 2020 while taking into

account the financial and operating impact of the COVID-19 pandemic on our shareholders and other stakeholders.

For 2020, the following cash incentive bonuses were awarded by

the Compensation Committee based upon our financial performance as well as the targeted payout levels and individual performance

measures for each named executive officer:

R. Jeffrey Bailly—Mr. Bailly’s

targeted payout level was 82% of base salary, or $490,000, with $285,000 tied to our financial performance and $205,000 tied to

individual goals. The financial component of the incentive bonus for Mr. Bailly fluctuates by 10% of the amount by which the

actual Adjusted Operating Income exceeds the targeted Adjusted Operating Income, with a maximum bonus of $700,000. To the extent

that actual Adjusted Operating Income is less than 80% of targeted Adjusted Operating Income, the financial component of Mr. Bailly’s

incentive bonus is zero. To the extent that actual Adjusted Operating Income equals or exceeds 80% of targeted Adjusted Operating

Income but is less than targeted Adjusted Operating Income, the financial component of Mr. Bailly’s incentive bonus

is determined as $142,500 (half of the targeted bonus) plus 2.73% of the amount by which actual Adjusted Operating Income exceeds

80% of targeted Adjusted Operating Income. Based upon our financial performance as well as an assessment of his performance for

fiscal 2020, Mr. Bailly was awarded a total bonus amount of $299,500.

Ronald J. Lataille—Mr. Lataille’s

targeted payout level was 40% of base salary, or $144,000. Based upon our financial performance as well as an assessment of his

performance for fiscal 2020, Mr. Lataille was awarded a total bonus amount of $85,500.

Mitchell C. Rock—Mr.

Rock’s targeted payout level was 40% of base salary, or $138,000. Based upon our financial performance as well as an assessment

of his performance for fiscal 2020, Mr. Rock was awarded a total bonus amount of $81,300.

Christopher P. Litterio—Mr. Litterio’s

targeted payout level was 40% of base salary, or $114,000. Based upon our financial performance as well as an assessment of his

performance for fiscal 2020, Mr. Litterio was awarded a total bonus amount of $66,500.

Daniel J. Shaw, Jr.—Mr. Shaw’s

targeted payout level was 40% of base salary, or $92,000. Based upon our financial performance as well as an assessment of his

performance for fiscal 2020, Mr. Shaw was awarded a total bonus amount of $31,650.

Long-term Incentives—it

is our philosophy and that of the Compensation Committee to provide executives with long-term incentives and, thus, align their

financial interests with those of our stockholders. We maintain a stock unit award program for the named executive officers under

the 2003 Incentive Plan. The stock unit awards represent a right to receive shares of our Common Stock in varying amounts based

on our achievement of certain financial performance objectives and time-based vesting requirements. For 2020, the following stock

unit awards were approved by our Compensation Committee for grant to our named executive officers:

|

|

Threshold(1)(2)

|

|

Target Adjusted

Operating Income of

$26,010,000(1)(2)

|

|

Exceptional Adjusted

Operating Income of

$30,015,000(1)(2)

|

|

|

Number of

shares

|

|

Grant Date

Value

|

|

Number of

shares

|

|

Grant Date

Value

|

|

Number of

shares

|

|

Grant Date

Value

|

|

R. Jeffrey Bailly

|

4,685

|

|

$233,370

|

|

4,684

|

|

$233,315

|

|

4,684

|

|

$233,315

|

|

Ronald J. Lataille

|

2,761

|

|

$137,500

|

|

1,380

|

|

$68,750

|

|

1,380

|

|

$68,750

|

|

Mitchell C. Rock

|

2,761

|

|

$137,500

|

|

1,380

|

|

$68,750

|

|

1,380

|

|

$68,750

|

|

Christopher P. Litterio

|

1,505

|

|

$75,000

|

|

753

|

|

$37,500

|

|

753

|

|

$37,500

|

|

Daniel J. Shaw, Jr.

|

753

|

|

$37,500

|

|

376

|

|

$18,750

|

|

376

|

|

$18,750

|

|

|

(1)

|

The “Threshold” stock unit awards are subject to time vesting only. The “Target” and “Exceptional”

stock unit awards are also subject to financial performance objectives, established by the Compensation Committee as the achievement

of 100% and 115%, respectively, of our targeted Adjusted Operating Income for fiscal 2020 of $26,010,000. Based upon our achievement

of $16,731,467 in actual Adjusted Operating Income for our 2020 fiscal year, the Compensation Committee determined that neither

the Target goal nor the Exceptional goal were achieved. Accordingly, each named executive officer earned the number of stock unit

awards set forth next to his name in the “Threshold” column.

|

|

|

(2)

|

One-third of these awards vest on March 1, 2022, one-third of these awards vest on March 1, 2023 and one-third of

these awards vest on March 1, 2024, provided that we continuously employ the recipient through each such vesting date (except

as set forth below) and the corresponding financial performance requirements are met. Except in the case of Mr. Bailly, any

unvested stock unit awards shall terminate upon the cessation of a recipient’s employment with us. With respect to Mr. Bailly,

in the event of a cessation of employment with us without Cause or by Mr. Bailly for Good Reason (as such terms are defined

in his stock unit award agreement), all earned but unvested stock unit awards shall become immediately vested, regardless of such

cessation of employment. In the event we undergo a Change in Control (as defined in the stock unit award agreement evidencing the

award) all earned but unvested stock unit awards held by each of the named executive officers shall become fully vested immediately

prior to the effective date of such Change in Control.

|

Other Practices, Policies & Guidelines

Stock Ownership Guidelines—we

have adopted stock ownership guidelines for the named executive officers and independent directors. Under our stock ownership guidelines

the Board has established a goal that (i) within five years after joining the Board, each non-employee director beneficially

own shares of our stock valued at three times his or her annual base cash retainer fee, (ii) within five years after being

appointed to his or her position, the Chief Executive Officer beneficially own shares of our stock valued at three times his or

her base salary, and (iii) within five years after being appointed to his or her position, the other named executive officers

beneficially shares of our stock valued at one times his or her base salary.

Claw-back Policy—we

have adopted a policy that if we are required to prepare an accounting restatement due to our material noncompliance, as a result

of misconduct, with any financial reporting requirement under the securities laws, within the meaning of Section 304 of the

Sarbanes-Oxley Act of 2002, our Chief Executive Officer and Chief Financial Officer shall reimburse us for any incentive bonus,