Texas Instruments Posts Quarterly Revenue Declines Amid Downturn

January 23 2019 - 4:41PM

Dow Jones News

By Maria Armental

Texas Instruments Inc. (TXN), feeling the strains of a

semiconductor downturn, on Wednesday reported lower revenue in the

latest period.

It was the first quarterly revenue decline since the March 2016

quarter, as the company recovered from a similar downturn.

Analysts expect the Dallas-based chip maker to post lower

revenue for much of the current year. On Wednesday, TI said this

quarter it expects to make $1.03 to $1.21 a share with revenue

falling to a range of $3.34 billion to $3.62 billion, compared with

the consensus forecast of $1.20 a share on $3.6 billion in revenue,

according to FactSet.

Fourth-quarter profit surged to $1.24 billion, or $1.27 a share,

from $344 million, or 34 cents a share, a year earlier.

Revenue fell 0.9% to $3.72 billion.

The results were roughly in line with both internal and Wall

Street expectations, thought the revenue decline was steeper than

analysts' projected, according to FactSet data.

Gross profit margin for the quarter narrowed to 64.8% from

65.1%.

Free cash flow, cash flow from operations less capital

expenditures, reached $6.1 billion.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

January 23, 2019 16:26 ET (21:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

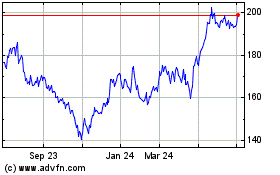

Texas Instruments (NASDAQ:TXN)

Historical Stock Chart

From Mar 2024 to Apr 2024

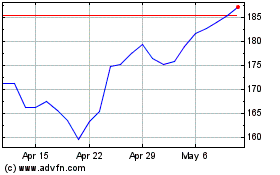

Texas Instruments (NASDAQ:TXN)

Historical Stock Chart

From Apr 2023 to Apr 2024