Tradeweb Markets Inc. (Nasdaq: TW), a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets, today reported financial results for the quarter ended

June 30, 2022.

$297.1 million quarterly revenues

increased 13.9% (17.8% on a constant currency basis)

compared to prior year period

$1.2 trillion average daily volume

(“ADV”) for the quarter, an increase of 20.4% compared to

prior year period, with record ADV in swaps/swaptions ≥ 1-year;

fully electronic U.S. High Grade; municipal bonds and repurchase

agreements

$81.6 million net income and

$111.7 million adjusted net income for the quarter,

increases of 23.2% and 19.3% respectively from prior

year period

52.4% adjusted EBITDA margin and

$155.6 million adjusted EBITDA for the quarter, compared to

50.6% and $131.9 million respectively for prior year period

$0.33 diluted earnings per share

(“Diluted EPS”) for the quarter and $0.47 adjusted diluted

earnings per share

$0.08 per share quarterly cash

dividend declared; $9.0 million of shares repurchased

Lee Olesky, Chairman and CEO, Tradeweb

Markets:

"Tradeweb delivered another quarter of

robust year-over-year revenue growth thanks to strong contributions

from multiple asset classes, showcasing our differentiated and

diversified business model. While complex macroeconomic conditions

and continued rates volatility made for challenging global markets,

we saw increased adoption and engagement with a range of trading

protocols. Institutional and wholesale clients continued to be

active this quarter, and a surge in retail trading volumes was led

by municipal bonds and U.S. Treasuries.

In June we launched the Spotlight Dealer

Diversity Program, developed with input from the dealer and

buy-side communities to promote diverse dealers on the Tradeweb

platform. More recently, we were delighted to announce that Thomas

Pluta will succeed Billy Hult as President of Tradeweb when Billy

succeeds me as CEO on January 1, 2023. We remain sharply focused on

collaborating with clients through challenging markets and

positioning Tradeweb for continued growth.”

SELECT FINANCIAL

RESULTS

2Q22

2Q21

Change

Constant

Currency

Growth (1)

ADV (US $bn)

(Unaudited)

(dollars in thousands except per share

amounts)(Unaudited)

Asset Class

Product

2Q22

2Q21

YoY

GAAP Financial Measures

Rates

Cash

$

341

$

319

7.0 %

Total revenue

$

297,138

$

260,840

13.9

%

17.8

%

Derivatives

368

257

43.2 %

Rates

$

151,586

$

134,003

13.1

%

17.6

%

Total

709

576

23.2 %

Credit

$

83,991

$

72,212

16.3

%

19.4

%

Credit

Cash

10

10

6.9 %

Equities

$

22,659

$

17,397

30.2

%

37.6

%

Derivatives

16

9

92.3 %

Money Markets

$

12,166

$

11,340

7.3

%

10.5

%

Total

27

18

47.4 %

Market Data

$

21,030

$

20,007

5.1

%

7.0

%

Equities

Cash

10

8

20.7 %

Other

$

5,706

$

5,881

(3.0)

%

(2.9)

%

Derivatives

7

8

(13.5) %

Net income

$

81,600

$

66,233

23.2

%

Total

17

16

4.1 %

Net income attributable to Tradeweb

Markets Inc. (2)

$

68,344

$

55,316

23.6

%

Money Markets

Cash

424

367

15.5 %

Total

424

367

15.5 %

Diluted EPS

$

0.33

$

0.27

22.2

%

Total

$

1,176

$

977

20.4 %

Non-GAAP Financial Measures

Adjusted EBITDA (1)

$

155,621

$

131,898

18.0

%

22.9

%

(1) Adjusted EBITDA, Adjusted EBITDA

margin, Adjusted EBIT, Adjusted EBIT margin, Adjusted Net Income,

Adjusted Diluted EPS and constant currency growth are non-GAAP

financial measures. See "Non-GAAP Financial Measures" below and the

attached schedules for additional information and reconciliations

of such non-GAAP financial measures.

(2) Represents net income less net income

attributable to non-controlling interests.

Adjusted EBITDA margin (1)

52.4 %

50.6 %

+181

bps

+220

bps

Adjusted EBIT (1)

$

142,612

$

120,271

18.6

%

23.9

%

Adjusted EBIT margin (1)

48.0 %

46.1 %

+189

bps

+238

bps

Adjusted Net Income (1)

$

111,659

$

93,558

19.3

%

24.7

%

Adjusted Diluted EPS (1)

$

0.47

$

0.39

20.5

%

25.6

%

DISCUSSION OF RESULTS

Rates – Revenues of $151.6 million in the second quarter

of 2022 increased 13.1% compared to prior year period (17.6% on a

constant currency basis). Rates ADV was up 23.2% with record ADV in

swaps/swaptions ≥ 1-year driven by robust client interest in the

request-for-market (RFM) protocol, increased engagement from

international clients and strong trading activity in emerging

markets swaps.

Credit – Revenues of $84.0 million in the second quarter

of 2022 increased 16.3% compared to prior year period (19.4% on a

constant currency basis). Credit ADV was up 47.4% with record ADV

in fully electronic U.S. High Grade credit and municipal bonds.

Tradeweb's share of fully electronic TRACE volume for U.S. High

Grade and U.S. High Yield for the quarter increased by +70 bps and

+140 bps, respectively, compared to prior year period. Client

adoption was strong across Tradeweb protocols, including

request-for-quote (RFQ), Tradeweb AllTrade and portfolio

trading.

Equities – Revenues of $22.7 million in the second

quarter of 2022 increased 30.2% compared to prior year period

(37.6% on a constant currency basis). Equities ADV was up 4.1%,

with double-digit ADV increases in U.S. and European ETFs offset by

double-digit ADV decreases in equity derivatives as market

volatility remained elevated.

Money Markets – Revenues of $12.2 million in the second

quarter of 2022 increased 7.3% compared to prior year period (10.5%

on a constant currency basis). Money Markets ADV was up 15.5% led

by record ADV in Repurchase Agreements.

Market Data – Revenues of $21.0 million in the second

quarter of 2022 increased 5.1% compared to prior year period (7.0%

on a constant currency basis). The increase was derived from

increased third party market data fees and Refinitiv market data

fees.

Other – Revenues of $5.7 million in the second quarter of

2022 decreased 3.0% compared to prior year period (2.9% decrease on

a constant currency basis).

Operating Expenses of $190.5 million in the second

quarter of 2022 increased 7.6% compared to $177.0 million in the

prior year period due to: higher employee compensation and benefits

associated with higher headcount to support growth and higher

performance-related compensation, including $5.7 million in CEO

Retirement Accelerated Stock-Based Compensation Expense recognized

during the second quarter of 2022; higher depreciation and

amortization expense; and higher technology and communications

expenses primarily due to increased clearing and data fees driven

by higher trading volumes; partially offset by lower general and

administrative expense, as foreign exchange gains increased more

than travel and entertainment expense increased following the

easing of restrictions relating to the pandemic.

Adjusted Expenses of $154.5 million increased 9.9% (12.6%

on a constant currency basis) compared to the prior year period due

to: higher employee compensation and benefits associated with

higher headcount to support growth and higher performance-related

compensation; higher general and administrative expenses; higher

technology and communications expenses; and higher depreciation and

amortization expenses. Please see "Non-GAAP Financial Measures"

below for additional information.

RECENT HIGHLIGHTS

Second Quarter 2022

- Launched Spotlight Dealer Diversity Program designed to promote

diverse dealers on the Tradeweb platform

- Introduced enhanced functionality of electronic portfolio

trading tool to increase flexibility and efficiency for

institutional clients

- Completed the first-ever fully electronic SOFR swaption

trade

- Recognized in numerous awards including: Trading & Tech

Awards — Best Fixed Income Trading Platform (Financial News);

Trading & Tech Awards, Trading Initiative of the Year — AiEX

(Financial News); 40 Top Innovators in Financial Markets — Lee

Olesky (TabbForum); Person of the Decade — Lee Olesky (Markets

Media); Women in Finance Asia Awards, Excellence in Trading — YiLin

Lee (Markets Media)

July 2022

- Announced Thomas Pluta will join Tradeweb in October as

President-elect

- Appointed Jacques Aigrain and Rana Yared as Independent

Directors to Tradeweb’s board

- Celebrated the opening of Tradeweb’s new Paris office

CAPITAL MANAGEMENT

- $959.7 million in cash and cash equivalents and an undrawn $500

million credit facility at June 30, 2022

- Non-acquisition related capital expenditures and capitalization

of software development in second quarter 2022: $15.0 million

- Free cash flow for the trailing twelve months ended June 30,

2022 of $538.4 million, up 24.1% compared to the prior year period.

See “Non-GAAP Financial Measures” for additional information

- During the second quarter of 2022, as part of its Share

Repurchase Program, Tradeweb purchased 103,458 shares of Class A

common stock, at an average price of $86.99, for purchases totaling

$9.0 million. As of June 30, 2022, a total of $18.0 million

remained available for repurchase pursuant to the Share Repurchase

Program

- $2.2 million in shares were withheld in the second quarter of

2022 to satisfy tax obligations related to the exercise of stock

options and vesting of restricted stock units and performance-based

restricted stock units

- The Board of Directors of Tradeweb Markets Inc. declared a

quarterly cash dividend of $0.08 per share of Class A common stock

and Class B common stock. The dividend will be payable on September

15, 2022 to stockholders of record as of September 1, 2022

OTHER MATTERS

Full-Year 2022 Guidance*

Full-Year 2022 guidance is unchanged from previous confirmation

on July 13, 2022.

- Adjusted Expenses: $620 - $655 million

- Acquisition and Refinitiv Transaction related depreciation and

amortization expense: $127 million

- Assumed non-GAAP tax rate: ~22.0%

- Capital expenditures and capitalization of software

development: $62 - $68 million

*GAAP operating expenses and tax rate guidance are not provided

due to the inherent difficulty in quantifying certain amounts due

to a variety of factors including the unpredictability in the

movement of foreign currency rates.

CONFERENCE CALL

Tradeweb Markets will hold a conference call to discuss second

quarter 2022 results starting at 9:30 AM EDT today, August 3, 2022.

A live, audio webcast of the conference call along with related

materials will be available at http://investors.tradeweb.com.

Alternatively, interested parties can register to participate in

the call by clicking here. After the conference call, an archived

recording will be available at http://investors.tradeweb.com.

ABOUT TRADEWEB MARKETS

Tradeweb Markets Inc. (Nasdaq: TW) is a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets. Founded in 1996, Tradeweb provides access to markets, data

and analytics, electronic trading, straight-through-processing and

reporting for more than 40 products to clients in the

institutional, wholesale and retail markets. Advanced technologies

developed by Tradeweb enhance price discovery, order execution and

trade workflows while allowing for greater scale and helping to

reduce risks in client trading operations. Tradeweb serves

approximately 2,500 clients in more than 65 countries. On average,

Tradeweb facilitated more than $1 trillion in notional value traded

per day over the past four fiscal quarters. For more information,

please go to www.tradeweb.com.

TRADEWEB MARKETS INC. INCOME STATEMENT Dollars

in Thousands, Except Per Share Data

Three Months Ended

Six Months Ended

June 30,

June 30,

2022

2021

2022

2021

Revenues

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Transaction fees and commissions

$

237,669

$

205,381

$

489,474

$

423,197

Subscription fees

41,540

37,883

82,995

75,751

Refinitiv market data fees

15,426

14,926

30,984

30,043

Other

2,503

2,650

5,171

5,248

Total revenue

297,138

260,840

608,624

534,239

Expenses

Employee compensation and benefits

109,890

98,449

227,881

202,071

Depreciation and amortization

44,770

41,867

89,220

82,833

Technology and communications

16,034

13,957

31,810

27,501

General and administrative

7,601

8,789

17,914

12,248

Professional fees

8,575

10,368

16,432

20,096

Occupancy

3,661

3,618

7,158

7,371

Total expenses

190,531

177,048

390,415

352,120

Operating income

106,607

83,792

218,209

182,119

Net interest income (expense)

541

(325

)

94

(818

)

Income before taxes

107,148

83,467

218,303

181,301

Provision for income taxes

(25,548

)

(17,234

)

(39,258

)

(33,503

)

Net income

81,600

66,233

179,045

147,798

Less: Net income attributable to

non-controlling interests

13,256

10,917

27,736

24,623

Net income attributable to Tradeweb

Markets Inc.

$

68,344

$

55,316

$

151,309

$

123,175

Earnings per share attributable to

Tradeweb Markets Inc. Class A and B common stockholders:

Basic

$

0.33

$

0.27

$

0.74

$

0.61

Diluted

$

0.33

$

0.27

$

0.73

$

0.60

Weighted average shares outstanding:

Basic

204,501,035

201,749,985

204,282,406

200,414,714

Diluted

207,272,675

207,463,960

207,371,372

206,253,756

TRADEWEB MARKETS INC. RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES (UNAUDITED) Dollars in Thousands, Except

per Share Data

Three Months Ended

Six Months Ended

Reconciliation of Net Income to

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EBIT and Adjusted

EBIT Margin

June 30,

June 30,

2022

2021

2022

2021

(dollars in thousands)

Net income

$

81,600

$

66,233

$

179,045

$

147,798

Acquisition transaction costs (1)

15

2,966

(3

)

4,727

Net interest (income) expense

(541

)

325

(94

)

818

Depreciation and amortization

44,770

41,867

89,220

82,833

Stock-based compensation expense (2)

7,295

2,803

11,164

9,186

Provision for income taxes

25,548

17,234

39,258

33,503

Foreign exchange (gains) / losses (3)

(3,066

)

470

(2,334

)

(4,883

)

Tax receivable agreement liability

adjustment (4)

—

—

—

—

Adjusted EBITDA

$

155,621

$

131,898

$

316,256

$

273,982

Less: Depreciation and amortization

(44,770

)

(41,867

)

(89,220

)

(82,833

)

Add: D&A related to acquisitions and

the Refinitiv Transaction (5)

31,761

30,240

63,530

59,843

Adjusted EBIT

$

142,612

$

120,271

$

290,566

$

250,992

Adjusted EBITDA margin (6)

52.4

%

50.6

%

52.0

%

51.3

%

Adjusted EBIT margin (6)

48.0

%

46.1

%

47.7

%

47.0

%

- Represents transaction and other costs related to the NFI

Acquisition, which closed in June 2021. Acquisition-related costs

primarily include legal, consulting and advisory fees and severance

costs incurred that relate to the acquisition transaction.

- Represents non-cash stock-based compensation expense associated

with the Special Option Award and post-IPO options awarded in 2019

and payroll taxes associated with the exercise of such options

totaling $1.6 million and $2.8 million during the three months

ended June 30, 2022 and 2021, respectively, and $3.8 million and

$9.2 million during the six months ended June 30, 2022 and 2021,

respectively. During the three and six months ended June 30, 2022,

this adjustment also includes $5.7 million and $7.4 million,

respectively, of non-cash accelerated stock-based compensation

expense and related payroll taxes associated with our former CFO

and our retiring CEO.

- Represents unrealized gain or loss recognized on foreign

currency forward contracts and foreign exchange gain or loss from

the revaluation of cash denominated in a different currency than

the entity’s functional currency.

- Represents income recognized during the applicable period due

to changes in the tax receivable agreement liability recorded in

the consolidated statement of financial condition as a result of

changes in the mix of earnings, tax legislation and tax rates in

various jurisdictions which impacted our tax savings.

- Represents intangible asset and acquired software amortization

resulting from the NFI Acquisition and intangible asset

amortization and increased tangible asset and capitalized software

depreciation and amortization resulting from the application of

pushdown accounting to the Refinitiv Transaction (where all assets

were marked to fair value as of the closing date of the Refinitiv

Transaction).

- Adjusted EBITDA margin and Adjusted EBIT margin are defined as

Adjusted EBITDA and Adjusted EBIT, respectively, divided by revenue

for the applicable period.

Three Months Ended

Six Months Ended

Reconciliation of Net Income to

Adjusted Net Income and Adjusted Diluted EPS

June 30,

June 30,

2022

2021

2022

2021

(in thousands, except per

share amounts)

Earnings per diluted share

$

0.33

$

0.27

$

0.73

$

0.60

—

Net income attributable to Tradeweb

Markets Inc.

$

68,344

$

55,316

$

151,309

$

123,175

Net income attributable to non-controlling

interests (1)

13,256

10,917

27,736

24,623

Net income

81,600

66,233

179,045

147,798

Provision for income taxes

25,548

17,234

39,258

33,503

Acquisition transaction costs (2)

15

2,966

(3

)

4,727

D&A related to acquisitions and the

Refinitiv Transaction (3)

31,761

30,240

63,530

59,843

Stock-based compensation expense (4)

7,295

2,803

11,164

9,186

Foreign exchange (gains) / losses (5)

(3,066

)

470

(2,334

)

(4,883

)

Tax receivable agreement liability

adjustment (6)

—

—

—

—

Adjusted Net Income before income

taxes

143,153

119,946

290,660

250,174

Adjusted income taxes (7)

(31,494

)

(26,388

)

(63,946

)

(55,038

)

Adjusted Net Income

$

111,659

$

93,558

$

226,714

$

195,136

Adjusted Diluted EPS (8)

$

0.47

$

0.39

$

0.95

$

0.82

- Represents the reallocation of net income attributable to

non-controlling interests from the assumed exchange of all

outstanding LLC Interests held by non-controlling interests for

shares of Class A or Class B common stock.

- Represents transaction and other costs related to the NFI

Acquisition, which closed in June 2021. Acquisition-related costs

primarily include legal, consulting and advisory fees and severance

costs incurred that relate to the acquisition transaction.

- Represents intangible asset and acquired software amortization

resulting from the NFI Acquisition and intangible asset

amortization and increased tangible asset and capitalized software

depreciation and amortization resulting from the application of

pushdown accounting to the Refinitiv Transaction (where all assets

were marked to fair value as of the closing date of the Refinitiv

Transaction).

- Represents non-cash stock-based compensation expense associated

with the Special Option Award and post-IPO options awarded in 2019

and payroll taxes associated with the exercise of such options

totaling $1.6 million and $2.8 million during the three months

ended June 30, 2022 and 2021, respectively, and $3.8 million and

$9.2 million during the six months ended June 30, 2022 and 2021,

respectively. During the three and six months ended June 30, 2022,

this adjustment also includes $5.7 million and $7.4 million,

respectively, of non-cash accelerated stock-based compensation

expense and related payroll taxes associated with our former CFO

and our retiring CEO.

- Represents unrealized gain or loss recognized on foreign

currency forward contracts and foreign exchange gain or loss from

the revaluation of cash denominated in a different currency than

the entity’s functional currency.

- Represents income recognized during the applicable period due

to changes in the tax receivable agreement liability recorded in

the consolidated statement of financial condition as a result of

changes in the mix of earnings, tax legislation and tax rates in

various jurisdictions which impacted our tax savings.

- Represents corporate income taxes at an assumed effective tax

rate of 22% applied to Adjusted Net Income before income taxes for

each of the three and six months ended June 30, 2022 and 2021.

- For a summary of the calculation of Adjusted Diluted EPS, see

“Reconciliation of Diluted Weighted Average Shares Outstanding to

Adjusted Diluted Weighted Average Shares Outstanding and Adjusted

Diluted EPS” below.

The following table summarizes the calculation of Adjusted

Diluted EPS for the periods presented:

Reconciliation of Diluted Weighted

Average Shares Outstanding to Adjusted Diluted Weighted Average

Shares Outstanding and Adjusted Diluted EPS

Three Months Ended

Six Months Ended

June 30,

June 30,

2022

2021

2022

2021

Diluted weighted average shares of Class A

and Class B common stock outstanding

207,272,675

207,463,960

207,371,372

206,253,756

Weighted average of other participating

securities (1)

76,426

—

80,778

—

Assumed exchange of LLC Interests for

shares of Class A or Class B common stock (2)

29,971,658

30,531,933

30,133,370

30,871,285

Adjusted diluted weighted average shares

outstanding

237,320,759

237,995,893

237,585,520

237,125,041

Adjusted Net Income (in thousands)

$

111,659

$

93,558

$

226,714

$

195,136

Adjusted Diluted EPS

$

0.47

$

0.39

$

0.95

$

0.82

- Represents weighted average unvested restricted stock units and

unsettled vested performance-based restricted stock units issued to

certain retired executives that are entitled to non-forfeitable

dividend equivalent rights and are considered participating

securities prior to being issued and outstanding shares of common

stock in accordance with the two-class method used for purposes of

calculating earnings per share.

- Assumes the full exchange of the weighted average of all

outstanding LLC Interests held by non-controlling interests for

shares of Class A or Class B common stock, resulting in the

elimination of the non-controlling interests and recognition of the

net income attributable to non-controlling interests.

Three Months Ended

Six Months Ended

June 30,

June 30,

Reconciliation of Operating Expenses to Adjusted Expenses

2022

2021

2022

2021

(in thousands)

Operating expenses

$

190,531

$

177,048

$

390,415

$

352,120

Acquisition transaction costs (1)

(15

)

(2,966

)

3

(4,727

)

D&A related to acquisitions and the

Refinitiv Transaction (2)

(31,761

)

(30,240

)

(63,530

)

(59,843

)

Stock-based compensation expense (3)

(7,295

)

(2,803

)

(11,164

)

(9,186

)

Foreign exchange gains / (losses) (4)

3,066

(470

)

2,334

4,883

Adjusted Expenses

$

154,526

$

140,569

$

318,058

$

283,247

- Represents transaction and other costs related to the NFI

Acquisition, which closed in June 2021. Acquisition-related costs

primarily include legal, consulting and advisory fees and severance

costs incurred that relate to the acquisition transaction.

- Represents intangible asset and acquired software amortization

resulting from the NFI Acquisition and intangible asset

amortization and increased tangible asset and capitalized software

depreciation and amortization resulting from the application of

pushdown accounting to the Refinitiv Transaction (where all assets

were marked to fair value as of the closing date of the Refinitiv

Transaction).

- Represents non-cash stock-based compensation expense associated

with the Special Option Award and post-IPO options awarded in 2019

and payroll taxes associated with the exercise of such options

totaling $1.6 million and $2.8 million during the three months

ended June 30, 2022 and 2021, respectively, and $3.8 million and

$9.2 million during the six months ended June 30, 2022 and 2021,

respectively. During the three and six months ended June 30, 2022,

this adjustment also includes $5.7 million and $7.4 million,

respectively, of non-cash accelerated stock-based compensation

expense and related payroll taxes associated with our former CFO

and our retiring CEO.

- Represents unrealized gain or loss recognized on foreign

currency forward contracts and foreign exchange gain or loss from

the revaluation of cash denominated in a different currency than

the entity’s functional currency.

Trailing Twelve Months Ended

June 30,

Reconciliation of Cash Flows from

Operating Activities to Free Cash Flow

2022

2021

(in thousands)

Cash flow from operating activities

$

597,330

$

482,687

Less: Capitalization of software

development costs

(35,767

)

(33,215

)

Less: Purchases of furniture, equipment

and leasehold improvements

(23,158

)

(15,651

)

Free Cash Flow

$

538,405

$

433,821

TRADEWEB MARKETS INC. BASIC AND DILUTED EPS

CALCULATIONS (UNAUDITED) Dollars in Thousands, Except per

Share Data

The following table summarizes the basic and diluted earnings

per share calculations for Tradeweb Markets Inc.:

Three Months Ended

Six Months Ended

EPS: Net income attributable to

Tradeweb Markets Inc.

June 30,

June 30,

2022

2021

2022

2021

(in thousands, except share

and per share amounts)

Numerator:

Net income attributable to Tradeweb

Markets Inc.

$

68,344

$

55,316

$

151,309

$

123,175

Less: Distributed and undistributed

earnings allocated to unvested RSUs and unsettled vested PRSUs

(1)

(26

)

—

(53

)

—

Net income attributable to outstanding

shares of Class A and Class B common stock - Basic and Diluted

$

68,318

$

55,316

$

151,256

$

123,175

Denominator:

Weighted average shares of Class A and

Class B common stock outstanding - Basic

204,501,035

201,749,985

204,282,406

200,414,714

Dilutive effect of PRSUs

782,955

2,021,234

765,497

1,926,771

Dilutive effect of options

1,839,177

3,461,230

2,080,602

3,656,412

Dilutive effect of RSUs

149,508

231,511

242,867

255,859

Weighted average shares of Class A and

Class B common stock outstanding - Diluted

207,272,675

207,463,960

207,371,372

206,253,756

Earnings per share - Basic

$

0.33

$

0.27

$

0.74

$

0.61

Earnings per share - Diluted

$

0.33

$

0.27

$

0.73

$

0.60

- During the three and six months ended June 30, 2022, there was

a total of 76,426 and 80,778, respectively, weighted average

unvested RSUs and unsettled vested PRSUs that were considered a

participating security for purposes of calculating earnings per

share in accordance with the two-class method. There were none

during the three and six months ended June 30, 2021.

TRADEWEB MARKETS INC. REVENUES BY ASSET CLASS

(UNAUDITED)

Three Months Ended

June 30,

2022

2021

$ Change

% Change

Revenues

Variable

Fixed

Variable

Fixed

Variable

Fixed

Variable

Fixed

(dollars in thousands)

Rates

$

96,334

$

55,252

$

79,766

$

54,237

$

16,568

$

1,015

20.8

%

1.9

%

Credit

77,497

6,494

65,712

6,500

11,785

(6

)

17.9

%

(0.1

)%

Equities

20,409

2,250

14,612

2,785

5,797

(535

)

39.7

%

(19.2

)%

Money Markets

7,658

4,508

7,242

4,098

416

410

5.7

%

10.0

%

Market Data

—

21,030

—

20,007

—

1,023

—

5.1

%

Other

—

5,706

—

5,881

—

(175

)

—

(3.0

)%

Total revenue

$

201,898

$

95,240

$

167,332

$

93,508

$

34,566

$

1,732

20.7

%

1.9

%

TRADEWEB MARKETS INC. AVERAGE VARIABLE FEES PER

MILLION DOLLARS OF VOLUME (UNAUDITED)

Three Months Ended

June 30,

YoY

2022

2021

% Change

Rates

$

2.20

$

2.18

0.9

%

Cash Rates

$

2.27

$

2.02

12.0

%

Rates Derivatives

$

2.14

$

2.38

(10.0

)%

Swaps / Swaptions Tenor (greater than 1

year)

$

3.42

$

3.54

(3.6

)%

Other Rates Derivatives (1)

$

0.22

$

0.28

(20.8

)%

Credit

$

47.31

$

57.62

(17.9

)%

Cash Credit (2)

$

155.56

$

138.52

12.3

%

Credit Derivatives and U.S. Cash “EP”

$

7.73

$

7.91

(2.3

)%

Equities

$

19.77

$

14.50

36.3

%

Cash Equities

$

29.20

$

23.21

25.8

%

Equity Derivatives

$

5.93

$

5.34

11.1

%

Money Markets (Cash)

$

0.29

$

0.31

(5.9

)%

Total Fees per Million

$

2.78

$

2.70

3.1

%

Total Fees per Million excluding Other

Rates Derivatives (3)

$

3.14

$

2.95

6.7

%

- Includes Swaps/Swaptions of tenor less than 1 year and Rates

Futures.

- The “Cash Credit” category represents the “Credit” asset class

excluding (1) Credit Derivatives and (2) U.S. High Grade and High

Yield electronically processed (“EP”) activity.

- Included to contextualize the impact of short-tenored

Swaps/Swaptions and Rates Futures on totals for all periods

presented.

TRADEWEB MARKETS INC. AVERAGE DAILY VOLUME

(UNAUDITED)

2022 Q2

2021 Q2

YoY

Asset Class

Product

ADV (USD mm)

Volume (USD mm)

ADV (USD mm)

Volume (USD mm)

ADV

Rates

Cash

$

341,351

$

21,125,468

$

318,996

$

20,346,393

7.01

%

U.S. Government Bonds

131,936

8,180,022

106,904

6,841,840

23.42

%

European Government Bonds

35,429

2,161,176

30,515

1,891,937

16.10

%

Mortgages

168,603

10,453,372

177,443

11,356,322

(4.98

)%

Other Government Bonds

5,384

330,898

4,135

256,293

30.20

%

Derivatives

367,604

22,616,945

256,648

16,209,757

43.23

%

Swaps/Swaptions ≥ 1Y

221,191

13,602,492

165,825

10,441,873

33.39

%

Swaps/Swaptions < 1Y

145,004

8,927,045

89,975

5,713,635

61.16

%

Futures

1,410

87,408

848

54,248

66.31

%

Total

708,956

43,742,413

575,644

36,556,150

23.16

%

Credit

Cash

10,173

624,892

9,519

599,766

6.87

%

U.S. High Grade - Fully

Electronic

3,256

201,877

2,857

182,873

13.95

%

U.S. High Grade - Electronically

Processed

2,652

164,397

2,231

142,770

18.86

%

U.S. High Yield - Fully

Electronic

653

40,488

477

30,506

37.00

%

U.S. High Yield - Electronically

Processed

353

21,910

359

22,975

(1.56

)%

European Credit

1,741

106,178

1,911

118,454

(8.89

)%

Municipal Bonds

394

24,444

193

12,367

104.04

%

Chinese Bonds

1,001

58,041

1,373

82,377

(27.11

)%

Other Credit Bonds

123

7,556

118

7,444

4.27

%

Derivatives

16,477

1,013,032

8,566

540,584

92.34

%

Swaps

16,477

1,013,032

8,566

540,584

92.34

%

Total

26,650

1,637,924

18,085

1,140,350

47.36

%

Equities

Cash

9,945

613,836

8,239

516,731

20.70

%

U.S. ETFs

7,201

446,492

5,885

370,742

22.37

%

European ETFs

2,743

167,344

2,355

145,988

16.51

%

Derivatives

6,761

418,547

7,815

490,800

(13.49

)%

Convertibles/Swaps/Options

3,273

202,579

3,850

241,047

(14.97

)%

Futures

3,488

215,968

3,965

249,752

(12.05

)%

Total

16,706

1,032,383

16,055

1,007,530

4.06

%

Money Markets

Cash

424,016

26,207,624

366,978

23,326,831

15.54

%

Repurchase Agreements (Repo)

405,685

25,071,439

353,361

22,456,390

14.81

%

Other Money Markets

18,332

1,136,185

13,617

870,441

34.62

%

Total

424,016

26,207,624

366,978

23,326,831

15.54

%

ADV (USD mm)

Volume (USD mm)

ADV (USD mm)

Volume (USD mm)

YoY

Total

$

1,176,328

$

72,620,344

$

976,762

$

62,030,861

20.43

%

To access historical traded volumes, go to

https://www.tradeweb.com/newsroom/monthly-activity-reports/.

FORWARD-LOOKING STATEMENTS

This release contains forward-looking statements within the

meaning of the federal securities laws. Statements related to,

among other things, our guidance, including full-year 2022

guidance, and future performance, the industry and markets in which

we operate, our expectations, beliefs, plans, strategies,

objectives, prospects and assumptions and future events are

forward-looking statements.

We have based these forward-looking statements on our current

expectations, assumptions, estimates and projections. While we

believe these expectations, assumptions, estimates and projections

are reasonable, such forward-looking statements are only

predictions and involve known and unknown risks and uncertainties,

many of which are beyond our control. These and other important

factors, including those discussed under the heading “Risk Factors”

in documents of Tradeweb Markets Inc. on file with or furnished to

the SEC, may cause our actual results, performance or achievements

to differ materially from those expressed or implied by these

forward-looking statements. Given these risks and uncertainties,

you are cautioned not to place undue reliance on such

forward-looking statements. The forward-looking statements

contained in this release are not guarantees of future performance

and our actual results of operations, financial condition or

liquidity, and the development of the industry and markets in which

we operate, may differ materially from the forward-looking

statements contained in this release. In addition, even if our

results of operations, financial condition, or liquidity, and

events in the industry and markets in which we operate, are

consistent with the forward-looking statements contained in this

release, they may not be predictive of results or developments in

future periods. Any forward-looking statement that we make in this

release speaks only as of the date of such statement. Except as

required by law, we do not undertake any obligation to update or

revise, or to publicly announce any update or revision to, any of

the forward-looking statements, whether as a result of new

information, future events or otherwise, after the date of this

release.

BASIS OF PRESENTATION

Tradeweb Markets Inc. (unless the context otherwise requires,

together with its subsidiaries, referred to as “we,” “our,”

“Tradeweb,” “Tradeweb Markets” or the “Company”) closed its IPO on

April 8, 2019. As a result of certain reorganization transactions

(the “Reorganization Transactions”) completed in connection with

the IPO, on April 4, 2019, Tradeweb Markets Inc. became a holding

company whose only material assets consist of its equity interest

in Tradeweb Markets LLC (“TWM LLC”) and related deferred tax

assets. As the sole manager of TWM LLC, Tradeweb Markets Inc.

operates and controls all of the business and affairs of TWM LLC

and, through TWM LLC and its subsidiaries, conducts its business.

As a result of this control, and because Tradeweb Markets Inc. has

a substantial financial interest in TWM LLC, Tradeweb Markets Inc.

consolidates the financial results of TWM LLC and its

subsidiaries.

Numerical figures included in this release have been subject to

rounding adjustments and as a result totals may not be the

arithmetic aggregation of the amounts that precede them and figures

expressed as percentages may not total 100%.

Please refer to the Company's previously filed Annual Report on

Form 10-K for capitalized terms not otherwise defined herein.

TRADEWEB SOCIAL MEDIA

Investors and others should note that Tradeweb Markets announces

material financial and operational information using its investor

relations website, press releases, SEC filings and public

conference calls and webcasts. Information about Tradeweb Markets,

its business and its results of operations may also be announced by

posts on the Company’s accounts on the following social media

channels: Instagram, LinkedIn and Twitter. The information that we

post through these social media channels may be deemed material. As

a result, we encourage investors, the media, and others interested

in Tradeweb Markets to monitor these social media channels in

addition to following our press releases, SEC filings and public

conference calls and webcasts. These social media channels may be

updated from time to time on our investor relations website.

NON-GAAP FINANCIAL MEASURES

This release contains “non-GAAP financial measures,” including

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBIT, Adjusted

EBIT margin, Adjusted Net Income, Adjusted Diluted EPS, Adjusted

Expenses and Free Cash Flow, which are supplemental financial

measures that are not calculated or presented in accordance with

GAAP. We make use of non-GAAP financial measures in evaluating our

past results and future prospects. We present these non-GAAP

financial measures because we believe they assist investors and

analysts in comparing our operating performance across reporting

periods on a consistent basis by excluding items that we do not

believe are indicative of our core operating performance.

Management and our board of directors use Adjusted EBITDA,

Adjusted EBITDA margin, Adjusted EBIT and Adjusted EBIT margin to

assess our financial performance and believe they are helpful in

highlighting trends in our core operating performance, while other

measures can differ significantly depending on long-term strategic

decisions regarding capital structure, the tax jurisdictions in

which we operate and capital investments. Further, our executive

incentive compensation is based in part on components of Adjusted

EBITDA.

We use Adjusted Net Income and Adjusted Diluted EPS as

supplemental metrics to evaluate our business performance in a way

that also considers our ability to generate profit without the

impact of certain items. Each of the normal recurring adjustments

and other adjustments included in Adjusted Net Income and Adjusted

Diluted EPS help to provide management with a measure of our

operating performance over time by removing items that are not

related to day-to-day operations or are non-cash expenses.

We use Adjusted Expenses as a supplemental metric to evaluate

our underlying operating performance over time by removing items

that are not related to day-to-day operations or are non-cash

expenses.

We use Free Cash Flow to assess our liquidity in a way that

considers the amount of cash generated from our core operations

after non-acquisition related expenditures for capitalized software

development costs and furniture, equipment and leasehold

improvements.

See the attached schedules for reconciliations of the non-GAAP

financial measures contained in this release to their most

comparable GAAP financial measure. Non-GAAP financial measures have

limitations as analytical tools, and you should not consider these

non-GAAP financial measures in isolation or as alternatives to net

income attributable to Tradeweb Markets Inc., net income, earnings

per share, operating income, operating expenses or cash flow from

operating activities or any other financial measure derived in

accordance with GAAP. You are encouraged to evaluate each

adjustment included in the reconciliations. In addition, in

evaluating Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBIT,

Adjusted EBIT margin, Adjusted Net Income, Adjusted Diluted EPS,

Adjusted Expenses and Free Cash Flow, you should be aware that in

the future, we may incur expenses similar to the adjustments in the

presentation of these non-GAAP financial measures.

We present certain growth information on a “constant currency”

basis. Since our consolidated financial statements are presented in

U.S. dollars, we must translate non-U.S. dollar revenues and

expenses into U.S. dollars. Constant currency growth, which is a

non-GAAP financial measure, is defined as growth excluding the

effects of foreign currency fluctuations. Constant currency

information is calculated by translating the current period and

prior period’s results using the annual average exchange rates for

the prior period. We use constant currency growth as a supplemental

metric to evaluate our underlying performance between periods by

removing the impact of foreign currency fluctuations. We present

certain constant currency growth information because we believe it

provides investors and analysts a useful comparison of our results

and trends between periods. This information should be considered

in addition to, not as a substitute for, results reported in

accordance with GAAP.

Our presentation of non-GAAP financial measures should not be

construed as an inference that our future results will be

unaffected by unusual or non-recurring items. In addition, the

non-GAAP financial measures contained in this release may not be

comparable to similarly titled measures used by other companies in

our industry or across different industries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220803005023/en/

Investor Relations Ashley Serrao + 1 646 430 6027

Ashley.Serrao@Tradeweb.com Media Relations Daniel Noonan + 1

646 767 4677 Daniel.Noonan@Tradeweb.com

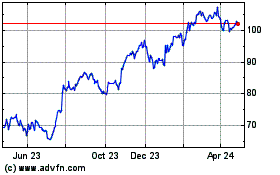

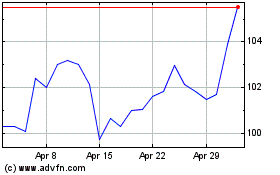

Tradeweb Markets (NASDAQ:TW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tradeweb Markets (NASDAQ:TW)

Historical Stock Chart

From Apr 2023 to Apr 2024