Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on July 22, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TTEC Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

84-1291044

(I.R.S. Employer

Identification No.)

|

9197 S. Peoria Street

Englewood, CO 80112-5833

(303) 397-8100

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Margaret B. McLean

Senior Vice President, General Counsel and Corporate Secretary

9197 S. Peoria Street

Englewood, CO 80112-5833

(303) 397-8100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

|

|

|

|

Copies to:

|

Paul Hilton

Hogan Lovells US LLP

1601 Wewatta Street, Suite 900

Denver, Colorado 80202

(303) 899-7300

|

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement, as determined by market and other conditions.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box.

o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act

of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon

filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an

emerging growth company. See the definitions of "large accelerated filer," \"accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act

(Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

o

|

|

Accelerated filer

ý

|

|

Non-accelerated filer

o

|

|

Smaller reporting company

o

Emerging growth company

o

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to Be Registered

|

|

Amount to be

Registered(1)

|

|

Proposed Maximum

Offering Price Per

Unit(1)(2)

|

|

Proposed Maximum

Aggregate Offering

Price(1)(2)

|

|

Amount of

Registration Fee

|

|

|

|

Primary Offering

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $0.01 per share

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

Preferred Stock, par value $0.01 per share

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

Debt Securities

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

Warrants

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

Purchase Contracts

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

Units

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

Total Primary Offering

|

|

—

|

|

—

|

|

$350,000,000(3)

|

|

$42,420(4)

|

|

|

|

Secondary Offering

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $0.01 per share

|

|

6,000,000(5)

|

|

$45.78(5)

|

|

$274,680,000

|

|

$33,292

|

|

|

|

Total Secondary Offering

|

|

6,000,000(5)

|

|

$45.78(5)

|

|

$274,680,000

|

|

$33,292

|

|

|

|

Total Registration Fee (Primary and Secondary)

|

|

—

|

|

—

|

|

$624,680,000

|

|

$75,712

|

|

|

-

(1)

-

An

indeterminate amount of securities to be offered at indeterminate prices is being registered pursuant to this registration statement, with an aggregate initial

offering price not to exceed $350,000,000. If any debt securities are issued at an original issue discount, then the issue price, and not the principal amount of such debt securities, shall be used

for purposes of calculating the aggregate initial offering price of all securities issued.

-

(2)

-

The

proposed maximum per share and aggregate offering prices per class of securities will be determined from time to time by the registrant in connection with the

issuance by the registrant of the securities registered under this registration statement and are not specified as to each class of security. Such information is not required to be included pursuant

to General Instruction II.D of Form S-3 under the Securities Act of 1933, as amended (the "Securities Act").

-

(3)

-

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act.

-

(4)

-

Calculated

pursuant to Rule 457(o) under the Securities Act.

-

(5)

-

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act based on the average of the high and low

prices of the registrant's common stock on the NASDAQ Global Select Market on July 16, 2019.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall

file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this

registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholder may sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state

where the offer or sale is not permitted.

Subject to Completion, Dated July 22, 2019

Prospectus

TTEC Holdings, Inc.

Up to $350,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Purchase Contracts

Units

and

6,000,000 Shares of Common Stock

Offered by the Selling Stockholder

We may offer from time to time, in one or more series of classes, up to $350,000,000 in aggregate principal amount of our common stock, preferred

stock, debt securities, warrants, purchase contracts or units, in any combination, together or separately, in one or more offerings in amounts at prices and on the terms that we will determine at the

time of the offering and which will be set forth in a prospectus supplement and any related free writing prospectus.

In

addition, Kenneth D. Tuchman (the "selling stockholder") may offer and sell up to 6,000,000 shares of our common stock from time to time, in amounts, at prices and on terms that will

be determined at the time the shares of our common stock are offered. We urge you to read this prospectus and the accompanying prospectus supplement, which will describe the specific terms of these

securities, carefully before you make your investment decision.

Our

common stock is listed on the NASDAQ Global Select Market under the trading symbol "TTEC." The last reported sale price of our common stock on July 19, 2019 was $47.24 per

share.

Investing in these securities involves certain risks. See "Risk Factors" on page 3 and the other information included and incorporated by

reference in this prospectus for a discussion of the factors you should carefully consider before deciding to purchase these securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2019.

Table of Contents

TABLE OF CONTENTS

Neither

we, the selling stockholder, our respective affiliates nor any underwriters have authorized anyone to provide any information other than that contained or incorporated by

reference in this prospectus or in any prospectus supplement or free writing prospectus prepared by or on behalf of us or to which we or the selling stockholder have referred you. We, the selling

stockholder and/or our respective affiliates, as applicable, take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the

selling stockholder and/or our respective affiliates, as applicable, are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the

information contained in or incorporated by reference in this prospectus or any prospectus supplement or in any such free writing prospectus is accurate as of any date other than their respective

dates.

In

this prospectus, (i) references to "TTEC," "we," "us," "our," "the registrant" and "our company" refer, collectively, to TTEC Holdings, Inc., a Delaware corporation, the

issuer of the securities offered hereby, and its subsidiaries and (ii) references to "selling stockholder" refer to Kenneth D. Tuchman and includes donees, pledgees, transferees or other

successors-in-interest selling shares of common stock received from the selling stockholder as a gift, pledge, partnership distribution or other transfer after the date of this prospectus.

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the "SEC"), utilizing a "shelf"

registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or more offerings with an initial aggregate offering

price of up to $350,000,000. In addition, under this shelf registration process, the selling stockholder may from time to time offer and sell up to an aggregate of 6,000,000 shares of our common stock

in one or more offerings. This prospectus provides you with a general description of the securities we may offer. Each time we and/or the selling stockholder, if applicable, sell securities, we will

provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this

prospectus. To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any prospectus supplement, on the other hand, you

shall rely on the information in the prospectus supplement. You should read this prospectus, any prospectus supplement and any free writing prospectus together with additional information described

under the sections "Risk Factors" and "Where You Can Find More Information."

We

have filed or incorporated by reference exhibits to the registration statement of which this prospectus forms a part. You should read the exhibits carefully for provisions that

may be important to you.

1

Table of Contents

THE COMPANY

TTEC is a leading global customer experience technology and services company focused on the design, implementation and delivery of

transformative solutions for many of the world's most iconic and disruptive brands. We help large global companies increase revenue and reduce costs by delivering personalized customer experiences

across every interactional channel and phase of the customer lifecycle as an end-to-end provider of customer engagement services, technologies, insights and innovations. We are organized into two

centers of excellence: TTEC Digital and TTEC Engage.

-

•

-

TTEC Digital designs and builds human centric, tech-enabled, insight-driven customer experience solutions.

-

•

-

TTEC Engage is the Company's global delivery center of excellence that operates turnkey customer acquisition, care, revenue growth, digital

fraud prevention and detection, and content moderation services.

TTEC

Digital and TTEC Engage come together under our unified offering, HumanifyTM Customer Engagement as a Service, which drives measurable results for clients through delivery of

personalized omnichannel interactions that are seamless and relevant. Our business is supported by 49,300 employees delivering services in 24 countries from 82 customer engagement centers on six

continents. Our end-to-end approach differentiates the Company by combining service design, strategic consulting,

data analytics, process optimization, system integration, operational excellence, and technology solutions and services. This unified offering is value-oriented, outcome-based, and delivered on a

global scale across all four of our business segments, two of which comprise TTEC Digital—Customer Strategy Services and Customer Technology Services; and two of which comprise TTEC

Engage—Customer Growth Services and Customer Management Services.

Since

our establishment in 1982, we have helped clients strengthen their customer relationships, brand recognition and loyalty by simplifying and personalizing interactions with their

customers. We deliver thought leadership, through innovation in programs that differentiate our clients from their competition.

TTEC

is a Delaware corporation. TTEC's principal executive offices are located at 9197 S. Peoria Street, Englewood, CO 80112-5833, and its telephone number is (303) 397-8100. The

address of our website is www.ttec.com. The information contained on, or accessible through, our website is not incorporated in, and shall not be part of, this prospectus. For more information about

TTEC, see "Where You Can Find More Information."

2

Table of Contents

RISK FACTORS

Investing in the securities involves substantial risks. Before purchasing any of the securities, you should carefully consider and evaluate all

of the information included and incorporated by reference or deemed to be incorporated by reference in this prospectus or the applicable prospectus supplement, including the risk factors incorporated

by reference herein from our

Annual Report on Form 10-K for the fiscal year ended

December 31, 2018,

as updated by annual, quarterly and other reports and documents that are incorporated by reference herein or in the applicable prospectus supplement. The risks

and uncertainties that we have described are not the only ones facing our company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect us.

The occurrence of any of these risks could materially and adversely impact our business, cash flows, condition (financial or otherwise), liquidity, prospects and/or results of operations. Please also

refer to the sections below entitled "Cautionary Note on Forward-Looking Statements" and "Where You Can Find More Information."

3

Table of Contents

USE OF PROCEEDS

Unless otherwise indicated in a prospectus supplement, the net proceeds from the sale of the securities will be used for general corporate

purposes, including working capital, acquisitions, retirement of debt and other business opportunities.

In

the case of a sale by the selling stockholder, we will not receive any of the proceeds from such sale. We are required to bear the expenses (other than underwriting discounts)

incident to an offering by the selling stockholder.

4

Table of Contents

SELLING STOCKHOLDER

In addition to the shares of our common stock that we may offer from time to time in one or more offerings, this prospectus also relates to the

possible resale from time to time by Kenneth D. Tuchman of up to 6,000,000 shares of our common stock that were issued and outstanding prior to the original date of filing of the registration

statement of which this prospectus forms a part.

The

following table details the number of shares of our common stock that Kenneth D. Tuchman beneficially owns and the number of shares of our common stock that Kenneth D. Tuchman may

offer for resale under this prospectus. The following table has been prepared on the assumption that all shares that Kenneth D. Tuchman may offer from time to time pursuant to this prospectus are

sold. The percentage of shares of our common stock that Kenneth D. Tuchman beneficially owns both prior to

and following an offering of securities pursuant to this prospectus is based on 46,386,727 shares of our common stock outstanding as of June 30, 2019 and does not take into account any

securities issued by us pursuant to this prospectus. We cannot advise you as to whether Kenneth D. Tuchman will in fact sell any or all of such shares of our common stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling Stockholder

|

|

Shares

beneficially

owned prior to

offering

|

|

Percentage of

outstanding

shares

beneficially

owned prior to

offering

|

|

Number of

shares being

registered

for resale

|

|

Shares

beneficially

owned after

offering

|

|

Percentage of

outstanding

shares

beneficially

owned after

offering

|

|

|

Kenneth D. Tuchman(1)

|

|

|

31,463,707

|

(2)(3)

|

|

67.8

|

%

|

|

6,000,000

|

|

|

25,463,707

|

|

|

54.9

|

%

|

-

(1)

-

The

address of Mr. Tuchman is 9197 S. Peoria Street, Englewood, CO 80112-5833.

-

(2)

-

Includes

31,453,707 shares subject to sole voting and investment power, and 10,000 shares with shared voting and investment power. The shares with sole voting and

investment power consist of: (i) 6,686,901 shares held by Mr. Tuchman; (ii) 14,766,806 shares held by a limited liability partnership controlled by Mr. Tuchman; and

(iii) 10,000,000 shares held by a revocable trust controlled by Mr. Tuchman. The shares with shared voting and investment power consist of 10,000 shares owned by Mr. Tuchman's

spouse.

-

(3)

-

On

May 7, 2018, Mr. Tuchman entered into a Security Agreement with Wells Fargo Bank, National Association, pursuant to the terms of which he agreed to

collateralize a certain personal loan with 3,070,000 of TTEC common stock held in KDT Stock Revocable Trust ("2018 Security Agreement"). Pursuant to 2018 Security Agreement, Mr. Tuchman may

pledge additional TTEC shares held by the Trust, directly, or through other vehicles to collateralized additional advancements on the Loan. The 2018 Security Agreement restates and supersedes a

certain security agreement for pledge of TTEC shares with Wells Fargo Bank previously executed in December 2015.

Material Relationships with Selling Stockholder

A description of certain relationships and related party transactions involving Kenneth D. Tuchman is included in our

Definitive Proxy Statement on Schedule 14A filed with the SEC on April 12,

2019

in the section entitled "Related Party Transactions," which is incorporated herein by reference.

5

Table of Contents

DESCRIPTION OF CAPITAL STOCK

The following description of certain terms of our capital stock does not purport to be complete and is subject to, and qualified in its entirety

by reference to, our restated certificate of incorporation, as amended (the "Certificate of Incorporation"), our amended and restated bylaws, as amended (the "Bylaws"), and the applicable provisions

of the Delaware General Corporation Law (the "DGCL"). For more information on how you can obtain the Certificate of Incorporation and the Bylaws, see "Where You Can Find More

Information."

General

Under the Certificate of Incorporation, we are authorized to issue up to 150,000,000 shares of common stock, par value $0.01 per share, and

10,000,000 shares of preferred stock, par value $0.01 per share. As of June 30, 2019, there were 46,386,727 shares of common stock outstanding and no shares of preferred stock outstanding.

Common Stock

The holders of our common stock are entitled to one vote per share on all matters to be voted upon by the stockholders. Stockholders may not

cumulate their votes in the election of directors. Subject to preferences that may be applicable to any outstanding preferred stock, the holders of common stock are entitled to receive ratably such

dividends, if any, as may be declared from time to time by the Board of Directors out of funds legally available therefor. In 2015, our Board of Directors adopted a dividend policy, with the intent to

distribute a periodic cash dividend to stockholders of our common stock, after consideration of, among other things, TTEC's performance, cash flows from operations, capital needs and liquidity

factors. The Company paid the initial dividend in 2015 and has continued to pay a semi-annual dividend in October and April of each year.

In

the event of liquidation, dissolution or winding up of TTEC, the holders of common stock are entitled to share ratably in all assets remaining after payment of liabilities, subject to

prior distribution rights of preferred stock, if any, then outstanding. The common stock has no preemptive or conversion rights or other subscription rights. There are no redemption or sinking fund

provisions applicable to the common stock. All outstanding shares of common stock are fully paid and non-assessable.

Preferred Stock

Our Board of Directors has the authority to issue our preferred stock in one or more series and to fix the rights, preferences, privileges and

restrictions thereof, including dividend rights, dividend rates, conversion rights, voting rights, terms of redemption, redemption prices, liquidation preferences and the number of shares constituting

any series or the designation of such series, without further vote or action by the stockholders. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in

control of TTEC without further action by the stockholders and may adversely affect the voting and other rights of the holders of common stock. Holders of preferred stock may be entitled to receive

dividends (other than dividends of common stock) before any dividends are payable to holders of common stock.

The

prospectus supplement relating to any preferred stock being offered will include specific terms relating to the offering.

Anti-Takeover Effects of Delaware Law

Delaware Law.

TTEC is subject to the "business combination" provisions of Section 203 of the Delaware General Corporation Law. In

general,

such provisions prohibit a publicly held Delaware corporation from engaging in various "business combination" transactions with any interested

6

Table of Contents

stockholder

for a period of three years after the date of the transaction in which the person became an interested stockholder, unless:

-

•

-

the business combination transaction or the transaction which resulted in the stockholder becoming an interested stockholder is approved by the

Board of Directors prior to the date the interested stockholder obtained such status;

-

•

-

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the stockholder owned at least 85%

of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for the purpose of determining the number of shares outstanding those shares owned by the

corporation's officers and directors and by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be

tendered in a tender or exchange offer; or

-

•

-

on or subsequent to such date the business combination is approved by the Board of Directors and authorized at an annual or special meeting of

stockholders by the affirmative vote of at least 66

2

/

3

% of the outstanding voting stock which is not owned by the interested stockholder.

A

"business combination" is defined to include mergers, asset sales and other transactions resulting in financial benefit to a stockholder. In general, an "interested stockholder" is a

person who, together with affiliates and associates, owns (or within three years, did own) 15% or more of a corporation's voting stock. The statute could prohibit or delay mergers or other takeover or

change in control attempts with respect to TTEC and, accordingly, may discourage attempts to acquire TTEC even though such a transaction may offer TTEC's stockholders the opportunity to sell their

stock at a price above the prevailing market price.

Certificate of Incorporation and Bylaws.

Various provisions contained in the Certificate of Incorporation and the Bylaws could delay or

discourage

stockholder actions with respect to transactions involving an actual or potential change of control of us or a chance in our management and may limit the ability of our stockholders to remove current

management or approve transactions that our stockholders may deem to be in their best interests. Among other things, these provisions:

-

•

-

provide that special meetings of stockholders may be called only by the Board of Directors, the Chairman of the Board of Directors or by the

Chief Executive Officer of our company and not by the stockholders;

-

•

-

provide that any stockholder wishing to nominate persons for election as directors at, or bring other business before, an annual meeting must

deliver to our secretary advance written notice of the stockholder's intention to do so;

-

•

-

establish that state courts located within the State of Delaware (or, if no state court located within the State of Delaware has jurisdiction,

the federal district court for the District of Delaware) are the sole and exclusive forum for certain disputes;

-

•

-

provide that the Board of Directors may, by resolution adopted by a majority of the directors, increase or decrease the number of directors on

the Board so long as the number of directors is not less than two nor more than eleven;

-

•

-

do not permit cumulative voting for directors; and

-

•

-

provide that vacancies in our Board of Directors may be filled only by the affirmative vote of a majority of the remaining directors.

7

Table of Contents

Stock Transfer Agent and Registrar

The Transfer Agent and Registrar for the Common Stock is American Stock Transfer & Trust Company.

Listing

Our common stock is listed on the NASDAQ Global Select Market under the symbol "TTEC."

8

Table of Contents

DESCRIPTION OF DEBT SECURITIES

The debt securities will be our direct unsecured general obligations. The debt securities will be issued under an indenture which may be amended

or supplemented from time to time, the form of which is filed as an exhibit to the registration statement of which this prospectus forms a part.

The

applicable prospectus supplement and/or other offering materials will describe the material terms of the debt securities offered through that prospectus supplement as well as any

general terms described in this section that will not apply to those debt securities. To the extent the applicable prospectus supplement or other offering materials relating to an offering of debt

securities are inconsistent with this prospectus, the terms of that prospectus supplement or other offering materials will supersede the information in this prospectus.

The

prospectus supplement relating to any series of debt securities that we may offer will contain the specific terms of the debt securities. These terms may include the

following:

-

•

-

the title and principal aggregate amount of the debt securities;

-

•

-

whether the debt securities will be secured or unsecured;

-

•

-

whether the debt securities are convertible or exchangeable into other securities;

-

•

-

the percentage or percentages of principal amount at which such debt securities will be issued;

-

•

-

the interest rate(s) or the method for determining the interest rate(s);

-

•

-

the dates on which interest will accrue or the method for determining dates on which interest will accrue and dates on which interest will be

payable;

-

•

-

the person to whom any interest on the debt securities will be payable;

-

•

-

the places where payments on the debt securities will be payable;

-

•

-

the maturity date;

-

•

-

redemption or early repayment provisions;

-

•

-

authorized denominations;

-

•

-

form;

-

•

-

amount of discount or premium, if any, with which such debt securities will be issued;

-

•

-

whether such debt securities will be issued in whole or in part in the form of one or more global securities;

-

•

-

the identity of the depositary for global securities;

-

•

-

whether a temporary security is to be issued with respect to such series and whether any interest payable prior to the issuance of definitive

securities of the series will be credited to the account of the persons entitled thereto;

-

•

-

the terms upon which the beneficial interests in a temporary global security may be exchanged in whole or in part for beneficial interests in a

definitive global security or for individual definitive securities;

-

•

-

any covenants applicable to the particular debt securities being issued;

-

•

-

any defaults and events of default applicable to the particular debt securities being issued;

-

•

-

the guarantors of each series, if any, and the extent of the guarantees, if any;

-

•

-

any restriction or condition on the transferability of the debt securities;

9

Table of Contents

-

•

-

the currency, currencies, or currency units in which the purchase price for, the principal of and any premium and any interest on, such debt

securities will be payable;

-

•

-

the time period within which, the manner in which and the terms and conditions upon which we or the purchaser of the debt securities can select

the payment currency;

-

•

-

the securities exchange(s) on which the securities will be listed, if any;

-

•

-

whether any underwriter(s) will act as market maker(s) for the securities;

-

•

-

the extent to which a secondary market for the securities is expected to develop;

-

•

-

our obligations or right to redeem, purchase or repay debt securities under a sinking fund, amortization or analogous provision;

-

•

-

provisions relating to covenant defeasance and legal defeasance;

-

•

-

provisions relating to satisfaction and discharge of the indenture;

-

•

-

provisions relating to the modification of the indenture both with and without consent of holders of debt securities issued under the

indenture;

-

•

-

the law that will govern the indenture and debt securities; and

-

•

-

additional terms not inconsistent with the provisions of the indenture.

General

We may sell the debt securities, including original issue discount securities, at par or at a substantial discount below their stated principal

amount. Unless we inform you otherwise in a prospectus supplement, we may issue additional debt securities of a particular series without the consent of the holders of the debt securities of such

series outstanding at the time of issuance. Any such additional debt securities, together with all other outstanding debt securities of that series, will constitute a single series of securities under

the applicable indenture. In addition, we will describe in the applicable prospectus supplement material U.S. federal income tax considerations and any other special considerations for any debt

securities we sell which are denominated in a currency or currency unit other than U.S. dollars. Unless we inform you otherwise in the applicable prospectus supplement, the debt securities will not be

listed on any securities exchange.

We

expect most debt securities to be issued in fully registered form without coupons and in denominations of $1,000 and integral multiples thereof. Subject to the limitations provided in

the indenture and in the prospectus supplement, debt securities that are issued in registered form may be transferred or exchanged at the corporate office of the trustee or the principal corporate

trust office of the trustee, without the payment of any service charge, other than any tax or other governmental charge payable in connection therewith.

If

specified in the applicable prospectus supplement, certain of our subsidiaries will guarantee the debt securities. The particular terms of any guarantee will be described in the

related prospectus supplement.

Governing Law

The indentures and the debt securities will be construed in accordance with and governed by the laws of the State of New York.

10

Table of Contents

DESCRIPTION OF WARRANTS

We may issue warrants to purchase our debt or equity securities or securities of third parties or other rights, including rights to receive

payment in cash or securities based on the value, rate or price of one or more specified commodities, currencies, securities or indices, or any combination of the foregoing. Warrants may be issued

independently or together with any other securities and may be attached to, or separate from, such securities. Each series of warrants will be issued under a separate warrant agreement to be entered

into between us and a warrant agent. The terms of any warrants to be issued and a description of the material provisions of the applicable warrant agreement will be set forth in the applicable

prospectus supplement.

The

applicable prospectus supplement will describe the following terms of any warrants in respect of which this prospectus is being delivered:

-

•

-

the title of such warrants;

-

•

-

the aggregate number of such warrants;

-

•

-

the price or prices at which such warrants will be issued;

-

•

-

the currency or currencies in which the price of such warrants will be payable;

-

•

-

the securities or other rights, including rights to receive payment in cash or securities based on the value, rate or price of one or more

specified commodities, currencies, securities or indices, or any combination of the foregoing, purchasable upon exercise of such warrants;

-

•

-

the price at which and the currency or currencies in which the securities or other rights purchasable upon exercise of such warrants may be

purchased;

-

•

-

the date on which the right to exercise such warrants shall commence and the date on which such right shall expire;

-

•

-

if applicable, the minimum or maximum amount of such warrants which may be exercised at any one time;

-

•

-

if applicable, the designation and terms of the securities with which such warrants are issued and the number of such warrants issued with each

such security;

-

•

-

if applicable, the date on and after which such warrants and the related securities will be separately transferable;

-

•

-

information with respect to book-entry procedures, if any;

-

•

-

if applicable, a discussion of any material United States federal income tax considerations; and

-

•

-

any other terms of such warrants, including terms, procedures and limitations relating to the exchange and exercise of such warrants.

11

Table of Contents

DESCRIPTION OF PURCHASE CONTRACTS

We may issue purchase contracts for the purchase or sale of:

-

•

-

debt or equity securities issued by us or securities of third parties, a basket of such securities, an index or indices of such securities or

any combination of the above as specified in the applicable prospectus supplement;

-

•

-

currencies; or

-

•

-

commodities.

Each

purchase contract will entitle the holder thereof to purchase or sell, and obligate us to sell or purchase, on specified dates, such securities, currencies or commodities at a

specified purchase price, which may be based on a formula, all as set forth in the applicable prospectus supplement. We may, however, satisfy our obligations, if any, with respect to any purchase

contract by delivering the cash value of such purchase contract or the cash value of the property otherwise deliverable or, in the case of purchase contracts on underlying currencies, by delivering

the underlying currencies, as set forth in the applicable prospectus supplement. The applicable prospectus supplement will also specify the methods by which the holders may purchase or sell such

securities, currencies or commodities and any acceleration, cancellation or termination provisions or other provisions relating to the settlement of a purchase contract.

The

purchase contracts may require us to make periodic payments to the holders thereof or vice versa, which payments may be deferred to the extent set forth in the applicable prospectus

supplement, and those payments may be unsecured or prefunded on some basis. The purchase contracts may require the holders thereof to secure their obligations in a specified manner to be described in

the applicable prospectus supplement. Alternatively, purchase contracts may require holders to satisfy their obligations thereunder when the purchase contracts are issued. Our obligation to settle

such pre-paid purchase contracts on the relevant settlement date may constitute indebtedness. Accordingly, pre-paid purchase contracts will be issued under an indenture.

12

Table of Contents

DESCRIPTION OF UNITS

As specified in the applicable prospectus supplement, we may issue units consisting of one or more purchase contracts, warrants, debt

securities, shares of preferred stock, shares of common stock or any combination of such securities. The applicable supplement will describe:

-

•

-

the terms of the units and of the warrants, debt securities and common stock comprising the units, including whether and under what

circumstances the securities comprising the units may be traded separately;

-

•

-

a description of the terms of any unit agreement governing the units; and

-

•

-

a description of the provisions for the payment, settlement, transfer or exchange of the units.

13

Table of Contents

PLAN OF DISTRIBUTION

TTEC and/or the selling stockholder, if applicable, may sell the securities in one or more of the following ways (or in any combination) from

time to time:

-

•

-

through underwriters or dealers;

-

•

-

directly to a limited number of purchasers or to a single purchaser;

-

•

-

through agents;

-

•

-

through a combination of any such methods; or

-

•

-

through any other methods described in a prospectus supplement.

The

prospectus supplement will state the terms of the offering of the securities, including:

-

•

-

the name or names of any underwriters, dealers or agents;

-

•

-

the purchase price of such securities and the proceeds to be received by TTEC, if any;

-

•

-

any underwriting discounts or agency fees and other items constituting underwriters' or agents' compensation;

-

•

-

any initial public offering price;

-

•

-

any discounts or concessions allowed or reallowed or paid to dealers; and

-

•

-

any securities exchanges on which the securities may be listed.

Any

initial public offering price and any discounts or concessions allowed or reallowed or paid to dealers may be changed from time to time.

If

we and/or the selling stockholder, if applicable, use underwriters in the sale, the securities will be acquired by the underwriters for their own account and may be resold from time

to time in one or more transactions, including:

-

•

-

negotiated transactions;

-

•

-

at a fixed public offering price or prices, which may be changed;

-

•

-

at market prices prevailing at the time of sale;

-

•

-

at prices related to prevailing market prices; or

-

•

-

at negotiated prices.

Unless

otherwise stated in a prospectus supplement, the obligations of the underwriters to purchase any securities will be conditioned on customary closing conditions and the

underwriters will be obligated to purchase all of such series of securities, if any are purchased.

We

and/or the selling stockholder, if applicable, may sell the securities through agents from time to time. The prospectus supplement will name any agent involved in the offer or sale of

the securities and any commissions we pay to them. Generally, any agent will be acting on a best efforts basis for the period of its appointment.

We

and/or the selling stockholder, if applicable, may authorize underwriters, dealers or agents to solicit offers by certain purchasers to purchase the securities from TTEC at the public

offering price set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future. The contracts will be subject only to

those conditions set forth in the prospectus supplement, and the prospectus supplement will set forth any commissions we pay for solicitation of these contracts.

14

Table of Contents

Underwriters

and agents may be entitled under agreements entered into with TTEC and/or the selling stockholder, if applicable, to indemnification by TTEC and/or the selling stockholder,

if applicable, against certain civil liabilities, including liabilities under the Securities Act of 1933, as amended (the "Securities Act"), or to contribution with respect to payments which the

underwriters or agents may be required to make. Underwriters and agents may be customers of, engage in transactions with, or perform services for TTEC and its affiliates in the ordinary course of

business.

Each

series of securities will be a new issue of securities and will have no established trading market other than the common stock, which is listed on the NASDAQ Global Select Market.

Any underwriters to whom securities are sold for public offering and sale may make a market in the securities, but such underwriters will not be obligated to do so and may discontinue any market

making at any time without notice. The securities, other than the common stock, may or may not be listed on a national securities exchange.

15

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet site at

http://www.sec.gov from which interested persons can electronically access our SEC filings, including the registration statement and the exhibits and schedules thereto.

The

SEC allows us to "incorporate by reference" the information we file with them, which means that we can disclose important information to you by referring you to those documents. The

information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC and which is incorporated by reference will automatically update and

supersede this information. We incorporate by reference the documents listed below and all future filings made pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than

information in the

documents or filings that is deemed to have been furnished and not filed) until the termination of the offerings of all of the securities covered by this prospectus.

-

•

-

Annual Report on Form 10-K

for the year ended December 31, 2018 filed with the SEC on March 6, 2019;

-

•

-

Quarterly Report on

Form 10-Q for the quarter ended March 31, 2019 filed with the SEC on May 7, 2019;

-

•

-

Current Reports on Form 8-K filed with the SEC on

February 26, 2019

,

April 23, 2019

,

May 21, 2019

and

May 24, 2019

;

-

•

-

Definitive Proxy Statement on

Schedule 14A filed with the SEC on April 12, 2019

; and

-

•

-

The description of our common stock

contained in our Registration Statement on Form 8-A filed with the SEC on July 19, 1996.

We

will provide, upon written or oral request, to each person to whom a prospectus is delivered, including any beneficial owner, a copy of any or all of the information that has been

incorporated by reference into the prospectus but not delivered with the prospectus. You may request a copy of these filings at no cost. Requests for documents should be directed to:

TTEC

Holdings, Inc.

9197 S. Peoria Street

Englewood, CO 80112-5833

(303) 397-8100

16

Table of Contents

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

This prospectus, including the documents incorporated by reference herein, contains "forward-looking statements" within the meaning of

Section 27A of the Securities Act, Section 21E of the Exchange Act, and the Private Securities Litigation Reform Act of 1995, relating to our operations, expected financial position,

results of operation, and other business matters that are based on our current expectations, assumptions, and projections with respect to the future, and are not a guarantee of performance. In many

cases, you can identify forward-looking statements by terms such as "may," "believe," "plan," "will," "anticipate," "estimate," "expect," "intend," "project," "would," "could," "target," or similar

expressions.

We

caution you not to rely unduly on any forward-looking statements. Actual results may differ materially from what is expressed in the forward-looking statements, and you should review

and consider carefully the risks, uncertainties and other factors that affect our business and may cause such differences as outlined but are not limited to factors discussed in under the caption

entitled "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018. Specifically, we would like for you to focus on risks related to our strategy

execution, our ability to innovate and introduce technologies that are sufficiently disruptive to allow us to maintain and grow our market share, cybersecurity risks and risks inherent to our equity

structure.

Although

we believe that the assumptions inherent in the forward-looking statements contained in this prospectus are reasonable, undue reliance should not be placed on these statements,

which only apply as of the date hereof. Except as required by applicable securities law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the

date on which the statement is made or to reflect the occurrence of unanticipated events.

LEGAL MATTERS

The validity of the issuance of the offered securities will be passed upon for TTEC by Hogan Lovells US LLP. Additional legal matters may

be passed upon for us or any underwriters, dealers or agents by counsel that we will name in the applicable prospectus supplement.

EXPERTS

The financial statements and management's assessment of the effectiveness of internal control over financial reporting (which is included in

Management's Report on Internal Control over Financial Reporting) incorporated in this Prospectus by reference to the

Annual Report on Form 10-K for the year ended December 31,

2018

have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as

experts in auditing and accounting.

17

Table of Contents

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the costs and expenses to be borne by the registrant in connection with the offerings described in this

registration statement.

|

|

|

|

|

|

|

|

Amount to

Be Paid

|

|

|

Registration fee

|

|

$

|

75,712

|

|

|

Transfer Agent and Trustee fees and expenses

|

|

|

|

*

|

|

Printing

|

|

|

|

*

|

|

Accounting fees and expenses

|

|

|

|

*

|

|

Legal fees and expenses

|

|

|

|

*

|

|

Rating Agency fees

|

|

|

|

*

|

|

Miscellaneous

|

|

|

|

*

|

|

|

|

|

|

|

|

TOTAL

|

|

$

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

*

-

The

applicable prospectus supplement will set forth the estimated aggregate amount of expenses payable with respect to any offering of the securities.

Item 15. Indemnification of Directors and Officers

Section 145 of the Delaware General Corporation Law provides that a corporation may indemnify directors and officers as well as other

employees and individuals against expenses (including attorneys' fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with any

threatened, pending or completed actions, suits or proceedings in which such person is made a party by reason of such person being or having been a director, officer, employee or agent to the

registrant. The Delaware General Corporation Law provides that Section 145 is not exclusive of other rights to which those seeking indemnification may be entitled under any bylaw, agreement,

vote of stockholders or disinterested directors or otherwise. Article Eight of the registrant's restated certificate of incorporation, as amended (the "Certificate of Incorporation") and

Article VII of the registrant's amended and restated bylaws, as amended (the "Bylaws") each provides for indemnification by the registrant of its directors, officers and employees to the

fullest extent permitted by the Delaware General Corporation Law.

Section 102(b)(7)

of the Delaware General Corporation Law permits a corporation to provide in its certificate of incorporation that a director of the corporation shall not be

personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (i) for any breach of the director's duty of

loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) for unlawful

payments of dividends or unlawful stock repurchases, redemptions or

other distributions, or (iv) for any transaction from which the director derived an improper personal benefit. The Certificate of Incorporation provides for such limitation of liability.

The

registrant maintains standard policies of insurance under which coverage is provided (a) to its directors and officers against loss rising from claims made by reason of breach

of duty or other wrongful act, and (b) to the registrant with respect to payments which may be made by the registrant to such officers and directors pursuant to the above indemnification

provision or otherwise as a matter of law. The registrant has entered into an indemnification agreement with each of its directors.

II-1

Table of Contents

The

foregoing summaries are subject to the complete text of the statutes, the Certificate of Incorporation and the Bylaws, and are qualified in their entirety by reference thereto.

Item 16. List of Exhibits.

The following is a list of all exhibits filed as a part of this registration statement on Form S-3, including those incorporated herein

by reference.

-

*

-

To

be filed, if necessary, by amendment or as an exhibit to a Current Report on Form 8-K.

-

**

-

To

be filed separately pursuant to Section 305(b)(2) of the Trust Indenture Act of 1939, as amended, and the appropriate rules and regulations thereunder.

Item 17. Undertakings.

The undersigned registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof)

which,

II-2

Table of Contents

individually

or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may

be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum

aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement;

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such

information in the registration statement;

provided, however

, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are

incorporated by reference in the registration statement or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To

remove from registration, by means of a post-effective amendment, any of the securities being registered which remain unsold at the termination of the offering.

(4) That,

for the purpose of determining liability under the Securities Act to any purchaser:

(i) Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus

was deemed part of and included in the registration statement; and

(ii) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to

an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to

be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in

the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a

new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof.

Provided, however

, that no statement made in a registration statement or prospectus that is part of

the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a

purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such effective date.

(5) That,

for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned

registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration

II-3

Table of Contents

statement,

regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications,

the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to the purchaser:

(i) Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned registrant;

(iii) The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided

by or on behalf of the undersigned registrant; and

(iv) Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(6) The

undersigned registrant hereby undertakes to file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of

Section 310 of the Trust Indenture Act in accordance with the rules and regulations prescribed by the Commission under Section 305(b)(2) of the Trust Indenture Act.

(7) The

undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant's annual report

pursuant to Section 13(a) or Section 15(d)

of the Exchange Act (and, where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the

registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(8) Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to

the provisions described under Item 15 above, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public

policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses

incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person

in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate

jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

II-4

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Englewood,

State of Colorado, on July 22, 2019.

|

|

|

|

|

|

|

|

|

TTEC HOLDINGS, INC.

|

|

|

By:

|

|

/s/ KENNETH D. TUCHMAN

Kenneth D. Tuchman

Chief Executive Officer

|

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated below.

|

|

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ KENNETH D. TUCHMAN

Kenneth D. Tuchman

|

|

PRINCIPAL EXECUTIVE OFFICER

Chief Executive Officer and Chairman of the Board

|

|

July 22, 2019

|

/s/ REGINA M. PAOLILLO

Regina M. Paolillo

|

|

PRINCIPAL FINANCIAL AND ACCOUNTING OFFICER

Chief Financial Officer

|

|

July 22, 2019

|

*

Steven J. Anenen

|

|

Director

|

|

July 22, 2019

|

*

Tracy L. Bahl

|

|

Director

|

|

July 22, 2019

|

*

Gregory A. Conley

|

|

Director

|

|

July 22, 2019

|

*

Robert N. Frerichs

|

|

Director

|

|

July 22, 2019

|

*

Marc L. Holtzman

|

|

Director

|

|

July 22, 2019

|

II-5

Table of Contents

|

|

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

*

Ekta Singh-Bushell

|

|

Director

|

|

July 22, 2019

|

*By:

|

|

/s/ REGINA M. PAOLILLO

Regina M. Paolillo

Attorney-in-Fact

|

|

|

|

|

II-6

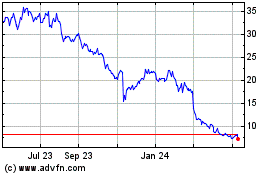

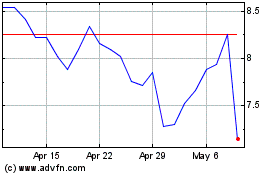

TTEC (NASDAQ:TTEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

TTEC (NASDAQ:TTEC)

Historical Stock Chart

From Apr 2023 to Apr 2024