Tesla Swoons as Tech Stock Rout Deepens

February 23 2021 - 10:55AM

Dow Jones News

By Michael Wursthorn

The late February tech-stock rout deepened Tuesday, with the

Nasdaq Composite Index falling 3% and Tesla Inc. tumbling as much

as 12% as rising interest rates prompt a broad re-evaluation of

investor growth expectations.

The Nasdaq pullback puts the tech-focused index on track for its

steepest decline since Sept. 8. Tesla, whose 743% surge last year

highlighted the tech-led market rebound from the coronavirus

selloff, is now down for 2021 and has lost a quarter of its value

since the electric-car firm said Feb. 8 that it had spent $1.5

billion on bitcoin in a bid to boost returns on cash.

Other investor favorites were also hit hard in early trading.

Moderna Inc., the biotech maker of a major Covid vaccine, dropped

13%. Apple dropped 3.4% and Amazon.com Inc. fell 2%.

The tech firms have emerged as a favorite of the small investors

who have piled into stock and options trading over the past year,

with Nasdaq rising 44% in 2020. But the scale of the rally has

prompted concerns that many of the stocks are overvalued, making

them vulnerable to sudden slumps.

The rise in U.S. interest rates over the past week to a recent

1.37% on the 10-year Treasury note signifies expectations of faster

economic growth, which investors said reduces the relative

attractiveness of the tech firms compared with more economically

sensitive and less highly valued investments such as banks and

manufacturing firms.

"We're seeing a nasty, violent rotation," said Mike Bailey,

director of research at FBB Capital Partners, an investment manager

in Bethesda, Md. "A lot of the stratosphere stocks are getting

dragged down."

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

February 23, 2021 10:40 ET (15:40 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

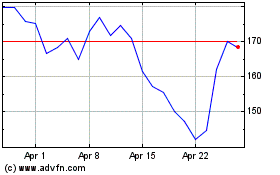

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024