Why Bitcoin Hasn't Gained Traction as a Form of Payment

February 09 2021 - 11:39AM

Dow Jones News

By Paul Vigna

Want to buy your next car with bitcoin? What about your next cup

of coffee?

Elon Musk, a longtime advocate for bitcoin, will soon give Tesla

Inc.'s customers the chance to buy the company's electric vehicles

using the digital currency. The news -- along with Tesla's move to

acquire $1.5 billion of the cryptocurrency for its corporate

treasury -- sent the price of bitcoin up more than 20% to a new

intraday record of $46,724 on Monday.

For bitcoin bulls, the announcement was the latest sign of

validation for the burgeoning digital currency.

Despite making inroads with investors, bitcoin has been slow to

take off as a form of payment. It was originally created in 2008 to

operate like an electronic version of cash, allowing two people

anywhere in the world to digitally exchange value as if they were

physically exchanging cash.

In practice, it hasn't worked that way. The cost of using

bitcoin, and its volatility, have made normal, day-to-day

transactions impractical. That isn't likely to change with Tesla's

acceptance of the currency.

For users who might want to buy something small, say a $4 cup of

coffee at Starbucks, bitcoin is an unattractive payment option

because of the associated fees. The median transaction fee is

currently around $5.40, according to the website BitInfoCharts, but

the average is more than $11, and it varies wildly, depending on

network traffic. (The fee rises when traffic is heavier.) Over the

past three months, the daily average fee has varied between $2.18

and $17.20.

Luxury purchases, on the other hand, are where bitcoin has found

its niche. Concerns about such fees are unlikely to be an issue for

large-scale items, like an $80,000 Tesla Model S.

Bitcoin buyers tend to be loyal and spend more, said Jeff Klee,

chief executive of CheapAir.com, which has been accepting bitcoin

since 2013. "Since we started accepting bitcoin, we have

consistently seen a 'wealth effect' where sales have increased as

the valuation has gotten higher," he said.

Among the other stumbling blocks bitcoin faces in becoming more

ubiquitous is its inherent volatility. Despite its recent surge in

value -- bitcoin has nearly quadrupled since September -- it still

swings wildly. It can rise or fall 20% in a single day, sometimes

for no apparent reason.

Tesla hasn't revealed any details about how its bitcoin payments

system would work, and a representative for the company didn't

respond to a request for comment. But industry watchers suggest

Tesla would likely use a third-party processor to mitigate the risk

of price volatility in the period between the parties agreeing to a

deal and the funds clearing the bank.

Companies like BitPay automate the process, handling the

back-end logistics for digital-currency payments. Unlike cash

wirings, which can take days to process, bitcoin transactions close

quickly, usually in a matter of minutes.

For example, if Tesla were to sell a Model S for $79,990 -- the

listed price on its website -- the customer would send $79,990 in

bitcoin to a processor like BitPay, which would then direct $79,990

in cash to Tesla. BitPay tacks on a 1% processing fee.

Another big hurdle for bitcoin transactions: Taxes. Because the

Internal Revenue Service classifies bitcoin as property rather than

currency, users selling bitcoin, no matter the reason, are subject

to capital-gains taxes on that transaction.

Of course, some longtime bitcoin holders have seen the value of

their holdings rise so much -- bitcoin's price has surged from

$1,000 at the beginning of 2017 -- they can afford to take a hit to

cash out some of their gains.

Despite the hoopla surrounding Tesla's announcement, it is

unlikely to be a game changer for bitcoin or the company itself, at

least in terms of transactions.

Among the few retailers that currently accept bitcoin, payments

in the cryptocurrency tend to comprise about 5% of total sales.

Applied to Tesla, bitcoin sales would have represented just 10,000

of the 200,000 cars it sold last year. Meanwhile, bitcoin

transactions, which are mostly among traders, total in the hundreds

of thousands a day.

Write to Paul Vigna at paul.vigna@wsj.com

(END) Dow Jones Newswires

February 09, 2021 11:24 ET (16:24 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

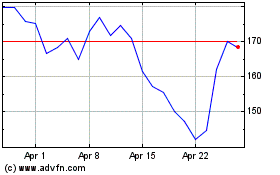

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024