Tesla Buys $1.5 Billion in Bitcoin -- Update

February 08 2021 - 10:17AM

Dow Jones News

By Caitlin Ostroff, Rebecca Elliott and Micah Maidenberg

Tesla Inc. on Monday said it bought $1.5 billion in bitcoin, a

purchase that comes after Chief Executive Elon Musk has promoted

the cryptocurrency and other digital-currency alternatives on

Twitter.

The electric-vehicle company also said it expects to start

accepting bitcoin as payment for its products soon. Bitcoin prices

jumped more than 10% after the announcement, according to

cryptocurrency research and news site CoinDesk.

Tesla disclosed the bitcoin purchase in its latest annual report

filed on Monday, saying the move aims to provide "flexibility to

further diversify and maximize returns on our cash that is not

required to maintain adequate operating liquidity." The policy

change also enables Tesla to invest cash in gold bullion and gold

exchange-traded funds among other assets.

"We believe our bitcoin holdings are highly liquid," Tesla said.

The purchase came after a board committee approved changes to a

company policy on investments.

Mr. Musk has shown he is interested in bitcoin. Last month, he

changed his Twitter biography to "#bitcoin," a move that sent

prices for it higher, though the mention has since been

removed.

"I think bitcoin is really on the verge of getting broad

acceptance by sort of the conventional finance people," he said

last week on the social-networking app Clubhouse. Mr. Musk also

acknowledged during that conversation that his comments can move

markets.

"I gotta watch what I say here 'cause some of these things can

really move the market," he said after being asked about

cryptocurrency.

Tesla didn't immediately respond to a request for comment.

Tesla bolstered its cash position last year by selling billions

in new stock. The company's cash holdings totaled around $19.4

billion at the end of last year, up from around $6.3 billion at the

end of 2019.

"He's already telegraphed it to the market," said Meltem

Demirors, chief strategy officer at London-based asset management

firm CoinShares, a reference to when Mr. Musk added bitcoin to his

Twitter biography. "One of the world's largest corporations doing

this -- I think it opens the floodgates."

His tweets about dogecoin, a cryptocurrency that was started in

2013 as a joke, also made that virtual currency much more

valuable.

Bitcoin is becoming more accessible to the public with PayPal

Inc. saying last year that it would allow users to directly buy and

sell bitcoin in their digital wallets. Square Inc. also allows

users to buy bitcoin through its Cash App.

Some companies have also begun increasing holdings of bitcoin,

with Square buying $50 million worth of the digital currency in

October to use as a hedging instrument in its corporate treasury.

In late January, bitcoin self-mining company Marathon Patent Group

Inc. said it purchased $150 million worth of bitcoin.

Bitcoin recently traded Monday at $44,183.45, according to

CoinDesk. In January, its price averaged $34,730.12.

"It is absolutely significant," said Ms. Demirors. "Bitcoin

sentiment has already shifted so dramatically over the last year

but over the last three months that's only accelerated. From here

it only accelerates."

Write to Caitlin Ostroff at caitlin.ostroff@wsj.com, Rebecca

Elliott at rebecca.elliott@wsj.com and Micah Maidenberg at

micah.maidenberg@wsj.com

(END) Dow Jones Newswires

February 08, 2021 10:02 ET (15:02 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

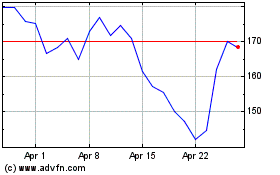

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024