Tesla Stock Price Still Makes No Sense -- Heard on the Street

October 22 2020 - 6:29AM

Dow Jones News

By Charley Grant

Even record results from Tesla underscore a dangerous truth for

shareholders: Wall Street's favorite stock is a car maker sporting

a valuation that tech darlings can only dream about.

Headline third-quarter results from Tesla were very strong.

After reporting record vehicle deliveries last month, Tesla

reported $8.7 billion in sales and earnings of 27 cents a share on

Wednesday. The sales figure topped analyst expectations and the

stock continued its relentless march higher in after-hours trading.

It was the company's fifth consecutive quarter of profits,

according to generally accepted accounting principles.

There is other good news. Chief Executive Elon Musk wisely took

advantage of the company's surging share price and raised $5

billion via a stock sale in September and Tesla ended the quarter

with $14.5 billion in cash on hand, by far the highest tally the

company has ever reported.

None of that means the stock is trading anywhere near fair

value, however: Tesla has earned just 50 cents a share over the

past four quarters, so shares trade at more than 800 times trailing

earnings. Its market value approaches $400 billion, or roughly five

times the combined value of Ford and General Motors.

What's more, those profits are heavily flattered by sales of

regulatory credits to help rivals meet emissions mandates. Tesla

has booked $1.3 billion in such sales over the past four quarters,

which carry a 100% profit margin. Total net income over that period

is just $556 million. That profit source might not be available in

the years to come as more electric competition from legacy auto

makers comes online.

To have a chance at justifying its valuation, Tesla will need to

dominate the auto industry. However, Tesla said achieving its

full-year goal of 500,000 global vehicle deliveries "has become

more difficult," despite its record results. While the company

didn't walk back that goal altogether, it said "further

improvements in logistics and delivery efficiency at higher volume

levels" are needed to achieve it. By way of reference, GM sold

about 660,000 cars in the U.S. in the third quarter alone.

Meanwhile, updates on several of Mr. Musk's past proclamations

about new products were either absent or vague. Tesla didn't

provide a production timeline for its semi truck or

second-generation Roadster sports car, products it unveiled in

2017. Mr. Musk said the pickup truck, which Tesla showed off last

fall, might be available by the end of next year "if all goes

well." There was also no update on Mr. Musk's April 2019

declaration that Tesla could have one million fully self-driving

"robotaxis" on the road by the end of this year.

Fantasies about the future can be far more pleasing than the

brutal, competitive nature of the day-to-day auto business. For

Tesla shareholders, confusing dreams with reality is still likely

to prove expensive, eventually.

Write to Charley Grant at charles.grant@wsj.com

(END) Dow Jones Newswires

October 22, 2020 06:14 ET (10:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

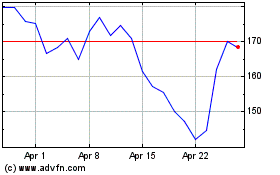

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024