By Heather Somerville

Tesla Inc. extended its profitability streak in the third

quarter and promised global production increases, in the latest

sign the coronavirus pandemic has done little to dent Chief

Executive Elon Musk's push to take electric vehicles

mainstream.

The Silicon Valley car maker on Wednesday posted a net profit of

$331 million for the three-month period ended Sept. 30. It marks

Tesla's fifth-consecutive quarter in the black and keeps the

company on track for 2020 to be the first calendar year of

profitability after years of losses.

Mr. Musk called it Tesla's "best quarter in history."

The company forecast significant production growth next year,

with plans including the roll out of its all-electric semitrailer

truck and, potentially, its pickup truck. It also projected more

cars coming out of its China factory and that its newest plants in

Berlin and Texas would start making vehicles. The aggressive

ramp-up puts Tesla a step closer to achieving the global footprint

Mr. Musk has long sought.

Tesla also revived a pre-pandemic target to build at least

500,000 vehicles this year, which Mr. Musk laid out in January, an

increase of at least 36% from last year. Tesla hadn't formally

withdrawn that guidance but until now had largely ignored the

projection that seemed improbable at the onset of the pandemic,

when it temporarily shut down its lone U.S. factory as local health

officials worked to contain the spread of the coronavirus.

"While achieving this goal has become more difficult, delivering

half a million vehicles in 2020 remains our target," the company

said. Reaching that lofty sales level will rely on building more

cars at its Shanghai factory, Tesla said, as well as further

improvements in logistics and delivery.

Mr. Musk, asked on an investor call if deliveries next year

could reach 840,000 to 1 million vehicles, said "it's in that

vicinity."

The pandemic disrupted Tesla's operations principally in the

second quarter, but the company quickly rebounded. Earlier this

month, Tesla reported record car sales for the third quarter, with

139,593 vehicle deliveries in the period, suggesting the target of

500,000 deliveries for the year was in reach.

Tesla posted a record $8.77 billion in revenue for the quarter,

a 39% jump from a year ago. Analysts surveyed by FactSet expected

sales of $8.28 billion.

The company was buoyed by efficiencies in manufacturing,

including lower battery and purchasing costs at its production

facility in China, as well as growing demand in that country for

electric cars. Its ability to sell emission credits to rivals to

meet regulatory requirements has padded the bottom line.

Shares were up more than 3% at about $438 in after-hours

trading. Tesla shares have roughly quintupled since the start of

the year.

"The real story was the ability to drive better margins despite

prices that are flat to down," said Toni Sacconaghi, an analyst

with Bernstein Research. "They sound pretty pedal-to-the-metal in

terms of growth."

Tesla has been trying to cut costs and build cars more

efficiently in part to reflect a shift in customers that are

increasingly buying its more-affordable Model 3 car and Model Y

sport-utility vehicle, rather than the higher-priced models that

would contribute a larger profit. The company said the factories in

Texas, Berlin and Shanghai would all produce Model Y vehicles next

year.

"We expect our operating margin will continue to grow over time,

ultimately reaching industry-leading levels," Tesla said in its

shareholder report.

However, Mr. Musk cautioned on the investor call that production

at the new factories will start off slowly and may take up to two

years to reach capacity.

The construction of sprawling new factories for battery-cell

manufacturing and car production come at a sizable cost. The

company said it plans to spend an additional $2 billion to $2.5

billion on capital expenditures in 2021 and 2022. Its bet is that a

large enough global footprint that enables Tesla to build cars in

the same market where they are delivered will continue to improve

margins.

Mr. Musk's goal to turn electric vehicles from a niche market to

having mass-market appeal appeared to gain traction in the second

half of last year as Model 3 sales fueled massive growth, and after

Tesla successfully opened its first overseas assembly factory in

China, where the company has churned out cars with lower-cost

labor.

Tesla posted a $143 million profit in the third quarter of last

year, and has stayed profitable since.

Mr. Musk has laid out a bold vision to be the world's largest

auto maker, although the entrepreneur has been prone to hyperbole.

At a shareholder event last month, he said he expects Tesla to

build 20 million cars annually within the decade, and laid out a

plan to use lower-cost batteries to make a $25,000 electric

vehicle, which would be significantly cheaper than anything Tesla

currently sells. "I do not think we lack for desire for our product

but we do lack for affordability," Mr. Musk said Wednesday.

Tesla said it has bolstered production at its factory in

Fremont, Calif., so that it can produce 500,000 Model 3 and Model Y

vehicles a year, a slight increase in capacity.

Its Berlin factory is under construction, and Tesla plans to

move in equipment in the coming weeks, with production starting

next year, the company said. Mr. Musk added that the Cybertruck, a

stainless-steel, futuristic and abrasive-looking truck the company

unveiled a year ago, would start shipping to customers at the end

of next year "if things go well" with most of the deliveries coming

in 2022.

The latest quarterly profit will likely revive debate about

Tesla joining the S&P 500 stock index. Tesla qualified for

inclusion in the index after reporting a profit in the second

quarter this year, but was left out in the latest update.

Write to Heather Somerville at Heather.Somerville@wsj.com

(END) Dow Jones Newswires

October 21, 2020 20:39 ET (00:39 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

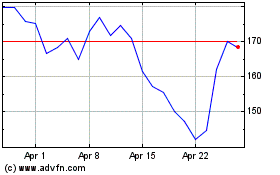

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024