Tesla's Largest Outside Shareholder Cuts Stake -- Update

September 02 2020 - 9:44AM

Dow Jones News

By Julie Steinberg

Baillie Gifford & Co., the Scottish investment house that is

Tesla Inc.'s second-largest shareholder after Chief Executive Elon

Musk, has pared its holdings in the electric-car maker, the latest

ripple effect of the company's soaring market value.

Baillie Gifford said Wednesday that it had reduced its stake

because it is bound by internal guidelines that govern the size of

a single stock in clients' portfolios.

The Edinburgh-based investor held a 4.25% stake in Tesla as of

the end of August, a securities filing showed, down from 7.67% in

February and 6.32% in June. According to Tesla's current $443

billion market valuation, the stake is worth $18.8 billion.

Tesla's shares have quintupled in value this year, boosting

investors' gains by billions of dollars. Earlier this week, Tesla

enacted a 5-for-1 stock split, potentially making the shares more

appealing to a broader base of investors.

Baillie Gifford said it intends to remain a significant

shareholder in Tesla and is optimistic about the company's future,

adding that it has contributed to an "energy revolution" that has

helped stave off the possibility of climate disaster. The firm said

it would buy shares again if Tesla's share price falters in the

future.

The investment firm's Scottish Mortgage Investment Trust PLC,

one of its funds that holds Tesla shares, is up nearly 70% so far

this year. Baillie Gifford first bought 2.3 million shares worth

$89 million in Tesla in 2013, building its holding to about 40

million shares.

Baillie Gifford manages or advises on GBP262 billion ($350

billion) in assets, according to its website.

--Adam Clark contributed to this article.

Write to Julie Steinberg at julie.steinberg@wsj.com

(END) Dow Jones Newswires

September 02, 2020 09:29 ET (13:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

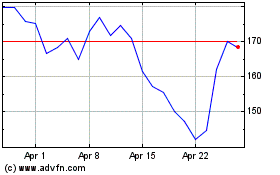

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024