Tesla to Sell Up to $5 Billion in Stock -- 2nd Update

September 01 2020 - 2:39PM

Dow Jones News

By Dave Sebastian

Tesla Inc. said it planned to raise up to $5 billion through

stock offerings from time to time as the electric-vehicle maker,

which has enjoyed a surging share price, makes another investment

push.

The return to capital markets comes after the stock split

5-for-1 on Monday, sending it up 13% to $498.32. The planned

fundraising represents roughly 1.1% of Tesla's $464 billion market

capitalization, according to FactSet.

Tesla has enjoyed a strong run despite the pandemic that

temporarily shut its lone U.S. car plant in Fremont, Calif., as

local authorities battled the spread of the Covid-19 disease. In

July, the company posted a fourth-consecutive profitable quarter

for the first time in its 17-year history, defying Wall Street

analysts who expected a loss. But reaching that point hasn't been

easy. In its quest to become the first mass producer of electric

cars, it burned cash to raise production and overcome logistical

hurdles.

Tesla, which had about $8.5 billion in debt at the end of the

latest quarter, has at times struggled with a lack of liquidity,

particularly during expansion periods when it introduced new models

and added production capacity.

The Silicon Valley car maker in July said it was planning to

open a second U.S. car factory to be located in Austin, Texas, with

production slated to start next year. The company already is

working on its first European car plant outside Berlin and has

signed a loan agreement with Chinese banks to expand its car plant

in Shanghai.

Tesla, which this year began delivering its Model Y

sport-utility vehicle, also is working on several new vehicle

types, including its Cypertruck pickup and Semi truck.

David Whiston, an analyst for Morningstar Research, said there

will likely be many more factories requiring heavy capital

spending, and with the run-up in its stock Tesla can tap what

almost amounts to free money.

The shares have risen nearly sixfold this year, including a

roughly 80% rise since the company's stock-split announcement on

Aug. 11.

Raising capital over time is a good way to involve retail

investors, Craig Irwin, senior research analyst at Roth Capital

Partners LLC, said. "They're going to sell $5 billion of their

stock into the open market from time to time for a much smaller fee

than they would if they sold straight equity in a secondary

[offering]."

Millions of Americans are actively trading the markets during

the Covid-19 pandemic. Individual investors have piled into pricey

yet popular stocks like Tesla through fractional-share trading.

The electric-vehicle maker in February raised more than $2

billion from a stock sale to help bolster its balance sheet. Chief

Executive Elon Musk, who is the largest owner of Tesla stock, has

had a complicated relationship with fundraising. With a showman's

flair, he has been successful in drumming up investor enthusiasm in

Tesla, while also expressing a reluctance to issue stock over

concerns it would dilute value for existing shareholders.

The car maker's shares fell about 2.8% to $484 in afternoon

trading after the company said it would issue more shares.

The company on Tuesday said it has entered an equity

distribution agreement with Goldman Sachs & Co., BofA

Securities Inc., Barclays Capital Inc., Citigroup Global Markets

Inc., Deutsche Bank Securities Inc., Morgan Stanley & Co.,

Credit Suisse Securities (USA), SG Americas Securities, Wells Fargo

Securities and BNP Paribas Securities Corp.

Those banks, which will act as sales agents, will get a

commission of up to 0.5% of gross proceeds from each sale of Tesla

shares, as well as reimbursement for certain expenses. The company

said it could terminate the agreement at any time.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

September 01, 2020 14:24 ET (18:24 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

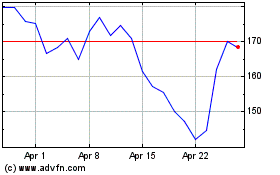

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024