Tesla Bulls Bet Big Ahead of Stock Split -- Update

August 28 2020 - 5:23PM

Dow Jones News

By Gunjan Banerji

A dizzying rally in Tesla Inc.'s shares has unleashed a burst of

options activity tied to the stock jumping even higher.

Tesla recently said it would enact a 5-for-1 stock split, making

its wildly popular stock even more accessible to individual

investors. Trading on a split-adjusted basis will go into effect

Monday.

The company said stockholders would receive four additional

shares for each one held as a dividend after the market closed

Friday. Trading on a split-adjusted basis would go into effect

Monday. Though Tesla investors will see more shares in their

brokerage accounts, the split doesn't alter the overall value of

their holdings.

So far, though, access to Tesla stock doesn't appear to be a

problem. Since Aug. 11 when the company unveiled plans for the

split, shares have jumped 61%, building on an already impressive

surge this year and bringing its market value to more than $400

billion. Tesla shares have more than quintupled this year and

closed at $2238.75 Thursday, a record. They inched lower Friday by

1.1%.

Investors have been scooping up call options tied to the shares'

continued advance. The ratio of put options bought relative to call

options on Tesla hit a record low on Aug. 21, according to Garrett

DeSimone, head of quantitative research at data provider

OptionMetrics. Mr. DeSimone analyzed Tesla options that are

out-of-the-money, or far from the current stock levels.

Some of the most actively traded options contracts in recent

days have been bullish calls tied to the shares jumping even

higher, to $2400 or $2500, Trade Alert data show.

And some rare dynamics have emerged in the market for Tesla

derivatives. Lately, bullish call options tied to the stock have

been more expensive than bearish put options, according to

Susquehanna Financial Group. Typically, bearish put options are

more expensive than calls because of their use as a hedge.

"The options are pricing in the potential for more violent moves

to the upside compared to the downside," said Chris Murphy, co-head

of derivative strategy at Susquehanna. "It's a combination of

euphoria, greed and a little bit of FOMO," he said, using the

acronym for the fear of missing out.

The electric-car maker is now worth more than auto makers around

the world and many giants of American industry. Tesla recently

reported its fourth consecutive quarter of profits, making it

eligible for inclusion in the S&P 500 index and further

boosting optimism about the company's trajectory. If Tesla were in

the index, it would be the eighth most valuable company, recently

passing Johnson & Johnson and Walmart Inc.

Analysts say the frenzied options activity can also contribute

to stock moves. As the shares jump, trading firms must hedge their

positions, potentially buying more of Tesla stock and driving the

price even higher.

"These record high levels of call buying are continuing to

support [Tesla's] tremendous momentum," Mr. DeSimone said in an

email.

Similar dynamics have emerged in options on Apple Inc. and the

broader technology sector, which has outperformed other groups for

much of the year. Apple also recently announced a stock split,

which typically gives a boost to a company's shares.

The Cboe Nasdaq-100 Volatility Index, a measure of expected

volatility in the tech-heavy gauge, rose in August even as the

Nasdaq-100 index advanced to fresh highs. Typically, volatility

recedes as the stock index rallies.

This highlights how investors are girding for sharp moves,

potentially even higher, for the index.

The Nasdaq-100 index, which includes Tesla shares, is up 37%

this year.

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com

(END) Dow Jones Newswires

August 28, 2020 17:08 ET (21:08 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

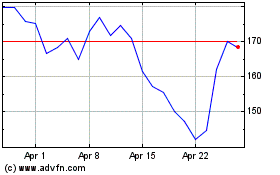

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024