By Tim Higgins

Tesla Inc., for the first time in its 17-year history, reported

a fourth-consecutive profitable quarter, a milestone that is sure

to bolster Chief Executive Elon Musk's pitch that he can usher in

the age of fully electric cars.

Defying the global coronavirus pandemic, threat of extended

economic recession and Wall Street analysts who expected a loss,

the Silicon Valley auto maker found a way, helped by the sale of

regulatory tax credits, to eke out a $104 million profit in the

second quarter.

On an adjusted basis, excluding stock-based compensation, the

company said Wednesday it made $2.18 a share. Analysts surveyed by

FactSet, on average, expected an adjusted loss of 2 cents a share

earlier in the day, an estimate that narrowed from a loss of 14

cents on Monday and a much larger projected loss in May.

Shares soared more than 5% in after-hours trading in New

York.

During a call with analysts, Mr. Musk said Tesla had picked a

location near Austin, Texas, for its second U.S. assembly plant,

where it will build a pickup and a semitrailer truck, as well as

Model 3 and Model Y compact vehicles for the Eastern U.S.

Tesla's ability to meet its pre-pandemic goal of delivering more

than 500,000 vehicles this year, a more than 36% increase from last

year, remained vague. The company pulled back slightly, saying that

its target remained to deliver 500,000 vehicles. But it added that

achieving that goal had become more difficult. It declined to

comment on the goal in late April, when Mr. Musk was railing

against California authorities for keeping his lone U.S. assembly

factory outside of San Francisco closed as part of an effort to

stop the spread of Covid-19.

"Although we have successfully ramped vehicle production back to

prior levels, it remains difficult to predict whether there will be

further operational interruptions or how global consumer sentiment

will evolve in the second half of 2020," the company said. "We will

continue to update our outlook as necessary."

The achievement of four cumulative quarters of profitability

means Tesla can now be considered for inclusion in the S&P 500

index. If included, large index funds would likely race to include

the shares among their holdings.

It also signals that an electric car company can do what many in

the auto industry thought unlikely when Tesla was founded years

ago: make money on an electric car. Though fun to drive, they were

seen as too costly to make because of expensive batteries that

power the motor.

"A roadway into the S&P 500 is kind of ordaining Tesla a

real company and that always wasn't the case," Gene Munster,

managing partner at investment and research firm Loup Ventures,

said. "That's why it's a historic day."

Reaching this point hasn't been easy. Tesla has lost more than

$6.78 billion since 2003 and neared financial collapse on several

occasions, including in 2008 and 2018 as the company struggled to

bring out the Model 3, Mr. Musk's long-held vision for how he would

pivot the company from niche luxury cars into a mainstream

player.

After losing $408 million in the second quarter a year ago, he

appeared to turn a corner in the second half of last year as the

Model 3 fueled massive growth and after Tesla successfully opened

its first overseas assembly factory in China.

That factory and its lower labor costs played an integral role

in the second quarter, allowing the company to continue to churn

out cars, even as its U.S. assembly plant was closed for about half

of the period. The company has also worked to slash costs amid the

pandemic: cutting salaries, furloughing workers and seeking rent

breaks.

Analysts were braced to write off the quarter, even as they held

out hope that Tesla could rebound in the second half and turn a

full-year profit. But on July 2, after a hard manufacturing and

sales push, Tesla reported deliveries for the period fell just

4.9%, beating expectations for a 24% slide.

Revenue fell 4.9% in the quarter to $6 billion, as Tesla relied

on selling less expensive vehicles. The results were helped by $428

million in revenue from the sale of regulatory tax credits to

competitors, which essentially goes straight to the company's

bottom line and has been an important way the company has eked out

profits in the past. A year ago, the company earned $111 million

from those credits. It also unlocked $48 million in revenue from

deploying software features through its so-called Full Self-Driving

driver-assist system.

Tesla may not be able to depend so heavily on those credits in

the second half of the year. Chief Financial Officer Zach Kirkhorn

told analysts the company's total revenue from the credits would

likely be about twice as much as in 2019 when the company reported

$594 million. In the first half of this year, Tesla has already

recorded $782 million from those credits.

"It simply boggles the mind that the most valuable auto company

in the market has to resort to these accounting games to even show

any profit," short seller David Rocker, a retired hedge-fund

manager, said.

The delivery results buoyed a stock surge that has seen Tesla's

share price nearly quadruple this year, helping the company unseat

Toyota Motor Corp. as the world's most valuable auto maker.

The math behind that valuation is hard for many longtime

observers of the auto industry to comprehend, and some investors

continue to bet that Tesla is overvalued and will face a coming

reckoning.

The run-up in the stock this week has qualified Mr. Musk for the

second tranche of a 12-part compensation package worth more than

$50 billion tied to operational milestones and market value. He

qualified for the first stock vesting in May after the company

maintained a market value of $100 billion. The shares at that time

would have nominally netted him more than $700 million if he sold

then, which he couldn't.

The final requirements for the second tranche of 1.69 million

shares were reached this week, with the market value staying at

$150 billion on average for six months and 30 days, and would be

worth $2.1 billion at Wednesday's closing share price minus the

$350.02 strike price he would need to pay.

Write to Tim Higgins at Tim.Higgins@WSJ.com

(END) Dow Jones Newswires

July 22, 2020 20:45 ET (00:45 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

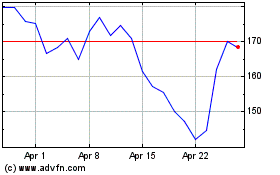

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024