Tesla is J.D. Power's Top Car for Appeal After Finishing Last in Quality

July 22 2020 - 12:29PM

Dow Jones News

By Tim Higgins

A month ago, Tesla Inc. scored the worst among other automotive

brands in an influential study that tracked the quality of new

cars. Now, a second part of the survey of those same customers

shows that despite problems, they think highly of the electric-car

brand for other, more emotional reasons.

The paradox is on display in the new Automotive Performance,

Execution and Layout Study by J.D. Power, which measures owners'

emotional attachment and excitement for their new vehicles. The

results underscore the challenges auto makers face balancing

attention to manufacturing quality while trying to capture a more

elusive factor: coolness.

It helps explain why Tesla's sales have soared in recent years

despite complaints about initial quality found in the J.D. Power

survey released in June and other places, including social media.

Buyers have recorded complaints about wind noise, ill-fitting body

panels and other gripes not typically associated with vehicles that

sold on average for $56,000 last year.

"The people love the car; they appear to be willing to accept

the issues that come along with it," Doug Betts, J.D. Power

automotive division president, said in an interview about the

differences between the two studies. "In the end, loyalty will be

something to look at, particularly if other companies start to

offer some of the same features and things that Tesla has -- will

they be lured away?"

In past reports that have raised quality questions, Tesla has

pointed to its own data that it says show improvements. The company

also says it takes customer feedback seriously and uses it to

address issues.

Enthusiasm for Tesla has helped the Silicon Valley auto maker's

stock more than quadruple this year. Deliveries of Tesla vehicles,

including the Model 3 compact car that touts acceleration of zero

to 60 miles an hour in 3.2 seconds, rose 50% last year compared

with 2018.

Chief Executive Elon Musk had targeted more than 36% growth this

year before the coronavirus pandemic raised questions about those

plans. The company is scheduled to release second-quarter financial

results Wednesday after the market closes and has said it would

update its forecast for the year then.

In the survey measuring cars' appeal, Tesla scored 896 out 1,000

points, better than any other brand. The next highest score went to

Volkswagen AG's Porsche, with 881, which ranked as the top premium

brand, and Dodge, with 872, to stand atop the mass-market

ranking.

This is the first time Tesla has appeared in the appeal survey,

which relies on information gathered from car-registration data and

measures 37 attributes, from sense of comfort to level of

excitement.

Some states require the car maker's permission to use

registration data and Tesla hasn't granted it. This year, however,

Tesla's sales have grown so much in states where permission isn't

necessary that J.D. Power could include the company. Because the

researcher doesn't have data from all 50 states, however, it didn't

include the Tesla results in its official rankings. For that

reason, the car maker's No. 1 appeal score doesn't qualify it for

official ranking.

Tesla owners raved about the electric powertrain, Mr. Betts

said, as well as the touch screens and falcon-wing doors found on

the Model X sport-utility vehicle. Even though the doors have been

plagued with problems from the beginning, they have captured the

popular imagination on social media and in the broader culture,

such as being featured prominently in Jaden Smith's "Icon" music

video in 2017.

In June, J.D. Power's Initial Quality Study found that Tesla

vehicles had 250 problems per 100 vehicles compared with an

industry average this year of 166 problems. Dodge and Kia Motors

Corp.'s namesake brand tied for having the fewest problems. In the

appeal study, Kia came in sixth among mass-market brands with a

score of 844.

Other auto-industry observers have weighed in on the disconnect

found in the J.D. Power studies. Reilly Brennan, general partner of

Trucks Venture Capital, a seed-stage investing fund in the

transportation sector, discussed on Twitter this week how he had

made mistakes in valuing Tesla. "For years I believed their initial

build quality would kill them 'once the big [car companies] create

something similar,'" he wrote. "After 10 yrs there is still not a

similar product and quality probs have declined."

Longtime automotive executive Philippe Chain described in a blog

post last week his experience of going to work at Tesla in 2011 as

vice president of quality after years working at other auto makers.

He noted in particular gaps between Tesla vehicle body panels that

would never have flown elsewhere.

"What would have been deemed as unacceptable by any car makers

was seen as part of an ongoing process by Elon Musk who believed,

rightly so, that the user experience of driving a truly innovative

automobile would outweigh minor defects that will be eventually

corrected," Mr. Chain wrote.

Write to Tim Higgins at Tim.Higgins@WSJ.com

(END) Dow Jones Newswires

July 22, 2020 12:14 ET (16:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

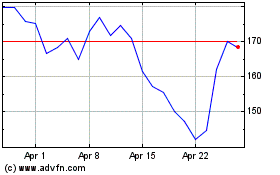

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024