Current Report Filing (8-k)

February 20 2020 - 4:10PM

Edgar (US Regulatory)

0001327318false00013273182020-02-132020-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 13, 2020

TrueCar, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-36449

|

|

04-3807511

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

120 Broadway, Suite 200

Santa Monica, California 90401

(Address of principal executive offices, including zip code)

(800) 200-2000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.0001 per share

|

TRUE

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 13, 2020, TrueCar, Inc. (the “Company”) entered into the Transition Services Agreement and the associated Order Addendum No. 1 (Transition of Auto-Buying Program Platform), each dated as of February 14, 2020 (the “TSA”), by and between the Company and USAA Federal Savings Bank, a federally chartered savings association (“USAA FSB”) and a wholly-owned subsidiary of the United Services Automobile Association (“USAA”). In addition to being party to the Original Agreement (as defined below), to which approximately 29% of the Company’s units in the year ended December 31, 2019 were attributable, USAA beneficially owned 9,042,992 shares of the Company’s common stock as of December 31, 2019, representing approximately 8.4% of the Company’s outstanding common stock.

Pursuant to the TSA, and upon the terms and subject to the conditions thereof, among other things, the Company will, during a transitional period ending on September 30, 2020, continue to operate the white-labeled website through which USAA FSB makes available to USAA members a new and used automobile buying program (the “Auto-Buying Program”). Beginning on October 1, 2020, the TSA provides for a 120-day wind-down period during which the Auto-Buying Program will no longer be made available to USAA members, and the parties will cooperate to wind down the Auto-Buying Program and provide services to USAA members who had submitted leads through the Auto-Buying Program before that date. The TSA took effect on February 14, 2020 upon the expiration of the Zag Services & Maintenance Agreement, dated as of February 13, 2007 (the “Original Agreement”), by and between USAA and the Company, as amended. The entry into the TSA did not change the revenue sharing amounts payable by the Company in connection with transactions by USAA members through the Auto-Buying Program, and USAA FSB will pay the Company a $20 million transition services fee over the term of the TSA. The TSA requires USAA FSB, subject to wind-down negotiations and certain regulatory carveouts, to use commercially reasonable efforts to support the Auto-Buying Program in a manner materially consistent with the manner in which it operated the Auto-Buying Program on February 14, 2020.

The foregoing description of the TSA does not purport to be complete and is qualified in its entirety by reference to the TSA, a copy of which is furnished as Exhibit 10.1 to this Current Report on Form 8-K. The representations, warranties and covenants contained in the TSA were made only for the purposes of the TSA and as of specific dates, were made solely for the benefit of the parties to the TSA and may be intended not as statements of fact but rather as a means of allocating risk to one of the parties if those statements prove to be inaccurate. In addition, those representations, warranties and covenants may apply standards of materiality in a way that is different from what may be viewed as material by stockholders of, or other investors in, the Company. The Company’s stockholders and other investors are not third-party beneficiaries under the TSA and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or conditions of the Company, USAA FSB or any of their respective affiliates.

Item 2.02 Results of Operations and Financial Condition.

On February 20, 2020, the Company announced its financial results for the fiscal year ended December 31, 2019. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Items 2.02, 7.01 and 9.01 of this Current Report on Form 8-K and the Exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure.

On February 20, 2020, the Company issued a press release announcing the execution of the TSA and the winding down of the Company’s partnership with USAA FSB, a copy of which is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

* Certain schedules and similar attachments to this Exhibit are omitted pursuant to Instruction 4 to Item 1.01 of this Current Report on Form 8-K (“Item 1.01”). The Company agrees to furnish supplementally a copy of any omitted schedules and similar attachments to the Securities and Exchange Commission or its staff upon request. Additionally, portions of this Exhibit have been redacted pursuant to Instruction 6 of Item 1.01 because they are not material and would likely cause competitive harm to the Company if publicly disclosed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

TRUECAR, INC.

|

|

|

|

|

By:

|

/s/ Jeff Swart

|

|

|

Jeff Swart

|

|

|

EVP, General Counsel & Secretary

|

|

|

|

Date: February 20, 2020

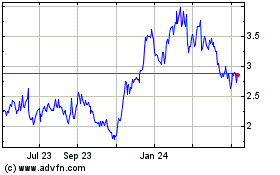

TrueCar (NASDAQ:TRUE)

Historical Stock Chart

From Mar 2024 to Apr 2024

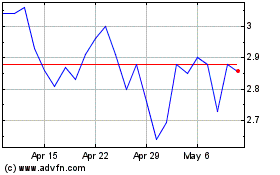

TrueCar (NASDAQ:TRUE)

Historical Stock Chart

From Apr 2023 to Apr 2024