T. Rowe Price Group, Inc (TROW)

Shareholder Proposal No. 5: Report on proxy voting related to climate change

Zevin Asset Management, LLC, a registered investment advisor,

seeks your support1 for Proposal No. 5 on the T. Rowe Price Group, Inc. (“T. Rowe Price” or “the

Company”) 2020 proxy ballot. The resolved clause states:

Shareowners

request that the Board of Directors initiate a review and issue a report on the proxy voting policies and practices of its

subsidiaries related to climate change, prepared at reasonable cost and omitting proprietary information, and including an assessment

of any incongruities between the Company’s public statements and pledges regarding climate change (including ESG risk considerations

associated with climate change), and the voting policies and practices of its subsidiaries.

Our Rebuttal to

the Company’s Statement of Opposition and our Rationale to vote FOR follows:

Firstly, T. Rowe Price’s

main argument in the Statement of Opposition2 in the 2020 proxy statement does not withstand scrutiny. T. Rowe Price

claims that because of its organizational structure and the relative independence of the Price Advisers, then “the Company

and its Board do not have direct responsibility for proxy voting” and “the suggestion that the Board should intervene

in oversight of the Price Advisers’ proxy voting is inappropriate and conflicts with the fiduciary principles applicable

to the Price Advisers.”

This argument elides T.

Rowe Price’s opportunities and responsibilities regarding climate change risk, which are discussed below. But, more than

that, T. Rowe Price’s argument is specifically contravened by the Division of Corporation Finance of the U.S. Securities

and Exchange Commission, which opined on March 13, 2020:

We are unable

to concur in your view that T. Rowe Price Group, the parent holding company, may exclude the Proposal under rule 14a-8(i)(7) as

the Proposal transcends T. Rowe Price Group’s ordinary business operations. In our view, the Proposal is focused on possible

differences between T. Rowe Price Group’s public statements and pledges regarding climate change and the voting policies

and practices of its subsidiaries, including any subsidiaries which are investment advisers (“Price Advisers”) regarding

climate change.

Accordingly, we do not believe that T. Rowe Price Group may omit the Proposal from its proxy materials in reliance on rule 14a-8(i)(7).

In reaching this position, we recognize that the Price Advisers are subject to the Investment Advisers Act of 1940 and, accordingly,

have a fiduciary duty to their clients and must vote their clients’ proxies in the clients’ best interest. As a result,

and as you note in your letter, the Proposal, if adopted, cannot nor should not require T. Rowe Price Group to direct or request

the Price Advisers to alter their voting policies or practices in any way that would interfere with the Price Advisers’ ability

to fulfill their fiduciary duty to their clients.3

In sum, investors should

be reassured that Proposal No. 5 does not present the risks claimed by the company summarized above, and the proposal can indeed

be reasonably implemented.

_____________________________

1 This

communication is an exempt proxy solicitation submitted pursuant to Rule 14a-6(g)(1) promulgated under

the Securities Exchange Act of 1934. Submission is not required under the terms of the Rule, but is made voluntarily in the

interest of public disclosure and consideration of these important issues. This is not a solicitation of authority to vote

your proxy and Zevin Asset Management, LLC will not accept proxies if sent. Zevin Asset Management, LLC urges shareholders to vote

for the proposals discussed in this communication following the instructions provided on the management’s proxy mailing.

The cost of this communication is being borne entirely by Zevin Asset Management, LLC.

2 T.

Rowe Price 2020 proxy statement, at p. 71. https://www.sec.gov/Archives/edgar/data/1113169/000120677420000899/trow3700021-def14a.htm

3 SEC

response to T. Rowe Price. https://www.sec.gov/divisions/corpfin/cf-noaction/14a-8/2020/zevintrp031320-14a8.pdf

2 Oliver Street, Suite 806 • Boston,

MA 02109 • 617-742-6666 • www.zevin.com • invest@zevin.com

Zevin Asset Management, LLC

Shareholder Proposal No. 5 at T. Rowe Price Group, Inc (2020)

Page 2

Turning to Proposal No.

5 itself, there is global scientific consensus on the reality of climate change and the toll it is already taking around the world.

Climate change is also an investment risk — with distinct physical, regulatory, and economic dimensions — which is

too large to ignore. Addressing climate change-related risks is now an integral part of sound investment practice:

|

|

·

|

In 2015, 409 investment institutions with

assets totaling more than $24 trillion declared that the global investment community is “acutely aware of the risks climate

change presents to our investments.”4 The group (which included publicly traded investment companies like BlackRock

and large institutional asset owners like CalPERS) pledged to assess climate change-related risks in their investment portfolios

and engage with companies in which they invest about their own climate change-related risks.5

|

|

|

·

|

A taskforce chaired by Michael Bloomberg

under the Financial Stability Board of the G20 wrote that climate change presents “significant” risks to companies

and the global economy. Moreover, investors need climate-related financial disclosures from companies “to appropriately assess

and price climate-related risks and opportunities.”6

|

|

|

·

|

In January 2019, Larry Fink, the CEO of T.

Rowe Price’s peer institution BlackRock, sent a letter to S&P 500 companies expressing the need for corporations to take

the lead in addressing environmental and social risks.

|

|

|

·

|

Since 2017, more than 450 professional investment

institutions with total assets under management exceeding $40 trillion have joined in the Climate Action 100+ coalition to collectively

press companies that emit large amounts of carbon toward responsible action in line with the Paris Climate Accord.7

Although many of its peer asset management companies (including BlackRock) have joined this initiative, T. Rowe Price has not joined

the Climate Action 100+.8

|

Proxy voting on shareholder

proposals is a primary avenue for investors to communicate with companies. In the words of a former SEC chair, “one

of the most important ways that shareholders have to express their views to company management is through the annual proxy process.”9

T. Rowe Price has acknowledged

the climate change-related risks and opportunities facing its own operations and the companies in which T. Rowe Price and its subsidiaries

invest. In 2010, T. Rowe Price became a signatory of the UN Principles for Responsible Investment (UNPRI), thus committing

to incorporate environmental, social and governance (ESG) issues into its investment process.10 In its 2019 response

to a survey by the Carbon Disclosure Project (CDP), T. Rowe Price described how the Company and its subsidiaries integrate climate

change research and analysis into the investment process: “As investors, the primary risk in our business is derived

from our investments in products rather than from physical aspects and, as such, we consider climate change risks/opportunities

within our environmental, social and governance (ESG) integration investment framework.”11

_____________________________

4 Global Investor Statement on Climate Change, 2015.

http://globalinvestorcoalition.org/wp-content/uploads/2016/09/2014_GlobalInvestState_ClimChange_092316.pdf

5 Ibid.

6 Recommendations of the Task Force on Climate-related

Financial Disclosures (TCFD), December 2016. https://www.fsb-tcfd.org/wp-content/uploads/2016/12/16_1221_TCFD_Report_Letter.pdf

7 Climate Action 100+ website. http://www.climateaction100.org/

8 “Biggest asset managers attacked over role

in climate change,” Financial Times, January 2020. https://www.ft.com/content/8aade207-09bc-41a7-9f0a-24417882f1bc

9 “Building Meaningful Communication and Engagement

with Shareholders,” remarks of former SEC Chair Mary Jo White, June 2015. https://www.sec.gov/news/speech/building-meaningful-communication-and-engagement-with-shareholde.html

10 Principles for Responsible Investment, T. Rowe

Price signatory page. https://www.unpri.org/signatory-directory/t-rowe-price/1892.article

11 CDP website, T. Rowe Price 2019 submission. https://www.cdp.net/en/formatted_responses/responses?campaign_id=66216852&discloser_id=827012&locale=en&organization_name=T.+Rowe+Price+Associates%2C+Inc.&organization_number=18169&program=Investor&project_year=2019&redirect=https%3A%2F%2Fcdp.credit360.com%2Fsurveys%2F9hz110bc%2F54723&survey_id=65670419

Zevin Asset Management, LLC

Shareholder Proposal No. 5 at T. Rowe Price Group, Inc (2020)

Page 3

T. Rowe Price has a commitment to vote its proxies responsibly

on proposals addressing key environmental and social risks. The Company’s Proxy Voting Guidelines commit to analyze every

such proposal on a case-by-case basis, and T. Rowe Price says that: “we support well targeted proposals addressing concerns

that are particularly relevant for a company’s business that have not yet been adequately addressed by management.”12

In its Statement of Opposition regarding Proposal No. 5 in the

2020 proxy statement, T. Rowe Price claims that these policies are carried out in its current proxy voting practices:

The proxy voting records of the Price Advisers

on resolutions relating to climate change clearly reflect an analytical, case-by-case approach that is consistent with their Proxy

Voting Policies and fiduciary duties. These policies state: “It is T. Rowe Price policy to analyze every shareholder proposal

of a social or environmental nature on a CASE-BY-CASE basis. To do this, we utilize research reports from our external proxy advisor,

company filings and sustainability reports, research from other investors and non-governmental organizations, our internal Responsible

Investment team, and our internal industry research analysts...”13

This process seems

reasonable, but there is ample evidence to question whether T. Rowe Price’s approach is being implemented effectively:

|

|

·

|

Mostly notably, the 2019 publicly reported

proxy voting records for T. Rowe Price subsidiaries reveal consistent votes against the vast majority of climate-related shareholder

proposals (with support for only 24 percent of such resolutions). This information was presented and analyzed in a comprehensive

report published by MajorityAction in 2019.14

|

|

|

·

|

T. Rowe Price funds routinely voted “No”

on requests for enhanced disclosure or adoption of greenhouse gas reduction goals, even when independent experts advance a strong

business and economic case for support. Such information would give analysts throughout T. Rowe Price’s organization key

additional insights into investment risks and opportunities related to each of those companies.

|

|

|

·

|

The voting analysis cited above showed that

several notable peers all support a dramatically higher share of reasonable climate change-related proposals, including PIMCO (97

percent), Legg Mason (73 percent), UBS Asset Management (59 percent), Invesco (66 percent), and Bank of New York Melon (46 percent).

|

This approach is at

odds with T. Rowe Price’s own commitments. In Principle 2 of the UNPRI, signatories pledge to “be active owners

and incorporate ESG issues into our ownership policies and practices.” Principle 3 states “we will seek appropriate

disclosure on ESG issues by the entities in which we invest” and includes language resolving to “support shareholder

initiatives and resolutions promoting ESG disclosure.”15 Sound proxy voting is one of the principal ways in which

T. Rowe Price and its subsidiaries can meet these commitments, elicit information from portfolio companies, and actively

manage portfolio risks and opportunities related to climate change.

By failing to support

more climate change-related shareholder proposals (and failing to keep pace with key peers), T. Rowe Price and its subsidiaries

are missing critical opportunities to reveal and address risks in investment portfolios. The proposals in question are frequently

simple requests for disclosures that would help T. Rowe Price and its subsidiaries understand how companies are dealing with the

risks and opportunities presented by climate change. Many of the measures are filed at companies in sectors with high carbon emissions

and serious climate risks, such as oil & gas, mining, chemicals, and industrials.

_____________________________

12 T.

Rowe Price Proxy Voting Guidelines. https://www.troweprice.com/content/dam/trowecorp/Pdfs/51326_TRP_Proxy_Voting_Guide_EN_PE_0220_HI_NC.pdf

13 T.

Rowe Price 2020 proxy statement, at p. 71. https://www.sec.gov/Archives/edgar/data/1113169/000120677420000899/trow3700021-def14a.htm

14 “Climate

in the Boardroom: How Asset Manager Voting Shaped Corporate Climate Action in 2019,” MajorityAction, 2019. https://www.majorityaction.us/asset-manager-report

15 “What

are the Principles for Responsible Investment?” PRI website. https://www.unpri.org/about/the-six-principles

Zevin Asset Management, LLC

Shareholder Proposal No. 5 at T. Rowe Price Group, Inc (2020)

Page 4

The Company’s

obligations to clients are also at stake. T. Rowe Price understands that its obligations to clients require proper handling

of ESG factors, including climate risk. The Company states in its “Responsible Investment Guidelines” document that

it has an “obligation to understand the long-term sustainability of a company’s business model and the factors that

could cause it to change.”16 Specifically regarding climate change, T. Rowe Price goes on to claim in the Responsible

Investment Guidelines: “Our investment professionals capture the impact of climate change as part of their ESG analysis,

which is embedded in our investment process. Climate change implications are considered in company and industry research, investment

decisions, and engagements with management teams.”17

The process of considering

ESG factors that T. Rowe Price describes should be supported by active ownership. Fiduciary duty compels the Company and its

subsidiaries to assess carefully how portfolio companies evaluate climate change and to press portfolio companies if their approach

or their disclosure is inadequate. T. Rowe Price itself has acknowledged the elements of that duty: the ESG Policy Statement18

highlights the importance of assessing the quality of an issuer’s disclosure on key ESG issues, and the Proxy Voting Guidelines19

acknowledge the role that proxy voting can play in addressing concerns that have not been adequately handled by management. Voting

on shareholder proposals that address climate risk and disclosure is a critical opportunity to discharge that duty.

Conclusion

In its Statement of Opposition

to Proposal No. 5, T. Rowe Price quotes from its Proxy Voting Policies to emphasize that its voting practices address ESG issues

and its subsidiaries evaluate ESG proposals on a case-by-case basis, supporting “well targeted proposals addressing concerns

that are particularly relevant for a company’s business but have not yet been adequately addressed by management.”20

However, that approach is obviously inadequate because it has prevented the Company from supporting commonsense steps on climate

change in the vast majority of instances.

Investors need a straightforward

report analyzing the consistency between proxy voting policies and practices of T. Rowe Price funds and T. Rowe Price’s well-articulated

understanding of ESG- and climate change-related risks.

Given the various statements made by T. Rowe Price, its status

as a UNPRI signatory, the empirically demonstrated ability of ESG issues to impact financial performance of portfolio companies,

the current competitive landscape and practices of T. Rowe Price’s peers, and the apparent disconnect between T. Rowe Price’s

own policies and actual voting practices, requesting a report is reasonable in our view. We believe that a report analyzing proxy

voting in light of the Company’s commitments and policies on climate change would help address the above risks.

Shareholders are urged to vote FOR Proposal No. 5

following the instructions provided on the Company’s proxy mailing.

For questions regarding T. Rowe Price Proposal No. 5 on

Climate Change and Proxy Voting, please contact Pat Miguel Tomaino, Zevin Asset Management, 617.742.6666, pat@zevin.com.

_____________________________

16 T. Rowe Price Responsible Investment Guidelines,

at p.1. https://www.troweprice.com/content/dam/trowecorp/Pdfs/FINAL%20GUIDELINES_CT0011790_P2_Approved_RI_Guidelines_2017.pdf

17 Ibid, at p. 5.

18 T. Rowe Price ESG Policy Statement. https://www.troweprice.com/content/dam/trowecorp/Pdfs/ESG%20Policy_Final.pdf

19 T. Rowe Price Proxy Voting Guidelines. https://www.troweprice.com/content/dam/trowecorp/Pdfs/51326_TRP_Proxy_Voting_Guide_EN_PE_0220_HI_NC.pdf

20 T. Rowe Price 2020 proxy statement, at p. 71.

https://www.sec.gov/Archives/edgar/data/1113169/000120677420000899/trow3700021-def14a.htm

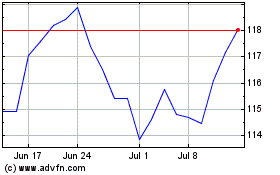

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Mar 2024 to Apr 2024

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Apr 2023 to Apr 2024