Securities Registration Statement (s-1/a)

July 22 2021 - 4:32PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on July 22, 2021

Registration Statement No. 333-258055

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

TROIKA MEDIA GROUP, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

7311

|

|

83-0401552

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(IRS Employer

Identification No.)

|

1715 N. Gower St.

Los Angeles, CA 90028

(323) 965-1650

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Robert Machinist, CEO

Troika Media Group, Inc.

1715 N. Gower St.

Los Angeles, CA 90028

(323) 965-1650

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

With copy to:

Elliot H. Lutzker

Davidoff Hutcher & Citron LLP

605 Third Ave, 34th Floor

New York, NY 10158

(212) 557-7200

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an “emerging growth company.” See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☒

|

|

Emerging Growth Company

|

☐

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Section Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Shares to be Registered (1)

|

|

|

Proposed Maximum Aggregate Offering Price Per Share (2)

|

|

|

Proposed Maximum Aggregate Offering Price (2)

|

|

|

Amount of

Registration

Fee (1)(2)

|

|

|

Common stock, $0.001 par value per share (3)

|

|

|

4,076,362

|

|

|

$

|

2.60

|

|

|

$

|

10,598,541

|

|

|

$

|

1,156.30

|

|

____________

|

(1)

|

The registration fee for securities to be offered by the Selling Shareholders is calculated solely for its purpose of calculating the registration fee pursuant to Rule 457(c).

|

|

|

|

|

(2)

|

Pursuant to Rule 457(c), the fee is based upon the average of the high and low prices of the Registrant’s Common Stock reported on the Nasdaq Capital Market on July 15, 2021.

|

|

|

|

|

(3)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the shares of Common Stock registered hereby also include an indeterminate number of additional shares as may from time to time become issuable by reason of stock splits, distributions, recapitalizations or other similar transactions.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

Explanatory Note

This Amendment No. 1 to Form S-1 of Troika Media Group, Inc. is being filed solely to include the Interactive data files formatted in XBRL, which were not completed until the date of this filing.

Item 16. Exhibits and Financial Statement Schedules.

(a) Exhibits

See the Exhibit Index on the page immediately following the signature page for a list of exhibits filed as part of this registration statement on Form S-1.

The following Exhibits are filed with this registration statement or incorporated by reference:

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

2.1

|

|

Subsidiary Merger Agreement, dated as of March 27, 2015 by and among SignalPoint Holdings Corp., Roomlinx, SignalShare Infrastructure Inc. and RMLX Merger Corp. is incorporated by reference to Exhibit 10.1 to the Registrant’s Current Report on Form 8-k filed on April 2, 2015.

|

|

|

|

|

|

2.2

|

|

Termination and Release Agreement, dated as of February 10, 2015 by and among the Registrant, SignalPoint Holdings Corp. and Roomlinx Merger Corp. is incorporated by reference to the Registrant’s Current Report on Form 8-K filed on February 13, 2015.

|

|

|

|

|

|

2.3

|

|

Stock Pledge and Security Agreement dated May 6, 2016 by and between Digital Media Acquisition Group Corp., SignalPoint Telecommunications Corp. and Signal Share Development Corp. to Brookville Special Purpose Fund LLC, Veritas High Yield Fund LLC and Allied International Fund, Inc. is incorporated by reference to Exhibit 10.1 to the Registrant’s Current Report on Form 8-K filed on May 12, 2016.

|

|

|

|

|

|

2.4

|

|

Merger Agreement, dated as of June 12, 2017 by and among (i) Troika Design Group Inc. and each of its subsidiaries; (ii) Daniel Pappalardo; (iii) M2 nGage Group Inc.; and (iv) Troika Acquisition Corp. is incorporated by reference to Exhibit 2.1 to the Registrant’s Current Report on Form 8-K filed on June 20, 2017.

|

|

|

|

|

|

2.5

|

|

Equity Purchase Agreement dated as of June 29, 2018 by and among Nicola Stephenson, James Stephenson, Troika Media Group Inc. and Troika Mission Holdings Inc. is incorporated by reference to Exhibit 10.1 to the Registrant’s Current Report on Form 8-K filed on July 6, 2018.

|

|

|

|

|

|

2.6

|

|

Asset Purchase Agreement dated May 21, 2021, by and among Redeeem LLC, Kyle Hill, Redeem Acquisition Corp. and Troika Media Group Inc. is incorporated by reference to Exhibit 21 to Registrant’s Current Report on Form 8-K filed on May 25, 2021.

|

|

|

|

|

|

3.1

|

|

Amended and Restated Articles of Incorporation of the Registrant, including Class A Preferred Stock terms, is incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed on July 22, 2010.

|

|

|

|

|

|

3.2

|

|

Amended and Restated By-Laws of the Registrant adopted on March 29, 2021. (3)

|

|

|

|

|

|

3.3

|

|

Certificate of Correction to Articles of Incorporation of Roomlinx dated March 26, 2015 is incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed on April 2, 2015.

|

|

|

|

|

|

3.4

|

|

Certificate of Designation of the Rights, Preferences, Privileges and Restrictions of Series B Convertible Preferred Stock is incorporated by reference to the Registrant’s Current Report on Form 8-K filed on February 8, 2016.

|

|

|

|

|

|

3.5

|

|

Amendment to Certificate of Designation of Series B Preferred Stock is incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed on March 30, 2016.

|

|

|

|

|

|

3.6

|

|

Certificate of Amendment to Articles of Incorporation dated July 27, 2016 changing the Registrant’s name to M2 nGage Group Inc. is incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed on July 28, 2016.

|

|

3.7

|

|

Certificate of Designation of the Rights, Preferences, Privileges and Designations of Series C Convertible Preferred Stock dated June 14, 2017. (2)

|

|

|

|

|

|

3.8

|

|

Articles of Merger dated July 7, 2017 changing the Registrant’s name to M2 nGage Group Inc. is incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed on September 18, 2017.

|

|

|

|

|

|

3.9

|

|

Certificate of Designation of the Rights, Preferences, Privileges and Designations of Series D Convertible Preferred Stock dated February 22, 2018. (2)

|

|

|

|

|

|

3.10

|

|

Certificate of Amendment to Certificate of Designation of Series D Preferred Stock dated June 20, 2018. (2)

|

|

|

|

|

|

3.11

|

|

Amendment to Certificate of Designation of Series D Preferred Stock dated April 23, 2018, is incorporated by reference to Exhibit 3.2 to the Registrant’s Current Report on Form 8-K filed on May 24, 2018.

|

|

|

|

|

|

3.12

|

|

Certificate of Amendment to Articles of Incorporation dated April 24, 2018 is incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K, filed on May 24, 2018.

|

|

|

|

|

|

3.13

|

|

Certificate of Amendment to Articles of Incorporation filed on September 24, 2020. (1)

|

|

|

|

|

|

4.1

|

|

Form of Common Stock Investor Warrants issued in connection with Series B Preferred Stock Offering is incorporated by reference to Exhibit 4.1 of the Registrant’s Current Report on Form 8-K filed on February 8, 2016.

|

|

|

|

|

|

4.2

|

|

Form of Subscription Agreement for use by Non-U.S. Persons dated February 27, 2017 for Series C Preferred Stock. (2)

|

|

|

|

|

|

4.3

|

|

Form of Subscription Agreement for use by Non-U.S. Persons dated June 5, 2018 for Series D Preferred Stock. (2)

|

|

|

|

|

|

4.4

|

|

Common Stock Purchase Warrant dated February 15, 2017 of M2 nGage Group Inc. to SAB Management LLC. (2)

|

|

|

|

|

|

4.5

|

|

Form of Stock Option Agreement dated June 12, 2017 granted to each of Christopher Broderick, Michael Tenore and Daniel Pappalardo. (2)

|

|

|

|

|

|

4.6

|

|

2015 Employee, Director and Consultant Equity Incentive Plan. (2)

|

|

|

|

|

|

4.7

|

|

Warrant to purchase 1,111,111 shares of Common Stock issued by the Company to NFS, incorporated by reference to Exhibit 10.6 of the Registrant’s Report on Form 8-K filed on August 6, 2015.

|

|

|

|

|

|

4.8

|

|

Goodwill Purchase Agreement dated as of June 29, 2018 between Nicola Stephenson, Troika Media Group Inc. and Troika Mission Holdings Inc. is incorporated by reference to Exhibit 10.2 to the Registrant’s Current Report on Form 8-K filed on July 6, 2018.

|

|

|

|

|

|

4.9

|

|

Form of Common Stock Purchase Warrant (included in Exhibit 10.11) (3)

|

|

|

|

|

|

5.1

|

|

Opinion of Davidoff Hutcher & Citron LLP

|

|

|

|

|

|

10.1

|

|

Amended and Restated Executive Employment Agreement dated as of February 15, 2017 by and between M2 nGage Group Inc. (the Registrant) and Christopher Broderick, as amended on June 1, 2017, June 12, 2017 and June 5, 2018.(2)

|

|

|

|

|

|

10.2

|

|

Amended and Restated Consulting Agreement dated February 15, 2017 by and between M2 nGage Group Inc. (the Registrant) and SAB Management LLC, as amended on August 8, 2017, April 16, 2018 and June 5, 2018.(2)

|

|

10.3

|

|

Amended and Restated Executive Employment Agreement dated as of October 21, 2016 by and between M2 nGage Group Inc. (the Registrant) and Michael Tenore, as amended on June 6, 2018. (2)

|

|

|

|

|

|

10.4

|

|

Executive Employment Agreement dated as of June 9, 2017 by and between Troika Design Group Inc. and Daniel Pappalardo is incorporated by reference to Exhibit 10.1 to the Registrant’s Current Report on Form 8-K filed on June 20, 2017

|

|

|

|

|

|

10.5

|

|

Executive Employment Agreement dated as of June 29, 2018 by and between Mission Media USA Inc., Troika Media Group Inc. and Nicola Stephenson is incorporated by reference to Exhibit 10.3 to the Registrant’s Current Report on Form 8-K filed on July 6, 2018.

|

|

|

|

|

|

10.6

|

|

Reconfirmation of Foreclosure and Notice of Asset Transfer dated as of October 24, 2016 to Digital Media Acquisition Group Corp., M2 nGage Communications Inc., M2 nGage, Inc. from M2 nGage Telecommunications Corp. and M2 nGage Software Development and Design Corp. (2)

|

|

|

|

|

|

10.7

|

|

Settlement Agreement and Mutual General Release dated as of July 26, 2017 by and among the Registrant, Robert DePalo, RoseMarie DePalo and the Secured Lenders. (2)

|

|

|

|

|

|

10.8

|

|

Office Lease dated January 6, 2020 for 1715 N. Gower Street, Los Angeles, California 90028. (3)

|

|

|

|

|

|

10.9

|

|

Office Lease dated May 2, 2017 for 45 Main Street, Brooklyn, New York 11201. (2)

|

|

|

|

|

|

10.10

|

|

Separation Agreement dated as of February 28, 2021 by and among the Registrant, SAB Management, LLC and Andrew Bressman. (3)

|

|

|

|

|

|

10.11

|

|

Form of Warrant Agreement by and between the Company and American Stock Transfer & Trust Company, LLC (3)

|

|

|

|

|

|

10.12

|

|

Office Lease dated April 6, 2019, for 28/32 Shelton Street, London, WC2 UK (3)

|

|

|

|

|

|

10.13

|

|

Promissory Notes dated between February 9 and February 23, 2021 in the respective amounts of $78,100, $74,900, $602,200, $125,400 and $812,600 payable to Connect One Bank under the U.S. Small Business Administration Paycheck Protection Program. (3)

|

|

|

|

|

|

10.14

|

|

Employment Agreement dated May 21, 2021, by and between Kyle Hill and Redeeem Acquisition Corp. is incorporated by reference to Exhibit 10.1 to the Registrant’s Current Report on Form 8-K filed on May 25, 2021.

|

_____________

|

*

|

Filed with this Report.

|

|

(1)

|

Incorporated by reference to the Registrant’s Draft Registration Statement No. 333-254889 filed on March 19, 2021.

|

|

(2)

|

Incorporated by reference to the Registrant’s Draft Registration Statement No. 333-254889 filed on August 1, 2019

|

|

(3)

|

Incorporated by reference to the Registrant’s Registration Statement No. 333-254889 filed on March 31, 2021, as amended on April 8, 2021

|

(b) Financial Statement Schedules

Financial Statement Schedules are omitted because the information is included in our financial statements or notes to those financial statements.

[SIGNATURE PAGE FOLLOWS]

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized on the 22nd day of July 2021.

|

|

TROIKA MEDIA GROUP, INC.

|

|

|

|

|

|

|

|

By:

|

/s/ Robert B. Machinist

|

|

|

|

Name:

|

Robert B. Machinist

|

|

|

|

Title:

|

Chief Executive Officer

|

|

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Robert B. Machinist

|

|

|

|

|

|

Robert B. Machinist

|

|

Chairman and Chief Executive Officer

|

|

July 22, 2021

|

|

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Christopher Broderick

|

|

|

|

|

|

Christopher Broderick

|

|

Chief Operating Officer/Interim CFO

|

|

July 22, 2021

|

|

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

|

|

|

|

|

*/s/ Jeff Kurtz

|

|

|

|

|

|

Jeff Kurtz

|

|

Director

|

|

July 22, 2021

|

|

|

|

|

|

|

|

*/s/ Daniel Pappalardo

|

|

|

|

|

|

Daniel Pappalardo

|

|

President of Troika Design Group and Director

|

|

July 22, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas Ochocki

|

|

Director

|

|

_____, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daniel Jankowski

|

|

Director

|

|

_____, 2021

|

|

|

|

|

|

|

|

*/s/ Martin Pompadur

|

|

|

|

|

|

Martin Pompadur

|

|

Director

|

|

July 22, 2021

|

|

|

|

|

|

|

|

*/s/ Christopher Broderick

|

|

|

|

|

|

Christopher Broderick

|

|

Attorney-In-Fact

|

|

July 22, 2021

|

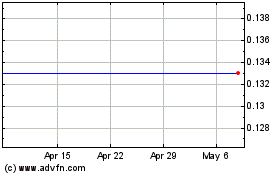

Troika Media (NASDAQ:TRKA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Troika Media (NASDAQ:TRKA)

Historical Stock Chart

From Apr 2023 to Apr 2024