Statement of Changes in Beneficial Ownership (4)

April 06 2021 - 5:04PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Liberty TripAdvisor Holdings, Inc. |

2. Issuer Name and Ticker or Trading Symbol

TripAdvisor, Inc.

[

TRIP

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

12300 LIBERTY BOULEVARD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

4/5/2021 |

|

(Street)

ENGLEWOOD, CO 80112

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| 0.50% Exch. Senior Debentures due 2051 (obligation to sell) | (1)(2) | 4/5/2021 | | S (1)(2) | | | $30000000 | (2) | (3) | Common Stock, par value $0.001 per share | 429897 | $30000000 | $330000000 (1) | D | |

| Explanation of Responses: |

| (1) | On April 5, 2021, the reporting person sold, pursuant to an option to purchase additional Debentures (as defined below) granted to the initial purchasers under a purchase agreement, dated as of March 22, 2021, $30,000,000 aggregate principal amount of its 0.50% exchangeable senior debentures due 2051 (the "Debentures") in a private sale pursuant to Rule 144A. Each $1,000 principal amount of Debentures is initially exchangeable for 14.3299 shares of the issuer's common stock, par value $0.001 per share (the "Common Stock"). Upon exchange at the option of the holder or a purchase of the Debentures pursuant to a holder's put right, the reporting person may elect physical or cash settlement, or a combination thereof. |

| (2) | Each Debenture is exchangeable at the option of the holder during specified periods as set forth in the Remarks section. Holders of the Debentures may put them to the reporting person on March 27, 2025, or prior thereto following the occurrence of a "fundamental change," and the Debentures may be redeemed by the reporting person, (i) in whole or in part, on or after March 27, 2025 at any time, or (ii) in whole, but not in part, prior to March 27, 2025, after the occurrence of certain conditions or events. |

| (3) | The Debentures mature on June 30, 2051. |

Remarks:

Each Debenture is exchangeable at the option of the holder, subject to certain terms and conditions, during specified periods after: (i) the calendar quarter ending December 31, 2021, if the market value of the underlying Common Stock exceeds 130% of the adjusted principal amount of the Debenture; (ii) December 31, 2021, if the trading price of a Debenture is less than 98% of the market value of the underlying Common Stock; (iii) the occurrence of a "fundamental change" or a "make-whole fundamental change" with respect to a significant reference company prior to March 27, 2025; (iv) the Debenture is called for redemption; and (v) the issuer of the Common Stock declares or makes a dividend or distribution that, pursuant to the terms of the Debentures, would reduce the principal amount of the Debentures to $0.00 or such principal amount is otherwise reduced to $0.00. The Debentures are also exchangeable at any time after March 1, 2025 until the close of business on the second scheduled trading day immediately preceding March 27, 2025, and at any time after April 1, 2051 until the close of business on the second scheduled trading day immediately preceding the maturity date of the Debentures. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Liberty TripAdvisor Holdings, Inc.

12300 LIBERTY BOULEVARD

ENGLEWOOD, CO 80112 | X | X |

|

|

Signatures

|

| Liberty TripAdvisor Holdings, Inc. By: /s/ Brittany A. Uthoff Name: Brittany A. Uthoff Title: Vice President | | 4/6/2021 |

| **Signature of Reporting Person | Date |

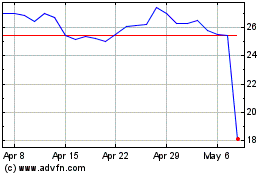

TripAdvisor (NASDAQ:TRIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

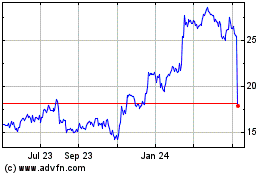

TripAdvisor (NASDAQ:TRIP)

Historical Stock Chart

From Apr 2023 to Apr 2024