Amended Statement of Beneficial Ownership (3/a)

April 30 2020 - 6:04PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Nelson Lindsay |

2. Date of Event Requiring Statement (MM/DD/YYYY)

4/28/2020

|

3. Issuer Name and Ticker or Trading Symbol

TripAdvisor, Inc. [TRIP]

|

|

(Last)

(First)

(Middle)

C/O TRIPADVISOR, INC., 400 1ST AVENUE |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

Chief Experience&Brand Officer / |

|

(Street)

NEEDHAM, MA 02494

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

4/30/2020

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Stock | 3567 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Restricted Stock Units (TSR performance-based) | 12/31/2022 (1) | 3/31/2023 | Common Stock, Par Value $.001 Per Share | 17564 | $0 | D | |

| Restricted Stock Units (TSR performance-based) | 12/31/2021 (2) | 3/31/2022 | Common Stock, Par Value $.001 Per Share | 10369 | $0 | D | |

| Stock Option | 10/30/2019 (3) | 10/30/2028 | Common Stock, Par Value $.001 Per Share | 96272 | $47.17 | D | |

| Stock Option | 2/15/2021 (4) | 2/25/2030 | Common Stock, Par Value $.001 Per Share | 44378 | $25.62 | D | |

| Stock Option | 2/15/2020 (3) | 2/27/2029 | Common Stock, Par Value $.001 Per Share | 22401 | $50.63 | D | |

| Restricted Stock Units | 2/15/2021 (5) | 2/16/2023 | Common Stock | 15553 | $0 | D | |

| Restricted Stock Units | 10/30/2020 (5) | 10/31/2022 | Common Stock | 33232 | $0 | D | |

| Restricted Stock Units | 12/20/2020 (6) | 12/21/2021 | Common Stock | 33266 | $0 | D | |

| Restricted Stock Units | 2/15/2021 (7) | 2/16/2024 | Common Stock | 35128 | $0 | D | |

| Explanation of Responses: |

| (1) | These market-based RSUs ("MSUs") will vest and settle shortly following expiration of the performance period which ends on December 31, 2022. |

| (2) | The market-based RSUs ("MSUs") will vest and settle shortly following expiration of the performance period which ends on December 31, 2021. |

| (3) | Date at which first vesting occurs is indicated. One-fourth of the total number of stock options vest on the first vesting date and an additional one-fourth vest on each anniversary thereafter, until the stock options are fully vested. |

| (4) | Date at which first vesting occurs is indicated. One fourth of the total number of stock options vest on February 15, 2021, and 6.25% of the remaining award vest in equal quarterly installments commencing thereafter. |

| (5) | One-third of the total number of RSUs vest on the first vesting date and an additional one-third vest on each anniversary thereafter, until the RSUs are fully vested. Upon vesting, shares will be issued on a one-for-one basis. |

| (6) | Date at which first vesting occurs is indicated. One-half of the total number of RSUs vest on the first vesting date and an additional one-half vest on second anniversary of the vesting date. Upon vesting, shares will be issued on a one-for-one basis. |

| (7) | Date at which first vesting occurs is indicated. One fourth of the total number of RSUs vest on February 15, 2021, and 6.25% of the remaining award vest in equal quarterly installments commencing thereafter. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Nelson Lindsay

C/O TRIPADVISOR, INC.

400 1ST AVENUE

NEEDHAM, MA 02494 |

|

| Chief Experience&Brand Officer |

|

Signatures

|

| /s/ Linda C. Frazier, attorney in fact | | 4/30/2020 |

| **Signature of Reporting Person | Date |

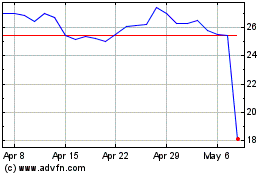

TripAdvisor (NASDAQ:TRIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

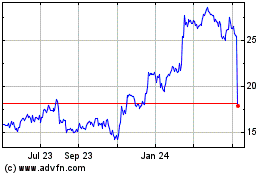

TripAdvisor (NASDAQ:TRIP)

Historical Stock Chart

From Apr 2023 to Apr 2024