Additional Proxy Soliciting Materials (definitive) (defa14a)

May 18 2020 - 4:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

|

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under 240.14a-12

|

Tandem Diabetes Care, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

No fee required.

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

|

(1) Title of each class of securities to which transaction applies:

|

|

|

|

|

(2) Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4) Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5) Total fee paid:

|

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

(1) Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

(2) Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

(3) Filing Party:

|

|

|

|

|

|

|

|

|

|

(4) Date Filed:

|

|

|

|

|

|

|

|

ADDITIONAL INFORMATION REGARDING THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON

WEDNESDAY, MAY 27, 2020

The following supplement relates to the proxy statement (the “Proxy Statement”) of Tandem Diabetes Care, Inc. (the “Company”), dated April 15, 2020, furnished to stockholders of the Company in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 27, 2020. This supplement is being filed with the Securities and Exchange Commission and is being made available to stockholders on or about May 18, 2020.

THE SUPPLEMENT SHOULD BE READ IN CONJUNCTION WITH THE PROXY STATEMENT.

SUPPLEMENT TO DEFINITIVE PROXY STATEMENT FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD WEDNESDAY, MAY 27, 2020

Notice of Change in Location of 2020 Annual Meeting of Stockholders

To the Stockholders of Tandem Diabetes Care, Inc.:

Due to public health concerns and travel restrictions relating to the novel coronavirus (COVID-19) pandemic, and to protect the health and well-being of our stockholders, directors and employees, our 2020 Annual Meeting of Stockholders (the “Annual Meeting”) will now be held virtually at 3:00 p.m Pacific Time on May 27, 2020. The virtual Annual Meeting will provide stockholders the ability to participate, vote their shares, and ask questions during the meeting.

As described in the proxy materials for the Annual Meeting previously distributed, you are entitled to participate in the meeting if you were a stockholder as of the close of business on March 31, 2020, the record date, or hold a legal proxy for the meeting provided by your bank, broker, or nominee.

To be virtually admitted to the Annual Meeting at https://web.lumiagm.com/235916184, you must enter the 16-digit control number found on the Notice of Internet Availability of Proxy Materials you previously received and enter the password “tandem2020”. We encourage you to access the meeting website prior to the start time to leave ample time for the check in process.

You may vote during the Annual Meeting by following the instructions available on the meeting website. Regardless of whether you plan to attend the Annual Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in the proxy materials for the Annual Meeting. The proxy card included with the proxy materials previously distributed will not be updated to reflect the change in location and may continue to be used to vote your shares in connection with the Annual Meeting. If you have already voted by proxy, your vote at the Annual Meeting will have the effect of revoking your proxy.

|

|

|

|

|

|

|

|

|

By Order of the Board of Directors,

|

|

|

David B. Berger

|

|

|

Executive Vice President, Chief Legal & Compliance Officer

|

|

|

May 18, 2020

|

The Proxy Statement and Annual Report are available on our Investor Relations website at http://investor.tandemdiabetes.com.

Beneficial Owners

If your shares are registered in the name of your broker, bank or other agent, you are the “beneficial owner” of those shares and those shares are considered as held in “street name.” If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than directly from us. Simply complete and mail the proxy card to ensure that your vote is counted. You may be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms offer Internet and telephone voting. If your bank or brokerage firm does not offer Internet or telephone voting information, please complete and return your proxy card in the self-addressed, postage-paid envelope provided. To vote in person at the virtual Annual Meeting, you must first obtain a valid legal proxy from your broker, bank or other agent and then register in advance to attend the Annual Meeting. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a legal proxy form.

After obtaining a valid legal proxy from your broker, bank or other agent, to then register to attend the Annual Meeting, you must submit proof of your legal proxy reflecting the number of your shares along with your name and email address to American Stock Transfer & Trust Company, LLC. Requests for registration should be directed to proxy@astfinancial.com or to facsimile number 718-765-8730. Written requests can be mailed to:

American Stock Transfer & Trust Company LLC

Attn: Proxy Tabulation Department

6201 15th Avenue

Brooklyn, NY 11219

Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on May 22, 2020.

You will receive a confirmation of your registration by email after we receive your registration materials. You may attend the Annual Meeting and vote your shares at https://web.lumiagm.com/235916184 during the meeting. The password for the meeting is “tandem2020”. Follow the instructions provided to vote. We encourage you to access the meeting prior to the start time leaving ample time for the check in.

Notice of Change to Annual Equity Compensation Arrangements for Non-Employee Directors

Page 21 of the Proxy Statement is supplemented by adding the following text immediately after the last paragraph under the section entitled “Director Compensation Changes for 2020”:

On May 15, 2020 our board of directors approved the following change to the compensation program for our non-employee directors:

Effective as of the Annual Meeting, on the date of each annual meeting of stockholders, each non-employee director that continues to serve as a director following the annual meeting will be entitled to receive either stock options to purchase shares of our Common Stock with an aggregate Black-Scholes value of $170,000, or restricted stock awards with a grant date fair value of $170,000, or a combination thereof with a total value of $170,000, which determination will be made by our board of directors (or a designated committee thereof) at the time of such grant. These annual grants, whether issued in the form of stock options or restricted stock awards, will be prorated based on the number of full months of service on our board of directors since the prior annual meeting of stockholders, and will vest over a 12-month period, subject to the director’s continued service. The exercise price of all stock options will equal the closing price of our Common Stock on the grant date, and the grant date fair value of all restricted stock awards will be based on the closing price of our Common Stock on the grant date. Each of these stock options and restricted stock awards, as well as any other equity awards granted to our non-employee directors, are expected to be granted pursuant to our 2013 Stock Incentive Plan (the “2013 Plan”).

Acceleration of Vesting of Certain Stock Option Awards

On May 15, 2020, our board of directors authorized the acceleration of vesting of 311 outstanding stock options previously awarded to Mr. Howard E. Greene, Jr. under the equity compensation arrangements for our non-employee directors pursuant to the 2013 Plan. The 311 options have an exercise price of $64.66 per share. Mr. Greene, has served as one of our non-employee directors since January 2008; however, he is not standing for re-election at the Annual Meeting.

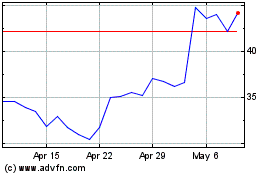

Tandem Diabetes Care (NASDAQ:TNDM)

Historical Stock Chart

From Mar 2024 to Apr 2024

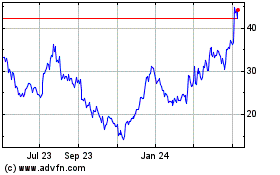

Tandem Diabetes Care (NASDAQ:TNDM)

Historical Stock Chart

From Apr 2023 to Apr 2024