AT&T, T-Mobile Are Top Spenders in Airwaves Auction

June 03 2019 - 8:44PM

Dow Jones News

By Drew FitzGerald

AT&T Inc., Verizon Communications Inc. and T-Mobile US Inc.

were the biggest spenders on a pair of Federal Communications

Commission auctions designed to spark investment in next-wave 5G

networks, according to results released Monday.

The auctions covered two swaths of wireless spectrum at

frequencies once considered too extreme for cellphone service. FCC

Chairman Ajit Pai has made those frequencies a cornerstone of his

strategy to spur 5G investments.

Bidding across both auctions totaled less than $3 billion,

compared with nearly $20 billion raised in a previous FCC auction

that freed up frequencies used by local television broadcasters for

cellphone use.

Verizon led spending on the first auction around 28 gigahertz

after it bid $505 million. The leading cellphone carrier by

subscribers was expected to focus on that auction to fill in gaps

in the more than $3 billion worth of licenses it had already bought

through private purchases.

AT&T spent the most on 24 GHz licenses, bidding $983

million. It was followed by T-Mobile, which bid $803 million in the

auction. Midwestern carrier US Cellular Inc. also earmarked cash

for licenses in its service area and won $129 million and $127

million worth of spectrum in the 28 GHz and 24 GHz auctions,

respectively.

Analysts expect the telecom companies to follow up their

spectrum purchases with heavy investments in wireless

infrastructure. The airwaves are considered useful for new 5G

networks that promise to make cellphone connections zippier and

home broadband more affordable, assuming phone companies are able

to offer new internet service at prices that are competitive with

cable.

The earliest U.S. 5G networks are still unproven, however, and

some companies' construction has met opposition from residents

annoyed by more visible antenna systems.

Some weather forecasters are also opposed to commercial activity

at an extreme edge of the 24 GHz range, which they say is too close

to the frequencies their satellites use to predict severe

weather.

The auction's conclusion could also shake up the telecom sector

by allowing more companies to hold merger talks, according to New

Street Research analyst Jonathan Chaplin. FCC rules designed to

prevent coordinated bidding in the auctions had the side effect of

discouraging acquisition discussions. Mr. Chaplin said in a

research note that companies are freer now to "wheel-and-deal until

the run up to [the] next auction, which begins on December

10th."

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

June 03, 2019 20:29 ET (00:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

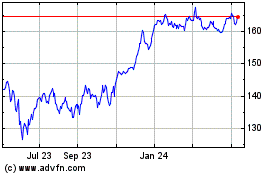

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

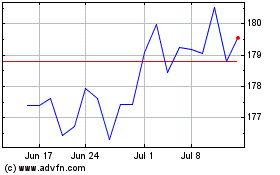

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2023 to Apr 2024