T-Mobile Spells CFO Out Exit Plan

March 29 2019 - 9:38PM

Dow Jones News

By Ezequiel Minaya

T-Mobile US Inc. on Friday filed an amended employment agreement

for its finance chief that spells out a plan for him to leave the

company as it awaits regulatory review of a proposed merger with

rival Sprint Corp.

CFO Braxton Carter has been a key figure in the mobile carrier's

pending deal to buy Sprint. A spokeswoman for T-Mobile declined to

comment on whether a successor had been chosen.

Mr. Carter's last day at T-Mobile will be decided by the status

of the merger, the company said in a regulatory filing with the

Securities and Exchange Commission. Mr. Carter is scheduled to

leave at one of three fixed dates, depending which arrives first:

the end of 2019; 20 days after the first quarterly filing of the

merged company; or 20 days after an announcement the deal is

off.

Analysts speculated about the departure of Mr. Carter in

September, when T-Mobile said Sunit Patel would join the company to

lead its expected integration with Sprint. Mr. Patel had been chief

financial officer at CenturyLink Inc.

"We believe this offers an interesting read through for the

future of current TMUS CFO Braxton Carter," analysts at Wells Fargo

Securities wrote of the hire in a Sept. 25 note. "Language in the

merger documents led us to believe Carter may retire post the close

of the merger."

Last year, T-Mobile announced a $26 billion deal to buy Sprint.

The combined company would be called T-Mobile and would be run by

T-Mobile CEO John Legere. It is the third time in recent years the

two rivals have attempted the combination.

In 2017, Sprint and T-Mobile entered merger negotiations but

walked away after the companies failed to agree on who would

control the combined company, people familiar with the matter told

The Wall Street Journal at the time. SoftBank Group controls 83% of

Sprint. Germany's Deutsche Telekom AG owns 62% of T-Mobile.

If the merger is successful, the resulting company would create

a wireless carrier that could challenge Verizon Communications

Inc., which reported about 118 million wireless customers at the

end of 2018.

The amended employment agreement increases Mr. Carter's base

salary to $950,000, among other changes to his compensation. Mr.

Carter has been CFO since April 2013. Previously, he was CFO for

MetroPCS Communications Inc. beginning on March 2005 until it was

acquired by T-Mobile US in 2013.

T-Mobile disclosed details of the contract after the close of

regular trading on the Nasdaq. Shares of the company closed at

$69.10, down 0.07%.

--Drew FitzGerald, Dana Cimilluca and Dana Mattioli contributed

to this article.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

March 29, 2019 21:23 ET (01:23 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

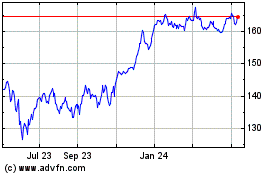

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

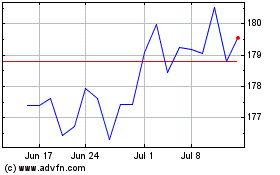

From Mar 2024 to Apr 2024

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2023 to Apr 2024