By Sarah Krouse and Drew FitzGerald

Wireless carriers say the next generation of faster, 5G wireless

service will transform entertainment, communication and the

workplace. What they haven't said: how much it will cost.

Telecom giants like Verizon Communications Inc. and AT&T

Inc. are touting the ultrafast speeds that their in-home 5G

services will offer, and the first smartphones compatible with the

new networks are scheduled to hit the U.S. market this year. But

the carriers are still grappling with how they will charge

consumers and businesses for the service.

"I think it's going to be much more about evolution than

revolution," says Val Elbert, a partner focused on technology,

media and telecommunications at Boston Consulting Group.

Business are likely to begin paying for 5G networks as part of

their capital expenditures, probably opting to build faster,

private networks to power factories and stores, he says. The prices

consumers pay for mobile-phone plans are less likely to change

dramatically, he says, though some carriers may only offer 5G to

clients in the higher tiers of their unlimited data plans.

"I pay $160; I don't think tomorrow you can double that to $320"

for a monthly mobile family plan, even if speeds are significantly

faster, says Anthony Goonetilleke, who helps telecom companies with

their network buildout and pricing models as chief technology

officer of Amdocs, a provider of software and services to

communications and media companies.

Pricey upgrades

The cost of mobile wireless service has plummeted in recent

years, with consumers growing accustomed to lower bills and

unlimited data usage. U.S. mobile data cost roughly $3.33 a

gigabyte at the end of 2017, according to consulting firm Recon

Analytics, down from $11.12 a gigabyte three years earlier.

But upgrading networks to 5G standards requires billions of

dollars of fresh cash. Carriers must buy new radio equipment and

the infrastructure to support it, including fiber-optic lines and

hundreds of thousands of new small-cell installations --

investments they aim to recoup.

It is hard to separate 5G investments from the 4G upgrades that

companies would have made anyway. Many carriers will spend billions

of dollars on more-powerful 4G equipment that could become

5G-capable once new software is available.

Market analyst New Street Research predicts that Verizon alone

will spend an extra $20 billion over the next seven years to

support wireless broadband to the home, a 5G upgrade. But the

carrier and its competitors will need to spend billions more to

make 5G wireless coverage available nationwide. New Street Research

says Chinese network operators will devote more than $60 billion to

pure 5G upgrades in China over the next five years.

Carriers will need to generate added revenue to justify all of

that expense, but they haven't settled on how they will set

prices.

"Given the expected ecosystem around 5G, which includes things

like self-driving cars, augmented reality, telemedicine and

traditional handsets, there may well be plans and pricing outside

the traditional industry model," an AT&T spokesman says.

Mr. Goonetilleke says he expects 5G will usher in more bundled

services that combine hardware and on-the-go wireless connectivity

for products like virtual reality or gaming entertainment

systems.

"I think there's going to come a time when connectivity is going

to become ubiquitous. You're not going to think 'Am I outside?' or

'Am I in my car?' " he says.

Carriers are trying to position themselves to cash in on what

families pay for 5G phones, cable, entertainment and gaming, having

missed out on revenue generated by the apps and e-commerce

opportunities developed on the back of 4G networks.

Verizon currently sells a version of in-home 5G residential

broadband service for $70 a month. But that service is only

available in a handful of neighborhoods in areas such as Los

Angeles, Indianapolis and Houston, and it isn't based on the

international 5G standard set by a global industry trade group,

meaning the equipment eventually will need to be updated.

Diego Scotti, chief marketing officer at Verizon, says that in

the future, carriers may offer consumers different buckets of

service. That could mean 5G plans for mobile devices such as

smartphones, tablets and watches, for internet access in the home

or for both of those things -- mobile and in-home broadband --

together.

T-Mobile US Inc. said earlier this month that the additional

revenue from 5G was likely to come from new services, more

connected devices and business applications, rather than from

people upgrading their smartphone plans.

"We don't have plans for the smartphone plans that you see today

to charge differently for 5G enablement versus 4G LTE," says Mike

Sievert, the carrier's chief operating officer.

Sprint Corp.'s chief executive, Michel Combes, said on an

earnings call in January that its 5G service would be embedded in

some of the carrier's plans, adding that it should allow the

carrier to shift more customers to its high-end plans. He declined

to provide further details.

Shifting economics

Every new generation of networks comes with shifting economics,

but 5G is unique because it will be rolled out in a more fragmented

way than 4G. U.S. carriers are offering the new service piecemeal

to certain pockets of the country, typically dense urban areas. The

new networks require carriers to install more clusters of equipment

closer to consumers. Some of the airwaves they are using only

travel short distances, boosting carriers' capital costs.

To reap the full benefits of 5G, consumers must also buy new

mobile devices and change in-home equipment, such as routers. That

could lead to a longer adoption cycle than the change to 4G from

3G, some analysts say.

The rollout of 4G networks also coincided with the early years

of the smartphone, which allowed carriers to charge a premium.

Today, consumers are holding on to their devices longer, which

could delay their willingness to spend money on 5G-compatible

devices.

Some 42% of consumers were willing to pay between $10 and $20

more a month for 5G mobile broadband service, according to a survey

last year for Intel Corp. of 4,676 people in the U.S. and U.K. by

market-research firm Ovum.

Ms. Krouse and Mr. FitzGerald are reporters for The Wall Street

Journal in New York and Washington, respectively. They can be

reached at sarah.krouse@wsj.com and andrew.fitzgerald@wsj.com.

(END) Dow Jones Newswires

February 26, 2019 22:18 ET (03:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

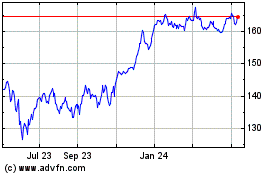

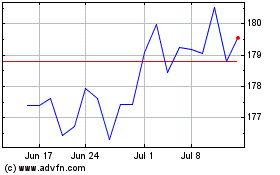

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2023 to Apr 2024