Tarsus Pharmaceuticals, Inc. Reports Full-Year 2021 Financial Results and Recent Business Achievements

March 14 2022 - 4:05PM

Tarsus Pharmaceuticals, Inc. (NASDAQ: TARS), whose mission is to

focus on unmet needs and apply proven science and new technology to

revolutionize treatment for patients, starting with eye care, today

announced financial results for the full-year ended December 31,

2021 and recent business achievements.

“During the last 12 months we made significant progress and

built considerable momentum towards becoming a leading eye care

pharmaceutical company. We completed enrollment in the Phase 3

Saturn-2 trial, the second pivotal trial of TP-03 and potentially

first FDA approved therapy for Demodex blepharitis, a lid margin

disease affecting approximately 25 million people in the U.S. The

Saturn-2 trial is similar in size and design to our successful

Saturn-1 trial that met all endpoints and demonstrated clinically

meaningful outcomes in resolving Demodex blepharitis,” said Bobak

Azamian, M.D., Ph.D., President and Chief Executive Officer of

Tarsus. “We enter 2022 well positioned to deliver Saturn-2 topline

data in April, submit the NDA this year for TP-03, a potential

blockbuster therapeutic. Our financial strength enables us to

advance our pipeline and commercial capabilities to drive

meaningful value for patients and our

stockholders.”

Recent Business Highlights and Corporate

Update

- Completed enrollment in the Saturn-2 Phase 3 trial, the second

pivotal trial of TP-03, a potential pioneering therapeutic for

Demodex blepharitis (DB)

- Pivotal topline data expected in April 2022, which, if

positive, is expected to be followed by an NDA submission later

this year

- The trial is designed to evaluate the same primary and

secondary endpoints as the pivotal Saturn-1 trial in which TP-03

met all endpoints and was well-tolerated

- Reported positive pivotal Saturn-1 trial results emphasizing

the potential of TP-03 to be the standard of care for DB patients

- Met primary endpoint of collarette cure, additional endpoints

of mite eradication and lid erythema (redness) cure, and

demonstrated clinically meaningful outcomes in resolving DB

- Well-tolerated with a safety profile similar to the vehicle

group

- Expanded market awareness and increased physician focus on DB

- Presented data from Titan and Atlas studies estimating there

are approximately 25 million DB patients in the U.S. and DB

negatively affecting daily life in 80% of patients

- Growing physician awareness and focus of recent major medical

meetings and educational programs

- Published three peer reviewed papers in the second half of 2021

and expect at least four in the first half of 2022

- Advanced TP-05, a novel, oral, non-vaccine potential

therapeutic for the prevention of Lyme disease, into the Callisto

Phase 1b trial with data expected in the second half of 2022

- Callisto is a single and multiple ascending dose trial to

evaluate safety, tolerability and pharmacokinetics of TP-05 in

healthy volunteers

- There are approximately 80 million people in the U.S. at risk

for Lyme disease exposure, more than 30 million of which are at

moderate-to-high risk, which can result in severe neurological and

other debilitating symptoms

- Expanded executive leadership team with the appointment of Jose

Trevejo, M.D., Ph.D., as Chief Medical Officer

- Dr. Trevejo has over 20 years of experience advancing the

clinical development of novel therapeutics, in particular

infectious diseases, which will be impactful in furthering our

anti-parasitic platform across multiple indications, including Lyme

disease prevention, community malaria reduction, rosacea and

meibomian gland disease

- Appointed two industry leaders to our Board of Directors

- Elizabeth Yeu, M.D., a nationally recognized Ophthalmologist

and Eye Care leader will continue to serve as Chief Medical Advisor

and joined the Science and Technology Committee, focused on

innovation and pipeline opportunities

- Rosemary A. Crane, a healthcare leader with more than 30 years

of pharmaceutical industry experience serves as the Chair of the

Science and Technology Committee and the Audit Committee

- Secured $175 million non-dilutive credit facility providing

significant financial optionality as we prepare for the expected

NDA submission, commercial launch of TP-03, and advancement and

expansion of our pipeline

- Received $55 million to date from our TP-03 out-license in

Greater China and we expect to receive $30 million in milestones in

2022

Anticipated 2022 Milestones

|

Program |

Milestone |

Anticipated Indication |

H1 2022 |

H2 2022 |

|

TP-03 |

Topline Pivotal Data (Saturn-2) |

Demodex blepharitis |

● |

|

|

TP-03 |

Initiate Phase 2 (Ersa) |

Meibomian Gland Disease |

● |

|

|

TP-03 |

NDA Submission |

Demodex blepharitis |

|

● |

|

TP-04 |

Initiate Phase 2 (Galatea) |

Rosacea |

|

● |

|

TP-05 |

Phase 1b Data (Callisto) |

Lyme disease prevention |

|

● |

|

TP-03 |

Initiate Phase 3 trial in China |

Demodex blepharitis |

|

● |

Full-Year 2021 Financial

Results

- Full year net loss

was $13.8 million, compared to $26.8 million in 2020

- Full year research and development

expenses were $41.7 million, compared to $18.8 million in 2020

- Full year general and

administrative expenses were $25.4 million, compared to $8.2

million in 2020

- As of December 31, 2021, cash, cash

equivalents and marketable securities were $171.8 million

About Tarsus Pharmaceuticals,

Inc.

Tarsus Pharmaceuticals, Inc. applies proven science and new

technology to revolutionize treatment for patients, starting with

eye care. It is advancing its pipeline to address several diseases

with high unmet need across a range of therapeutic categories,

including eye care, dermatology, and infectious disease prevention.

The company is studying two investigational medicines in clinical

trials. Its lead product candidate, TP-03, is a novel therapeutic

being studied in a second Phase 3 pivotal trial for the treatment

of Demodex blepharitis. TP-03 is also being developed for the

treatment of Meibomian Gland Disease. In addition, Tarsus is

developing TP-05, an oral, non-vaccine therapeutic for the

prevention of Lyme disease, which is currently being studied in a

Phase 1b clinical trial.

Forward-Looking Statements

Statements in this press release about future expectations,

plans and prospects, as well as any other statements regarding

matters that are not historical facts, may constitute

“forward-looking statements.” These statements include statements

regarding the Company’s estimates on its cash runway; the receipt

by Tarsus of future payments and achievement and timing of

milestones under the terms of the collaboration with LianBio, the

potential market size for TP-03 and TP-05, future events and

Tarsus’ plans for and the anticipated benefits of its product

candidates including TP-03, TP-04 and TP-05, the impact of recent

new hires, the timing, objectives and results of the clinical

trials including the potential clinical results of the Saturn-2

trial, anticipated regulatory and development milestones and the

quotations of Tarsus’ management. The words, without limitation,

“believe,” “contemplate,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,”

“project,” “should,” “target,” “will,” or “would,” or the negative

of these terms or other similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain these or similar identifying

words. Actual results may differ materially from those indicated by

such forward-looking statements as a result of various important

factors. Important factors that could cause actual results to

differ materially from those in the forward-looking statements

include: Tarsus has incurred significant losses and negative cash

flows from operations since inception and anticipates that it will

continue to incur significant expenses and losses for the

foreseeable future; Tarsus may need to obtain additional funding to

complete the development and any commercialization of its product

candidates, if approved; Tarsus is heavily dependent on the success

of its lead product candidate, TP-03 for the treatment of Demodex

blepharitis; the COVID-19 pandemic may affect Tarsus’ ability to

initiate and complete preclinical studies and clinical trials,

disrupt regulatory activities, disrupt manufacturing and supply

chain or have other adverse effects on Tarsus’ business and

operations; even if TP-03, TP-05, or any other product candidate

that Tarsus develops receives marketing approval, Tarsus may not be

successful in educating healthcare professionals and the market

about the need for treatments specifically for Demodex blepharitis,

Lyme disease, and/or other diseases or conditions targeted by

Tarsus’ products; the development and commercialization of Tarsus

products is dependent on intellectual property it licenses from

Elanco Tiergesundheit AG; Tarsus will need to develop and expand

the company and Tarsus may encounter difficulties in managing its

growth, which could disrupt its operations; the sizes of the market

opportunity for Tarsus’ product candidates, particularly TP-03 for

the treatment of Demodex blepharitis and MGD, as well as TP-05 for

the treatment of Lyme disease, have not been established with

precision and may be smaller than estimated; the results of Tarsus’

earlier studies and trials may not be predictive of future results;

any termination or suspension of, or delays in the commencement or

completion of, Tarsus’ planned clinical trials could result in

increased costs, delay or limit its ability to generate revenue and

adversely affect its commercial prospects; and if Tarsus is unable

to obtain and maintain sufficient intellectual property protection

for its product candidates, or if the scope of the intellectual

property protection is not sufficiently broad, Tarsus’ competitors

could develop and commercialize products similar or identical to

Tarsus’ products. Further, there are other risks and uncertainties

that could cause actual results to differ from those set forth in

the forward-looking statement and they are detailed from time to

time in the reports Tarsus files with the Securities and Exchange

Commission, including Tarsus’ Form 10-K for the year ended December

31, 2021 filed on March 14, 2022 with the SEC, which Tarsus

incorporates by reference into this press release, copies of which

are posted on its website and are available from Tarsus without

charge. However, new risk factors and uncertainties may emerge from

time to time, and it is not possible to predict all risk factors

and uncertainties. Accordingly, readers are cautioned not to place

undue reliance on these forward-looking statements. Any

forward-looking statements contained in this press release are

based on the current expectations of Tarsus’ management team and

speak only as of the date hereof, and Tarsus specifically disclaims

any obligation to update any forward-looking statement, whether as

a result of new information, future events or otherwise.

| Media

Contact: |

|

| SuJin Oh |

|

| twelvenote |

|

| (917) 841-5213 |

|

| soh@twelvenote.com |

|

| |

|

| Investor

Contact: |

|

| David Nakasone |

|

| Head of Investor

Relations |

|

| (949) 620-3223 |

|

| DNakasone@tarsusrx.com |

|

TARSUS PHARMACEUTICALS, INC.

STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS(In thousands, except share and

per share amounts)

| |

Year Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

| Revenues: |

|

|

|

|

License fees |

$ |

53,067 |

|

|

$ |

— |

|

|

Collaboration revenue |

|

3,960 |

|

|

|

— |

|

|

Total revenues |

|

57,027 |

|

|

|

— |

|

| Operating

expenses: |

|

|

|

|

Cost of license fees and collaboration revenue |

$ |

2,075 |

|

|

$ |

— |

|

|

Research and development |

|

41,712 |

|

|

|

18,826 |

|

|

General and administrative |

|

25,397 |

|

|

|

8,172 |

|

|

Total operating expenses |

|

69,184 |

|

|

|

26,998 |

|

| Loss from operations before other

(expense) income and income taxes |

|

(12,157 |

) |

|

|

(26,998 |

) |

| Other (expense) income: |

|

|

|

|

Interest income |

|

36 |

|

|

|

188 |

|

|

Other expense, net |

|

(73 |

) |

|

|

— |

|

|

Unrealized loss on equity securities |

|

(591 |

) |

|

|

— |

|

|

Change in fair value of equity warrant rights |

|

(987 |

) |

|

|

— |

|

|

Total other (expense) income, net |

|

(1,615 |

) |

|

|

188 |

|

| Loss from operations before

income taxes |

|

(13,772 |

) |

|

|

(26,810 |

) |

| Provision for income taxes |

|

(55 |

) |

|

|

(1 |

) |

| Net loss and comprehensive

loss |

$ |

(13,827 |

) |

|

$ |

(26,811 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.67 |

) |

|

$ |

(4.32 |

) |

| Weighted-average shares

outstanding used in computing net loss per share, basic and

diluted |

|

20,554,086 |

|

|

|

6,207,367 |

|

TARSUS PHARMACEUTICALS, INC.

BALANCE SHEETS(In

thousands, except share and par value amounts)

| |

December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

| ASSETS |

|

|

|

| Current

assets: |

|

|

|

| Cash and cash equivalents |

$ |

171,332 |

|

|

$ |

168,129 |

|

| Marketable securities |

|

483 |

|

|

|

— |

|

| Restricted cash |

|

— |

|

|

|

20 |

|

| Other receivables |

|

92 |

|

|

|

20 |

|

| Prepaid expenses and other

current assets |

|

4,045 |

|

|

|

2,486 |

|

|

Total current assets |

|

175,952 |

|

|

|

170,655 |

|

| Property and equipment,

net |

|

755 |

|

|

|

548 |

|

| Operating lease right-of-use

assets |

|

1,074 |

|

|

|

688 |

|

| Other assets |

|

1,126 |

|

|

|

81 |

|

| Total

assets |

$ |

178,907 |

|

|

$ |

171,972 |

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts payable and other

accrued liabilities |

$ |

8,680 |

|

|

$ |

4,347 |

|

| Accrued payroll and

benefits |

|

2,798 |

|

|

|

1,040 |

|

|

Total current liabilities |

|

11,478 |

|

|

|

5,387 |

|

| Other long-term

liabilities |

|

699 |

|

|

|

605 |

|

| Total

liabilities |

|

12,177 |

|

|

|

5,992 |

|

| Commitments and

contingencies (Note

8) |

|

|

|

| Stockholders’

equity: |

|

|

|

| Preferred stock, $0.0001 par

value; 10,000,000 shares authorized; no shares issued and

outstanding |

|

— |

|

|

|

— |

|

| Common stock, $0.0001 par value;

200,000,000 shares authorized; 20,726,580 shares issued and

20,698,737 outstanding, which excludes 27,840 shares subject to

repurchase at December 31, 2021; 20,502,576 shares issued and

20,323,201 outstanding, which excludes 179,375 shares subject to

repurchase at December 31, 2020 |

|

4 |

|

|

|

4 |

|

| Additional paid-in

capital |

|

213,398 |

|

|

|

198,821 |

|

| Accumulated deficit |

|

(46,672 |

) |

|

|

(32,845 |

) |

| Total stockholders’

equity |

|

166,730 |

|

|

|

165,980 |

|

| Total liabilities and

stockholders’ equity |

$ |

178,907 |

|

|

$ |

171,972 |

|

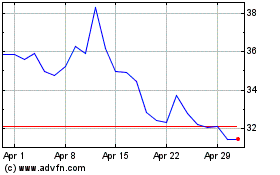

Tarsus Pharmaceuticals (NASDAQ:TARS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tarsus Pharmaceuticals (NASDAQ:TARS)

Historical Stock Chart

From Apr 2023 to Apr 2024