Gross Margins Expand; New Contracts Awarded

For 2020

Sypris Solutions, Inc. (Nasdaq/GM: SYPR) today reported

financial results for its fourth quarter and full-year ended

December 31, 2019. Having completed a series of strategic

initiatives over the past several years, Sypris Solutions is now

better positioned to achieve long-term growth and a return to

profitable operations. These steps have included reducing and

realigning our cost structure while diversifying our book of

business in terms of both customers and markets.

Results for 2019 fundamentally reflected these expectations,

especially with respect to Sypris Technologies, with year-over-year

gains in revenue and gross margin. However, our performance was

impacted by lower than expected shipments for Sypris Electronics in

2019 that related primarily to ongoing shortages of electronic

components and resulting labor inefficiencies during the year.

HIGHLIGHTS

─────────────────────

- The

Company’s fourth quarter 2019 consolidated gross margin increased

660 basis points compared to the prior year period and 200 basis

points sequentially to 12.5%, while gross profit increased 92.7%

compared to the prior year period and 16.4%

sequentially.

- For the

full-year, consolidated gross margin increased 260 basis points

from 2018 to 11.2%, while gross profit increased 30.5% from

2018.

- Gross margin

for Sypris Technologies for the fourth quarter of 2019 increased

110 basis points to 15.4% compared to the prior year quarter

despite lower revenue as a result of softening commercial vehicle

demand and year-end inventory rebalancing by certain

customers.

- During the

fourth quarter of 2019, Sypris Technologies announced the award of

two long-term contracts: one to produce components for a new,

dual-clutch sportscar transmission and another for the transmission

of a leading all-terrain vehicle. Both contracts are expected to

contribute meaningfully to the diversification and financial

results of the business beginning in the first half of

2020.

- Gross margin

for Sypris Electronics increased materially to 8.2% for the fourth

quarter of 2019, up from a gross margin loss of 8.5% for the fourth

quarter of 2018 and up from a gross margin loss of 2.8%

sequentially.

- During the

fourth quarter of 2019, Sypris Electronics announced that it

received a contract award from Collins Aerospace to manufacture and

test electronic assemblies for the power management, environmental

control and life support systems of the Deep-Space Orion spacecraft

program.

- Subsequent

to year-end, Sypris Electronics announced that it received a

contract award from BAE Systems to manufacture and test electronic

power supply modules for a large, mission-critical military

program, with production to begin in 2020.

─────────────────────

“Gross margin for Sypris Technologies increased 110 basis points

for the fourth quarter and expanded by 330 basis points for the

year, despite the reduced demand in the commercial vehicle market

at the end of 2019,” commented Jeffrey T. Gill, President and Chief

Executive Officer. “Shipments of energy related products remained

strong in the quarter, reflecting demand from domestic as well as

from international customers. The reduction of new program launch

costs going forward is expected to have a meaningful impact on the

financial results of the business beginning in early 2020.

“Revenue for Sypris Electronics increased 30.4% sequentially

during the fourth quarter, reflecting the resolution of some of the

challenges we have faced during the year with shortages of certain

electronic components. As shipments rebound to normal run rates, we

will continue to focus on improving operational performance, while

recent new contract wins are expected to provide important support

for the growth of the business during the coming year.”

Concluding, Mr. Gill said, “The ramp up of the recently

announced new program awards is expected to help mitigate the

softening within the commercial vehicle market. Our customer base

and the markets we serve are considerably more diversified than at

any point in our recent history. With that said, the global

macroeconomic environment is experiencing uncertainty and

volatility as a result of the COVID-19 outbreak, and we are closely

monitoring the developments and will act promptly to mitigate the

risks to our business as we look forward to 2020.”

Fourth Quarter and Full-Year Results

The Company reported revenue of $21.6 million for the fourth

quarter of 2019, compared to $24.0 million for the prior-year

period. Additionally, the Company reported a net loss of $0.9

million for the fourth quarter, or $0.04 per share, compared to a

net loss of $0.2 million, or $0.01 per share, for the prior-year

period. The results for the quarter ended December 31, 2018,

included a benefit in selling, general and administrative expense

of $1.9 million for the favorable resolution of a legal fee

dispute.

For the full-year 2019, the Company reported revenue of $87.9

million compared with $88.0 million for the prior year. The Company

reported a net loss of $3.9 million for 2019, or $0.19 per share,

compared with a net loss of $3.5 million, or $0.17 per share, for

2018. Results for 2019 include a gain of $1.5 million in connection

with a contract settlement with one of our customers and a gain of

$0.7 million on the sale of excess equipment, partially offset by

costs of $0.5 million related to preparing the Broadway facility

for sale. In addition to the $1.9 million legal fee benefit

recorded in the fourth quarter of 2018, results for 2018 included

an insurance recovery gain of $2.3 million, which was partially

offset by a loss of $0.2 million on the sale of excess equipment

and costs of $1.4 million related to preparing the Broadway

facility for sale or other use.

Sypris Technologies

Revenue for Sypris Technologies was $13.0 million in the fourth

quarter of 2019, compared to $15.1 million for the prior-year

period, reflecting the inventory rebalancing at year-end by certain

customers and the softness in the commercial vehicle market,

partially offset by an increase in energy related product sales.

Gross profit for the fourth quarter was $2.0 million, or 15.4% of

revenue, compared to $2.2 million, or 14.3% of revenue, for the

same period in 2018.

Sypris Electronics

Revenue for Sypris Electronics was $8.6 million in the fourth

quarter of 2019, compared to $8.8 million for the prior-year

period. Revenue for the quarter was affected by a delay in

production resulting from final pricing negotiations on a follow-on

program and the supply chain issues discussed above. Gross profit

for the quarter was $0.7 million, or 8.2% of revenue, compared to a

loss of $0.8 million, or 8.5% or revenue, for the same period in

2018. Gross profit for the quarter ended December 31, 2018,

included a $0.4 million physical inventory adjustment and

additional excess and obsolete inventory reserves of $0.5

million.

Outlook

Commenting on the future, Mr. Gill added, “The ramp up of the

recently announced new programs is expected to mitigate the

expected softness coming from the Class 8 commercial vehicle

market. The President of the United States’ proposed Fiscal Year

2021 budget request would provide $740 billion of funding for

national security, $705 billion of which is for the Department of

Defense. Maintaining defense spending at this level is expected to

support program growth and market expansion for aerospace and

defense participants during the coming years. The energy market has

benefited from oil and natural gas infrastructure development

providing opportunities to grow revenue from our product

offerings.

“Our performance in early 2020 has improved sequentially from

the fourth quarter of 2019 and is consistent with the outlook

discussed on our previous earnings call in November. At this point

our business has not been materially impacted by COVID-19, but the

environment appears to be changing rapidly with regard to

customers, suppliers and public policy, and we are paying close

attention to developments on a daily basis. First and foremost, we

are focused on the health and safety of our employees, their

families and our customers. We are closely monitoring local, state

and federal government agencies and will follow all

recommendations. The extent and duration of the impacts that

COVID-19 may have on our business are not known at this time, but

we are monitoring developments in order to be in a position to take

appropriate action.”

Sypris Solutions is a diversified provider of truck components,

oil and gas pipeline components and aerospace and defense

electronics. The Company performs a wide range of manufacturing

services, often under multi-year, sole-source contracts. For more

information about Sypris Solutions, visit its Web site at

www.sypris.com.

Forward Looking Statements

This press release contains “forward-looking” statements

within the meaning of the federal securities laws.

Forward-looking statements include our plans and expectations of

future financial and operational performance. Such statements

may relate to projections of the company’s revenue, earnings, and

other financial and operational measures, our liquidity, our

ability to mitigate or manage disruptions posed by COVID-19, and

the impact of COVID-19 and economic conditions on our future

operations, among other matters. Each forward-looking statement

herein is subject to risks and uncertainties, as detailed in our

most recent Form 10-K and Form 10-Q and other SEC filings.

Briefly, we currently believe that such risks also include the

following: the impact of COVID-19 and economic conditions on our

future operations; possible public policy response to the pandemic,

including legislation or restrictions that may impact our

operations or supply chain; our failure to return to profitability

on a timely basis by steadily increasing our revenues from

profitable contracts with a diversified group of customers, which

would cause us to continue to use existing cash resources or other

assets to fund operating losses; our failure to achieve targeted

gains and cash proceeds from the anticipated sale of certain

equipment; the fees, costs and supply of, or access to, debt,

equity capital, or other sources of liquidity; dependence on,

retention or recruitment of key employees and distribution of our

human capital; the cost, quality, timeliness, efficiency and yield

of our operations and capital investments, including the impact of

tariffs, product recalls or related liabilities, employee training,

working capital, production schedules, cycle times, scrap rates,

injuries, wages, overtime costs, freight or expediting costs; our

inability to develop new or improved products or new markets for

our products; cost, quality and availability of raw materials such

as steel, component parts (especially electronic components),

natural gas or utilities; breakdowns, relocations or major repairs

of machinery and equipment, especially in our Toluca Plant; our

reliance on a few key customers, third party vendors and

sub-suppliers; continued shortages and extensive lead-times for

electronic components; inventory valuation risks including

excessive or obsolescent valuations or price erosions of raw

materials or component parts on hand or other potential

impairments, non-recoverability or write-offs of assets or deferred

costs; other potential weaknesses in internal controls over

financial reporting and enterprise risk management; disputes or

litigation involving governmental, supplier, customer, employee,

creditor, stockholder, product liability or environmental claims;

failure to adequately insure or to identify environmental or other

insurable risks; unanticipated or uninsured disasters, public

health crises, losses or business risks; our failure to

successfully complete final contract negotiations with regard to

our announced contract “orders”, “wins” or “awards”; volatility of

our customers’ forecasts, scheduling demands and production levels

which negatively impact our operational capacity and our

effectiveness to integrate new customers or suppliers, and in turn

cause increases in our inventory and working capital levels; the

costs of compliance with our auditing, regulatory or contractual

obligations; labor relations; strikes; union negotiations; pension

valuation, health care or other benefit costs; our inability to

patent or otherwise protect our inventions or other intellectual

property from potential competitors; adverse impacts of new

technologies or other competitive pressures which increase our

costs or erode our margins; our ability to maintain compliance with

the NASDAQ listing standards; U.S. government spending on products

and services that Sypris Electronics provides, including the timing

of budgetary decisions; changes in licenses, security clearances,

or other legal rights to operate, manage our work force or import

and export as needed; risks of foreign operations; currency

exchange rates; war, terrorism, or political uncertainty; cyber

security threats and disruptions; inaccurate data about markets,

customers or business conditions; or unknown risks and

uncertainties. We undertake no obligation to update our

forward-looking statements, except as may be required by law.

SYPRIS SOLUTIONS, INC. Financial Highlights (In

thousands, except per share amounts)

Three Months

Ended December 31,

2019

2018

(Unaudited)

Revenue

$

21,624

$

23,955

Net loss

$

(859

)

$

(188

)

Loss per common share: Basic

$

(0.04

)

$

(0.01

)

Diluted

$

(0.04

)

$

(0.01

)

Weighted average shares outstanding: Basic

20,974

20,555

Diluted

20,974

20,555

Year Ended December 31,

2019

2018

(Unaudited) Revenue

$

87,891

$

87,969

Net loss

$

(3,949

)

$

(3,505

)

Loss per common share: Basic

$

(0.19

)

$

(0.17

)

Diluted

(0.19

)

(0.17

)

Weighted average shares outstanding: Basic

20,865

20,512

Diluted

20,865

20,512

Sypris Solutions, Inc. Consolidated Statements of

Operations (in thousands, except for per share data)

Three Months Ended Year Ended December

31, December 31,

2019

2018

2019

2018

(Unaudited) (Unaudited) Net revenue: Sypris

Technologies

$

13,010

$

15,130

$

61,683

$

59,816

Sypris Electronics

8,614

8,825

26,208

28,153

Total net revenue

21,624

23,955

87,891

87,969

Cost of sales: Sypris Technologies

11,006

12,973

51,898

52,293

Sypris Electronics

7,910

9,577

26,110

28,104

Total cost of sales

18,916

22,550

78,008

80,397

Gross profit (loss): Sypris Technologies

2,004

2,157

9,785

7,523

Sypris Electronics

704

(752

)

98

49

Total gross profit

2,708

1,405

9,883

7,572

Selling, general and administrative

3,474

1,213

13,680

10,474

Severance, relocation and other costs

118

306

509

1,394

Operating loss

(884

)

(114

)

(4,306

)

(4,296

)

Interest expense, net

227

185

903

850

Other (income) expense, net

(100

)

215

(1,256

)

(1,436

)

Loss before taxes

(1,011

)

(514

)

(3,953

)

(3,710

)

Income tax expense, net

(152

)

(326

)

(4

)

(205

)

Net Loss

$

(859

)

$

(188

)

$

(3,949

)

$

(3,505

)

Loss per common share: Basic

$

(0.04

)

$

(0.01

)

$

(0.19

)

$

(0.17

)

Diluted

$

(0.04

)

$

(0.01

)

$

(0.19

)

$

(0.17

)

Dividends declared per common share

$

-

$

-

$

-

$

-

Weighted average shares outstanding: Basic

20,974

20,555

20,865

20,512

Diluted

20,974

20,555

20,865

20,512

Sypris Solutions, Inc. Consolidated Balance Sheets

(in thousands, except for share data)

December 31,

December 31,

2019

2018

(Unaudited) (Note) ASSETS Current assets: Cash

and cash equivalents

$

5,095

$

10,704

Accounts receivable, net

7,444

9,881

Inventory, net

20,784

18,584

Other current assets

4,282

4,755

Assets held for sale

2,233

1,474

Total current assets

39,838

45,398

Property, plant and equipment, net

11,675

14,655

Operating lease right-of-use assets

7,014

-

Other assets

1,529

1,515

Total assets

$

60,056

$

61,568

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Accounts payable

$

9,346

$

13,427

Accrued liabilities

12,495

14,965

Operating lease liabilities, current portion

841

-

Finance lease obligations, current portion

684

593

Total current liabilities

23,366

28,985

Note payable - related party

6,463

6,449

Operating lease liabilities, net of current portion

6,906

-

Finance lease obligations, net of current portion

2,351

2,804

Other liabilities

7,539

8,496

Total liabilities

46,625

46,734

Stockholders’ equity: Preferred stock, par value $0.01 per share,

975,150 shares authorized; no shares issued

-

-

Series A preferred stock, par value $0.01 per share, 24,850 shares

authorized; no shares issued

-

-

Common stock, non-voting, par value $0.01 per share, 10,000,000

shares authorized; no shares issued

-

-

Common stock, par value $0.01 per share, 30,000,000 shares

authorized; 21,324,618 shares issued and 21,298,426 outstanding in

2019 and 21,414,374 shares issued and 21,398,182 outstanding in

2018

213

214

Additional paid-in capital

154,702

154,388

Accumulated deficit

(117,433

)

(114,926

)

Accumulated other comprehensive loss

(24,051

)

(24,842

)

Treasury stock, 26,192 and 16,192 in 2019 and 2018, respectively

-

-

Total stockholders’ equity

13,431

14,834

Total liabilities and stockholders’ equity

$

60,056

$

61,568

Note: The balance sheet at December 31, 2018, has been

derived from the audited consolidated financial statements at that

date but does not include all information and footnotes required by

accounting principles generally accepted in the United States for a

complete set of financial statements.

Sypris Solutions, Inc.

Consolidated Cash Flow Statements (in thousands)

Year Ended December 31,

2019

2018

(Unaudited) Cash flows from operating activities: Net loss

$

(3,949

)

$

(3,505

)

Adjustments to reconcile net loss to net cash (used in) provided by

operating activities: Depreciation and amortization

2,671

2,648

Deferred income taxes

(260

)

(509

)

Non-cash compensation expense

469

637

Deferred loan costs recognized

11

14

Net (gain) loss on the sale of assets

(654

)

249

Insurance recovery gain

-

(2,275

)

Settlement gain

-

(1,890

)

Provision for excess and obsolete inventory

616

520

Non-cash lease expense

650

-

Other noncash items

(69

)

278

Contributions to pension plans

(382

)

(77

)

Changes in operating assets and liabilities: Accounts receivable

2,425

(612

)

Inventory

(2,823

)

(2,857

)

Prepaid expenses and other assets

560

(1,163

)

Accounts payable

(4,066

)

2,948

Accrued and other liabilities

(1,019

)

7,486

Net cash (used in) provided by operating activities

(5,820

)

1,892

Cash flows from investing activities: Capital expenditures

(859

)

(2,051

)

Proceeds from sale of assets

1,858

1,380

Insurance proceeds for recovery of property damage, net

-

2,275

Net cash provided by investing activities

999

1,604

Cash flows from financing activities: Finance lease payments

(632

)

(829

)

Indirect repurchase of shares for minimum statutory tax

withholdings

(156

)

(107

)

Net cash used in financing activities

(788

)

(936

)

Net (decrease) increase in cash and cash equivalents

(5,609

)

2,560

Cash and cash equivalents at beginning of period

10,704

8,144

Cash and cash equivalents at end of period

$

5,095

$

10,704

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200319005181/en/

Anthony C. Allen Chief Financial Officer (502)

329-2000

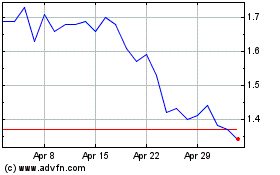

Sypris Solutions (NASDAQ:SYPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sypris Solutions (NASDAQ:SYPR)

Historical Stock Chart

From Apr 2023 to Apr 2024