FibroGen Reports Second Quarter 2020 Financial Results

August 06 2020 - 4:02PM

FibroGen, Inc. (NASDAQ:FGEN) reported financial results for the

second quarter of 2020 and provided an update on the company’s

recent developments.

“Despite this difficult time, we continue to be inspired by our

unique opportunity to leverage world-class science to benefit

patients,” said Enrique Conterno, Chief Executive

Officer, FibroGen. “I am pleased with the progress we are

making with roxadustat across a number of fronts; including our

engagement with the FDA, the European submission, and our

impressive sales in China. Additionally, we recently initiated

three new trials with pamrevlumab: our Phase 3 study with DMD and

two trials in patients hospitalized with COVID-19.”

Key Events in Recent Months and Other

Developments

Roxadustat

- U.S. NDA for roxadustat for the treatment of anemia of chronic

kidney disease (CKD), in dialysis-dependent and

non-dialysis-dependent patients, is under review with a

Prescription Drug User Fee Act (PDUFA) date of December 20,

2020.

- Marketing authorization application (MAA) for roxadustat for

the treatment of anemia in adult patients with CKD, both on

dialysis and not on dialysis, accepted by the European Medicines

Agency (EMA) for regulatory review in May.

- Japan sNDA for roxadustat for the treatment of anemia of CKD in

non-dialysis-dependent patients is under review.

- Presented results from the DOLOMITES Phase 3 study at the 57th

ERA-EDTA Virtual Congress in which roxadustat demonstrated

non-inferiority to darbepoetin alfa in achievement of hemoglobin

correction in non-dialysis-dependent patients with CKD.

- Continued enrollment of Phase 3 roxadustat clinical trial in

anemia associated with myelodysplastic syndromes (MDS) and Phase 2

roxadustat clinical trial in chemotherapy-induced anemia

(CIA).

Pamrevlumab

- Initiated a randomized, double-blind, placebo-controlled

Phase 2 study investigating the efficacy and safety of

pamrevlumab in approximately 130 hospitalized patients with acute

COVID-19 infection in the U.S.

- Initiated BOREA, a Phase 2/3 investigator-initiated clinical

trial investigating the efficacy and safety of pamrevlumab in

approximately 68 patients hospitalized with COVID-19 in Italy.

- Reopened enrollment of the ZEPHYRUS Phase 3 clinical trial of

pamrevlumab in patients with IPF after pausing for two months to

minimize the risk of exposure to COVID-19.

- Continued enrollment of the LAPIS Phase 3 clinical trial of

pamrevlumab in patients with locally advanced unresectable

pancreatic cancer (LAPC).

Upcoming Events

- Plan to initiate ZEPHYRUS 2, a second IPF Phase 3 clinical

trial similar in size and design to ZEPHYRUS, as COVID-19

conditions improve.

- Plan to initiate LELANTOS, a Phase 3, randomized, double-blind,

placebo-controlled trial of pamrevlumab in approximately 90

patients with non-ambulatory Duchenne muscular dystrophy

(DMD).

Corporate and Financial

- Total revenue for the second quarter of 2020 was $42.9 million,

as compared to $191.6 million for the second quarter of 2019. The

current quarter revenue consisted of $15.7 million in net

roxadustat sales in China, $19.0 million in development revenue,

and $8.2 million in roxadustat API sales to Astellas in Japan.

- Net loss for the second quarter of 2020 was $85.3 million, or

$0.95 net loss per basic and diluted share, compared to a net

income of $116.0 million, or $1.34 net income per basic share and

$1.26 per diluted share one year ago.

- At June 30, 2020, FibroGen had $716.0 million in cash, cash

equivalents, restricted time deposits, investments, and

receivables.

- Based on our latest forecast, we reiterate our year-end 2020

estimate to be in the range of $720 to $730 million in cash, cash

equivalents, restricted time deposits, investments, and

receivables.

- Amended China Agreement with AstraZeneca in July 2020 such that

both parties are optimally aligned to maximize the economic value

of the roxadustat franchise, with more predictable economics and

profitability for FibroGen.

- Appointed Thane Wettig to the newly-created position of Chief

Commercial Officer.

- Appointed Aoife Brennan, M.B., B.Ch., President and CEO of

Synlogic, Inc. (NASDAQ:SYBX) to board of directors effective August

5, 2020.

- Appointed Ben Cravatt, Ph.D., Professor and the Norton B.

Gilula Chair of Chemical Biology in the Department of Chemistry at

The Scripps Research Institute to board of directors effective

August 5, 2020.

Conference Call and Webcast Details

FibroGen will host a conference call and webcast today, Thursday,

August 6, 2020, at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time)

to discuss financial results and provide a business update. A live

audio webcast of the call may be accessed in the investor section

of the company’s website, www.fibrogen.com. To participate in the

conference call by telephone, please dial 1 (877) 658-9081 (U.S.

and Canada) or 1 (602) 563-8732 (international), reference the

FibroGen second quarter 2020 financial results conference call, and

use passcode 8363719. A replay of the webcast will be available

shortly after the call for a period of two weeks. To access the

replay, please dial (855) 859-2056 (domestic) or (404) 537-3406

(international) and use passcode 8363719.

About Roxadustat Roxadustat is a

first-in-class, orally administered small molecule HIF-PH inhibitor

that promotes erythropoiesis through increasing endogenous

production of erythropoietin, and improved iron absorption,

transport and mobilization. Roxadustat is approved in China for the

treatment of anemia in adult patients with CKD, both on dialysis

and not on dialysis. In Japan it is approved for the treatment of

anemia in CKD patients on dialysis and a supplemental NDA for the

treatment of anemia in CKD patients not on dialysis is under

regulatory review. The roxadustat NDA for the treatment of anemia

in CKD is under review by the U.S. Food and Drug Administration

with a Prescription Drug User Fee Act date of December 20, 2020.

The Marketing Authorization Application for roxadustat for the

treatment of anemia in CKD was filed by our partner Astellas and

accepted by the European Medicines Agency for review on May 21,

2020. Roxadustat is also in clinical development for anemia

associated with myelodysplastic syndromes (MDS) and for

chemotherapy-induced anemia (CIA).

Astellas and FibroGen are collaborating on the development and

commercialization of roxadustat for the treatment of anemia in

territories including Japan and Europe. AstraZeneca and FibroGen

are collaborating on the development and commercialization of

roxadustat for the treatment of anemia in the U.S., China, and

other markets.

About Pamrevlumab Pamrevlumab is a

first-in-class antibody developed by FibroGen that inhibits the

activity of connective tissue growth factor (CTGF), a common factor

in fibrotic and proliferative disorders. Pamrevlumab is in Phase 3

clinical development for the treatment of idiopathic pulmonary

fibrosis (IPF) and locally advanced unresectable pancreatic cancer

(LAPC), and in Phase 2 clinical development for the treatment of

Duchenne muscular dystrophy (DMD) and coronavirus (COVID-19). For

information about pamrevlumab studies currently recruiting

patients, please visit www.clinicaltrials.gov.

About FibroGen FibroGen, Inc. is a

biopharmaceutical company committed to discovering, developing and

commercializing a pipeline of first-in-class therapeutics. The

company applies its pioneering expertise in hypoxia-inducible

factor (HIF) and connective tissue growth factor (CTGF) biology to

advance innovative medicines to treat unmet needs. The Company is

currently developing and commercializing roxadustat, an oral small

molecule inhibitor of HIF prolyl hydroxylase activity, for anemia

associated with chronic kidney disease (CKD). Roxadustat is also in

clinical development for anemia associated with myelodysplastic

syndromes (MDS) and for chemotherapy-induced anemia (CIA).

Pamrevlumab, an anti-CTGF human monoclonal antibody, is in clinical

development for the treatment of idiopathic pulmonary fibrosis

(IPF), locally advanced unresectable pancreatic cancer (LAPC),

Duchenne muscular dystrophy (DMD), and coronavirus (COVID-19). For

more information, please visit www.fibrogen.com.

Forward-Looking Statements This release

contains forward-looking statements regarding our strategy, future

plans and prospects, including statements regarding the development

and commercialization of the company’s product candidates, our

financial results, the potential safety and efficacy profile of our

product candidates, our clinical programs and regulatory events,

and those of our partners. These forward-looking statements

include, but are not limited to, statements about our plans,

objectives, representations and contentions and are not historical

facts and typically are identified by use of terms such as “may,”

“will”, “should,” “on track,” “could,” “expect,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,”

“continue” and similar words, although some forward-looking

statements are expressed differently. Our actual results may differ

materially from those indicated in these forward-looking statements

due to risks and uncertainties related to the continued progress

and timing of our various programs, including the enrollment and

results from ongoing and potential future clinical trials, and

other matters that are described in our Annual Report on Form 10-K

for the fiscal year ended December 31, 2019 and our Quarterly

Report on Form 10-Q for quarter ended June 30, 2020 filed with the

Securities and Exchange Commission (SEC), including the risk

factors set forth therein. Investors are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this release, and we undertake no obligation

to update any forward-looking statement in this press release,

except as required by law.

Condensed Consolidated Balance Sheets(In

thousands)

| |

June 30, 2020 |

|

|

December 31, 2019 |

|

| |

(Unaudited) |

|

|

(1) |

|

| Assets |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

429,269 |

|

|

$ |

126,266 |

|

|

|

Short-term investments |

|

256,317 |

|

|

|

407,491 |

|

|

|

Accounts receivable, net |

|

26,519 |

|

|

|

28,455 |

|

|

|

Inventory |

|

8,582 |

|

|

|

6,887 |

|

|

|

Prepaid expenses and other current assets |

|

6,481 |

|

|

|

133,391 |

|

|

|

Total current assets |

|

727,168 |

|

|

|

702,490 |

|

|

| |

|

|

|

|

|

|

|

| Restricted time deposits |

|

2,072 |

|

|

|

2,072 |

|

|

| Long-term investments |

|

229 |

|

|

|

61,118 |

|

|

| Property and equipment, net |

|

36,984 |

|

|

|

42,743 |

|

|

| Finance lease right-of-use assets |

|

34,368 |

|

|

|

39,602 |

|

|

| Other assets |

|

6,862 |

|

|

|

9,372 |

|

|

|

Total assets |

$ |

807,683 |

|

|

$ |

857,397 |

|

|

| |

|

|

|

|

|

|

|

| Liabilities, stockholders’ equity and non-controlling

interests |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

5,015 |

|

|

$ |

6,088 |

|

|

|

Accrued and other liabilities |

|

50,464 |

|

|

|

83,816 |

|

|

|

Deferred revenue |

|

9,813 |

|

|

|

490 |

|

|

|

Finance lease liabilities, current |

|

12,279 |

|

|

|

12,351 |

|

|

|

Total current liabilities |

|

77,571 |

|

|

|

102,745 |

|

|

| |

|

|

|

|

|

|

|

| Long-term portion of lease obligations |

|

940 |

|

|

|

1,141 |

|

|

| Product development obligations |

|

16,959 |

|

|

|

16,780 |

|

|

| Deferred revenue, net of current |

|

138,242 |

|

|

|

99,449 |

|

|

| Finance lease liabilities, non-current |

|

31,586 |

|

|

|

37,610 |

|

|

| Other long-term liabilities |

|

127,242 |

|

|

|

64,266 |

|

|

|

Total liabilities |

|

392,540 |

|

|

|

321,991 |

|

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

395,872 |

|

|

|

516,135 |

|

|

| Non-controlling interests |

|

19,271 |

|

|

|

19,271 |

|

|

| Total equity |

|

415,143 |

|

|

|

535,406 |

|

|

| Total liabilities, stockholders’ equity and

non-controlling interests |

$ |

807,683 |

|

|

$ |

857,397 |

|

|

| |

(1) The condensed consolidated balance sheet

amounts at December 31, 2019 are derived from audited financial

statements.

Condensed Consolidated Statements of

Operations(In thousands, except per share data)

| |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

| |

|

|

| |

(Unaudited) |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License revenue |

$ |

— |

|

|

$ |

150,581 |

|

|

$ |

— |

|

|

$ |

150,581 |

|

|

Development and other revenue |

|

18,957 |

|

|

|

40,985 |

|

|

|

38,402 |

|

|

|

64,848 |

|

|

Product revenue, net |

|

15,693 |

|

|

|

— |

|

|

|

20,648 |

|

|

|

— |

|

|

Drug product revenue |

|

8,238 |

|

|

|

— |

|

|

|

8,238 |

|

|

|

— |

|

|

Total revenue |

|

42,888 |

|

|

|

191,566 |

|

|

|

67,288 |

|

|

|

215,429 |

|

| Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

3,076 |

|

|

|

— |

|

|

|

4,047 |

|

|

|

— |

|

|

Research and development |

|

61,414 |

|

|

|

52,008 |

|

|

|

116,315 |

|

|

|

102,505 |

|

|

Selling, general and administrative |

|

63,535 |

|

|

|

26,739 |

|

|

|

113,138 |

|

|

|

48,948 |

|

|

Total operating costs and expenses |

|

128,025 |

|

|

|

78,747 |

|

|

|

233,500 |

|

|

|

151,453 |

|

| Income (loss) from operations |

|

(85,137 |

) |

|

|

112,819 |

|

|

|

(166,212 |

) |

|

|

63,976 |

|

| Interest and other, net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(651 |

) |

|

|

(736 |

) |

|

|

(1,284 |

) |

|

|

(1,507 |

) |

|

Interest income and other, net |

|

644 |

|

|

|

4,125 |

|

|

|

3,810 |

|

|

|

8,303 |

|

|

Total interest and other, net |

|

(7 |

) |

|

|

3,389 |

|

|

|

2,526 |

|

|

|

6,796 |

|

| Income (loss) before income taxes |

|

(85,144 |

) |

|

|

116,208 |

|

|

|

(163,686 |

) |

|

|

70,772 |

|

| Provision for (benefit from) income taxes |

|

169 |

|

|

|

205 |

|

|

|

(25 |

) |

|

|

180 |

|

| Net income (loss) |

$ |

(85,313 |

) |

|

$ |

116,003 |

|

|

$ |

(163,661 |

) |

|

$ |

70,592 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.95 |

) |

|

$ |

1.34 |

|

|

$ |

(1.84 |

) |

|

$ |

0.82 |

|

|

Diluted |

$ |

(0.95 |

) |

|

$ |

1.26 |

|

|

$ |

(1.84 |

) |

|

$ |

0.77 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares used to calculate net

income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

89,451 |

|

|

|

86,445 |

|

|

|

88,835 |

|

|

|

86,077 |

|

|

Diluted |

|

89,451 |

|

|

|

91,728 |

|

|

|

88,835 |

|

|

|

92,069 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact: FibroGen, Inc.

Media Inquiries: Sara Iacovino

1.703.474.4452sara.iacovino@gcihealth.com

Investors: Michael Tung, M.D.Corporate Strategy / Investor

Relations1.415.978.1434mtung@fibrogen.com

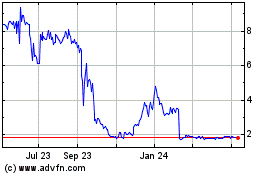

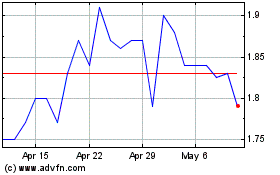

Synlogic (NASDAQ:SYBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Synlogic (NASDAQ:SYBX)

Historical Stock Chart

From Apr 2023 to Apr 2024