Current Report Filing (8-k)

June 23 2022 - 3:23PM

Edgar (US Regulatory)

0001499717

false

--12-31

0001499717

2022-06-23

2022-06-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

June

23, 2022

Date

of Report (Date of earliest event reported)

STAFFING

360 SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-37575 |

|

68-0680859 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

757

Third Avenue

27th

Floor

New

York, NY 10017

(Address

of principal executive offices)

(646)

507-5710

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock |

|

STAF |

|

NASDAQ |

Item

3.03 Material Modification to Rights of Security Holders.

To

the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this report is incorporated herein by reference.

Item

5.03 Amendment to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

June 23, 2022, Staffing 360 Solutions, Inc. (the “Company”) filed a Certificate of Amendment of Amended and Restated Certificate

of Incorporation (the “Certificate of Amendment”) with the Secretary of State of Delaware to effect a 1-for-10 reverse

stock split of the shares of the Company’s common stock, par value $0.00001 per share (the “Common Stock”), either

issued and outstanding or held by the Company as treasury stock, effective as of 4:05 p.m. (Delaware time) on June 23, 2022 (the “Reverse

Stock Split”). As reported below under Item 5.07 of this report, the Company held a special meeting of stockholders on June 23,

2022 (the “Special Meeting”), at which meeting the Company’s stockholders, approved the amendment to the Company’s

Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to effect a reverse stock split of

the Company’s common stock at a ratio in the range of 1-for-2 to 1-for-20, with such ratio to be determined by the Company’s

board of directors (the “Board”) and included in a public announcement. Following the Special Meeting, the Board determined

to effect the Reverse Stock Split at a ratio of 1-for-10 and approved the corresponding final form of the Certificate of Amendment.

As

a result of the Reverse Stock Split, every ten shares of issued and outstanding Common Stock will be automatically combined into

one issued and outstanding share of Common Stock, without any change in the par value per share. No fractional shares will be issued

as a result of the Reverse Stock Split. Any fractional shares that would otherwise have resulted from the Reverse Stock Split will be

rounded up to the next whole number. The Reverse Stock Split will reduce the number of shares of Common Stock outstanding from 17,618,300

shares to approximately 1,761,830 shares, subject to adjustment for the rounding up of fractional shares. The number of authorized

shares of Common Stock under the Certificate of Incorporation will remain unchanged at 200,000,000 shares.

Proportionate

adjustments will be made to the number of shares of Common Stock that may be received upon conversion of the issued and outstanding shares

of the Company’s Series H Convertible Preferred Stock, par value $0.00001 per share (“Series H Preferred Stock”). In

addition, proportionate adjustments will be made to the per share exercise price and the number of shares of Common Stock that may be

purchased upon exercise of outstanding stock options granted by the Company, and the number of shares of Common Stock reserved for future

issuance under the Company’s 2014 Equity Incentive Plan, 2015 Omnibus Plan, 2016 Omnibus Plan and 2020 Omnibus Plan.

The

Common Stock will begin trading on a reverse stock split-adjusted basis on The NASDAQ Capital Market on June 24, 2022. The trading symbol

for the Common Stock will remain “STAF.” The new CUSIP number for the Common Stock following the Reverse Stock Split is 852387505.

For

more information about the Reverse Stock Split, see the Company’s definitive proxy statement filed with the U.S. Securities and

Exchange Commission on May 26, 2022 (the “Proxy Statement”), the relevant portions of which are incorporated herein by reference.

The information set forth herein is qualified in its entirety by reference to the complete text of the Certificate of Amendment, a copy

of which is filed with this report as Exhibit 3.1.

Item

5.07 Submission of Matters to a Vote of Security Holders.

The

Special Meeting was held on June 23, 2022. As of the close of business on May 19, 2022, the record date for the Special Meeting, there

were 17,618,300 shares of Common Stock, 9,000,000 shares of Series H Preferred Stock, voting on an as-converted basis, and 17,618.300

shares of shares of our Series J Preferred Stock, par value $0.00001 (“Series J Preferred Stock”) outstanding and entitled

to vote on the proposals described below. The matters described below were submitted to a vote of the Company’s stockholders at

the Special Meeting. Each proposal is described in detail in the Proxy Statement.

At

the Special Meeting, the proposals set forth below were submitted to a vote of the Company’s stockholders. The final voting results

are as follows:

| |

1. |

To

approve an amendment to our amended and restated certificate of incorporation to effect, at the discretion of the Board but prior

to the one-year anniversary of the date on which the reverse stock split is approved by the Company’s stockholders at the Special

Meeting, a reverse stock split of all of the outstanding shares of our Common Stock, at a ratio in the range of 1-for-2 to 1-for-20,

such ratio to be determined by the Board in its discretion and included in a public announcement (the “Reverse Stock Split

Proposal”). |

| For |

|

Against |

|

Abstain |

| 2,662,927,322 |

|

1,926,364,748 |

|

121,179,395 |

| |

2. |

To

approve a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation

and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Reverse

Stock Split Proposal. |

| For |

|

Against |

|

Abstain |

| 2,694,890,876 |

|

1,846,102,648 |

|

169,477,941 |

For

more information about the foregoing proposals, see the Proxy Statement, the relevant portions of which are incorporated herein by reference.

The results reported above are final voting results. No other matters were considered or voted upon at the meeting.

Item

7.01 Regulation FD Disclosure.

On

June 23, 2022, the Company issued a press release announcing the Reverse Stock Split. A copy of the press release is attached hereto

as Exhibit 99.1 and is incorporated herein by reference.

In

accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 of this Current Report on Form 8-K, including

Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by reference in

such a filing. Furthermore, the furnishing of information under Item 7.01 of this Current Report on Form 8-K is not intended to constitute

a determination by the Company that the information contained herein, including the exhibits hereto, is material or that the dissemination

of such information is required by Regulation FD.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

June 23, 2022 |

STAFFING

360 SOLUTIONS, INC. |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

|

Brendan

Flood |

| |

|

Chairman,

President and Chief Executive Officer |

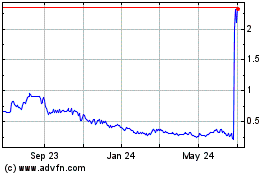

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

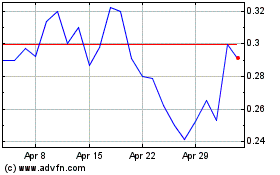

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Apr 2023 to Apr 2024