As filed with the Securities and Exchange

Commission on June 8, 2020

Registration

No. 333-237214

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 1

TO

FORM S-4

ON

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

South State

Corporation

(Exact name of registrant as specified in its charter)

|

South Carolina

(State or other jurisdiction of

incorporation or organization)

|

57-0799315

(I.R.S. Employer

Identification Number)

|

1101 First Street South

Winter Haven, Florida 33880

(863) 293-4710

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

John C. Corbett

Chief Executive Officer

South State Corporation

1101 First Street South

Winter Haven, Florida 33880

(863) 293-4710

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including

communications sent to agent for service, should be sent to:

Matthew M. Guest

Jacob A. Kling

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, New York 10019

(212) 403-1000

Approximate date of commencement

of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being

registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, other

than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration

statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with

the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

|

Large accelerated

filer x

|

Accelerated filer

|

¨

|

|

Non-accelerated filer ¨

|

Smaller reporting company

|

¨

|

|

|

Emerging growth company

|

¨

|

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

|

Title of Securities to be Registered

|

Amount

to be

Registered(1)

|

Maximum

Offering Price

Per Share

|

Maximum

Aggregate

Offering Price

|

Amount of

Registration Fee

|

|

Common stock, par value $2.50 per share

|

5,175

|

N/A

|

N/A

|

(2)

|

|

|

|

|

|

|

|

|

(1)

|

Represents the maximum number of shares of common stock, par value $2.50 per share (“Common Stock”), of South State

Corporation, a South Carolina corporation (“South State” or the “Company” or “we”), issuable

under outstanding warrants (collectively, the “CSFL Rollover Warrants”) to purchase shares of common stock, par value

$0.01 per share, of CenterState Bank Corporation, a Florida corporation (“CenterState”), which CSFL Rollover Warrants

were converted into warrants to purchase shares of Common Stock (the “SSB Warrants”) in connection with the merger

of equals between South State and CenterState, which was completed on June 7, 2020. Pursuant to Rule 416(a) under the Securities

Act of 1933, as amended (the “Securities Act”), this registration statement is also registering an indeterminate number

of shares of Common Stock that may be issued as a result of stock splits, stock dividends or similar transactions.

|

|

|

(2)

|

These shares of Common Stock were registered under the registration statement on Form S-4 (File No. 333-237214)

filed by the Company with the Securities and Exchange Commission (the “Commission”) on March 16, 2020, as amended by

Pre-Effective Amendment No. 1 filed on April 16, 2020, which became effective on April 20, 2020 (the “Form S-4”). All

filing fees payable in connection with the issuance of these shares were previously paid in connection with the filing of the Form

S-4.

|

The Company hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Company shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act or until this registration statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

EXPLANATORY NOTE

South State Corporation, a South

Carolina corporation (“South State” or the “Company” or “we”), hereby amends its

registration statement on Form S-4 (File No. 333-237214) filed with the Securities and Exchange Commission (the

“Commission”) on March 16, 2020, as amended by Pre-Effective Amendment No. 1 filed on April 16, 2020, which

became effective on April 20, 2020 (the “Form S-4”), by filing this Post-Effective Amendment No. 1 on Form S-3

(this “Post-Effective Amendment”) containing an updated prospectus relating to the shares of our common stock,

par value $2.50 per share (“Common Stock”), issuable upon the future exercise of certain outstanding warrants

(collectively, the “CSFL Rollover Warrants”) to purchase shares of common stock, par value $0.01 per share, of

CenterState Bank Corporation, a Florida corporation (“CenterState”), which were converted into warrants to

purchase shares of Common Stock (the “SSB Warrants”) in connection with the merger of equals between South State

and CenterState, which was completed on June 7, 2020. All such shares of Common Stock were previously registered on the Form

S-4. This Post-Effective Amendment is being filed to convert 5,175 shares of Common Stock covered by the Form S-4 to be

covered by Form S-3.

On June 7, 2020, pursuant to the Agreement

and Plan of Merger, dated as of January 25, 2020 (the “Merger Agreement”), by and between CenterState and South State,

CenterState merged with and into South State (the “Merger”), with South State continuing as the surviving corporation

in the Merger.

At the effective time of the Merger, each

outstanding CSFL Rollover Warrant was converted into an SSB Warrant, with the number of underlying shares and applicable exercise

price adjusted based on the Exchange Ratio (as defined in the Merger Agreement).

5,175

Shares

Common

Stock

This prospectus relates to an aggregate

of up to 5,175 shares of common stock, par value $2.50 per share (“Common Stock”), of South State Corporation (“South

State” or the “Company” or “we”), issuable upon the future exercise of certain outstanding warrants

(collectively, the “CSFL Rollover Warrants”) to purchase shares of common stock, par value $0.01 per share, of CenterState

Bank Corporation, a Florida corporation (“CenterState”), which were converted into warrants to purchase shares of

Common Stock (the “SSB Warrants”) in connection with the merger of equals between South State and CenterState, which

was completed on June 7, 2020, plus an indeterminate number of shares of Common Stock that may be issued as a result of stock

splits, stock dividends, recapitalizations or similar events as described in the warrant agreements governing the CSFL Rollover

Warrants.

On June 7, 2020, pursuant to the Agreement

and Plan of Merger, dated as of January 25, 2020 (the “Merger Agreement”), by and between CenterState and South State,

CenterState merged with and into South State (the “Merger”), with South State continuing as the surviving corporation

in the Merger.

At the effective time of the Merger, each

outstanding CSFL Rollover Warrant was converted into an SSB Warrant, with the number of underlying shares and applicable exercise

price adjusted based on the Exchange Ratio (as defined in the Merger Agreement).

Our Common Stock is listed on The NASDAQ

Global Select Market (“NASDAQ”) under the symbol “SSB”. On June 5, 2020, the last reported sale price

of our Common Stock on NASDAQ was $60.27.

Investing in our Common Stock involves

risk. See “Risk Factors” beginning on page 8 of this prospectus, as well as the other information contained

in or incorporated by reference into this prospectus, including the information contained under the caption entitled “Risk

Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, which is incorporated by reference herein.

Neither the Securities and Exchange

Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy

of this prospectus. Any representation to the contrary is a criminal offense.

The shares of our Common Stock issuable

in this offering will not be savings accounts, deposits or other obligations of any of our bank or non-bank subsidiaries and are

not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

The date of this prospectus is June

8, 2020.

table

of contents

Page

ABOUT

THIS PROSPECTUS

You should read carefully this prospectus

in its entirety, together with additional information described under the heading “Where You Can Find More Information”

in this prospectus.

If the information in this prospectus conflicts

with any statement in a document that we have incorporated by reference, then you should consider only the statement in the more

recent document. The information contained or incorporated by reference into this prospectus or in any prospectus supplement is

accurate only as of the date of the applicable document. Our business, financial condition, results of operations and prospects

may have changed since that date.

We have not authorized anyone to provide

you with different or additional information from that contained or incorporated by reference into this prospectus. We take no

responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This

prospectus may be used only for the purpose for which it has been prepared. We are offering to sell our Common Stock, and seeking

offers to buy our Common Stock, only in jurisdictions where such offers and sales are permitted. This prospectus does not constitute

an offer, or an invitation on our behalf to subscribe for and purchase any of our securities, and may not be used for or in connection

with an offer or solicitation by anyone, in any jurisdiction in which such an offer or solicitation is not authorized or to any

person to whom it is unlawful to make such an offer or solicitation.

Unless otherwise indicated or the context

otherwise requires, all references in this prospectus to “we,” “our,” “us,” “ourselves,”

“SSB,” “South State” or the “Company” refer to South State Corporation, a South Carolina corporation,

and its consolidated subsidiaries. All references in this prospectus to “South State Bank” or “the Bank”

refer to South State Bank, National Association, our wholly-owned bank subsidiary. All references in this prospectus to “CSFL”

or “CenterState” refer to CenterState Bank Corporation, a Florida corporation, and all references in this prospectus

to the “Merger” refer to the merger contemplated in the Agreement and Plan of Merger, dated as of January 25, 2020,

by and between CenterState and South State.

WHERE

YOU CAN FIND MORE INFORMATION

We file reports, proxy statements and other

information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at www.sec.gov

and on our website at www.southstatebank.com. Information contained in or linked to our website is not a part of this prospectus.

You may also read and copy any document we file with the SEC at its public reference facilities at 100 F Street N.E., Washington,

D.C. 20549. You can also obtain copies of the documents upon the payment of a duplicating fee to the SEC. Please call the SEC

at 1-800-SEC-0330 for further information on the operation of the public reference facilities.

The SEC also maintains an Internet site

that contains reports, proxy statements and other information about issuers like us who file electronically with the SEC. The

address of that site is: http://www.sec.gov.

The SEC allows us to “incorporate

by reference” information into this prospectus. This means that we can disclose important information to you by referring

you to another document that we file separately with the SEC. The information incorporated by reference contains information about

us and our business, financial condition and results of operations and is an important part of this prospectus. The information

incorporated by reference is considered to be a part of this prospectus, except for any information that is superseded by information

that is included directly in this document or in a more recent incorporated document.

This prospectus incorporates by reference

the documents listed below that we have previously filed with the SEC (excluding any portion of these documents that has been

furnished to and deemed not to be filed with the SEC).

|

Report(s)

|

|

Period(s)

of Report(s) or Date(s) Filed

|

|

·

|

Annual Report on Form 10-K, as amended by Amendment No. 1 to the Annual Report on Form 10-K/A

|

|

For the year ended December 31, 2019, filed on February 21, 2020, as amended by Amendment No. 1, filed

on March 6, 2020

|

|

|

|

|

|

·

|

Quarterly Report on Form 10-Q

|

|

For the quarter ended March 31, 2020, filed on May 4, 2020

|

|

|

|

|

|

·

|

Current Reports on Form 8-K

|

|

Filed on January 27, 2020 (second filing), January 29, 2020, April 29, 2020, May 6, 2020, May 11, 2020 (as amended), May 18, 2020, May 21, 2020, May 22, 2020, June 3, 2020 and June 8, 2020

|

|

|

|

|

|

·

|

The section entitled “Description of South State Capital Stock” from our Registration Statement on Form S-4

|

|

Filed on March 16, 2020 (as amended)

|

In addition, we incorporate by reference

all future documents that we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), on or after the date of this prospectus until the completion of the offering of the

securities covered by this prospectus or until we terminate this offering, in each case excluding any portion of these documents

that is furnished to and deemed not to be filed with the SEC. These documents include periodic reports, such as Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K (other than Current Reports furnished under Item

2.02 or Item 7.01 of Form 8-K), as well as Proxy Statements.

You can obtain any of the documents incorporated

by reference in this document through us, or from the SEC through the SEC’s web site at www.sec.gov. Documents incorporated

by reference are available from us without charge, excluding any exhibits to those documents, unless the exhibit is specifically

incorporated by reference in those documents. You can obtain documents incorporated by reference in this prospectus by requesting

them in writing or by telephone from us at the following address:

South State Corporation

1101 First Street South

Winter Haven, Florida

33880

(863) 293-4710

In addition, we maintain an Internet website,

www.southstatebank.com. We make available, through our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q,

Current Reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the

Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. This

reference to our website is for the convenience of investors as required by the SEC and shall not be deemed to incorporate any

information on the website into this prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

Some of the statements in this prospectus

constitute forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 and the Exchange

Act. Forward looking statements are based on, among other things, management’s beliefs, assumptions, current expectations,

estimates and projections about the financial services industry, the economy, South State and our merger of equals with CenterState.

Words and phrases such as “may,” “approximately,” “continue,” “should,” “expects,”

“projects,” “anticipates,” “is likely,” “look ahead,” “look forward,”

“believes,” “will,” “intends,” “estimates,” “strategy,” “plan,”

“could,” “potential,” “possible” and variations of such words and similar expressions are intended

to identify such forward-looking statements. We caution readers that forward-looking statements are subject to certain risks, uncertainties

and assumptions that are difficult to predict with regard to, among other things, timing, extent, likelihood and degree of occurrence,

which could cause actual results to differ materially from anticipated results. Such risks, uncertainties and assumptions, include,

among others, the following:

|

|

·

|

economic downturn risk, potentially resulting in deterioration in the credit markets, greater than expected noninterest expenses,

excessive loan losses and other negative consequences, which risks could be exacerbated by potential negative economic developments

resulting from federal spending cuts and/or one or more federal budget-related impasses or actions;

|

|

|

·

|

increased expenses, loss of revenues, and increased regulatory scrutiny associated with our total assets having exceeded $10.0

billion;

|

|

|

·

|

personnel risk, including our inability to attract and retain consumer and commercial bankers to execute on our client-centered,

relationship driven banking model;

|

|

|

·

|

risks related to our merger of equals with CenterState, including potential difficulty in maintaining relationships with clients,

employees or business partners as a result of the merger and problems arising from the integration of the two companies, including

the risk that the integration will be materially delayed or will be more costly or difficult than expected;

|

|

|

·

|

failure to realize cost savings and any revenue synergies from, and to limit liabilities associated with, mergers and acquisitions

within the expected time frame, including our merger of equals with CenterState;

|

|

|

·

|

controls and procedures risk, including the potential failure or circumvention of our controls and procedures or failure to

comply with regulations related to controls and procedures;

|

|

|

·

|

ownership dilution risk associated with potential mergers and acquisitions in which our stock may be issued as consideration

for an acquired company;

|

|

|

·

|

potential deterioration in real estate values;

|

|

|

·

|

the impact of competition with other financial service businesses and from nontraditional financial technology (“FinTech”)

companies, including pricing pressures and the resulting impact, including as a result of compression to net interest margin;

|

|

|

·

|

credit risks associated with an obligor’s failure to meet the terms of any contract with the Bank or otherwise fail to

perform as agreed under the terms of any loan-related document;

|

|

|

·

|

interest risk involving the effect of a change in interest rates on our earnings, the market value of our loan and securities

portfolios, and the market value of our equity;

|

|

|

·

|

liquidity risk affecting our ability to meet our obligations when they come due;

|

|

|

·

|

risks associated with an anticipated increase in our investment securities portfolio, including risks associated with acquiring

and holding investment securities or potentially determining that the amount of investment securities we desire to acquire are

not available on terms acceptable to us;

|

|

|

·

|

price risk focusing on changes in market factors that may affect the value of traded instruments in “mark-to-market”

portfolios;

|

|

|

·

|

transaction risk arising from problems with service or product delivery;

|

|

|

·

|

compliance risk involving risk to earnings or capital resulting from violations of or nonconformance with laws, rules, regulations,

prescribed practices, or ethical standards;

|

|

|

·

|

regulatory change risk resulting from new laws, rules, regulations, accounting principles, proscribed practices or ethical

standards, including, without limitation, the possibility that regulatory agencies may require higher levels of capital above the

current regulatory mandated minimums and including the impact of the Tax Cuts and Jobs Act, the Consumer Financial Protection Bureau

rules and regulations, and the possibility of changes in accounting standards, policies, principles and practices, including changes

in accounting principles relating to loan loss recognition (CECL);

|

|

|

·

|

strategic risk resulting from adverse business decisions or improper implementation of business decisions;

|

|

|

·

|

cybersecurity risk related to our dependence on internal computer systems and the technology of outside service providers,

as well as the potential impacts of third party security breaches, which subject us to potential business disruptions or financial

losses resulting from deliberate attacks or unintentional events;

|

|

|

·

|

the risks of fluctuations in the market price of our common stock that may or may not reflect our economic condition or performance;

|

|

|

·

|

risks associated with actual or potential information gatherings, investigations or legal proceedings by customers, regulatory

agencies or others;

|

|

|

·

|

major catastrophes such as earthquakes, floods or other natural or human disasters, including infectious disease outbreaks,

including the recent outbreak of a novel strain of coronavirus, a respiratory illness, the related disruption to local, regional

and global economic activity and financial markets, and the impact that any of the foregoing may have on us and our customers and

other constituencies; and

|

|

|

·

|

other risks and uncertainties disclosed in our Annual Report on Form 10-K for the year ended December 31, 2019, including the

factors discussed in Item 1A, “Risk Factors,” and in our other reports we file from time to time with the SEC, which

are incorporated by reference into this prospectus, as the same may be amended, supplemented or superseded from time to time by

our filings under the Exchange Act.

|

All forward looking statements attributable

to our Company are expressly qualified in their entirety by these cautionary statements. There is no assurance that future results,

levels of activity, performance or goals will be achieved.

The foregoing factors should not be

construed as exhaustive and should be read together with the other cautionary statements included in this prospectus. If one

or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be

incorrect, actual results may differ materially from what we anticipate. Accordingly, you should not place undue reliance on

any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and we do

not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new

information, future developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict

which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor,

or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements.

PROSPECTUS SUMMARY

This summary highlights selected

information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider

before deciding to purchase common stock in this offering. You should read this entire prospectus carefully, as well as the information

to which we refer you and the information incorporated by reference herein, before deciding to purchase common stock in this offering.

You should pay special attention to the sections titled “Risk Factors,” in each of this prospectus and our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, and in our other reports filed from time to time with the SEC, which

are incorporated by reference into this prospectus, as well as our consolidated financial statements, and the related notes thereto

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” each of which is

incorporated by reference in this prospectus, before making an investment decision.

South State Corporation

South State Corporation is a South Carolina

corporation that is a bank holding company registered with the Board of Governors of the Federal Reserve System (the “Federal

Reserve Board”) under the Bank Holding Company Act of 1956, as amended (the “BHC Act”). South State was incorporated

in 1985 under the laws of South Carolina. South State provides a wide range of banking services and products to its customers through

its wholly-owned bank subsidiary, South State Bank, National Association (the “Bank”). South State does not engage

in any significant operations other than the ownership of its banking subsidiary. The Bank provides a full range of retail and

commercial banking services, mortgage lending services, trust and wealth management, and consumer loans through financial centers

in South Carolina, North Carolina, Florida, Georgia, Alabama and Virginia.

In recent years, South State has grown its

business through, among other things, the merger of equals with CenterState Bank Corporation on June 7, 2020, the acquisition of

Park Sterling Bank on November 30, 2017 and the acquisition of Georgia Bank & Trust on January 3, 2017.

At December 31, 2019, South State had approximately

$15.9 billion in assets, $11.3 billion in loans, $12.2 billion in deposits, $2.4 billion in shareholders’ equity, and a market

capitalization of approximately $2.9 billion. At December 31, 2019, CenterState had total consolidated assets of $17.1 billion,

total consolidated loans of $12.0 billion, total consolidated deposits of $13.1 billion, and total consolidated shareholders’

equity of $2.9 billion.

South State’s principal executive

offices are located at 1101 First Street South, Winter Haven, Florida 33880, and its telephone number is (863) 293-4710.

South State common stock is traded on the

NASDAQ under the symbol “SSB”.

Additional information about us and our

subsidiaries is included in documents incorporated by reference in this prospectus. See “Where You Can Find More Information”.

THE OFFERING

The following summary contains basic

information about our Common Stock offered hereby. This description is not complete and does not contain all of the information

that you should consider before investing in shares of our Common Stock. For a more complete understanding of our common stock,

you should read “Description of South State Capital Stock” included in our Registration Statement on Form S-4 (File

No. 333-237214), as amended, which is

incorporated by reference herein.

|

Issuer

|

South State Corporation, a South Carolina corporation.

|

|

|

|

|

Common Stock offered

|

5,175 shares of Common Stock.

|

|

|

|

|

Use of proceeds

|

If all of the SSB Warrants are exercised in full, we will issue approximately 5,175 shares of Common Stock and will receive aggregate net proceeds of up to approximately $237,636. We intend to use the proceeds, if any, from the exercise of the SSB Warrants for general corporate purposes. We have no assurance that any of the SSB Warrants will be exercised.

|

|

|

|

|

Dividends

|

On April 22, 2020, our board of directors declared a quarterly cash dividend in the amount of $0.47 per share of outstanding Common Stock. The dividend was paid on May 15, 2020 to holders of record of our Common Stock on May 8, 2020.

|

|

|

|

|

|

We currently intend to continue to pay quarterly cash dividends on our Common Stock, subject to approval by our board of directors, although we may elect not to pay dividends or to change the amount of such dividends. The payment of dividends is a decision of our board of directors based upon then-existing circumstances, including our rate of growth, profitability, financial condition, existing and anticipated capital requirements, the amount of funds legally available for the payment of cash dividends, regulatory constraints and such other factors as our board of directors determines relevant. See “Dividend Policy.”

|

|

|

|

|

Listing

|

Our Common Stock is listed on NASDAQ under the trading symbol “SSB”.

|

|

|

|

|

Risk factors

|

Investing in our Common Stock involves risks. See “Risk Factors,” beginning on page 8 of this prospectus, as well as the other information contained in or incorporated by reference into this prospectus, including the information contained under the caption entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, for a discussion of certain factors that you should carefully consider before making an investment decision.

|

|

|

|

Unless otherwise indicated, the information

contained in this prospectus is as of the date set forth on the cover of this prospectus.

RISK FACTORS

An investment in shares of our Common

Stock involves various risks. You should carefully consider the risk factors described in Part I, Item 1A, “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2019, and in our other reports we file from time to time with

the SEC, which are incorporated by reference into this prospectus, as the same may be amended, supplemented or superseded from

time to time by our filings under the Exchange Act. You should also carefully consider the risks and the other information included

or incorporated by reference into this prospectus before investing in our Common Stock. The risks described in the documents incorporated

by reference herein are not the only risks applicable to us or an investment in our Common Stock. Additional risks not currently

known to us or that we currently consider immaterial also may impair our business.

USE OF PROCEEDS

If all of the SSB Warrants are exercised

in full, we will issue approximately 5,175 shares of Common Stock and will receive aggregate net proceeds of up to approximately

$237,636. We intend to use the proceeds from the exercise, if any, of the SSB Warrants for general corporate purposes. We have

no assurance that any of the SSB Warrants will be exercised.

DIVIDEND POLICY

On April 22, 2020, our board of directors

declared a quarterly cash dividend in the amount of $0.47 per share of outstanding Common Stock. The dividend was paid on May 15,

2020 to holders of record of our Common Stock on May 8, 2020.

We currently intend to continue to pay quarterly

cash dividends on our Common Stock, subject to approval by our board of directors, although we may elect not to pay dividends or

to change the amount of such dividends. The payment of dividends is a decision of our board of directors based upon then-existing

circumstances, including our rate of growth, profitability, financial condition, existing and anticipated capital requirements,

the amount of funds legally available for the payment of cash dividends, regulatory constraints and such other factors as our board

of directors determines relevant.

As a South Carolina corporation, we are

subject to certain restrictions on distributions to shareholders under the South Carolina Business Corporation Act of 1988, as

amended (the “SCBCA”). Generally, a South Carolina corporation may not pay dividends if, after giving a dividend effect,

(i) the corporation would not be able to pay its debts as they become due in the usual course of business, or (ii) the corporation’s

total assets would be less than the sum of its total liabilities plus the amount that would be needed, if the corporation were

to be dissolved at the time of the dividend, to satisfy the preferential rights upon dissolution of shareholders whose preferential

rights are superior to those receiving the divided.

In addition, we are subject to certain restrictions

on the payment of cash dividends as a result of banking laws, regulations and policies.

Because we do not engage directly in business

activities of a material nature, our ability to pay dividends to our stockholders depends, in large part, upon our receipt of dividends

from South State Bank, which is also subject to numerous limitations on the payment of dividends under federal and state banking

laws, regulations and policies.

CERTAIN MATERIAL UNITED STATES FEDERAL

INCOME TAX CONSIDERATIONS

FOR NON-U.S. HOLDERS

The following is a general discussion of

certain material U.S. federal income tax considerations with respect to the ownership and disposition of shares of our common stock

applicable to non-U.S. holders who acquire such shares in this offering. This discussion is based on current provisions of the

Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury regulations promulgated thereunder, administrative

rulings of the IRS and court decisions, each as in effect as of the date hereof. All of these authorities are subject to change

and differing interpretations, possibly with retroactive effect, and any such change or differing interpretation could result in

U.S. federal income tax consequences different from those discussed below.

For purposes of this discussion, the term

“non-U.S. holder” means a beneficial owner of our common stock that is not, for U.S. federal income tax purposes, a

partnership or any of the following:

|

|

·

|

an individual who is a citizen or resident of the United States;

|

|

|

·

|

a corporation created or organized in the United States or under the laws of the United States, any state thereof or the District

of Columbia;

|

|

|

·

|

an estate, the income of which is includible in gross income for U.S. federal income tax purposes regardless of its source;

or

|

|

|

·

|

a trust if (1) a court within the United States is able to exercise primary supervision over the administration of the trust

and one or more U.S. persons have the authority to control all substantial decisions of the trust, or (2) it has a valid election

in effect under applicable U.S. Treasury regulations to be treated as a U.S. person for U.S. federal income tax purposes.

|

This discussion assumes that a non-U.S.

holder holds our common stock as a capital asset within the meaning of Section 1221 of the Code (generally, property held for investment).

This discussion does not address all aspects of U.S. federal income taxation that may be relevant to a non-U.S. holder in light

of that non-U.S. holder’s particular circumstances or that may be applicable to non-U.S. holders subject to special treatment

under U.S. federal income tax laws (including, for example, banks or other financial institutions, brokers or dealers in securities,

traders in securities that elect mark-to-market treatment, insurance companies, “controlled foreign corporations,”

“passive foreign investment companies,” tax-exempt entities, entities or arrangements treated as partnerships for U.S.

federal income tax purposes or other “flow-through” entities and investors therein, certain former citizens or former

long-term residents of the United States, holders who hold our common stock as part of a hedge, straddle, constructive sale or

conversion transaction, and holders who own or have owned (directly, indirectly or constructively) five percent or more of our

common stock (by vote or value)). In addition, this discussion does not address U.S. federal tax laws other than those pertaining

to the U.S. federal income tax, nor does it address any aspects of the unearned income Medicare contribution tax pursuant to the

Health Care and Education Reconciliation Act of 2010, any considerations in respect of the Foreign Account Tax Compliance Act of

2010 (including the U.S. Treasury regulations promulgated thereunder and intergovernmental agreements entered into pursuant thereto)

or U.S. state, local or non-U.S. taxes. Prospective investors should consult with their own tax advisors regarding the U.S. federal,

state, local, non-U.S. income and other tax considerations with respect to acquiring, holding and disposing of shares of our common

stock.

If an entity or arrangement treated as a

partnership for U.S. federal income tax purposes holds shares of our common stock, the tax treatment of a person treated as a partner

in such partnership generally will depend on the status of the partner and the activities of the partnership. Persons that for

U.S. federal income tax purposes are treated as a partnership or a partner in a partnership holding shares of our common stock

should consult their tax advisors.

THIS DISCUSSION IS FOR GENERAL

INFORMATION ONLY AND IS NOT INTENDED TO CONSTITUTE A COMPLETE DESCRIPTION OF ALL TAX CONSEQUENCES RELATING TO THE

ACQUISITION, OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK. PROSPECTIVE HOLDERS OF OUR COMMON STOCK SHOULD CONSULT WITH THEIR

TAX ADVISORS REGARDING THE TAX CONSEQUENCES TO THEM OF THE ACQUISITION, OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK,

INCLUDING THE APPLICATION AND EFFECT OF ANY U.S. FEDERAL, STATE, LOCAL, NON-U.S. INCOME AND OTHER TAX LAWS.

Distributions

In general, subject to the discussion below

regarding “effectively connected” dividends, the gross amount of any distribution we make to a non-U.S. holder with

respect to its shares of our common stock will be subject to U.S. withholding tax at a rate of 30% to the extent the distribution

constitutes a dividend for U.S. federal income tax purposes, unless the non-U.S. holder is eligible for an exemption from, or a

reduced rate of, such withholding tax under an applicable income tax treaty and the non-U.S. holder provides proper certification

of its eligibility for such exemption or reduced rate. A distribution with respect to shares of our common stock will constitute

a dividend for U.S. federal income tax purposes to the extent of our current or accumulated earnings and profits, as determined

for U.S. federal income tax purposes. To the extent any distribution does not constitute a dividend, it will be treated first as

reducing the adjusted basis in the non-U.S. holder’s shares of our common stock and then, to the extent it exceeds the non-U.S.

holder’s adjusted basis in its shares of our common stock, as gain from the sale or exchange of such stock. Any such gain

will be subject to the treatment described below under “—Gain on Sale or Other Disposition of our Common Stock.”

Dividends we pay with respect to our common

stock to a non-U.S. holder that are effectively connected with the conduct by such non-U.S. holder of a trade or business within

the United States (or, if required by an applicable income tax treaty, are attributable to a permanent establishment or a fixed

base of such non-U.S. holder in the United States) generally will not be subject to U.S. withholding tax, as described above, if

the non-U.S. holder complies with applicable certification and disclosure requirements. Instead, such dividends generally will

be subject to U.S. federal income tax on a net income basis, at the U.S. federal income tax rates applicable to U.S. citizens,

nonresident aliens or domestic corporations, as applicable. Dividends received by a non-U.S. holder that is a corporation and that

are effectively connected with its conduct of trade or business within the United States may be subject to an additional “branch

profits tax” at a rate of 30% (or such lower rate as may be specified by an applicable income tax treaty).

Gain on Sale or Other Disposition of our

Common Stock

Subject to the discussion below under the

heading “—Informational Reporting and Backup Withholding,” in general, a non-U.S. holder will not be subject

to U.S. federal income tax on any gain realized upon the sale or other disposition of the non-U.S. holder’s shares of our

common stock unless:

|

|

·

|

the gain is effectively connected with a trade or business carried on by the non-U.S. holder within the United States (or,

if required by an applicable income tax treaty, is attributable to a permanent establishment or a fixed base of such non-U.S. holder

in the United States);

|

|

|

·

|

the non-U.S. holder is an individual and is present in the United States for 183 days or more in the taxable year of disposition

and certain other conditions are met; or

|

|

|

·

|

we are or have been a U.S. real property holding corporation (a “USRPHC”) for U.S. federal income tax purposes

at any time during the shorter of the five-year period ending on the date of such disposition or such non-U.S. holder’s holding

period of such shares of our common stock.

|

Gain described in the first bullet

immediately above generally will be subject to U.S. federal income tax on a net income tax basis, at the U.S. federal income

tax rates applicable to U.S. citizens, nonresident aliens or domestic corporations, as applicable. A non-U.S. holder that is

a corporation and that recognizes gain described in the first bullet immediately above may also be subject to branch profits

tax at a rate of 30% (or such lower rate as may be specified by an applicable income tax treaty) with respect to such

effectively connected gain. An individual non-U.S. holder described in the second bullet immediately above will be subject to

a flat 30% tax (unless the non-U.S. holder is eligible for a lower rate under an applicable income tax treaty) on the gain

from such sale or other disposition, which may be offset by U.S. source capital losses, if any, of the non-U.S. holder.

We believe we are not, and do not anticipate

becoming, a USRPHC for U.S. federal income tax purposes. However, no assurance can be given that we are not or will not become

a USRPHC. If we were or were to become a USRPHC, however, any gain recognized on a sale or other disposition of shares of our common

stock by a non-U.S. holder that did not own (directly, indirectly or constructively) more than 5% of our common stock during the

applicable period would not be subject to U.S. federal income tax, provided that our common stock is “regularly traded on

an established securities market” (within the meaning of Section 897(c)(3) of the Code).

Informational Reporting and Backup Withholding

We must report annually to the IRS and to

each non-U.S. holder the amount of dividends paid to such non-U.S. holder and the tax withheld with respect to such dividends.

These reporting requirements apply regardless of whether withholding was reduced or eliminated by an applicable tax treaty.

A non-U.S. holder generally will be subject

to backup withholding (currently at a rate of 24%) on dividends paid with respect to such non-U.S. holder’s shares of our

common stock unless such holder certifies under penalties of perjury that, among other things, it is a non-U.S. holder (and the

payor does not have actual knowledge or reason to know that such holder is a U.S. person as defined under the Code).

Information reporting and backup withholding

generally is not required with respect to any proceeds from the sale or other disposition of our common stock by a non-U.S. holder

outside of the United States through a foreign office of a foreign broker that does not have certain specified connections to the

United States. However, if a non-U.S. holder sells or otherwise disposes of its shares of our common stock through a U.S. broker

or the U.S. offices of a foreign broker, the broker will generally be required to report the amount of proceeds paid to the non-U.S.

holder to the IRS, and may also be required to backup withhold on such proceeds unless such non-U.S. holder certifies under penalties

of perjury that, among other things, it is a non-U.S. holder (and the payor does not have actual knowledge or reason to know that

such holder is a U.S. person as defined under the Code). Information reporting will also apply if a non-U.S. holder sells its shares

of our common stock through a foreign broker with certain specified connections to the United States, unless such broker has documentary

evidence in its records that such non-U.S. holder is a non-U.S. person and certain other conditions are met, or such non-U.S. holder

otherwise establishes an exemption (and the payor does not have actual knowledge or reason to know that such holder is a U.S. person

as defined under the Code).

Copies of any information returns may also

be made available to the tax authorities in the country in which the non-U.S. holder resides or is established under the provisions

of an applicable income tax treaty or agreement.

Backup withholding

is not an additional tax. Any amounts withheld under the backup withholding rules from a payment to a non-U.S. holder can be credited

against the non-U.S. holder’s U.S. federal income tax liability, if any, or refunded, provided that the required information

is furnished to the IRS in a timely manner. Non-U.S. holders should consult their tax advisors regarding the application of the

information reporting and backup withholding rules to them.

PLAN OF DISTRIBUTION

This prospectus relates to the shares of

Common Stock that are issuable upon the exercise of SSB Warrants. We are offering these shares of Common Stock directly to the

holders of these warrants according to the terms of the underlying warrant agreements. We are not using an underwriter in connection

with this offering. These shares of Common Stock will be listed for trading on NASDAQ.

In order to facilitate the exercise of any

such warrants, we will furnish, at our expense, such reasonable number of copies of this prospectus to each person holding such

a warrant as such holder may request, together with instructions that copies be delivered to the beneficial owners of such warrants.

VALIDITY OF COMMON STOCK

The validity of the securities offered in

this offering will be passed upon for us by V. Nicole Comer, Senior Vice President, Deputy General Counsel of South State. As of

June 5, 2020, Ms. Comer beneficially owned less than 1% of our outstanding Common Stock.

EXPERTS

The consolidated financial statements of

South State Corporation appearing in its Annual Report on Form 10-K for the year ended December 31, 2019, and the effectiveness

of its internal control over financial reporting as of December 31, 2019, have been audited by Dixon Hughes Goodman LLP, independent

registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein by reference.

Such consolidated financial statements are incorporated herein by reference in reliance upon such reports given on the authority

of such firm as experts in accounting and auditing.

The consolidated

financial statements of CenterState Bank Corporation as of December 31, 2019 and 2018, and for each of the years in the three

(3)-year period ended December 31, 2019 and the effectiveness of internal control over financial reporting as of December 31,

2019 incorporated by reference herein have been audited by Crowe LLP, an independent registered public accounting firm,

as set forth in their report thereon, incorporated herein by reference. Such consolidated financial statements are incorporated

herein by reference in reliance upon such reports given on the authority of such firm as experts in accounting and auditing.

5,175

Shares

Common

Stock

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the expenses,

other than underwriting compensation, expected to be incurred in connection with the registration and sale of the securities covered

by this registration statement.

|

SEC registration fee

|

|

$

|

0

|

|

|

Legal fees and expenses

|

|

|

30,000

|

|

|

Accounting fees and expenses

|

|

|

30,000

|

|

|

Printing and miscellaneous fees and expenses

|

|

|

5,000

|

|

|

Total

|

|

$

|

65,000

|

|

Item 15. Indemnification of Directors and Officers

Article

VII of our amended and restated bylaws provides that South State shall indemnify any person who at any time serves or has

served as a director or officer of South State, or who, while serving as a director or officer of South State, serves or has served,

at the request of South State, as a director, officer, partner, trustee, employee or agent of another corporation, partnership,

joint venture, trust or other enterprise, or as a trustee or administrator under an employee benefit plan to the fullest extent

permitted by law against (i) reasonable expenses, including attorneys’ fees, incurred by him or her in connection with any

threatened, pending or completed proceedings, whether or not brought by or on behalf of South State, seeking to hold him or her

liable by reason of the fact that he or she is or was acting in such capacity, and (ii) reasonable payments made by him or her

in satisfaction of any judgment, money decree, fine, penalty or settlement for which he or she may have become liable in any such

proceeding.

Pursuant to the SCBCA, a South Carolina

corporation has the power to indemnify its directors and officers provided that they act in good faith and reasonably believe that

their conduct was lawful and in the corporate interest (or not opposed thereto), as set forth in the SCBCA. Under the SCBCA, unless

limited by its articles of incorporation, a corporation must indemnify a director or officer who is wholly successful, on the merits

or otherwise, in the defense of any proceeding to which he or she was a party because he or she is or was a director or officer,

against reasonable expenses incurred by the director or officer in connection with the proceeding. Our amended and restated articles

of incorporation, as amended, do not contain any such limitations. The SCBCA permits a corporation to pay for or reimburse reasonable

expenses in advance of final disposition of an action, suit or proceeding only upon (i) the director’s certification that

he or she acted in good faith and in the corporate interest (or not opposed thereto), (ii) the director furnishing a written undertaking

to repay the advance if it is ultimately determined that he or she did not meet this standard of conduct, and (iii) a determination

is made that the facts then known to those making the determination would not preclude indemnification under the SCBCA.

Article

Seventeen of our amended and restated articles of incorporation, as amended, provides that a director of South State shall

not be personally liable to South State or its shareholders for monetary damages for breach of fiduciary duty as a director, subject

to certain exceptions, including with respect to (i) a breach of the director’s duty of loyalty to South State or its shareholders,

(ii) an act or omission not in good faith or which involves gross negligence, intentional misconduct or a knowing violation of

law, (iii) an act or omission for which liability is imposed due to an unlawful distribution, as provided under South Carolina

law, and (iv) a transaction from which the director derives an improper benefit.

We also maintains directors’ and officers’

liability insurance.

Our amended and restated articles of incorporation,

as amended, and our amended and restated bylaws were previously filed with the Commission and are incorporated by reference into

this registration statement.

Item 16. Exhibits

|

EXHIBIT

NO.

|

|

DESCRIPTION

|

|

2.1

|

|

Agreement and Plan of Merger, dated as of January 25, 2020, by and between CenterState Bank Corporation and South State Corporation (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K, filed with the SEC on January 29, 2020).

|

|

|

|

|

|

3.1

|

|

Amended and Restated Articles of Incorporation of South State Corporation (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SEC on October 28, 2014).

|

|

|

|

|

|

3.2

|

|

Articles of Amendment to the Amended and Restated Articles of Incorporation of South State Corporation (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on October 26, 2017).

|

|

|

|

|

|

3.3

|

|

Articles of Amendment to the Amended and Restated Articles of Incorporation of South State Corporation (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on June 8, 2020).

|

|

|

|

|

|

3.4

|

|

Amended and Restated Bylaws of South State Corporation (incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K filed on June 8, 2020).

|

|

|

|

|

|

4.1

|

|

Specimen Stock Certificate of South State Corporation (incorporated by reference to Exhibit 4.1 to the Company’s Annual Report on Form 10-K filed on February 27, 2015).

|

|

|

|

|

|

4.2

|

|

Form of SSB Warrant (warrant of FirstAtlantic Financial Holdings, Inc. (“FA”) assumed by NCOM by merger of FA with and into NCOM on January 1, 2018, assumed by CenterState by merger of NCOM with and into CenterState on April 1, 2019 and assumed by South State by merger of CenterState with and into South State on June 7, 2020) (incorporated by reference to Exhibit 4.2 to CenterState’s Post-Effective Amendment No. 2 to Form S-4 on Form S-3, filed on April 1, 2019).

|

|

|

|

|

|

5.1

|

|

Opinion of V. Nicole Comer, Esq. as to validity of the securities being registered.

|

|

|

|

|

|

23.1

|

|

Consent of V. Nicole Comer, Esq. (included in Exhibit 5.1 hereto).

|

|

|

|

|

|

23.2

|

|

Consent of Dixon Hughes Goodman LLP.

|

|

|

|

|

|

23.3

|

|

Consent of Crowe LLP.

|

|

|

|

|

|

24.1

|

|

Power of Attorney (included on the Signature Page).

|

(b) Financial Statement

Schedules:

Not Applicable.

Item 17. Undertakings.

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made

a post-effective amendment to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933, as amended (the “Securities

Act”);

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the

most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information

set forth in the registration statement.

Notwithstanding the foregoing, any increase or decrease

in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and

any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed

with the Securities and Exchange Commission (the “Commission”) pursuant to Rule 424(b) if, in the aggregate, the changes

in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration

statement or any material change to such information in the registration statement;

provided, however, that the undertakings set forth in

paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment by

those paragraphs is contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are incorporated by reference

in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration

statement;

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be

deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that

time shall be deemed to be the initial bona fide offering thereof;

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering;

(4)

That, for the purpose of determining liability under the Securities Act to any purchaser:

(i)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement

as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in

reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the

information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement

as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale

of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement

relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in

a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed

incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to

a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the

registration statement or prospectus that was part of the registration statement or made in any such document immediately prior

to such effective date.

(5)

That, for the purpose of determining any liability of the registrant under the Securities Act to any purchaser in the initial

distribution of the securities, the registrant undertakes that in a primary offering of securities of the registrant pursuant to

this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the registrant will be a seller to the purchaser

and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the registrant relating to the offering required to be filed pursuant to Rule

424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the registrant or used or referred to by

the registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the registrant

or its securities provided by or on behalf of the registrant; and

(iv)

Any other communication that is an offer in the offering made by the registrant to the purchaser.

(b)

The undersigned registrant hereby undertakes that, for the purposes of determining any liability under the Securities Act,

each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable,

each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated

by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof;

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and

controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that

in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant

of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action,

suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered,

the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court

of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities

Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, as amended, the registrant has duly caused this Post-Effective Amendment to be signed on its behalf by the undersigned,

thereunto duly authorized, in Winter Haven, Florida, on June 8, 2020.

SOUTH STATE CORPORATION

|

|

By:

|

/s/ William E. Matthews, V

|

|

|

|

Name:

|

William E. Matthews, V

|

|

|

|

Title:

|

Senior Executive Vice President and Chief Financial Officer

|

We, the undersigned officers and directors

of South State Corporation, hereby severally constitute and appoint John C. Corbett and William E. Matthews, V, and each of them

singly, our true and lawful attorneys with full power to them, and each of them singly, to sign for us and in our names in the

capacities indicated below, the registration statement on Form S-3 filed herewith and any and all subsequent amendments to said

registration statement, and generally to do all such things in our names and on our behalf in our capacities as officers and directors

to enable South State Corporation to comply with the provisions of the Securities Act of 1933, as amended, and all requirements

of the Securities and Exchange Commission, hereby ratifying and confirming our signatures as they may be signed by our said attorneys,

or any of them, to said registration statement and any and all amendments thereto.

Pursuant to the requirements of the Securities

Act of 1933, as amended, this Post-Effective Amendment has been signed by the following persons in the capacities indicated on

June 8, 2020.

|

Signature

|

|

Title

|

|

|

|

|

|

/s/ Robert

R. Hill, Jr.

(Robert R. Hill, Jr.)

|

|

Executive Chairman and Director

|

|

|

|

|

|

/s/ John

C. Corbett

(John C. Corbett)

|

|

Chief Executive Officer and Director

(Principal Executive Officer)

|

|

|

|

|

|

/s/ William

E. Matthews, V

(William E. Matthews, V)

|

|

Senior Executive Vice President and Chief Financial Officer

(Principal Financial Officer and Principal Accounting Officer)

|

|

|

|

|

|

/s/ Jean

E. Davis

(Jean E. Davis)

|

|

Director

|

|

|

|

|

|

/s/ Robert

H. Demere, Jr.

(Robert H. Demere, Jr.)

|

|

Director

|

|

|

|

|

|

/s/ Cynthia

A. Hartley

(Cynthia A. Hartley)

|

|

Director

|

|

Signature

|

|

Title

|

|

|

|

|

|

/s/ John

H. Holcomb, III

(John H. Holcomb, III)

|

|

Director

|

|

|

|

|

|

/s/ Robert

R. Horger

(Robert R. Horger)

|

|

Director

|

|

|

|

|

|

/s/ Charles

W. McPherson

(Charles W. McPherson)

|

|

Director

|

|

|

|

|

|

/s/ Ernest

S. Pinner

(Ernest S. Pinner)

|

|

Director

|

|

|

|

|

|

/s/ John

C. Pollok

(John C. Pollok)

|

|

Director

|

|

|

|

|

|

/s/ William

K. Pou, Jr.

(William K. Pou, Jr.)

|

|

Director

|

|

|

|

|

|

/s/ David

G. Salyers

(David G. Salyers)

|

|

Director

|

|

|

|

|

|

/s/ Kevin

P. Walker

(Kevin P. Walker)

|

|

Director

|

(Constituting a majority of the Board of Directors of South

State Corporation)

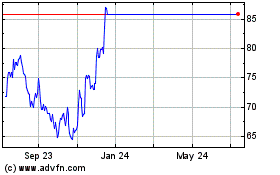

SouthState (NASDAQ:SSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

SouthState (NASDAQ:SSB)

Historical Stock Chart

From Apr 2023 to Apr 2024