UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________________

FORM 11-K

______________________________________________

| | | | | |

x

| ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

OR

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-35006

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

Spectrum Pharmaceuticals, Inc. 401(k) Plan

B. Name of the issuer of the securities held pursuant to the plan and the address of its principal executive office:

Spectrum Pharmaceuticals, Inc.

11500 South Eastern Avenue, Suite 220

Henderson, Nevada 89052

Spectrum Pharmaceuticals, Inc. 401(k) Plan

Table of Contents

| | | | | |

|

| |

| |

| |

| Financial Statements: | |

| |

| |

| |

| |

| Supplemental Information: | |

| |

| |

| |

| |

Report of Independent Registered Public Accounting Firm

Fiduciary Retirement Committee and Plan Participants

Spectrum Pharmaceuticals, Inc. 401(k) Plan

Opinion on the Financial Statements

We have audited the accompanying statement of net assets available for benefits of the Spectrum Pharmaceuticals, Inc. 401(k) Plan (the Plan) as of December 31, 2021 and 2020, and the related statement of changes in net assets available for benefits for the year ended December 31, 2021, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits for the year ended December 31, 2021, in conformity with accounting principles generally accepted in the United States of America.

Basis For Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information in the accompanying schedule of assets (held at end of year) as of December 31, 2021 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

We have served as the Plan’s auditor since 2021.

/s/ RubinBrown LLP

Las Vegas, Nevada

June 23, 2022

Spectrum Pharmaceuticals, Inc. 401(k) Plan

Statements of Net Assets Available for Benefits

| | | | | | | | | | | |

| December 31, |

| 2021 | | 2020 |

| ASSETS | | | |

| Investments, at fair value | | | |

| Registered investment companies | $ | 21,289,799 | | | $ | 16,815,141 | |

| Spectrum Pharmaceuticals Unitized Stock Fund | 648,902 | | | 1,785,665 | |

| Common/collective trust | 1,514,636 | | | 1,350,867 | |

| Total investments at fair value | 23,453,337 | | | 19,951,673 | |

| | | |

| Receivables: | | | |

| Employer contributions | 581,194 | | | 536,209 | |

| Notes receivable from participants | 162,465 | | | 136,615 | |

| Total receivables | 743,659 | | | 672,824 | |

| NET ASSETS AVAILABLE FOR BENEFITS | $ | 24,196,996 | | | $ | 20,624,497 | |

The accompanying notes are an integral part of these financial statements.

Spectrum Pharmaceuticals, Inc. 401(k) Plan

Statement of Changes in Net Assets Available for Benefits

| | | | | |

| Year ended, December 31, 2021 |

| ADDITIONS TO NET ASSETS ATTRIBUTED TO: | |

| Contributions: | |

| Participant deferrals | $ | 2,242,059 | |

| Participant rollovers | 58,849 | |

| Employer matching contributions | 1,109,257 | |

| Employer profit sharing contributions | 531,303 | |

| 3,941,468 | |

| Investment income: | |

| Interest and dividends | 1,638,786 | |

| |

| Net appreciation in fair value of investments | 335,869 | |

| 1,974,655 | |

| Interest income from notes receivable from participants | 8,575 | |

| Total additions | 5,924,698 | |

| |

| DEDUCTIONS TO NET ASSETS ATTRIBUTED TO: | |

| Distributions to participants | 2,293,429 | |

| Administrative expenses | 58,770 | |

| Total deductions from net assets | 2,352,199 | |

| |

| NET INCREASE IN NET ASSETS | 3,572,499 | |

| NET ASSETS AVAILABLE FOR BENEFITS, AT BEGINNING OF YEAR | 20,624,497 | |

| NET ASSETS AVAILABLE FOR BENEFITS, AT END OF YEAR | $ | 24,196,996 | |

The accompanying notes are an integral part of these financial statements.

Spectrum Pharmaceuticals, Inc. 401(k) Plan

Notes to Financial Statements

December 31, 2021

1. Description of the Plan

The following description of the Spectrum Pharmaceuticals, Inc. 401(k) Plan (the “Plan”) is only provided for general information purposes. Participants should refer to the Plan Document for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution pension plan covering eligible employees of Spectrum Pharmaceuticals, Inc. (the “Company” or “Spectrum”) as defined in the Plan Document. The Plan was adopted January 1, 1990, and established for the purpose of providing retirement benefits for eligible employees of the Company. The Plan is subject to regulation under the Employee Retirement Income Security Act of 1974 (“ERISA”),as amended and the qualification provisions of the Internal Revenue Code (the “Code”).

Administration

Joseph W. Turgeon ("Mr. Turgeon"), Chief Executive Officer and Keith McGahan, Executive Vice President and Chief Legal Officer are the trustees of the Plan. In June 2019, Mr. Turgeon was designated as the Audit Committee Chair of the Plan. Matrix Trust Company, LLC, (“Matrix Trust”) serves as the account custodian for the Plan. Digital Retirement Solutions, Inc. (“DRS”) performs administrative and record keeping services for the Plan.

Eligibility

All Company employees are eligible to participate in the Plan, provided the employee has completed three months of employment. Effective January 1,2021 the Plan was amended to remove the three month service requirement.An eligible employee may enter the Plan on the first day of the month following his or her satisfaction of the eligibility requirements.

In the event of the Company's acquisition of a business, the employees of the newly acquired entity are given credit for the years of service earned prior to the Company’s ownership. If this credit for prior service allows such employees to meet Plan eligibility requirements, each has the option of participating in the Plan on the first day of the month following the business acquisition date.

Contributions

Each year, participants may elect to make pre-tax contributions up to 75% of their eligible compensation, as defined in the Plan. In addition, participants may elect to make after-tax (Roth) contributions up to 75% of their eligible compensation. Compensation deferrals cannot exceed the maximum deferral, as determined by the Internal Revenue Service ("IRS") each year. Such deferral limitation was $19,500 in 2021 and 2020, respectively. Employees who attained the age of 50 before the end of the Plan year, were eligible to make additional catch-up contributions of up to $6,500 in 2021 and 2020. Participants may also make rollover contributions into the Plan from other qualified plans.

The Company provides matching contributions, under a Safe Harbor arrangement, equal to 100 percent of the first three percent of eligible compensation deferred by a participant and 50 percent of the next two percent of eligible compensation deferred by a participant. The Company’s matching contribution made on behalf of any participant for any Plan year cannot exceed four percent of their eligible compensation. The Company has the right under the Plan to discontinue or modify its matching contributions at any time. The value of the Company’s aggregate matching contribution was $1,109,257 for the year ended December 31, 2021. Additional amounts may be contributed at the discretion of the Company’s Board of Directors.

The Company also provides a discretionary profit sharing contribution to the Plan. The allocation conditions of this discretionary profit sharing contribution include: (i) all employees who were employed on the last day of the Plan year, and (ii) all employees who completed one-thousand hours of service during the Plan year, except for reasons including death, disability, or termination of employment after normal retirement age (defined as 65 years of age). The contribution amount for the Plan year is up to 2% of an employee's compensation earned during 2021, totaling $531,303, which was included in the employer contribution receivable at December 31, 2021. Compensation is generally defined as total compensation that is subject to income tax withholding and paid by the Company during the Plan year and is limited by law to $290,000 in 2021 for contribution calculation purposes.

Participant Accounts

Spectrum Pharmaceuticals, Inc. 401(k) Plan

Notes to Financial Statements (Continued)

DRS maintains an account in the name of each participant. Each eligible participant’s account is credited with (a) the participant’s contributions, (b) the Company’s Safe Harbor matching contributions and discretionary profit sharing contributions, and (c) an allocation of interest, dividends and any change in the market value of the various investment funds. Each eligible participant’s account is charged with any withdrawals or distributions requested by the participant and an allocation of administrative expenses, if applicable. Allocations are based on the ratio that each participant’s account balance in the fund bears to the total account balances of all participants in the respective fund.

Investment Options

Participants direct the investment of their contributions and any subsequent changes made to the Company’s Safe Harbor matching and discretionary profit sharing contributions into various investment options offered by the Plan. These options include numerous registered investment companies and a common/collective trust. Participants may change their investment elections at any time for both existing account balances and future contributions.

Vesting

Safe Harbor Contributions: Participant contributions and Company Safe Harbor matching contributions are fully vested when made.

Profit Sharing Contributions: The "vested percentage" in the employees account attributable to discretionary profit sharing contributions is determined under the below schedule. Employees are 100% vested in the discretionary profit sharing contributions if the employee is employed on or after the normal retirement age or if the employee dies or becomes disabled.

| | | | | | | | |

| Vesting Schedule Profit Sharing Contributions |

| Years of Service | | Percentage |

| Less than 2 years | | — | % |

| 2 years | | 20 | % |

| 3 years | | 40 | % |

| 4 years | | 60 | % |

| 5 years | | 80 | % |

| 6 years | | 100 | % |

Distributions and Payments of Benefits

On termination of service due to death, disability, retirement, or other reasons, a participant may receive the value of the vested interest in his or her account as a lump-sum distribution, or as directed by the participant in accordance with the Plan's provisions. The Plan also permits in-service withdrawals for participants attaining certain age requirements and distributions for hardships, as defined in the Plan Document.

Forfeitures

Although participant contributions and the Company's Safe Harbor matching contributions are fully vested at all times, forfeitures could result from the Company's discretionary profit sharing contributions and certain excess matching contributions. Excess Company matching contributions results in a credit to the Plan and are held in a separate account for the payment of Plan administrative expenses or allowed Company contributions. During the year ended December 31, 2021, $34,254 was used to pay advisor fees. At December 31, 2021 and 2020, there was $4,327 and $5,263, respectively, held in this account.

Investment Management Fees and Operating Expenses

Investment management fees and operating expenses charged to the Plan for investments in the various funds are deducted from the income earned on a daily basis and are reflected as a component of the net appreciation in the fair value of investments. Effective January 1, 2015, an ERISA Investment Advisory Agreement was entered into whereby rebates from certain

Spectrum Pharmaceuticals, Inc. 401(k) Plan

Notes to Financial Statements (Continued)

fund investments are deposited into a separate account to be used to pay investment advisory fees and other revenue sharing is credited to the Plan to offset administrative expenses. Such amounts are reported in administrative expenses, rather than in net appreciation in fair value of investments. As of December 31, 2021 and 2020, there was $470 and $304, respectively in Plan assets designated to pay Plan investment advisory fees.

Administrative Expenses

The compensation or fees of accountants, counsel and other specialists and any other costs of administering the Plan are generally paid by the Company (see Note 4). As discussed above, beginning in 2015, there was a change in the reporting of certain investment advisory expenses in the financial statements. Administrative expenses that are not paid by the Company are paid by the Plan. Administrative expenses for the year ended December 31, 2021 paid by the Plan were $58,770 and are included in administrative expenses in the Plan's financial statements.

Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan, subject to the provisions of ERISA. In the event of Plan termination, any unvested amounts of Plan participants would become fully vested.

Notes Receivable from Participants

Loans to participants are secured by the participant’s account balance and may not exceed the lesser of 50% of the participant’s account balance or $50,000 in the aggregate for any individual participant. Loans bear interest at fixed annual rates, as determined by the Plan trustees, that are the prime interest rate plus two percent on the date the loan is processed. At December 31, 2021 and 2020, the annual interest rate of all loans outstanding was between 5.25% and 7.5%. Principal and interest are paid ratably through payroll deductions over a term not to exceed five years, unless the loan qualifies as a home loan, in which case the term may not exceed 15 years. A participant applying for a loan through the Plan will be charged a $100 loan application fee. The loan application fee is nonrefundable and is used to offset the administrative expenses associated with the loan.

2. Summary of Significant Accounting Policies

Basis of Accounting

The Plan’s financial statements are prepared on the accrual basis, in conformity with generally accepted accounting principles in the United States of America ("U.S. GAAP").

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

Investment Valuation and Income Recognition

The Plan’s investments are stated at fair value. See Note 3 for discussion of fair value measurements.

Purchases and sales of securities are recorded on a trade date basis, dividends are recorded on the record date and interest income is recorded on the accrual basis. Net appreciation in fair value of investments includes the Plan's realized/unrealized gains and losses on investments purchased, sold, and held during the year.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent participant loans are reclassified as distributions based upon the terms of the Plan document.

Payment of Benefits

Benefit payments to participants are recorded when paid.

Spectrum Pharmaceuticals, Inc. 401(k) Plan

Notes to Financial Statements (Continued)

Contributions

Contributions made by participants and the Company are recorded on an accrual basis. Contributions are recognized during the period in which the related compensation was paid.

Administrative Expenses

The Company pays for certain administrative expenses for the Plan (see Note 4). Only expenses paid by the Plan are reflected in the Plan’s financial statements.

3. Fair Value Measurements

Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurements and Disclosures, provides the framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under ASC Topic 820 are described as follows:

•Level 1: Quoted prices in active markets for identical assets or liabilities.

•Level 2: Quoted prices for similar assets and liabilities in active markets or inputs that are observable for the asset or liability, either directly or indirectly through market corroboration, for substantially the full term of the financial instrument.

•Level 3: Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

The Plan uses appropriate valuation techniques based on the available inputs to measure the fair value of their investments. When available, the Plan measures fair value using Level 1 inputs because they generally provide the most reliable evidence of fair value. Level 3 inputs are only used when Level 1 or Level 2 inputs are not available. The Plan has no investments that are classified as Level 2 or Level 3 as of December 31, 2021 or 2020.

The registered investment companies are valued at the net asset value (“NAV”) of shares held by the Plan at year-end, based upon quoted market prices. Registered investment companies held by the Plan are open-end mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily NAV and to transact at that price. The registered investment companies held by the Plan are deemed to be actively traded.

The common/collective trust is valued at NAV. The NAV, as provided by the trustee, is used as a practical expedient to estimate fair value. The NAV is based on the fair value of the underlying investments held by the fund less its liabilities. This practical expedient is not used when it is determined to be probable that the fund will sell the investment for an amount different than the reported NAV. Participant transactions (purchases and sales) may occur daily. Were the Plan to initiate a full redemption of the common/collective trust, the investment advisor reserves the right to temporarily delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business manner. A full redemption of the Plan’s interest in the Wells Fargo Stable Return Fund M requires a twelve-month notice period. The common/collective trust held by the Plan files an annual return on Form 5500 as a direct filing entity.

The Spectrum Pharmaceuticals Unitized Stock Fund (the Fund) consists of the Company’s common stock and short-term cash, which provides liquidity for daily trading. The Company’s common stock is valued at the quoted market price from a national securities exchange and the short-term cash investments are held in a money market mutual fund and are valued at fair value based on the NAV per share. A market-based NAV per share is calculated for the Fund periodically, and is the basis for participant transactions. The Fund is valued using the calculated NAV as a practical expedient to estimate fair value.

The preceding methods described may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes the valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date. There have been no changes to the methodologies used at December 31, 2021 or 2020.

The following tables represent the Plan’s fair value hierarchy for its investments as of December 31, 2021 and 2020:

Spectrum Pharmaceuticals, Inc. 401(k) Plan

Notes to Financial Statements (Continued)

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements as of December 31, 2021 |

| Investment Category | Level 1 | | Level 2 | | Level 3 | | Total |

| Total registered investment companies | $ | 21,289,799 | | | $ | — | | | $ | — | | | $ | 21,289,799 | |

| | | | | | | |

Common/collective trust measured at NAV(1) | | | | | | | 1,514,636 | |

Spectrum Pharmaceuticals Unitized Stock Fund(1) | | | | | | | 648,902 | |

| Total assets at fair value | | | | | | | $ | 23,453,337 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements as of December 31, 2020 |

| Investment Category | Level 1 | | Level 2 | | Level 3 | | Total |

| Total registered investment companies | $ | 16,815,141 | | | $ | — | | | $ | — | | | $ | 16,815,141 | |

| | | | | | | |

Common/collective trust measured at NAV(1) | | | | | | | 1,350,867 | |

Spectrum Pharmaceuticals Unitized Stock Fund(1) | | | | | | | 1,785,665 | |

| Total assets at fair value | | | | | | | $ | 19,951,673 | |

(1) Certain investments that are measured at fair value using NAV per share/unit (or its equivalent) practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the statement of net assets available for benefits.

4. Related Party and Party-In-Interest Transactions

The Plan allows for transactions with certain parties who may perform services or have fiduciary responsibilities to the Plan. At December 31, 2021 and 2020, Plan investments include 471,173 and 476,422 shares of common stock of Spectrum, respectively, the Plan's sponsor. The fair value of these shares was $598,390 and $1,624,599, at December 31, 2021 and 2020, respectively. The Plan issues loans to participants, which are secured by the vested balances in the participant’s account. The Company paid certain administrative expenses on behalf of the Plan, which totaled $31,124 relating to the year ended December 31, 2021. Such transactions all qualify as exempt party-in-interest transactions under the provisions of ERISA.

5. Concentration, Market and Credit Risk

The Plan provides for various investment options. Investments are exposed to various risks, such as interest rate, market and credit risk. Due to the level of risk associated with certain investment securities, it is possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amount reported in the Statements of Net Assets Available for Benefits. As of December 31, 2021 and 2020, Spectrum’s stock price closed at $1.27 and $3.41, respectively.

On March 10, 2022, the Company received notice from The NASDAQ Stock Market (“Nasdaq”) that, because the closing bid price for the Company's common stock has fallen below $1.00 per share for 30 consecutive business days, the Company no longer complies with the minimum bid price requirement for continued listing on the Nasdaq Global Market.

Nasdaq's notice has no immediate effect on the listing of the Company's common stock on the Nasdaq Global Market. Pursuant to Nasdaq Marketplace Rule 5810(c)(3)(A), the Company has been provided an initial compliance period of 180 calendar days, or until September 6, 2022, to regain compliance with the minimum bid price requirement. To regain compliance, the closing bid price of the Company's common stock must meet or exceed $1.00 per share for a minimum of 10 consecutive business days prior to September 6, 2022.

If the Company does not regain compliance by September 6, 2022, the Company may be eligible for an additional grace period if it applies to transfer the listing of its common stock to the Nasdaq Capital Market. To qualify, the Company would be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the minimum bid price requirement, and provide written notice of its intention to cure the minimum bid price deficiency during the second compliance period by effecting a reverse stock split if necessary. If the Nasdaq staff determines that the Company will not be able to cure the deficiency, or if the Company is otherwise not eligible for such additional compliance period, Nasdaq will provide notice that the Company's common stock will be subject to delisting. The

Spectrum Pharmaceuticals, Inc. 401(k) Plan

Notes to Financial Statements (Continued)

Company would have the right to appeal a determination to delist its common stock, and the common stock would remain listed on the Nasdaq Global Market until the completion of the appeal process.

6. Tax Status of the Plan

The Plan adopted a volume submitter plan document sponsored by DRS. DRS received an advisory letter from the IRS, dated June 30, 2020, which states that the volume submitter document satisfies the applicable provisions of the IRC. The Plan itself has not received a determination letter from the IRS. However, the Plan Administrator and the Plan’s tax counsel believe that the Plan is currently designed and being operated in compliance with the applicable requirements of the IRC. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

U.S. GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the organization has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2021 and 2020, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

7. Subsequent Events

On January 5, 2022, the Plan Sponsor, Spectrum Pharmaceuticals,Inc., finalized an agreement to restructure the workforce by 30%, which resulted in a partial plan termination. As a result, the affected participants were determined to be 100% vested in their accounts not withstanding their credited services.

Spectrum Pharmaceuticals, Inc. 401(k) Plan

EIN: 93-0979187, PN: 001

Supplementary Information

Schedule H, Part IV, Line 4i

Schedule of Assets (Held at End of Year)

As of December 31, 2021

| | | | | | | | | | | | | | | | | | | | |

| Identity of Issuer | | Description of Investment | | Type of Investment | | Current Value |

| Capital Research and Management Co. | | American Funds New World R5 | | RIC | | $ | 523,996 | |

| Energy Select Sector SPDR | | Energy Select Sector SPDR ETF | | RIC | | 160,643 | |

| Federated Government Obligations | | Federated Government Obligations IC | | RIC | | 408,365 | |

| Fidelity Investments | | Fidelity Advisor Balanced | | RIC | | 1,276,876 | |

| Fidelity Investments | | Fidelity Advisor Investment Grade | | RIC | | 645,560 | |

| Fidelity Investments | | Fidelity Advisor Worldwide | | RIC | | 1,046,819 | |

| Fidelity Investments | | Fidelity Real Estate Investment | | RIC | | 212,699 | |

| Fidelity Investments | | Fidelity Select Health Care Portfolio | | RIC | | 821,782 | |

| Fidelity Investments | | Fidelity Select Software & Comp Port | | RIC | | 2,981,685 | |

| Fidelity Investments | | Fidelity Telecom and Utilities | | RIC | | 45,252 | |

| Hartford Funds | | Hartford International Growth | | RIC | | 506,301 | |

| Janus Mutual Funds | | Janus Enterprise Fund | | RIC | | 1,242,805 | |

| J.P. Morgan Funds | | JP Morgan Large Cap Growth | | RIC | | 92,400 | |

| J.P. Morgan Funds | | JP Morgan Small Cap Core | | RIC | | 642,781 | |

| J.P. Morgan Funds | | JP Morgan Smart Retirement 2020 | | RIC | | 167,323 | |

| J.P. Morgan Funds | | JP Morgan Smart Retirement 2025 | | RIC | | 286,750 | |

| J.P. Morgan Funds | | JP Morgan Smart Retirement 2030 | | RIC | | 477,791 | |

| J.P. Morgan Funds | | JP Morgan Smart Retirement 2035 | | RIC | | 451,945 | |

| J.P. Morgan Funds | | JP Morgan Smart Retirement 2040 | | RIC | | 782,921 | |

| J.P. Morgan Funds | | JP Morgan Smart Retirement 2045 | | RIC | | 465,894 | |

| J.P. Morgan Funds | | JP Morgan Smart Retirement 2050 | | RIC | | 258,713 | |

| J.P. Morgan Funds | | JP Morgan Smart Retirement 2055 | | RIC | | 234,154 | |

| J.P. Morgan Funds | | JP Morgan Smart Retirement Income | | RIC | | 45,807 | |

| MFS Investment Management | | MFS Core Equity Fund | | RIC | | 1,767,282 | |

| Prudential Financial | | Prudential Global Total Return | | RIC | | 109,617 | |

| Putnam Investments | | Putnam Equity Income | | RIC | | 482,606 | |

| State Street Global Advisors | | SPDR Gold Shares | | RIC | | 133,810 | |

| State Street Global Advisors | | SPDR S&P 500 | | RIC | | 2,055,412 | |

| T. Rowe Price Associates, Inc. | | T. Rowe Price Emerging Markets Bond | | RIC | | 262,156 | |

| Vanguard Group, Inc. | | Vanguard Long Term Investment Grade | | RIC | | 788,284 | |

| Vanguard Group, Inc. | | Vanguard Stock Market Index | | RIC | | 1,060,810 | |

| Wells Fargo Advisors | | Wells Fargo Precious Metals | | RIC | | 183,132 | |

| Wells Fargo Advisors | | Wells Fargo Special Mid Cap Value | | RIC | | 667,428 | |

| Wells Fargo Bank, N/A | | Wells Fargo Stable Value Fund M | | CCT | | 1,514,636 | |

| Spectrum Pharmaceuticals, Inc.* | | Spectrum Pharmaceuticals Unitized Stock Fund | | SPCS | | 648,902 | |

| | Total investments | | | | $ | 23,453,337 | |

| | | | | | |

| Participant Loans* | | Participant Loans (maturing 2022 to 2036) at interest rates of 5.25% to 7.5% | | | | $ | 162,465 | |

* Indicates a party-in-interest to the Plan.

RIC - Registered investment company

CCT - Common/collective trust

SPCS - Spectrum Pharmaceuticals Unitized Stock Fund

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the members of the Fiduciary Retirement Committee of the Plan have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| |

| | | | |

| | | | |

| | SPECTRUM PHARMACEUTICALS, INC. |

| | | |

| Date: | June 23, 2022 | By: | | /s/ Thomas J. Riga |

| | | | President and Chief Executive Officer |

| | | | |

EXHIBIT INDEX

| | | | | |

| Exhibit Number | Exhibit Title |

| Consent of Independent Registered Public Accounting Firm, RubinBrown LLP |

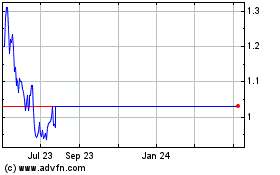

Spectrum Pharmaceuticals (NASDAQ:SPPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Spectrum Pharmaceuticals (NASDAQ:SPPI)

Historical Stock Chart

From Apr 2023 to Apr 2024