via NewMediaWire -- Sono-Tek Corporation (NASDAQ:

SOTK), the leading developer and manufacturer of ultrasonic coating

systems, today reported financial results for the second quarter

and first half periods of fiscal year 2022, ended August 31, 2021.

Second Quarter FY2022 Financial

Highlights: (Compared with prior-year period unless

otherwise noted)

- Net sales were $4,070,000, up 17% or $589,000, driven by

increased sales of OEM systems to the China market.

- Gross Profit increased 28% to $2,074,000 due to higher sales

and product mix.

- Gross Margin expanded 440 basis points to 51.0% primarily due

to product mix.

- Operating income increased 123% to $449,000, compared to

$201,000.

- Net income was $344,000, an increase of 93%.

- Backlog reached a record high of $6,332,000, an increase of 45%

compared with backlog of $4,380,000 on May 31, 2021 (the end of the

fiscal Q1) and increased 64% compared to backlog of $3,851,000 on

February 28, 2021 (the end of fiscal 2021).

- Uplisted to Nasdaq Capital Market on August 27, 2021.

First Half Fiscal 2022 Highlights(Compared

with prior-year period unless otherwise noted)

- Net Sales were $7,715,000, an increase of 12%, primarily driven

by strength in the semiconductor and electronic diagnostic coating

markets.

- Gross Profit increased 23% to $3,898,000 due to higher sales

and product mix.

- Gross Margin expanded 440 basis points to 50.5% primarily due

to product mix and lower than expected warranty and installation

costs.

- Operating Income increased 105% to $791,000 due to increases in

gross profit, partially offset by increases in operating

expenses.

- Income before taxes increased 94% to $802,000, excluding the

benefit from PPP loan forgiveness of $1.0 million.

- As of August 31, 2021, the Company had no outstanding

debt.

Guidance

- Sales Growth Guidance for the third and fourth quarters of

FY2022 is for double digit increases over the comparable periods of

last year.

- Sono-Tek continues to expect the highest annual sales in

corporate history for fiscal year 2022, ending February 28,

2022.

Dr. Christopher L. Coccio, Chairman and CEO,

commented, “Sono-Tek had another strong performance in the second

quarter of fiscal 2022. Net sales increased 17% with strength in

multi-axis coating systems and the OEM markets for semiconductor

and fluxing systems. The electronics/microelectronics segment again

accounted for a large portion of the quarter’s sales, 36% compared

to 23% in the second quarter of last fiscal year, driven by sales

of systems for diagnostic coatings on electronic devices for

COVID-19 test kits and the ongoing global shortages and investments

in semiconductors. Approximately 62% of sales originated outside of

the US and Canada in the quarter. APAC accounted for 65% of foreign

sales, led by sales to China. We expect continued international

growth as countries around the world roll back COVID-19

restrictions and bring manufacturing capacity back online. We’ve

already begun to see increased activity in our global network of

process development labs. We effectively contained costs in the

quarter and the product mix was favorable, enabling a 28% increase

in gross profit to $2.1 million and a 440 basis point expansion in

gross margin to 51.0%. Operating income more than doubled and net

income increased 93%. Backlog reached a record high of $6.3

million, an increase of 45% from the end of the first quarter and

an increase of 64% from the end of our last fiscal year on February

28, 2021.

“The outlook is strong as well. We expect

double-digit sales increases for both the third and fourth quarters

of the fiscal year based on the strength of our backlog. We expect

this growth to generate the highest annual sales in corporate

history for the year ending in February 2022. We’re very excited

about this expanded revenue which reflects the success of our

strategic shift to provide higher value, complete machine solutions

and larger subsystems to OEMs. Our continued positive trajectory

undoubtedly facilitated the uplisting of our common stock to the

Nasdaq Capital Market during the second quarter. SOTK began trading

on Nasdaq on August 27th, and we rang the closing bell a few days

later to mark the achievement of this important milestone,”

concluded Dr. Coccio.

Year-to-Date Fiscal 2022

Results (Narrative compares with prior-year period unless

otherwise noted)

|

|

Six Months Ended August 31, |

Change |

|

|

2021 |

2020 |

$ |

% |

|

Net Sales |

$ 7,715,000 |

$ 6,909,000 |

806,000 |

12% |

|

Gross Profit |

3,898,000 |

3,182,000 |

716,000 |

23% |

|

Gross

Margin |

50.5% |

46.1% |

|

|

|

Operating Income |

$ 791,000 |

$ 386,000 |

405,000 |

105% |

|

Operating

Margin |

10.3% |

5.6% |

|

|

|

Net Income |

$ 1,611,000 |

$ 346,000 |

1,265,000 |

366% |

|

Net

Margin |

20.9% |

5.0% |

|

|

|

Diluted Earnings Per Share |

$ 0.10 |

$ 0.02 |

|

|

|

Weighted Average Shares - Diluted |

15,614,000 |

15,531,000 |

|

|

Second Quarter Fiscal 2021

Results (Narrative compares with prior-year period unless

otherwise noted)

|

|

Three Months Ended August 31, |

Change |

|

|

2021 |

2020 |

$ |

% |

|

Net Sales |

$ 4,070,000 |

$ 3,481,000 |

589,000 |

17% |

|

Gross Profit |

2,074,000 |

1,621,000 |

453,000 |

28% |

|

Gross

Margin |

51.0% |

46.6% |

|

|

|

Operating Income |

$ 449,000 |

$ 201,000 |

248,000 |

123% |

|

Operating

Margin |

11.0% |

5.8% |

|

|

|

Net Income |

$ 344,000 |

$ 178,000 |

166,000 |

93% |

|

Net

Margin |

8.5% |

5.1% |

|

|

|

Diluted Earnings Per Share |

$0.02 |

$0.01 |

|

|

|

Weighted Average Shares - Diluted |

15,602,000 |

15,533,000 |

|

|

Second Quarter FY2022 Financial

Overview

Fiscal second quarter net sales were $4,070,000,

up 17% or $589,000 from the second quarter of last year. The growth

was primarily driven by a significant shipment of multi-axis

coating systems used to coat electronic diagnostic devices for

rapid COVID-19 test kits, as well as strong sales of OEM systems

used in the Semiconductor and Spray Fluxing markets. The

sales increases in these product lines more than offset the

decrease in Integrated Coating Systems, which were lower due to the

shipment of a large integrated coating machine in last year’s

second quarter. The Alternative Energy market was also

strong with growing investments in the clean energy sector from

both government and private industry driving demand for Sono-Tek

equipment for coating membranes used in fuel cells and carbon

capture applications.

In the second quarter of fiscal 2022,

approximately 62% of sales originated outside of the United States

and Canada compared with 38% in the prior year

period. Unwinding from the worst of the global pandemic,

the strong sales in Q2 FY2022 were primarily driven from the Asia

Pacific region (APAC), reflecting the transition of several

countries emerging from COVID-19 lockdowns to bring their

manufacturing operations back online.

Backlog reached a record high of $6,332,000, an

increase of 45% compared with backlog of $4,380,000 on May 31, 2021

(the end of the fiscal Q1) and increased 64% compared to backlog of

$3,851,000 on February 28, 2021 (the end of fiscal 2021).

For the second quarter of fiscal 2022, the gross

profit margin was 51.0% compared with 46.6% for the prior year

period, an improvement of 440 basis points. The

improvement is due to increased sales combined with a favorable

product mix.

Operating income increased 123% to $449,000

compared with $201,000 for the prior year period. Growth in revenue

and gross profit were key factors in the improvement, partially

offset by increased operating expenses. Operating margin for the

quarter increased to 11% compared with 5.8% in the prior year

period.

Net income for the second quarter was $344,000,

an increase of 93%, compared with $178,000 for the prior year

period. On a per share basis, earnings were $0.02 compared with

$0.01 for the prior year period. Diluted weighted average shares

outstanding totaled 15,602,359 compared to 15,533,010 for the prior

year period.

Balance Sheet and Cash Flow Overview

Cash and cash equivalents and short-term

investments at August 31, 2021 were $9.7 million, an increase of

$1.1 million from February 28, 2021, the end of fiscal year

2021. The increase was primarily the result of the

current period’s net income as well as a decrease in account

receivables and an increase in customer deposits, offset by an

increase in inventory to support the growth in backlog.

Capital expenditures in the second quarter

totaled $147,000 and were directed to ongoing upgrades of the

Company’s manufacturing facilities. Sono-Tek anticipates

total capital expenditures will total approximately $300,000 -

$350,000 in the current fiscal year.

At August 31, 2021, the Company had no debt on

its balance sheet.

Conference Call Information

The Company will hold a conference call to

discuss its second quarter fiscal year 2022 financial results

today, Wednesday, October 13th, 2021 at 11:00am EST. To participate

in the call, please dial 1 (877) 270-2148 at least 10 minutes prior

to the start of the call and ask to join the Sono-Tek call. A

simultaneous webcast of the call may be accessed through the

Company's

website, https://www.sono-tek.com/about-us/investors/events-presentations/

A replay of the call will be available at 1

(877) 344-7529, access code 10160904, through October 20,

2021.

About Sono-Tek

Sono-Tek Corporation is the leading developer

and manufacturer of ultrasonic coating systems for applying

precise, thin film coatings to protect, strengthen or smooth

surfaces on parts and components for the

microelectronics/electronics, alternative energy, medical and

industrial markets, including specialized glass applications in

construction and automotive.

The Company’s solutions are

environmentally-friendly, efficient and highly reliable and enable

dramatic reductions in overspray, savings in raw material, water

and energy usage and provide improved process repeatability,

transfer efficiency, high uniformity and reduced emissions.

Sono-Tek’s growth strategy is focused on

leveraging its innovative technologies, proprietary know-how,

unique talent and experience, and global reach to further develop

microscopic coating technologies that enable better outcomes for

its customers’ products and processes.

For further information,

visit www.sono-tek.com.

Safe Harbor Statement

We discuss expectations regarding our future

performance, such as our business outlook, in our annual and

quarterly reports, news releases, and other written and oral

statements. These “forward-looking statements” are based on

currently available competitive, financial and economic data and

our operating plans. They are inherently uncertain, and investors

must recognize that events could turn out to be significantly

different from our expectations and could cause actual results to

differ materially. These factors include, among other

considerations, general economic and business conditions;

political, regulatory, tax, competitive and technological

developments affecting our operations or the demand for our

products; the duration and scope of the COVID-19 pandemic; the

extent and duration of the pandemic’s adverse effect on economic

and social activity, consumer confidence, discretionary spending

and preferences, labor and healthcare costs, and unemployment

rates, any of which may reduce demand for some of our products and

impair the ability of those with whom we do business to satisfy

their obligations to us; our ability to sell and provide our

services and products, including as a result of continued pandemic

related travel restrictions, mandatory business closures, and

stay-at home or similar orders; any temporary reduction in our

workforce, closures of our offices and facilities and our ability

to adequately staff and maintain our operations resulting from the

pandemic; the ability of our customers and suppliers to continue

their operations as result of the pandemic, which could result in

terminations of contracts, losses of revenue; and further adverse

effects to our supply chain; maintenance of increased order

backlog, including effects of any COVID-19 related cancellations;

the imposition of tariffs; timely development and market acceptance

of new products and continued customer validation of our coating

technologies; adequacy of financing; capacity additions, the

ability to enforce patents; maintenance of operating leverage;

maintenance of increased order backlog; consummation of order

proposals; completion of large orders on schedule and on budget;

successful transition from primarily selling ultrasonic nozzles and

components to a more complex business providing complete machine

solutions and higher value subsystems; and realization of quarterly

and annual revenues within forecasted range of sales guidance. We

refer you to documents that the company files with the Securities

and Exchange Commission, which includes Form 10-K and Form 10-Qs

containing additional important information.

For more information, contact:

Stephen J. BagleyChief Financial OfficerSono-Tek

Corporationinfo@sono-tek.com

Investor Relations:Stephanie PrincePCG

Advisory(646) 863-6341sprince@pcgadvisory.com

Financial Tables Follow

SONO-TEK CORPORATIONCONDENSED

CONSOLIDATED BALANCE SHEETS

|

|

|

August 31, |

|

|

|

|

|

|

|

2021 |

|

|

February 28, |

|

|

|

|

|

(Unaudited) |

|

|

2021 |

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,143,106 |

|

|

$ |

4,084,078 |

|

|

|

Marketable securities |

|

|

3,554,124 |

|

|

|

4,563,470 |

|

|

|

Accounts receivable (less allowance of $56,123) |

|

|

1,482,334 |

|

|

|

1,757,802 |

|

|

|

Inventories, net |

|

|

2,923,855 |

|

|

|

2,611,106 |

|

|

|

Prepaid expenses and other current assets |

|

|

124,214 |

|

|

|

151,316 |

|

|

|

Total current assets |

|

|

14,227,633 |

|

|

|

13,167,772 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Land |

|

|

250,000 |

|

|

|

250,000 |

|

|

|

Buildings, net |

|

|

1,525,958 |

|

|

|

1,575,135 |

|

|

|

Equipment, furnishings and building improvements, net |

|

|

1,057,084 |

|

|

|

1,075,190 |

|

|

|

Intangible assets, net |

|

|

85,736 |

|

|

|

95,456 |

|

|

|

Deferred tax asset |

|

|

236,120 |

|

|

|

259,838 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

17,382,531 |

|

|

$ |

16,423,391 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,080,255 |

|

|

$ |

1,294,483 |

|

|

|

Accrued expenses |

|

|

1,398,318 |

|

|

|

1,750,916 |

|

|

|

Customer deposits |

|

|

1,916,784 |

|

|

|

1,166,541 |

|

|

|

Income taxes payable |

|

|

202,188 |

|

|

|

53,567 |

|

|

|

Total current liabilities |

|

|

4,597,545 |

|

|

|

4,265,507 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred tax liability |

|

|

183,011 |

|

|

|

205,562 |

|

|

|

Long term debt, less current maturities |

|

|

- |

|

|

|

1,001,640 |

|

|

|

Total liabilities |

|

|

4,780,556 |

|

|

|

5,472,709 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

Common stock, $.01 par value; 25,000,000 shares authorized,

15,531,285 and 15,452,656 shares issued and outstanding,

respectively |

|

|

155,313 |

|

|

|

154,527 |

|

|

|

Additional paid-in capital |

|

|

9,104,925 |

|

|

|

9,064,994 |

|

|

|

Accumulated earnings |

|

|

3,341,737 |

|

|

|

1,731,161 |

|

|

|

Total stockholders’ equity |

|

|

12,601,975 |

|

|

|

10,950,682 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

17,382,531 |

|

|

$ |

16,423,391 |

|

|

See notes to unaudited condensed consolidated

financial statements.

SONO-TEK CORPORATIONCONDENSED

CONSOLIDATED STATEMENTS OF INCOME(Unaudited)

|

|

|

Six Months EndedAugust 31, |

|

|

Three Months EndedAugust 31, |

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

7,714,935 |

|

|

$ |

6,909,185 |

|

|

$ |

4,070,467 |

|

|

$ |

3,480,641 |

|

|

Cost of Goods Sold |

|

|

3,816,771 |

|

|

|

3,727,486 |

|

|

|

1,996,468 |

|

|

|

1,859,675 |

|

|

Gross Profit |

|

|

3,898,164 |

|

|

|

3,181,699 |

|

|

|

2,073,999 |

|

|

|

1,620,966 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and product development costs |

|

|

826,213 |

|

|

|

834,940 |

|

|

|

412,397 |

|

|

|

423,516 |

|

|

Marketing and selling expenses |

|

|

1,504,245 |

|

|

|

1,388,987 |

|

|

|

739,603 |

|

|

|

682,270 |

|

|

General and administrative costs |

|

|

776,222 |

|

|

|

572,254 |

|

|

|

473,423 |

|

|

|

313,852 |

|

|

Total

Operating Expenses |

|

|

3,106,680 |

|

|

|

2,796,181 |

|

|

|

1,625,423 |

|

|

|

1,419,638 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income |

|

|

791,484 |

|

|

|

385,518 |

|

|

|

448,576 |

|

|

|

201,328 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense |

|

|

- |

|

|

|

(17,704 |

) |

|

|

- |

|

|

|

(9,287 |

) |

|

Interest and Dividend Income |

|

|

11,000 |

|

|

|

25,483 |

|

|

|

7,640 |

|

|

|

2,837 |

|

|

Other Income |

|

|

- |

|

|

|

19,519 |

|

|

|

- |

|

|

|

8,084 |

|

|

Paycheck Protection Program Loan Forgiveness |

|

|

1,005,372 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Before Income Taxes |

|

|

1,807,856 |

|

|

|

412,816 |

|

|

|

456,216 |

|

|

|

202,962 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Expense |

|

|

197,280 |

|

|

|

67,125 |

|

|

|

112,392 |

|

|

|

25,199 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

$ |

1,610,576 |

|

|

$ |

345,691 |

|

|

$ |

343,824 |

|

|

$ |

177,763 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings Per Share |

|

$ |

0.10 |

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings Per Share |

|

$ |

0.10 |

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares - Basic |

|

|

15,500,952 |

|

|

|

15,410,952 |

|

|

|

15,507,484 |

|

|

|

15,424,126 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares - Diluted |

|

|

15,613,930 |

|

|

|

15,530,910 |

|

|

|

15,602,359 |

|

|

|

15,533,010 |

|

See notes to unaudited condensed consolidated

financial statements.

SONO-TEK CORPORATIONCONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(Unaudited)

|

|

|

Unaudited |

|

|

|

|

Six Months EndedAugust 31, |

|

|

|

|

2021 |

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net Income |

|

$ |

1,610,576 |

|

|

$ |

345,691 |

|

|

Adjustments to reconcile net income to net cash (used in)

provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

224,233 |

|

|

|

214,280 |

|

|

Stock based compensation expense |

|

|

40,717 |

|

|

|

16,003 |

|

|

Inventory reserve |

|

|

(24,919 |

) |

|

|

36,000 |

|

|

Paycheck Protection Program Loan Forgiveness |

|

|

(1,005,372) |

|

|

|

- |

|

|

Deferred tax expense |

|

|

1,167 |

|

|

|

- |

|

|

Decrease (Increase) in: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

275,468 |

|

|

|

(418,947) |

|

|

Inventories |

|

|

(287,830 |

) |

|

|

(116,157) |

|

|

Prepaid expenses and other current assets |

|

|

27,101 |

|

|

|

58,863 |

|

|

(Decrease) Increase in: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

|

(563,094 |

) |

|

|

(250,099) |

|

|

Customer deposits |

|

|

750,243 |

|

|

|

(660,588) |

|

|

Income taxes payable |

|

|

148,622 |

|

|

|

(6,878) |

|

|

Net Cash Provided by (Used in) Operating Activities |

|

|

1,196,912 |

|

|

|

(781,832) |

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Purchase of equipment, furnishings and leasehold improvements |

|

|

(147,230 |

) |

|

|

(290,347 |

) |

|

Capital expenditure grant proceeds |

|

|

- |

|

|

|

100,000 |

|

|

Sale (purchase) of marketable securities |

|

|

1,009,346 |

|

|

|

366,639 |

|

|

Net Cash Provided by Investing Activities |

|

|

862,116 |

|

|

|

176,292 |

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Proceeds from note payable |

|

|

- |

|

|

|

1,001,640 |

|

|

Repayment of long term debt |

|

|

- |

|

|

|

(84,040 |

) |

|

Net Cash Provided by Financing Activities |

|

|

- |

|

|

|

917,600 |

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE IN CASH AND CASH EQUIVALENTS |

|

|

2,059,028 |

|

|

|

312,060 |

|

|

|

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS |

|

|

|

|

|

|

|

|

|

Beginning of period |

|

|

4,084,078 |

|

|

|

3,659,551 |

|

|

End of period |

|

$ |

6,143,106 |

|

|

$ |

3,971,611 |

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW DISCLOSURE: |

|

|

|

|

|

|

|

|

|

Interest paid |

|

$ |

- |

|

|

$ |

13,972 |

|

|

Income Taxes Paid |

|

$ |

47,488 |

|

|

$ |

74,004 |

|

See notes to unaudited condensed consolidated

financial statements.

SONO-TEK CORPORATION ADDITIONAL INFORMATION --

PRODUCT, MARKET AND GEOGRAPHIC SALES(unaudited)

Product Sales

|

|

|

Three Months Ended August 31, |

|

|

Change |

|

|

Six Months Ended August 31, |

|

|

Change |

|

|

|

|

2021 |

|

|

2020 |

|

|

$ |

|

|

% |

|

|

2021 |

|

|

2020 |

|

|

$ |

|

|

% |

|

|

Fluxing Systems |

|

$ |

117,000 |

|

|

$ |

94,000 |

|

|

|

23,000 |

|

|

|

24% |

|

|

$ |

476,000 |

|

|

$ |

438,000 |

|

|

|

38,000 |

|

|

|

8% |

|

|

Integrated Coating Systems |

|

|

565,000 |

|

|

|

673,000 |

|

|

|

(108,000 |

) |

|

|

(16% |

) |

|

|

720,000 |

|

|

|

1,849,000 |

|

|

|

(1,129,000) |

|

|

|

(61% |

) |

|

Multi-Axis Coating Systems |

|

|

1,891,000 |

|

|

|

1,985,000 |

|

|

|

(94,000 |

) |

|

|

(5%) |

|

|

|

3,970,000 |

|

|

|

2,898,000 |

|

|

|

1,072,000 |

|

|

|

37% |

|

|

OEM Systems |

|

|

845,000 |

|

|

|

232,000 |

|

|

|

613,000 |

|

|

|

264% |

|

|

|

1,171,000 |

|

|

|

654,000 |

|

|

|

517,000 |

|

|

|

79% |

|

|

Other |

|

|

652,000 |

|

|

|

497,000 |

|

|

|

155,000 |

|

|

|

31% |

|

|

|

1,378,000 |

|

|

|

1,070,000 |

|

|

|

308,000 |

|

|

|

29% |

|

|

TOTAL |

|

$ |

4,070,000 |

|

|

$ |

3,481,000 |

|

|

|

589,000 |

|

|

|

17% |

|

|

$ |

7,715,000 |

|

|

$ |

6,909,000 |

|

|

|

806,000 |

|

|

|

12% |

|

Market Sales

|

|

|

Three Months Ended August 31, |

|

|

Change |

|

|

Six Months Ended August 31, |

|

|

Change |

|

|

|

|

2021 |

|

|

2020 |

|

|

$ |

|

|

% |

|

|

2021 |

|

|

2020 |

|

|

$ |

|

|

% |

|

|

Electronics/Microelectronics |

|

$ |

1,448,000 |

|

|

$ |

811,000 |

|

|

|

637,000 |

|

|

|

79% |

|

|

$ |

3,707,000 |

|

|

$ |

3,051,000 |

|

|

|

656,000 |

|

|

|

22% |

|

|

Medical |

|

|

1,097,000 |

|

|

|

961,000 |

|

|

|

136,000 |

|

|

|

14% |

|

|

|

1,814,000 |

|

|

|

1,653,000 |

|

|

|

161,000 |

) |

|

|

10% |

|

|

Alternative Energy |

|

|

957,000 |

|

|

|

826,000 |

|

|

|

131,000 |

|

|

|

16% |

|

|

|

1,389,000 |

|

|

|

1,221,000 |

|

|

|

168,000 |

|

|

|

14% |

|

|

Emerging R&D and Other |

|

|

269,000 |

|

|

|

479,000 |

|

|

|

(210,000) |

|

|

|

(43% |

) |

|

|

435,000 |

|

|

|

516,000 |

|

|

|

(81,000 |

) |

|

|

(16%) |

|

|

Industrial |

|

|

299,000 |

|

|

|

404,000 |

|

|

|

(105,000) |

|

|

|

(26%) |

|

|

|

370,000 |

|

|

|

468,000 |

|

|

|

(98,000) |

|

|

|

(21% |

) |

|

TOTAL |

|

$ |

4,070,000 |

|

|

$ |

3,481,000 |

|

|

|

589,000 |

|

|

|

17% |

|

|

$ |

7,715,000 |

|

|

$ |

6,909,000 |

|

|

|

806,000 |

|

|

|

12% |

|

Geographic Sales

|

|

|

Three Months Ended August 31, |

|

|

Change |

|

|

Six Months Ended August 31, |

|

|

Change |

|

|

|

|

2021 |

|

|

2020 |

|

|

$ |

|

|

% |

|

|

2021 |

|

|

2020 |

|

|

$ |

|

|

% |

|

|

U.S. & Canada |

|

$ |

1,553,000 |

|

|

$ |

2,156,000 |

|

|

|

(603,000) |

|

|

|

(28% |

) |

|

$ |

2,781,000 |

|

|

$ |

2,911,000 |

|

|

|

(130,000) |

|

|

|

(4% |

) |

|

Asia Pacific (APAC) |

|

|

1,631,000 |

|

|

|

455,000 |

|

|

|

1,176,000 |

|

|

|

258% |

|

|

|

2,853,000 |

|

|

|

2,377,000 |

|

|

|

476,000 |

|

|

|

20% |

|

|

Europe, Middle East, Asia (EMEA) |

|

|

593,000 |

|

|

|

767,000 |

|

|

|

(174,000 |

) |

|

|

(23% |

) |

|

|

1,436,000 |

|

|

|

1,198,000 |

|

|

|

238,000 |

|

|

|

20% |

|

|

Latin America |

|

|

293,000 |

|

|

|

103,000 |

|

|

|

190,000 |

|

|

|

184% |

|

|

|

645,000 |

|

|

|

423,000 |

|

|

|

222,000 |

|

|

|

52% |

|

|

TOTAL |

|

$ |

4,070,000 |

|

|

$ |

3,481,000 |

|

|

|

589,000 |

|

|

|

17% |

|

|

$ |

7,715,000 |

|

|

$ |

6,909,000 |

|

|

|

806,000 |

|

|

|

12% |

|

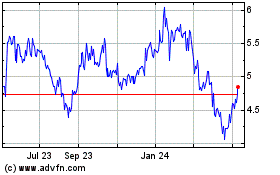

Sono Tek (NASDAQ:SOTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

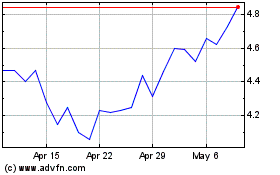

Sono Tek (NASDAQ:SOTK)

Historical Stock Chart

From Apr 2023 to Apr 2024