UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check appropriate box:

|

[X]

|

Preliminary Proxy Statement

|

|

[ ]

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[ ]

|

Definitive Proxy Statement

|

|

[ ]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Pursuant §240.14a-12

|

|

SONOMA PHARMACEUTICALS, INC.

|

|

(Name of Registrant as Specified in its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

[X]

|

No fee required.

|

|

|

|

|

[ ]

|

Fee computed based on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

[ ]

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

4)

|

Date Filed:

|

|

|

|

|

|

Notice

of Special

Stockholders’ Meeting

and Proxy Statement

|

Thursday,

May 30,

2019

at 10 a.m.

PDT

|

TABLE OF CONTENTS

|

Notice of Special Meeting of Stockholders

|

2

|

|

|

|

|

|

|

|

Material United States Federal Income Tax Consequences of the Reverse Stock Split

|

11

|

|

Proxy Summary

|

3

|

|

|

|

|

|

|

|

Tax Consequences of the Reverse Stock Split Generally

|

12

|

|

General Voting and Meeting Information

|

3

|

|

|

|

|

|

|

|

No Dissenter’s Rights

|

13

|

|

Voting Methods

|

3

|

|

|

|

|

|

|

|

Required Vote

|

13

|

|

Voting at the Special Meeting

|

4

|

|

|

|

|

|

|

|

Voting Recommendation

|

13

|

|

Voting Matters and Board Recommendations

|

4

|

|

|

|

|

|

|

|

Security Ownership of Beneficial Ownership

|

13

|

|

Questions and Answers

|

4

|

|

|

|

|

|

|

|

Stockholders Known by Us to Own 5% or More of Our Common Stock

|

14

|

|

Proposal 1- Reverse Stock Split

|

6

|

|

|

|

|

|

|

|

Officers and Directors

|

14

|

|

General

|

6

|

|

|

|

|

|

|

|

Section 16(a) Beneficial Ownership

|

|

|

Effective Date of Reverse Stock Split

|

7

|

|

Reporting Compliance

|

15

|

|

|

|

|

|

|

|

Background and Reasons for the Reverse Stock Split

|

7

|

|

Questions and Answers

|

15

|

|

|

|

|

|

|

|

Determination of Reverse Stock Split

|

8

|

|

Stockholder Proposals and Additional Information

|

15

|

|

|

|

|

|

|

|

Material Effects of the Proposed Reverse Stock Split

|

8

|

|

“Householding” of Proxy Materials

|

16

|

|

|

|

|

|

|

|

Potential Advantages of the Reverse Stock Split

|

9

|

|

Other Matters

|

16

|

|

|

|

|

|

|

|

Potential Disadvantages of the Reverse Stock Split

|

9

|

|

Appendix A- Proxy Card

|

19

|

|

|

|

|

|

|

|

Potential Consequences that the Reverse Stock Split Will Fail to Achieve the Desired Effects

|

10

|

|

Appendix B- Proposed Certificate of Amendment to the Restated Certificate of Incorporation, as Amended

|

21

|

|

|

|

|

|

|

|

Procedures for Effecting the Reverse Stock Split and Exchange of Stock Certificates

|

11

|

|

|

|

|

|

|

|

|

|

|

Fractional Shares

|

11

|

|

|

|

|

|

|

|

|

|

|

Discretionary Authority of the Board to Abandon the Reverse Stock Split

|

11

|

|

|

|

|

|

|

|

|

|

|

Criteria to be Used for Decision to Apply the Reverse Stock Split

|

11

|

|

|

|

1129 N. McDowell Blvd.

Petaluma, California 94954

+1 (707) 283-0550

April 12, 2019

Dear Fellow Stockholder of Sonoma Pharmaceuticals,

Inc.:

We are asking you to approve a reverse

stock split of our outstanding common stock in order to remain a Nasdaq-listed company and to increase our stock price to the range

of $5 - $7 per share. In December of 2018, we had a change in management. In the time since that change, we’ve evaluated

our business and taken measures intended to cut costs while increasing revenues. We believe this approach will increase shareholder

value however, this process will take time to yield positive results.

Effecting a reverse stock split

will allow Sonoma to remain a Nasdaq-listed company. On January 4, 2019, we received a letter from the Listing

Qualifications staff from Nasdaq notifying us that we failed to comply with Nasdaq Listing Rule 5550(a)(2), which requires us

to maintain a bid price of $1.00 per share for our common stock. We were also notified that we have 180 calendar days, or

until July 3, 2019, to regain compliance with the Listing Rule. Commonly, the method of gaining compliance with the Listing

Rule is to effect a reverse stock split of the Company’s common stock. In order to remain competitive with other

specialty pharmaceutical companies, we must maintain our trading volume and trading efficiency. This may not be possible if

we were to list on alternative markets. Therefore, we believe it is in the best interests of the Company and its

stockholders to effect a reverse stock split in order to remain a Nasdaq-listed company.

A reverse stock split would result

in an effective increase in the price per share of our common stock to a price closer to $5 - $7 per share. We believe this

will make Sonoma more appealing to investors reluctant to invest in companies that have a common stock price at or below $1

because they perceive such securities to be less promising investments and to be less liquid securities. The reverse split

would combat this perception and increase investors’ interest in our common stock, which in turn could increase our

marketability and liquidity.

Lastly, effecting a reverse

stock split of our outstanding common stock will allow us to reserve authorized shares, enabling us to attract suitable

investors, if we find it necessary to pursue future financings, and to provide management with incentives to maximize the

value of Sonoma. By increasing the price of our common stock above the $1 minimum bid price and thus remaining a

Nasdaq-listed company, we believe it is more likely that we will be able to pursue financing options which might not be

possible if we were listed on an alternative market less valued by investors than a national securities exchange, such as

Nasdaq. Also, maintaining our number of authorized shares means we will have shares to issue for future financings,

acquisitions, mergers and other corporate transactions.

We are in the process of making exciting

changes to Sonoma which we believe will create value for Sonoma and our stockholders. We thank you for your continued patience

and support while we make these changes, and we look forward to hearing from you at our Special Stockholders’ Meeting.

Our Special Stockholders’ Meeting

will be held at 10:00 a.m. Pacific Daylight Time, on Thursday, May 30, 2019, at our offices located at 1129 N. McDowell Blvd.

Petaluma, CA 94954.

Sincerely,

|

|

|

Bubba Sandford

|

|

Chief Executive Officer

|

|

|

|

Page

1

Page

1

|

Notice

of Special Meeting of Stockholders

Thursday, May 30, 2019 10:00 a.m., Pacific

Daylight Time

1129 N. McDowell Blvd., Petaluma, CA 94954

NOTICE IS HEREBY GIVEN that a Special Meeting

of Stockholders (the “Special Meeting”) of Sonoma Pharmaceuticals, Inc., a Delaware corporation (the “Company”)

will be held on Thursday, May 30, 2019 at 10:00 a.m. Pacific Daylight Time, at the Company’s principal executive offices

located at 1129 N. McDowell Blvd., Petaluma, California 94954, for the following purposes, as more fully described in the proxy

statement accompanying this notice:

|

|

1.

|

To (i) approve an amendment to the Company’s Restated Certificate of Incorporation, as amended, and authorize the Company’s Board of Directors, if in their judgment it is necessary, to effect a reverse stock split of the Company’s outstanding common stock, $0.0001 par value per share, at a whole number ratio in the range of 1-for-6 to 1-for-9, such ratio to be determined in the discretion of the Company’s Board of Directors, and to (ii) authorize the Company’s Board of Directors to file such amendment, if in their judgment it is necessary, that would effect the foregoing; and

|

|

|

2.

|

To transact such other business as may properly come before the meeting or any adjournment or adjournments thereof.

|

Only stockholders of record at the

close of business on April 5, 2019 are entitled to notice of and to vote at the Special Meeting and any adjournments or

postponements thereof. For ten days prior to the Special Meeting, a complete list of stockholders entitled to vote at the

Special Meeting will be available for inspection at the Company’s principal executive offices, 1129 N. McDowell Blvd.,

Petaluma, California 94954.

All stockholders are cordially invited

to attend the Special Meeting in person. Whether or not you plan to attend, please sign and return the proxy in the envelope enclosed

for your convenience, or vote your shares by telephone or by the Internet as promptly as possible. Telephone and Internet voting

instructions can be found on the attached proxy. Should you receive more than one proxy because your shares are registered in different

names and addresses, each proxy should be signed and returned to assure that all your shares will be voted. You may revoke your

proxy at any time prior to the Special Meeting. If you attend the Special Meeting and vote in person, your proxy will be revoked

and only your vote in person at the Special Meeting will be counted.

This Proxy Statement is available at https://www.proxyvote.com.

You can also access these materials by scanning the QR codes on the last page of this Proxy Statement, or by contacting our Investor

Relations department by email at

ir@sonomapharma.com

.

|

|

By Order of the Board of Directors,

Frederick Sandford

Chief Executive Officer and Chief Financial Officer

Petaluma, California

April 12, 2019

|

Your Vote is Important to us

.

Regardless of whether you plan to attend, we urge all stockholders to vote on the matters described in the accompanying proxy statement.

We hope that you will promptly vote and submit your proxy by dating, signing and returning the enclosed proxy card. This will not

limit your rights to attend or vote at the Special Meeting.

|

|

|

Page

2

Page

2

|

Proxy

Summary

General Voting and Meeting

Information

The Notice and Access cards detailing

the availability of this proxy statement and proxy card are being mailed to stockholders on or about April 22, 2019, and all proxy

documents will be made available via www.proxyvote.com. It is important that you carefully review the proxy materials and follow

the instruction below to cast your vote on all voting matters.

Voting Methods

Even if you plan to attend the

Special Meeting in person please vote as soon as possible by using one of the following advance voting methods.

Voting via

the Internet or by telephone helps save money by reducing postage and proxy tabulation costs.

|

VOTE BY INTERNET*

24 hours a day / 7 days a week

|

Instructions:

1.

Read this Proxy Statement.

2. Go to the applicable website listed on your proxy card or

voting instructions form.

3. Have this Proxy Statement, proxy card, or voting instruction

form in hand and follow the instructions.

|

|

VOTE BY TELEPHONE*

24 hours a day / 7 days a week

|

Instructions:

1.

Read this Proxy Statement.

2.

Call the number listed on your proxy card or voting instructions

form.

3. Have this Proxy Statement, proxy card, or voting instruction

form in hand and follow the instructions.

|

|

VOTE BY MAIL

|

Instructions:

1.

Read this Proxy Statement.

2.

Fill out, sign and date each proxy card or voting instruction

form you receive and return it in the prepaid envelope.

|

*If you are a beneficial owner

you may vote via the telephone or internet if your bank, broker, or other nominee makes those methods available, in which case

they will include the instructions with the proxy materials. If you are a stockholder of record, Sonoma will include instructions

on how to vote via internet or telephone directly on your proxy voting card.

We encourage you to register to receive

all future shareholder communications electronically, instead of print. This means that access to the annual report, proxy statement,

and other correspondence will be delivered to you via e-mail.

|

|

|

Page

3

Page

3

|

Voting at the Special Meeting

Stockholders of record may vote at the

Special Meeting. Beneficial owners may vote in person if they have a legal proxy.

Even if you plan to attend the Special Meeting,

we recommend that you also submit your proxy or voting instructions or vote by telephone or the Internet so that your vote will

be counted if you later decide not to attend the meeting.

Voting Matters and Board Recommendations

Stockholders are being asked to vote on

the following matter at the Special Meeting:

|

Proposal 1

|

Recommendation

|

|

Amendment to Restated Certificate of Incorporation, as Amended, to Effect a Reverse Stock Split

|

FOR

|

|

To (i) approve an amendment to our Restated

Certificate of Incorporation, as amended, and to authorize our Board of Directors, if in their judgment it is necessary, to effect

a reverse stock split of our outstanding common stock, $0.0001 par value per share, at a whole number ratio in the range of 1-for-6

to 1-for-9, such ratio to be determined in the discretion of our Board of Directors, and to (ii) authorize our Board of Directors

to file such amendment, if in their judgment it is necessary, that would effect the foregoing

|

Questions and Answers

1.

What is a proxy statement, what is a proxy and how does it work?

A proxy statement is a document that the U.S. Securities and Exchange Commission requires us to give you when we ask you to sign

a proxy card designating someone other than you to vote the stock you own. The written document you sign indicating who may vote

your shares of common stock is called a proxy card and the person you designate to vote your shares is called a proxy. The Board

of Directors is asking to act as your proxy. By signing and returning to us the proxy card enclosed you are designating us as

your proxy to cast your votes at the Special Meeting of Stockholders. We will cast your votes as you indicate on the enclosed

proxy card.

Our employees, officers and

directors may solicit proxies. We have retained D.F. King & Co., Inc. to solicit proxies for us. We have agreed to compensate

D.F. King a fee of $7,500, as well as reimburse $4.50 per incoming/outgoing stockholder telephone call. We have also agreed to

reimburse D.F. King for other reasonable expenses. We will bear the cost of soliciting proxies and will reimburse brokerage houses

and other custodians, nominees and fiduciaries for their reasonable, out-of-pocket expenses for forwarding proxy and solicitation

material to the owners of our common stock. Please contact D.F. King toll free at (800) 676-7437 or SNOA@dfking.com, or by mail

at 48 Wall Street, 22nd Floor, New York, New York 10005 if you have any questions or require any assistance. Banks and Brokers

may call collect D.F. King at (212) 269-5550.

2.

Who is entitled to vote at the Special Meeting of Stockholders?

Only

stockholders who were Sonoma Pharmaceuticals, Inc. stockholders of record at the close of business on April 5, 2019,

(the “Record Date”) may vote at the Special Meeting of Stockholders. As of the close of business on the Record

Date, there were 11,972,328 shares of our common stock outstanding. Each stockholder is entitled to one vote for each share

of our common stock held as of the Record Date.

3.

What is the difference between a stockholder of record and a beneficial owner?

If your shares are registered directly in your name with Sonoma’s transfer agent, Computershare, Inc., you are considered,

with respect to those shares, a

stockholder of record

. As a stockholder of record, a Proxy Statement and proxy card have

been sent directly to you by us.

|

|

|

Page

4

Page

4

|

If your shares are held in a

brokerage account or by a bank or other nominee, you are considered the beneficial owner of your shares of common stock. This Proxy

Statement has been forwarded to you by your broker, bank or nominee who is considered, with respect to those shares, the stockholder

of record. As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote your shares by using

the voting instruction form included in the mailing.

4.

What does it mean if I receive more than one proxy card?

If you hold your shares in multiple registrations, or in both registered and street name, you will receive a proxy card for each

account. Please mark, sign, date and return each proxy card you receive. If you choose to vote by telephone or Internet, please

vote each proxy card you receive.

5.

How will my shares be voted?

To designate how you would like to vote, fill out the proxy card indicating how you would like your votes cast.

If you sign and return the enclosed

proxy, but do not specify how to vote, we will vote your shares as follows:

Ø

“

FOR

” Proposal No. 1 to effect the Reverse Stock Split.

6. Can I change

my vote or revoke my proxy?

You may change your vote or revoke your proxy at any time prior to the vote at the Special Meeting. If you submitted your proxy

by mail, you must file with our Secretary, at Sonoma Pharmaceuticals, Inc., 1129 N. McDowell Blvd., Petaluma, California 94954,

a written notice of revocation or deliver a valid, later-dated proxy. If you submitted your proxy by telephone or the Internet,

you may change your vote or revoke your proxy with a later telephone or Internet proxy, as the case may be.

Attendance at the

Special Meeting will not have the effect of revoking a proxy unless you give written notice of revocation to the Secretary before

the proxy is exercised or you vote by written ballot at the Special Meeting.

7.

What is a broker non-vote and what is the impact of not voting?

A broker “non-vote” occurs when a nominee holding shares of common stock for a beneficial owner, such as a bank or

broker, does not vote on one or more proposals because the nominee does not have discretionary voting power on that matter, which

is also referred to as holding shares in street name. We believe that Proposal No. 1 is a routine proposal on which a broker or

other nominee is generally empowered to vote. Thus, if you are a beneficial owner holding shares through a broker, bank or other

holder of record and you do not vote on this proposal, your broker may cast a vote on your behalf for this Proposal.

If you are a stockholder of

record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Special Meeting.

8.

What constitutes a quorum?

A quorum is the minimum number of stockholders necessary to conduct the Special Meeting. The presence at the Special Meeting,

in person or by proxy, of the holders of a majority of common stock outstanding on the Record Date will constitute a quorum. As

of the close of business on the Record Date, there were 11,972,328 shares of our common stock outstanding. Votes “for,”

“against” and “abstentions” will all be counted as present to determine whether a quorum has been established.

9. What

is the vote required for Proposal No. 1 to pass?

The affirmative “FOR” vote of a majority of the outstanding shares of common stock entitled to vote at the Special

Meeting is needed (i) to approve an amendment to our Restated Certificate of Incorporation, as amended, and to authorize our Board

of Directors, if in their judgment it is necessary, to effect a reverse stock split of our outstanding common stock, $0.0001 par

value per share, at a whole number ratio in the range of 1-for-6 to 1-for-9, such ratio to be determined in the discretion of

our Board of Directors, and (ii) to authorize our Board of Directors to file such amendment, if in their judgment it is necessary,

that would effect the foregoing. A properly executed proxy marked “ABSTAIN” with respect to this proposal will not

be voted, although it will be counted for purposes of determining the number of shares of common stock entitled to vote. Accordingly,

an abstention will have the effect of a negative vote. Because Proposal No. 1 is a routine proposal on which a broker or other

nominee is generally empowered to vote, broker “non-votes” likely will not result from this Proposal. Thus, if you

are a beneficial owner holding shares through a broker, bank or other holder of record and you do not vote on this proposal, your

broker may cast a vote on your behalf for this Proposal.

|

|

|

Page

5

Page

5

|

We do not know of any other

matters that may come before the Special Meeting other than the proposal included herein. If any other matters are properly presented

at the Special Meeting, the persons named as proxies in the accompanying proxy card intend to vote or otherwise act in accordance

with their judgment on the matter.

Proposal

No. 1 Reverse Stock Split

To approve an amendment to the Company’s

Restated Certificate of Incorporation, as amended, and to authorize the Company’s Board of Directors, if in their judgment

it is necessary, to effect a reverse stock split of the Company’s outstanding common stock, $0.0001 par value per share,

at a whole number ratio in the range of 1-for-6 to 1-for-9, such ratio to be determined in the sole discretion of the Company’s

Board of Directors.

General

Our Board of Directors has unanimously

adopted a resolution approving, declaring advisable and recommending to the stockholders to approve an amendment to the Company’s

Restated Certificate of Incorporation, as amended, and to authorize our Board of Directors, if in their judgment it is necessary,

to effect a reverse stock split of our outstanding common stock, $0.0001 par value per share, at any whole number ratio not less

than 1-for-6 (every six shares would be combined into one) and not greater than 1-for-9 (every nine shares would be combined into

one), with the exact ratio to be set within such range in the discretion of our Board of Directors, or the Reverse Stock Split.

The principal effect of the Reverse Stock Split will be to decrease the number of our outstanding shares of common stock, such

split to combine a number of outstanding shares of our common stock between six and nine, such number consisting of only whole

shares, into one share of common stock based on the Reverse Stock Split ratio selected by our Board of Directors.

Approval of this proposal will grant the

Board the authority, without further action by the stockholders, to carry out the amendment to the Restated Certificate of Incorporation,

as amended, after the date stockholder approval for the amendment is obtained but before the anniversary of the shareholder approval

of the Reverse Stock Split, May 30, 2020, with the exact timing and Reverse Stock Split ratio within such timeframe to be determined

in the sole discretion of the Board and within the range approved by our stockholders. If the Reverse Stock Split is not effectuated

before the anniversary of the shareholder approval of the Reverse Stock Split, May 30, 2020, the Reverse Stock Split cannot be

effectuated unless again approved by our stockholders. Upon such action of the Board, the Reverse Stock Split will become effective

upon the filing of an amendment to our Restated Certificate of Incorporation, as amended, with the Secretary of State of the State

of Delaware, or the Certificate of Amendment, whereby each share of common stock outstanding at the effective time of the Reverse

Stock Split, will, without any action on the part of the holder thereof, become equal to no less than one-sixth of a share of our

common stock and no greater than one-ninth of a share of our common stock.

The Board of Directors reserves the right,

even after stockholder approval, to abandon or postpone the filing of the Certificate of Amendment if the Board of Directors determines

that the action is not in the best interests of the Company and our stockholders. If the amendment effecting the Reverse Stock

Split proposal subsequently approved by the stockholders is not implemented by the Board of Directors before the anniversary of

the shareholder approval of the Reverse Stock Split, May 30, 2020, the proposal will be deemed abandoned, without any further effect.

In that case, the Board of Directors may again seek stockholder approval at a future date for a reverse stock split if it deems

a reverse stock split to be advisable at that time.

The amendment to our Restated Certificate

of Incorporation, as amended, to effect the Reverse Stock Split will not change the terms of our common stock. After the Reverse

Stock Split, the par value of our common stock will remain unchanged at $0.0001 per share and shares of common stock will have

the same voting rights and will be identical in all other respects to the common stock currently authorized. Our authorized common

stock will not be proportionally decreased in conjunction with the Reverse Stock Split. Each stockholder’s percentage ownership

of the new, post-split common stock will not be altered except for the effect of eliminating fractional shares. The common stock

issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable. The Reverse Stock Split is not intended as,

and will not have the effect of, a “going private transaction” covered by Rule 13e−3 under the Exchange Act.

Following the Reverse Stock Split, we will continue to have the same number of stockholders and we will still be subject to the

periodic reporting requirements of the Exchange Act.

Certain of our officers and directors have

an interest in this Reverse Stock Split as a result of their ownership of shares of stock of the Company, as discussed in further

detail in the section entitled “

Security Ownership of Certain Beneficial Owners

” set forth below.

|

|

|

Page

6

Page

6

|

Effective Date of Reverse Stock Split

The Reverse Stock Split will become effective

upon the filing of the Certificate of Amendment with the Secretary of State of the State of Delaware which states that, upon the

filing of the Certificate of Amendment, each share of common stock then issued and outstanding would automatically become and be

converted into not less than one-sixth and not greater than one-ninth of a share of common stock, as determined in the sole discretion

of our Board of Directors.

The exact date of the Reverse Stock Split

will be determined by the Board in its sole discretion, unless the Board abandons the Reverse Stock Split in its sole discretion.

If the Reverse Stock Split is not effectuated before the anniversary of the shareholder approval of the Reverse Stock Split, May

30, 2020, the Reverse Stock Split cannot be effectuated unless again approved by the stockholders.

The text of the form of the Certificate

of Amendment relating to this proposal, which we would file with the Secretary of State of the State of Delaware to effect the

Authorized Share Increase, is attached to this Proxy Statement as

Appendix B.

Background and Reasons for the Reverse Stock Split

The Board recommends the Reverse Stock

Split for the following reasons:

|

|

·

|

The Board believes that the Reverse Stock Split is the most effective means of increasing the per-share market price of our common stock in order to maintain our listing on The Nasdaq Capital Market; and

|

|

|

·

|

The Board believes that a higher per-share market price of our common stock could encourage investor interest in our Company and promote greater liquidity for our stockholders.

|

Our common stock is listed on The Nasdaq

Capital Market under the symbol “SNOA.” We believe our listing on The Nasdaq Capital Market supports and maintains

the liquidity of our common stock and company recognition for our stockholders.

In order for our common stock to continue

to be quoted on The Nasdaq Capital Market, we must satisfy the continued listing requirements established by The Nasdaq Stock Market

LLC. Among other requirements, we are required to maintain a minimum bid price of $1.00 per share for our common stock.

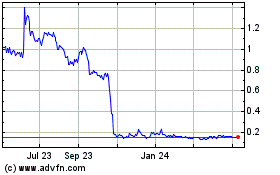

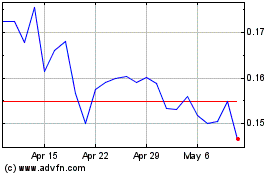

On January 4, 2019, we received a letter

from the Listing Qualifications staff from Nasdaq notifying us that, for the last 30 consecutive business days, we failed to comply

with Nasdaq Listing Rule 5550(a)(2), which requires us to maintain a minimum bid price of $1.00 per share for our common stock.

In accordance with Listing Rule 5810(c)(3)(A), Nasdaq granted us a compliance period of 180 calendar days, or until July 3, 2019,

to regain compliance with the Listing Rule. If at any time during this 180-day period the closing bid price of our common stock

is at least $1.00 for a minimum of 10 consecutive business days, we will regain compliance with the Listing Rule and Nasdaq will

close the matter.

The Board of Directors’ primary objective

in proposing the Reverse Stock Split is to increase the per-share market price of our common stock in order to maintain our listing

on The Nasdaq Capital Market. Effecting the Reverse Stock Split would reduce our total shares of common stock outstanding, which

the Board believes will increase the price per share of our common stock and therefore, better enable us to maintain the listing

of our common stock on The Nasdaq Capital Market. However, the effect of the Reverse Stock Split on the market value of our common

stock cannot be predicted with any certainty, and there can be no assurance that the market price per post-split share will either

exceed or remain in excess of the $1.00 minimum bid price for a sustained period of time. The Reverse Stock Split itself does not

affect our market value, and the market price of our common stock may also be based on other factors that are unrelated to the

number of shares outstanding, including our future performance.

If we are unable to regain compliance with

the Nasdaq Listing Rules, we may be delisted from The Nasdaq Capital Market. If we are delisted and cannot obtain listing or quotation

on another major market or exchange, our stock’s liquidity would likely suffer, and we would likely experience reduced investor

interest. Such factors may result in a decrease in our stock’s trading price. Delisting from The Nasdaq Capital Market also

may restrict us from securing additional financing.

While our stock price could trade above

the minimum bid price of $1.00 on its own accord without engaging in the Reverse Stock Split, our Board believes that it is in

our best interests and in the interests of our stockholders to seek approval of the proposed amendment to our Restated Certificate

of Incorporation, as amended, to effect the Reverse Stock Split in order to increase the likelihood that we regain compliance with

the minimum bid price requirement before our stock is delisted from Nasdaq.

|

|

|

Page

7

Page

7

|

Determination of Reverse Stock Split Ratio

The Board of Directors believes that stockholder

approval of a range of potential exchange ratios (rather than a single exchange ratio) is in the best interests of our Company

and stockholders because it provides the Board of Directors with the flexibility to achieve the desired results of the Reverse

Stock Split and because it is not possible to predict market conditions at the time the Reverse Stock Split would be implemented.

The ratio to be selected by the Board of Directors in its sole discretion will be a whole number ratio not less than 1-for-6 and

not more than 1-for-9.

In determining the Reverse Stock Split

ratio, the Board of Directors will consider, among other factors:

|

|

·

|

The historical and projected performance of our common stock;

|

|

|

·

|

Prevailing market conditions;

|

|

|

·

|

General economic and other related conditions in our industry and in the marketplace;

|

|

|

·

|

The projected impact of the selected Reverse Stock Split ratio on trading liquidity in our common stock and our ability to maintain the listing of our common stock on The Nasdaq Capital Market;

|

|

|

·

|

Our capitalization (including the number of shares of our common stock issued and outstanding);

|

|

|

·

|

The prevailing trading price for our common stock and the volume level thereof; and

|

|

|

·

|

Potential devaluation of our market capitalization as a result of a Reverse Stock Split.

|

The purpose of asking for authorization

to implement the Reverse Stock Split at a ratio to be determined by our Board of Directors, as opposed to a ratio fixed in advance,

is to give the Board of Directors the flexibility to take into account then-current market conditions and changes in price of our

common stock and to respond to other developments that may be deemed relevant when considering the appropriate ratio.

Material Effects of the Proposed Reverse Stock Split

The Board believes that the Reverse Stock

Split will increase the per-share market price of common stock in order to, among other things, maintain our listing on The Nasdaq

Capital Market and generate interest in our Company among investors. The Board cannot predict, however, the effect of the Reverse

Stock Split upon the market price for our common stock, and the history of similar reverse stock splits for companies that have

effected reverse stock splits is varied. The market price per share of our common stock after the Reverse Stock Split may not rise

in proportion to the reduction in the number of shares of common stock outstanding resulting from the Reverse Stock Split, which

would reduce our market capitalization. The market price per post-split share may not remain in excess of the $1.00 minimum bid

price as required by The Nasdaq Capital Market, or we may not otherwise meet the additional requirements for continued listing

on The Nasdaq Capital Market. The market price of our common stock may also be based on our performance and other factors, the

effect of which the Board cannot predict.

The Reverse Stock Split will affect all

of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests or proportionate voting

power, except to the extent that the Reverse Stock Split results in any of the stockholders owning a fractional share. In lieu

of issuing fractional shares, we will pay in cash the value of each fractional share.

The principal effects of the Reverse Stock

Split will be that

|

|

(i)

|

each outstanding share of common stock issued and outstanding will automatically be changed into not less than one-sixth and not greater than one-ninth of a share of common stock, as determined in the discretion of our Board of Directors;

|

|

|

(ii)

|

the number of shares of common stock subject to our outstanding options and warrants entitling the holders thereof to purchase shares of common stock will be reduced by a factor not less one-sixth and not greater than one-ninth of common stock, as determined in the discretion of our Board of Directors and any applicable exercise price will be appropriately adjusted, resulting in the same aggregate price being required to be paid upon exercise thereof immediately preceding the Reverse Stock Split; and

|

|

|

(iii)

|

the number of shares reserved for issuance pursuant to our stock plans will be reduced by a factor not less than one-sixth and not greater than one-ninth of a share of common stock, as determined in the discretion of our Board of Directors, of the number of shares currently included in each such plan.

|

|

|

|

Page

8

Page

8

|

The Reverse Stock Split will not change

the terms of our common stock. After the Reverse Stock Split, the par value of our common stock will remain unchanged at $0.0001

per share and shares of common stock will have the same voting rights and will be identical in all other respects to the common

stock currently authorized. Our authorized common stock will not be proportionally decreased in conjunction with the Reverse Stock

Split. Each stockholder’s percentage ownership of the new common stock will not be altered except for the effect of eliminating

fractional shares. The common stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable. The Reverse

Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered by Rule 13e−3

under the Exchange Act. Following the Reverse Stock Split, we will continue to have the same number of stockholders and we will

still be subject to the periodic reporting requirements of the Exchange Act.

The Reverse Stock Split would result in

some stockholders owning “odd-lots” of less than 100 shares of our common stock. Brokerage commissions and other costs

of transactions in odd-lots are generally higher than the costs of transactions in “round-lots” of even multiples of

100 shares.

Potential Advantages of the Reverse Stock Split

Maintain our Listing on The Nasdaq Capital

Market

. We believe the delisting of our common stock from The Nasdaq Capital Market would be undesirable for our stockholders

and potentially detrimental to our business. If our common stock is delisted from The Nasdaq Capital Market, our common stock would

likely be quoted on the OTCQX, OTCQB or OTCBB tier of the OTC Markets. It is the Board’s opinion that these alternative markets

have significantly lower trading volume and are much less efficient than The Nasdaq Capital Market. As a result, investors may

find it more difficult to trade, or to obtain frequent quotations, as to the market value of our common stock. Trading on other

markets can therefore negatively impact the liquidity and marketability of our common stock and our ability to obtain future financing

on favorable terms.

We believe that a Reverse Stock Split would

result in an increase in the price per share of our common stock, and thereby help us meet the minimum bid price of $1.00 per share

for our common stock as required by the Nasdaq Listing Rules. While our stock price could trade above $1.00 on its own accord without

engaging in the Reverse Stock Split, our Board believes that it is in our best interests and in the interests of our stockholders

to seek approval of the proposed amendment to our Restated Certificate of Incorporation, as amended to effect the Reverse Stock

Split in order to increase the likelihood that we regain compliance prior to, and to avoid, delisting from Nasdaq. Even if our

common stock’s closing bid price were to satisfy the minimum closing bid price requirements prior to approval of this proposal,

we may still effect the Reverse Stock Split if our stockholders approve this proposal and our Board determines that effecting the

Reverse Stock Split would be in the best interests of our Company and our stockholders.

Increase our Common Stock Price to a

Level More Appealing for Investors

. The Board believes an increase in the stock price of our common stock as a result of the

Reverse Stock Split may enhance the appeal of our common stock to the financial community, including institutional investors and

the general investing public, and improve our Company’s marketability, thus enhancing our liquidity. We believe that a number

of institutional investors and investment funds are reluctant to invest in lower-priced securities and that brokerage firms may

be reluctant to recommend lower-priced stock to their clients, which may be due in part to a perception that lower-priced securities

are less promising as investments, are less liquid, or are less likely to be followed by institutional securities research firms.

We believe that the anticipated increased stock price immediately following and resulting from the Reverse Stock Split may encourage

further interest in our common stock.

Facilitate Potential Future Financings.

By preserving our listing on The Nasdaq Capital Market, we can continue to consider and pursue future financing options to

support our business that would not be likely be available to us if our common stock was not listed on a national exchange. We

believe being listed on a national securities exchange, such as The Nasdaq Capital Market, is valued highly by many long-term and

institutional investors. A listing on a national securities exchange also has the potential to create better liquidity and reduce

volatility for buying and selling shares of our stock, which benefits our current and future stockholders.

Potential Disadvantages of the Reverse Stock Split

The Reverse Stock Split May Not Increase

our Stock Price over the Long-Term

. As noted above, the principal purpose of the Reverse Stock Split is to increase the per-share

market price of our common stock above the $1.00 per share minimum bid price requirement under the Nasdaq Listing Rules. We cannot

assure you, however, that the Reverse Stock Split will accomplish this objective for any meaningful period of time. While we expect

that the reduction in the number of outstanding shares of common stock will proportionally increase the market price of our common

stock, we cannot assure you that the Reverse Stock Split will increase the market price of our common stock by a multiple of the

Reverse Stock Split ratio chosen by our Board of Directors in its sole discretion, or result in any permanent or sustained increase

in the market price of our stock, which is dependent upon many factors, including our business and financial performance, general

market conditions, and prospects for future success. Thus, while our stock price might meet the continued listing requirements

for The Nasdaq Capital Market initially, we cannot assure you that it will continue to do so.

|

|

|

Page

9

Page

9

|

The Reverse Stock Split May Lead to

a Decrease in our Overall Market Capitalization

. Should the market price of our common stock decline after the Reverse Stock

Split, the percentage decline may be greater, due to the smaller number of shares outstanding, than it would have been prior to

the Reverse Stock Split. A reverse stock split is often viewed negatively by the market and, consequently, can lead to a decrease

in our overall market capitalization. If the per share market price does not increase in proportion to the Reverse Stock Split

ratio, then the value of our Company, as measured by our stock capitalization, will be reduced. In some cases, the per-share stock

price of companies that have effected reverse stock splits subsequently declined back to pre-reverse split levels, and accordingly,

we cannot assure you that the total market value of your shares will remain the same after the Reverse Stock Split is effected,

or that the Reverse Stock Split will not have an adverse effect on our stock price due to the reduced number of shares outstanding

after the Reverse Stock Split.

The Reverse Stock Split May Decrease

the Liquidity of the Common Stock

. Although the Board believes that the anticipated increase in the market price of our common

stock could encourage interest in our common stock and possibly promote greater liquidity for our stockholders, such liquidity

could also be adversely affected by the reduced number of shares outstanding after the Reverse Stock Split. Our outstanding shares

will be reduced by a factor of 1-for-6 to 1-for-9, such ratio to be determined in the sole discretion of our Board of Directors,

which may lead to reduced trading and a smaller number of market makers for our common stock.

Dilution to Existing Stockholders, in

Case the Company Issues New Shares of Common Stock

. Although the Reverse Stock Split will not in itself cause dilution to our

existing stockholders, the number of authorized shares the Company will be authorized to issue will not be decreased proportionally.

Thus, should the Company decide to issue new shares of common stock in the future to raise capital, existing stockholders’

ownership will be diluted.

Potential Consequences that the Reverse Stock Split Will

Fail to Achieve the Desired Effects

Stockholders should note that the effect

of the Reverse Stock Split upon the market price of our common stock cannot be accurately predicted. In particular, we cannot assure

you of the per-share market price for shares of our common stock after the Reverse Stock Split. Furthermore, we cannot assure you

that the market price of our common stock immediately after the proposed Reverse Stock Split will be maintained for any period

of time. Even if an increased per-share price can be maintained, the Reverse Stock Split may not achieve the desired results that

have been outlined above. Moreover, because some investors may view the Reverse Stock Split negatively, we cannot assure you that

the Reverse Stock Split will not adversely impact the market price of our common stock or, alternatively, that the market price

following the Reverse Stock Split will either exceed or remain in excess of the current market price. While we expect the Reverse

Stock Split to be sufficient to prevent Nasdaq from delisting our common stock, it is possible that, even if the Reverse Stock

Split results in a bid price for our common stock that exceeds the minimum requirement of $1.00 per share, we may not be able to

continue to satisfy the additional criteria for continued listing of our common stock on The Nasdaq Capital Market.

We would also need to satisfy additional

criteria to continue to have our common stock eligible for continued listing on The Nasdaq Capital Market. These criteria require,

in addition to the requirement of the minimum bid price of $1.00 per share for our common stock, require us to maintain:

|

|

·

|

Stockholders’ equity of at least $2.5 million or a market value of listed securities of $35 million, or net income from continuing operations (in the latest fiscal year or in 2 of the last 3 fiscal years) of $500,000;

|

|

|

·

|

At least 500,000 publicly held shares (publicly held shares defined under Nasdaq’s rules as the shares not held directly or indirectly by an officer, director or any person who is the beneficial owner of more than 10% of our total outstanding shares);

|

|

|

·

|

At least a $1 million market value of publicly held shares;

|

|

|

·

|

At least 300 public holders of our common stock;

|

|

|

·

|

At least two registered and active market makers for our common stock; and

|

|

|

·

|

Compliance with certain corporate governance requirements.

|

We believe that we satisfy all of these

other continued listing requirements of The Nasdaq Capital Market as of the mailing date of this Proxy Statement. However, we cannot

assure you that we will be successful in continuing to meet all requisite continued listing criteria.

We believe that the Reverse Stock Split

may result in greater liquidity for our stockholders. However, it is also possible that such liquidity could be adversely affected

by the reduced number of shares outstanding after the Reverse Stock Split.

|

|

|

Page

10

Page

10

|

Procedure for Effecting the Reverse Stock Split and Exchange

of Stock Certificates

If the Reverse Stock Split is approved

by our stockholders, and if at such time the Board determines it is in the best interests of our Company and our stockholders to

effect the Reverse Stock Split, the Board will determine the whole number ratio, within the range approved by our stockholders,

of the Reverse Stock Split to be implemented. We will file the Certificate of Amendment with the Secretary of State of the State

of Delaware at such time as the Board of Directors deems appropriate to effect the Reverse Stock Split. The Board of Directors

may delay effecting the Reverse Stock Split without re-soliciting stockholder approval. The Reverse Stock Split would become effective

at such time as the Certificate of Amendment is filed with the Secretary of State of the State of Delaware. Upon the filing of

the Certificate of Amendment, all of our existing common stock will be converted into new common stock as set forth in the amendment.

As soon as practicable after the effective

date of the Reverse Stock Split, stockholders will be notified that the Reverse Stock Split has been effected. Computershare, our

transfer agent, will act as exchange agent for purposes of implementing the exchange of stock certificates. Holders of pre-split

shares will be asked to surrender to the exchange agent certificates representing pre-split shares in exchange for certificates

representing post-split shares in accordance with the procedures to be set forth in a letter of transmittal that will be delivered

to our stockholders. No new certificates will be issued to a stockholder until the stockholder has surrendered to the exchange

agent his, her or its outstanding certificate(s) together with the properly completed and executed letter of transmittal. STOCKHOLDERS

SHOULD NOT DESTROY ANY STOCK CERTIFICATES AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL REQUESTED TO DO SO. Stockholders whose shares

are held by their stockbroker do not need to submit old share certificates for exchange. These shares will automatically reflect

the new quantity of shares based on the Reverse Stock Split ratio. Beginning on the effective date of the Reverse Stock Split,

each certificate representing pre-split shares will be deemed for all corporate purposes to evidence ownership of post-split shares.

Fractional Shares

We will not issue fractional

certificates for post-split shares in connection with the Reverse Stock Split. In lieu of issuing fractional shares, we will

pay in cash the value of each fractional share.

Discretionary Authority of the Board to Abandon the Reverse

Stock Split

If the proposed Reverse Stock Split is

approved by our stockholders at the Special Meeting, our Board of Directors may, in its sole discretion, at any time prior to the

anniversary of the shareholder approval of the Reverse Stock Split, May 14, 2020, authorize a reverse stock split at a whole number

ratio not less than 1-for-6 and not greater than 1-for-9, with the exact ratio to be set within such range in the discretion of

our Board of Directors, and file the Certificate of Amendment with the Secretary of State of the State of Delaware. The Board reserves

the right to abandon the Reverse Stock Split without further action by our stockholders at any time before the effectiveness of

the Certificate of Amendment, even if the Reverse Stock Split has been authorized by our stockholders at the Special Meeting. By

voting in favor of the Reverse Stock Split, you are expressly also authorizing our Board to determine not to proceed with, and

abandon, the Reverse Stock Split if it should so decide.

Criteria to be Used for Decision to Apply the Reverse Stock

Split

If the stockholders approve the Reverse

Stock Split, the Board will be authorized to proceed with the Reverse Stock Split. In determining whether to proceed with the Reverse

Stock Split, the Board will consider a number of factors, including market conditions, existing and expected trading prices of

our common stock, the Nasdaq Capital Market listing requirements, our additional funding requirements, and the amount of our authorized

but unissued common stock.

Material

United States Federal Income Tax Consequences of the Reverse Stock Split

The following discussion describes the

material United States Federal income tax consequences to “U.S. holders” (as defined below) of our common stock relating

to the Reverse Stock Split. This discussion is based upon the Internal Revenue Code of 1986, as amended (the “Code”),

Treasury Regulations, judicial authorities, published positions of the Internal Revenue Service and other applicable authorities,

all as currently in effect and all of which are subject to change or differing interpretations (possibly with retroactive effect).

We have not obtained a ruling from the IRS or an opinion of legal or tax counsel with respect to the tax consequences of the Reverse

Stock Split. The following discussion is for informational purposes only and is not intended as tax or legal advice. Each holder

should seek advice based on the holder’s particular circumstances from an independent tax advisor.

|

|

|

Page

11

Page

11

|

For purposes of this discussion, the term

“U.S. holder” means a beneficial owner of our common stock that is for United States Federal income tax purposes:

|

|

·

|

An individual citizen or resident of the United States;

|

|

|

·

|

A corporation (or other entity treated as a corporation for United States Federal income tax purposes) organized under the laws of the United States, any state, or the District of Columbia;

|

|

|

·

|

An estate with income subject to United States Federal income tax regardless of its source; or

|

|

|

·

|

A trust that (a) is subject to primary supervision by a United States court and for which United States persons control all substantial decisions or (b) has a valid election in effect under applicable Treasury Regulations to be treated as a United States person.

|

This discussion assumes that a U.S. holder

holds our common stock as a capital asset within the meaning of Code Section 1221. This discussion does not address all of the

tax consequences that may be relevant to a particular stockholder of our Company or to stockholders of our Company that are subject

to special treatment under United States Federal income tax laws including, but not limited to, banks, financial institutions,

tax-exempt organizations, insurance companies, regulated investment companies, real estate investment trusts, persons that are

broker-dealers, traders in securities who elect the mark-to-market method of accounting for their securities, certain former citizens

or long-term residents of the United States, or stockholders holding their shares of our common stock as part of a “straddle,”

“hedge,” “conversion transaction,” or other integrated transaction. This discussion also does not address

the tax consequences to our Company, or to stockholders that own 5% or more of our common stock, are affiliates of our Company,

or are not U.S. holders. In addition, this discussion does not address other United States Federal taxes (such as gift or estate

taxes or alternative minimum taxes), the tax consequences of the Reverse Stock Split under state, local, or foreign tax laws or

certain tax reporting requirements that may be applicable with respect to the Reverse Stock Split. No assurance can be given that

the IRS would not assert, or that a court would not sustain, a position contrary to any of the tax consequences set forth below.

If a partnership (or other entity treated

as a partnership for United States Federal income tax purposes) is a Company stockholder, the tax treatment of a partner in the

partnership, or any equity owner of such other entity will generally depend upon the status of the person and the activities of

the partnership or other entity treated as a partnership for United States Federal income tax purposes.

Tax Consequences of the Reverse Stock Split Generally

We believe that the Reverse Stock Split will qualify as a “reorganization”

under Section 368(a)(1)(E) of the Code, with the following consequences:

|

|

·

|

A U.S. holder will not recognize any gain or loss as a result of the Reverse Stock Split, except to the extent of any cash received in lieu of a fractional share as described below (which fractional share will be treated as received and then exchanged for cash).

|

|

|

·

|

A U.S. holder’s aggregate tax basis in the U.S. holder’s post-split shares, including any fractional share treated as received and then exchanged for cash, will be equal to the aggregate tax basis in the U.S. holder’s pre-split shares exchanged therefor.

|

|

|

·

|

A U.S. holder’s holding period for the post-split shares will include the period during which such stockholder held the pre-split shares surrendered in the Reverse Stock Split.

|

A U.S. holder who receives cash in lieu

of a fractional share of our common stock pursuant to the Reverse Stock Split should recognize capital gain or loss in an amount

equal to the difference between the amount of cash received and the U.S. holder’s tax basis in the shares of our common stock

surrendered that is allocated to such fractional share of our common stock. Such capital gain or loss should be long-term capital

gain or loss if the U.S. holder’s holding period for our common stock surrendered exceeded one year at the time the Reverse

Stock Split becomes effective. The deductibility of net capital losses by individuals and corporations is subject to limitations.

U.S. Information Reporting and Backup

Withholding

. Information returns generally will be required to be filed with the Internal Revenue Service with respect to the

receipt of cash in lieu of a fractional share of our common stock pursuant to the Reverse Stock Split in the case of certain U.S.

holders. In addition, U.S. holders may be subject to a backup withholding tax (at the current applicable rate of 24%) on the payment

of such cash if they do not provide their taxpayer identification numbers in the manner required or otherwise fail to comply with

applicable backup withholding tax rules. Backup withholding is not an additional tax. Any amounts withheld under the backup withholding

rules may be refunded or allowed as a credit against the U.S. holder’s federal income tax liability, if any, provided the

required information is timely furnished to the IRS.

|

|

|

Page

12

Page

12

|

No Dissenter’s Rights

Under the Delaware General Corporation

Law, stockholders will not be entitled to dissenter’s rights with respect to the proposed amendment to our Restated Certificate

of Incorporation, as amended, to effect the Reverse Stock Split, and we do not intend to independently provide stockholders with

any such right.

Required Vote

The affirmative vote of the majority

of the outstanding shares of common stock entitled to vote is needed to approve this Proposal No. 1. A properly executed

proxy marked “ABSTAIN” with respect to this proposal will not be voted, although it will be counted for purposes

of determining the number of shares of common stock entitled to vote. Accordingly, an abstention will have the effect of a

negative vote. Because Proposal No. 1 is a routine proposal on which a broker or other nominee is generally empowered to

vote, broker “non-votes” likely will not result from this Proposal. Thus, if you are a beneficial owner holding

shares through a broker, bank or other holder of record and you do not vote on this proposal, your broker may cast a vote on

your behalf for this Proposal.

Voting Recommendation

|

Our Board of Directors unanimously recommends a vote “

FOR

” the proposal to approve

an amendment to our Restated Certificate of Incorporation, as amended, and to authorize our Board of Directors to effect a reverse

stock split of our outstanding common stock, $0.0001 par value per share, at a whole number ratio in the range of 1-for-6 to 1-for-9,

such ratio to be determined in the discretion of our Board of Directors, and to authorize our Board of Directors to file such amendment,

if in their judgment it is necessary, that would effect the foregoing.

|

Forward

Looking Statements Disclaimer

Forward-looking statements are subject

to risks and uncertainties that could cause our actual results to differ materially from those projected. These risks and uncertainties

include, but are not limited to, the risks described in our Annual Report on Form 10-K filed on June 26, 2018 and available at

www.sec.gov. The words “may,” “will,” “anticipate,” “believe,” “estimate,”

“expect,” “intend,” “plan,” “aim,” “seek,” “should,” “likely,”

and similar expressions as they relate to us or our management are intended to identify these forward-looking statements. All statements

by us regarding our expected financial position, revenues, cash flows and other operating results, business strategy and similar

matters are forward-looking statements. Our expectations expressed or implied in these forward-looking statements may not turn

out to be correct. Any forward-looking statement speaks only as of the date as of which such statement is made, and, except as

required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances, including

unanticipated events, after the date as of which such statement was made.

Security

Ownership of Certain Beneficial Owners

The following table sets forth certain

information as of April 5, 2019, as to shares of our common stock beneficially owned by: (1) each person who is known by us to

own beneficially 5% or more of our common stock, (2) each of our Named Executive Officers, (3) each of our current directors and

(4) all of our directors and executive officers as a group.

We have determined beneficial ownership

in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished

to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares

of common stock that they beneficially own, subject to applicable community property laws.

In computing the number of shares of common

stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of common stock

subject to options held by that person that are currently exercisable or exercisable within 60 days after April 5, 2019. We did

not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person.

|

|

|

Page

13

Page

13

|

Officers and Directors

Name and address

of beneficial owner (1)

|

Nature of beneficial ownership

|

Amount of Beneficial Ownership

|

Percent of

Shares

Beneficially

Owned (3)

|

Shares

Owned

|

Shares – Includes

all Rights

to

Acquire

(2)

|

Total

|

|

Bubba Sandford (4)

|

President, Chief Executive Officer, Chief Financial Officer and Director

|

0

|

450,000

|

450,000

|

3.6%

|

|

Jerry McLaughlin (5)

|

Lead Independent Director

|

48,728

|

29,224

|

77,952

|

*

|

|

Sharon Barbari (6)

|

Director

|

43,417

|

16,192

|

59,609

|

*

|

|

Philippe Weigerstorfer (7)

|

Director

|

22,500

|

0

|

22,500

|

*

|

|

Jay Birnbaum (8)

|

Director

|

51,659

|

32,228

|

83,

887

|

*

|

|

All directors and executive officers as a group (7 persons) (9)

|

178,591

|

646,347

|

824,928

|

6.5%

|

*Indicates ownership of less than 1.0%

|

(1)

|

Unless otherwise stated, the address of each beneficial owner listed in the table is c/o Sonoma Pharmaceuticals, Inc. 1129 North McDowell Blvd. Petaluma, CA 94954.

|

|

(2)

|

Represents shares subject to outstanding stock options and warrants currently exercisable or exercisable upon vesting.

|

|

(3)

|

We had a total of 11,972,328 shares of common stock issued and outstanding on April 5, 2019.

|

|

(4)

|

Mr. Sandford is our President, Chief Executive Officer and Chief Financial Officer. He is also a member of our Board of Directors. Mr. Sandford beneficially owns 0 shares of common stock and 450,000 shares of common stock issuable upon the exercise of options.

|

|

(5)

|

Mr. McLaughlin is a member of our Board of Directors and was appointed as Lead Independent Director on March 26, 2014. He beneficially owns 48,728 shares of common stock and 29,224 shares of common stock issuable upon the exercise of options.

|

|

(6)

|

Ms. Barbari is a member of our Board of Directors. She beneficially owns 43,417 shares of common stock held by The Barbari Family Trust – Sharon Ann Barbari and Edward Paul Barbari Trustees, and 16,192 shares of common stock issuable upon the exercise of options.

|

|

(7)

|

Mr. Weigerstorfer is a member of our Board of Directors. He beneficially owns 22,500 shares of common stock and 0 shares of common stock issuable upon the exercise of options.

|

|

(8)

|

Dr. Birnbaum is a member of our Board of Directors. He beneficially owns 51,659 shares of common stock and 32,228 shares of common stock issuable upon the exercise of options.

|

|

(9)

|

Apart from our Named Executive Officers and Directors listed in the table, this includes Dr. Robert Northey, our EVP of Research and Development and Bruce Thornton, our EVP of International Operations and Sales.

|

|

|

|

Page

14

Page

14

|

Section

16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange

Act of 1934 requires our executive officers and directors, and persons who own more than 10% of a registered class of our equity

securities, to file reports of ownership on Forms 3, 4 and 5 with the SEC. Officers, directors and greater than 10% stockholders

are required to furnish us with copies of all Forms 3, 4 and 5 they file.

Based solely on our review of the copies

of such forms we have received and written representations from certain reporting person that they filed all required reports,

we believe that all of our officers, directors and greater than 10% stockholders complied with all Section 16(a) filing requirements

applicable to them with respect to transactions during fiscal year 2018.

Questions

and Answers

Below you will find general information

on Stockholder Proposals, “Householding” of Proxy Materials, and more specific instructions on how to vote, which can

be found on your proxy voting card.

Stockholder Proposals and

Additional Information

As disclosed in the Company’s proxy statement for its 2018 Annual Meeting filed on June 27, 2018:

How do I submit a Stockholder Proposal to be Included in the Proxy Statement?

You must submit your proposal to our Secretary no later than

April 11, 2019 – 120 calendar days before the anniversary of our 2018 Annual Proxy Statement mailing. This is to comply with

Rule 14a-8 under the 1934 act.

What if the date of the

2019 Annual Meeting is significantly different?

If the date of the Annual Meeting is changed by more than 30

days, the proposal must be submitted to our Secretary by the close of business on the later of:

|

|

·

|

90 days prior to the Annual Meeting,

|

|

|

·

|

or 7 days following the first public announcement of the Annual Meeting date

|

Who Presents the Proposal

at the Meeting?

The Stockholder proponent, or a representative who is qualified

under state law, must appear in person at the 2019 Annual Meeting of Stockholders to present the proposal.

|

|

|

Page

15

Page

15

|

How Should I Send my Proposal?

Please send your proposal to our Secretary at:

Sonoma Pharmaceuticals, Inc.

Attn. Secretary

1129 North McDowell Blvd.

Petaluma, California 94954

We strongly suggest that proposals are sent by Certified Mail

– Return Receipt Requested.

What Must be Included in

My Notice that I send to the Secretary?

|

1.

|

|

A brief description of the proposed business

|

|

2.

|

|

The text of the proposal

|

|

3.

|

|

Reasons for conducting the business at the meeting

|

|

4.

|

|

Name and address (as they appear on our books) of the stockholder proposing such business

|

|

5.

|

|

The beneficial owner (if any) on whose behalf the proposal is made

|

|

6.

|

|

Any material interest of the stockholder in such business

|

|

7.

|

|

Any other information required by proxy proposal submission rules of the SEC

|

“Householding”

of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy delivery requirements for proxy

statements with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to

those stockholders. This process, which is commonly referred to as ‘‘householding,’’ potentially provides

extra convenience for stockholders and cost savings for us. Under this procedure, multiple stockholders who share the same last

name and address will receive only one copy of the annual proxy materials, unless they notify us that they wish to continue receiving

multiple copies. We have undertaken householding to reduce our printing costs and postage fees.

If you wish to opt-out of householding

and continue to receive multiple copies of the proxy materials at the same address, you may do so at any time prior to thirty days

before the mailing of proxy materials, which will typically be mailed in July of each year, by notifying us in writing at: Secretary,

Sonoma Pharmaceuticals, Inc., 1129 N. McDowell Blvd., Petaluma, California 94954, or by contacting us at (707) 283-0550. You also

may request additional copies of the proxy materials by notifying us in writing at the same address or contacting us at (707) 283-0550,

and we will undertake to deliver such additional copies promptly. If you share an address with another stockholder and currently

are receiving multiple copies of the proxy materials, you may request householding by notifying us at the above referenced address

or telephone number.

Other Matters

Your Board of Directors does not know of any other business that will be presented at the Special Meeting. If any other business

is properly brought before the Special Meeting, your proxy holders will vote on it as they think best unless you direct them otherwise

in your proxy instructions.

Whether or not you intend to