By Anne Steele, Brent Kendall and Cara Lombardo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 13, 2019).

An affiliate of John Malone's Liberty Media Corp. is seeking

Justice Department permission to buy a larger piece of iHeartMedia

Inc., according to people familiar with the matter, a deal that

would put the nation's largest radio broadcaster under the same

corporate umbrella as the leading concert promoter and

satellite-radio giant SiriusXM.

Liberty owns a 4.8% stake in iHeart through Liberty SiriusXM

Group; the deal now under consideration could give it control or

outright ownership of the broadcaster, according to people familiar

with the matter.

The government is considering the request, the people said, with

one of them cautioning that Liberty hasn't decided what kind of

transaction, if any, it would proceed with should it receive

permission.

Liberty acquired its iHeart stake via debt it took on before the

company restructured, which converted to equity when the

broadcaster emerged from bankruptcy early this year.

Liberty owns 33% of Live Nation Entertainment Inc., making it

the concert giant's largest shareholder, and 71% of satellite-radio

company Sirius XM Holdings Inc.

A deal for iHeart would increase its ability to collaborate

among those businesses, potentially creating a bulwark against the

rising influence of music-streaming companies.

Last year, Liberty orchestrated Sirius's purchase of

internet-radio company Pandora Media Inc. -- in which it also held

a controlling stake -- for $3 billion, another move intended to

compete more effectively against Spotify Technology SA and other

on-demand music-streaming services.

Liberty Chief Executive Greg Maffei at an investor day in late

November touted the company's increased focus on audio and

particularly its exposure to the "exploding" podcast market

including through iHeart, the No. 2 publisher by audience,

according to Podtrac, a podcast-analytics company.

If Liberty were to gain control of iHeart, it would represent a

major consolidation of the avenues by which music and other audio

content is distributed, promoted and monetized.

Justice Department antitrust officials recently asked interested

parties how they might be affected by a potential deal between a

live-entertainment company and a radio company, according to a

person familiar with the inquiries, without mentioning Liberty,

Live Nation or iHeart by name.

Such a deal has been rumored for some time. Liberty in February

of last year made an offer to pump $1.16 billion in cash into

iHeart, weeks before it filed for bankruptcy, for a 40% stake in

the reorganized company. It withdrew the offer that June because

iHeart's results were below expectations, but left the door open

for future discussions. The New York Post last December reported

Liberty was seeking to assemble a roughly 35% stake in the company

postbankruptcy.

A judge in January approved a restructuring plan, wiping more

than $10 billion in debt off iHeart's books and turning over

control of the company to lenders and bondholders from its longtime

owners, private-equity companies Bain Capital and Thomas H. Lee

Partners LP. The private-equity firms took iHeart private in a

$19.4 billion deal in 2008 when it was known as Clear Channel

Communications Inc.

The restructuring plan, which reduced iHeart's debt load to

$5.75 billion from $16.1 billion, transferred ownership of the

company to a group of lenders and bondholders led by Franklin

Advisers Inc.

iHeart's CEO Bob Pittman -- a veteran media executive who

previously played integral roles in creating and running MTV and

AOL -- and finance chief Rich Bressler remain in their roles.

As part of the restructuring, publicly traded

outdoor-advertising unit Clear Channel Outdoor Holdings Inc. was

separated from the company. Mr. Pittman said that move would let

iHeart focus on its audio business.

iHeart returned to the public markets in July, listing on the

Nasdaq. Its market value was just under $1 billion Thursday

afternoon but that belies the company's heft.

iHeart, which operates 848 broadcast radio stations in the U.S.,

also runs a concert-promotion business and has been in the

on-demand streaming-music market since 2016, when it launched a

pair of services within its existing iHeartRadio app, which had

previously just played programming from the broadcast stations.

Revenue in the third quarter rose 3% to $948 million.

Sirius offers satellite-radio subscriptions, primarily for

listening in cars, but has been expanding into ad-supported

streaming media, mainly though its Pandora acquisition, and

podcasts. Revenue rose 6% last year to $5.77 billion. It ended the

most recent quarter with more than 34.6 million satellite-radio

subscribers in the U.S. and Canada, and the company's shares are up

over 20% this year.

Pandora, available only in the U.S., after closing operations in

Australia and New Zealand in 2017, had 63.1 million monthly active

users -- down from 68.8 in the prior-year period -- and 6.3 million

subscribers to its premium tier.

Live Nation, the world's largest concert promoter and parent of

Ticketmaster, which dominates the ticketing industry, sits at the

forefront of a booming live-events business. It ended 2018 with

$10.79 billion in revenue, up 11% from the year prior. Its stock

price has risen more than 40% so far this year.

The live-events business has been growing rapidly for several

years thanks to consumers' seemingly unlimited willingness to pay

top dollar for major concerts and festivals. Music-streaming

services have contributed to that boom by helping more artists find

bigger audiences world-wide.

At the same time, streaming has upended the entire music

business. While services like Spotify and Apple Music have

resuscitated record labels' fortunes, they have turned music fans

onto on-demand listening -- the ability to queue up virtually any

song in the world at any time through a monthly subscription --

posing a challenge for radio operators.

Music-streaming and radio companies alike have been investing in

podcasts in a bid to better compete in on-demand audio.

Write to Anne Steele at Anne.Steele@wsj.com, Brent Kendall at

brent.kendall@wsj.com and Cara Lombardo at

cara.lombardo@wsj.com

(END) Dow Jones Newswires

December 13, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

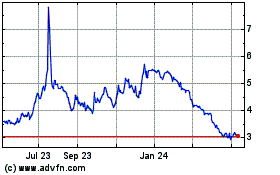

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

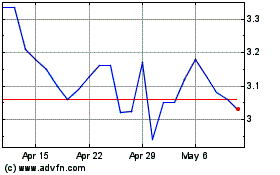

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Apr 2023 to Apr 2024