Sify reports Revenues of INR 5807 Million for Second Quarter of FY 2019-20

October 18 2019 - 7:36AM

PERFORMANCE HIGHLIGHTS:

- Revenue for the quarter was

INR 5807 Million, an increase of 5% over the same quarter last

year.

- EBITDA for the quarter was INR

1061 Million, an increase of 38% over the same quarter last

year. Considering IFRS16 leases adoption from

April 1, 2019 the increase is 24% on comparable

basis.

- Profit before tax for the

quarter was INR 280 Million, an increase of 11% over the same

quarter last year.

- Profit after tax for the

quarter was INR 191 Million, a decrease of 25% over the same

quarter last year due to tax expense during the current

quarter.

- CAPEX during the quarter was

INR 983 Million.

- Cash balance at the end of the

quarter was INR 1375 Million.

MANAGEMENT

COMMENTARY

Mr. Raju Vegesna, Chairman, said, “With the rapid

adoption of digital technology across India, Global Enterprises and

domestic players now see a market of 1.3 billion people who have to

be quickly transitioned to the reality of a digital economy. In

their pursuit to do so, they will draw upon the strength of local

IT enablers who have the capability and local knowledge to

execute.

"That is the opportunity in front of Sify

today.”

Mr. Kamal Nath, CEO, said, "We

continue to see increasing Cloud adoption in Enterprises as well as

Government clients. Our investments, skills and partnerships are

attracting clients who are renewing their erstwhile on-prem

outsourcing, people heavy contracts and looking for hybrid or

multi-cloud flavoured models. We are also able to bring in benefits

to clients with our hyperscale network services which enables cloud

adoption. The true value of Sify’s ICT services is being unleashed

in Cloud transformation projects.”

Mr. M P Vijay Kumar, CFO, said,

“With the focus on digital transformation, Enterprises are actively

engaging for multiple ICT services for the operational benefits of

our comprehensive set of services. We are seeing our managed

services on top of the DC and Cloud as having the most traction

among them. While we expand our capacity, both data centers and

network infrastructure, we continue to exercise prudence in our

capital investments.

"This financial year, the increase in

depreciation and interest is partly due to IFRS 16 becoming

applicable for leases and the tax expense is due to company being

subject to income tax as the benefit of past losses has been

utilized in full until last year.

"Our cash balance at the end of the quarter

stands at INR 1375 Million.”

| |

| FINANCIAL

HIGHLIGHTS |

| Unaudited

Consolidated Income Statement as per IFRS |

|

|

| (In INR

millions) |

|

|

Quarter ended |

Quarter ended |

Quarter ended |

|

Description |

September |

September |

June |

|

|

2019 |

2018 |

2019 |

|

|

|

|

|

| |

|

|

|

| Revenue |

5,807 |

5,509 |

5,518 |

| Cost of

Revenues |

(3,650) |

(3,470) |

(3,550) |

| Selling, General and

Administrative Expenses |

(1,096) |

(1,268) |

(1,094) |

| |

|

|

|

| EBITDA |

1,061 |

771 |

874 |

| |

|

|

|

| Depreciation and

Amortisation expense |

(527) |

(384) |

(506) |

| Net Finance

Expenses |

(261) |

(175) |

(64) |

| Other Income

(including exchange gain) |

15 |

67 |

28 |

| Other Expenses

(including exchange loss) |

(8) |

(26) |

(12) |

| |

|

|

|

| Profit before

tax |

280 |

253 |

320 |

| Income tax

expense |

(89) |

- |

(104) |

| Profit for the

period |

191 |

253 |

216 |

| |

|

|

|

| Profit attributable

to: |

|

|

|

| Reconciliation with

Non-GAAP measure |

|

|

|

| Profit for the

period |

191 |

253 |

216 |

|

Add: |

|

|

|

| Depreciation and

Amortisation expense |

527 |

384 |

506 |

| Net Finance

Expenses |

261 |

175 |

64 |

| Other Expenses

(including exchange loss) |

8 |

26 |

12 |

| Income tax

expense |

89 |

- |

104 |

| Less: |

|

|

|

| Other Income

(including exchange gain) |

(15) |

(67) |

(28) |

| |

|

|

|

| EBITDA |

1,061 |

771 |

874 |

| |

|

|

|

BUSINESS HIGHLIGHTS

- Revenue from Data Center centric IT Services fell by 4% over

the same quarter last year.

- Segment-wise, revenue from Data Center Services and Cloud and

Managed Services grew by 18% and 30% respectively, while those from

Technology Integration Services and Application Integration

Services fell by 32% and 3% respectively.

- Revenue from Telecom centric services grew by 16% over the same

quarter last year.

- Segment-wise, revenue from Data and Managed Services grew 15%

while revenue from the Voice business grew by 17%.

GROWTH DRIVERS

The primary growth driver in the market

continues to be cloud adoption, led by digital initiatives and

transformation. This trend is triggering movement of workloads from

on-premise Data Centers to hyperscale Public Cloud and hosted

Private Cloud in varied degrees, based on the digital objectives of

the Enterprises. This results in transformation of the traditional

network architecture, and transformation at the edge which connects

the end user. The need for digital services like analytics, data

lakes, IoT, etc are shifting the balance to adoption of hyperscale

Public Cloud vs Private Cloud. Collectively, these trends are

generating opportunities for full scale Cloud, DC and Network

service providers with digital services skills. KEY

WINS

Highlights of our major wins in the quarter include:

- Customers choosing Sify for migration of their on-premise data

center to multi-cloud platforms like Cloudinfinit, AWS and Azure.

They also entrusted Sify with management and security.

- Customers choosing Sify as their DC Hosting partner as they

embrace hybrid cloud strategy.

- Customers choosing Sify as their Digital services partner.

- Customers choosing Sify as their Network Transformation and

Management partner as they migrate to Cloud-ready

network.

A consolidated summary of the key highlights during the quarter

is noted below:

Data

Center Centric IT Services highlights include:

- 11 customers contracted to have their workload migrated from

their on-premise DC to multiple clouds. These cover key verticals

such as Banking, ITeS, Manufacturing, Agri-sciences and

Logistics.

- 4 customers contracted with Sify for greenfield Cloud

implementation from verticals such as a PSU, Logistics, Media and

IT.

- 18 new customers contracted for services like DRaaS, PaaS and

IaaS on public Cloud and Cloudinfinit platform.

- 4 customers, including one of India’s largest private banks,

moved their IT infrastructure from competitor DC to Sify DC, while

3 customers migrated from their on-premise DC to Sify DC. These

were across verticals such as Banking and Financial services, Heavy

Industry, Manufacturing and a Commodities exchange platform.

- One of India’s largest MNCs contracted Sify to modernize their

Data center.

- One of India’s largest private banks contracted for the design,

supply and deployment of their on-premise DC.

- 18 customers contracted for Cloud managed services.

- A public sector bank contracted for a multi-year deployment and

management of their Security Operations center.

- 24 customers contracted for a complete technology refresh of

their security services.

- Telecom Centric Services added 144 new

customers in the quarter.

- A global technology corporation contracted with Sify for

interconnects to the Cloud.

- A public sector Insurance company contracted for a complete

network transformation that includes a secondary network, SD-WAN

and Managed services.

- A public sector industry major, a private bank and a financial

company contracted for managed and secure SD-WAN services.

- Another public sector insurance company signed up for

integrated network transformation project.

- 20 customers contracted for collaboration services from across

verticals like technology, insurance, banking, manufacturing and

the government.

- Sify launched Carrier Ethernet during the quarter.

About Sify TechnologiesSify

Technologies is the India’s most comprehensive largest ICT service

& solution provider. With Cloud at the core of our solutions

portfolio, Sify is focussed on the changing ICT requirements of the

emerging Digital economy and the resultant demands from large, mid

and small-sized businesses.

Sify’s infrastructure comprising the largest

MPLS network, top-of-the-line DCs, partnership with global

technology majors, vast expertise in business transformation

solutions modelled on the cloud make it the first choice of

start-ups, incoming enterprises and even large Enterprises on the

verge of a revamp,

More than 10000 businesses across multiple

verticals have taken advantage of our unassailable trinity of Data

Centers, Networking and Security services and conduct their

business seamlessly from more than 1600 cities in India.

Internationally, Sify has presence across North America, the United

Kingdom and Singapore.

Sify, www.sify.com, Sify Technologies and

www.sifytechnologies.com are registered trademarks of Sify

Technologies Limited

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. The forward-looking

statements contained herein are subject to risks and uncertainties

that could cause actual results to differ materially from those

reflected in the forward-looking statements. Sify undertakes no

duty to update any forward-looking statements.

For a discussion of the risks associated with

Sify’s business, please see the discussion under the caption “Risk

Factors” in the company’s Annual Report on Form 20-F for the year

ended March 31, 2019, which has been filed with the United States

Securities and Exchange Commission and is available by accessing

the database maintained by the SEC at www.sec.gov, and Sify’s other

reports filed with the SEC.

For further information, please contact:

|

Sify Technologies Limited Mr. Praveen Krishna

Investor Relations & Public Relations +91 44 22540777

(ext.2055) praveen.krishna@sifycorp.com |

20:20 Media Nikhila Kesavan +91 9840124036

nikhila.kesavan@2020msl.com |

Grayling Investor Relations Shiwei Yin

+1-646-284-9474 Shiwei.Yin@grayling.com |

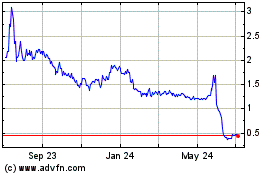

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

From Mar 2024 to Apr 2024

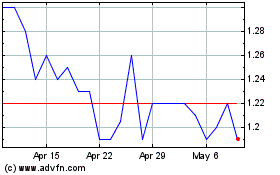

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

From Apr 2023 to Apr 2024