Filed Pursuant to Rule 424(b)(3)

Registration No. 333-249786

PROSPECTUS SUPPLEMENT NO. 21

(to Prospectus dated December 3, 2020)

Up to 24,988,338 Shares of Class A

Common Stock

Up to 7,745,000 Shares of Class A Common Stock Issuable Upon Exercise of Warrants

This prospectus supplement updates and supplements

the prospectus dated December 3, 2020 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-249786). This

prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our

current report on Form 8-K, filed with the Securities and Exchange Commission on June 24, 2022 (the “Current Report”). Accordingly,

we have attached the Current Report to this prospectus supplement.

This prospectus supplement updates and supplements

the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus,

including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there

is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this

prospectus supplement.

Investing in our securities involves risks

that are described in the “Risk Factors” section beginning on page 6 of the Prospectus.

Neither the U.S. Securities and Exchange

Commission (the “SEC”), nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is

June 24, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported) June

24, 2022 (June 22, 2022)

SHIFT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38839 |

|

82-5325852 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 290 Division Street, Suite 400, San Francisco, CA |

|

94103 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (855) 575-6739

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

SFT |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) if the Exchange Act. ☐

Item 5.02 Departure of Directors or Principal

Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

Foy Amended and Restated Retention Bonus Agreement

On June 22, 2022, Shift Technologies, Inc. (the “Company”)

entered into an Amended and Restated Retention Bonus Agreement with Sean Foy, Chief Operating Officer of the Company (the “Amended

and Restated Retention Agreement”). Pursuant to the Amended and Restated Retention Agreement (which replaces and supersedes

in its entirety that certain retention bonus agreement between Mr. Foy and the Company dated January 7, 2022), Mr. Foy will be eligible

to receive a cash award of $2,000,000 to be paid in two installments, subject to continued employment with the Company as a full-time

employee in good standing through the applicable payment date and executing a release agreement in favor of the Company, with the first

installment equal to $400,000 to be paid no later than the first payroll date that occurs after the release effective date applicable

to such payment, and the second installment equal to $1,600,000 to be paid no later than the first payroll date that occurs after the

release effective date applicable to such payment. If (i) Mr. Foy resigns from his position for any reason, (ii) Mr. Foy’s employment

with the Company is terminated due to death or disability (as defined under the Company’s long-term disability plan and/or policy

applicable to the Employee, as may be modified or implemented from time to time), or (iii) the Company terminates Mr. Foy’s employment

for “Cause” (as defined in the Amended and Restated Retention Agreement), in each case, at any time prior to November 19,

2023, Mr. Foy will no longer be eligible to receive any unpaid installments of the cash award. In addition, if the Company terminates

Mr. Foy’s employment without Cause prior to July 19, 2023, Mr. Foy will no longer be eligible to receive any unpaid installments

of the cash award. If the Company terminates Mr. Foy’s employment without Cause after July 19, 2023 but prior to November 19, 2023,

then, subject to Mr. Foy executing a release agreement in favor of the Company, Mr. Foy shall receive a prorated payment of any unpaid

portion of the second installment of the cash award.

The foregoing description of the Amended and Restated

Retention Agreement is not complete and is qualified in its entirety by reference to the full text of such agreement, a copy of which

is filed hereto as Exhibit 10.1 and is incorporated herein by reference.

Shein Retention Bonus Agreement

On June 22, 2022, the Company entered into a Retention

Bonus Agreement with Oded Shein, Chief Financial Officer of the Company (the “Retention Agreement”). Pursuant to the

Retention Agreement, Mr. Shein will be eligible to receive a cash award of $400,000 subject to his continued employment with the Company

as a full-time employee in good standing through November 15, 2022 and his execution of a release agreement in favor of the Company. If

(i) Mr. Shein resigns from his position for any reason, (ii) Mr. Shein’s employment with the Company is terminated due to death

or disability (as defined under the Company’s long-term disability plan and/or policy applicable to the Employee, as may be modified

or implemented from time to time), or (iii) the Company terminates Mr. Shein’s employment for “Cause” (as defined in

the Retention Agreement), in each case, at any time prior to November 15, 2022, Mr. Shein will no longer be eligible to receive the cash

award. In addition, if the Company terminates Mr. Shein’s employment without “Cause” prior to November 15, 2022, Mr.

Shein will receive the unpaid cash award, subject to Mr. Shein executing a release agreement in favor of the Company.

The foregoing description of the Retention Agreement

is not complete and is qualified in its entirety by reference to the full text of such agreement, a copy of which is filed hereto as Exhibit

10.2 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SHIFT TECHNOLOGIES, INC. |

| |

|

| Dated: June 24, 2022 |

/s/ George Arison |

| |

Name: |

George Arison |

| |

Title: |

Chief Executive Officer and Chairman |

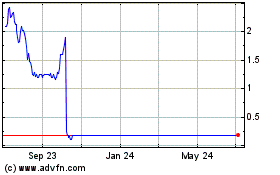

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Apr 2023 to Apr 2024