Filed Pursuant to Rule 424(b)(3)

Registration No. 333-249786

PROSPECTUS SUPPLEMENT NO. 16

(to Prospectus dated December 3, 2020)

Up to 24,988,338 Shares of Class A Common Stock

Up to 7,745,000 Shares of Class A Common Stock

Issuable Upon Exercise of Warrants

This prospectus

supplement updates and supplements the prospectus dated December 3, 2020 (the “Prospectus”), which forms a part of our registration

statement on Form S-1 (No. 333-249786). This prospectus supplement is being filed to update and supplement the information

in the Prospectus with the information contained in our current report on Form 8-K, filed with the Securities and Exchange Commission

on January 12, 2022 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

This prospectus supplement updates and supplements the

information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus,

including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there

is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this

prospectus supplement.

Investing in our securities involves risks that are

described in the “Risk Factors” section beginning on page 6 of the Prospectus.

Neither the U.S. Securities and Exchange Commission

(the “SEC”), nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is January

12, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported) January

12, 2022 (January 6, 2022)

SHIFT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-38839

|

|

82-5325852

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

290 Division Street, Suite 400, San Francisco, CA

|

|

94103

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code:

(855) 575-6739

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A common stock, par value $0.0001 per share

|

|

SFT

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) if the Exchange Act.

Item 5.02 Departure of Directors or Principal

Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

Severance Plan

On January 6, 2022, the Leadership Development, Compensation

and Governance Committee of the Board of Directors of Shift Technologies, Inc. (the “Company”) adopted a Severance

Plan for Key Management Employees (the “Severance Plan”) to provide severance benefits to certain key management employees

of the Company, including but not limited to persons holding the title of Chief Executive Officer, President, Chief Financial Officer

or Chief Operating Officer; provided, however, that the Severance Plan shall not apply to a Chief Executive Officer until such participation

is approved by the Board of Directors of the Company, which is expected to occur in the first quarter of 2022. Such executives are eligible

to receive severance benefits if their employment is terminated for “Cause” or without “Good Reason” (each as

defined in the Severance Plan) and they enter into a release agreement with the Company within sixty (60) days of such termination. Specific

severance benefits are dependent on the executive’s position and whether such termination occurs upon or within one (1) year of

a “Change in Control” (as defined in the Shift Technologies, Inc. 2020 Omnibus Equity Compensation Plan, as amended (the “Equity

Plan”)). Generally, following a qualifying termination, an executive will be eligible to receive certain cash severance and

the option to receive certain continuing health insurance coverage. If such termination occurs upon or within one (1) year of a Change

in Control, an executive will also be eligible (i) to receive a payment equal to the executive’s prorated annual bonus, (ii) to

receive a payment equal to a prorated portion of any unpaid retention payment payable under an applicable retention agreement, and (iii)

to have a portion or all of the outstanding unvested equity awards held by the executive under the Equity Plan vest.

The foregoing description of the Severance Plan is

not complete and is qualified in its entirety by reference to the full text of such agreement, a copy of which will be filed as an exhibit

to the Company’s Annual Report on Form 10-K for the period ended December 31, 2021.

Foy Retention Bonus Agreement

On January 10, 2022, the Company entered into a Retention

Bonus Agreement with Sean Foy, Chief Operating Officer of the Company (the “Retention Agreement”). Pursuant to the

Retention Agreement, Mr. Foy will be eligible to receive a cash award of Two Million Dollars ($2,000,000) upon serving as a full-time

employee in good standing through November 19, 2023 and executing a release agreement in favor of the Company. If (i) Mr. Foy resigns

from his position for any reason, (ii) Mr. Foy’s employment with the Company is terminated due to death or disability (as defined

under the Company’s long-term disability plan and/or policy applicable to the Employee, as may be modified or implemented from time

to time), or (iii) the Company terminates Mr. Foy’s employment for “Cause” (as defined in the Retention Agreement),

in each case, at any time prior to November 19, 2023, Mr. Foy will no longer be eligible to receive the cash award. In addition, if the

Company terminates Mr. Foy’s employment without “Cause” (i) prior to May 19, 2023, Mr. Foy will no longer be eligible

to receive the cash award, or (ii) after May 19, 2023 and prior to November 19, 2023, and subject to Mr. Foy executing a release agreement

in favor of the Company, Mr. Foy shall receive a prorated portion of such cash award.

The foregoing description of the Retention Agreement

is not complete and is qualified in its entirety by reference to the full text of such agreement, a copy of which will be filed as an

exhibit to the Company’s Annual Report on Form 10-K for the period ended December 31, 2021.

Item 9.01 Financial Statements and Exhibits.

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SHIFT TECHNOLOGIES, INC.

|

|

|

|

|

Dated: January 12, 2022

|

/s/ George Arison

|

|

|

Name:

|

George Arison

|

|

|

Title:

|

Co-Chief Executive Officer and Chairman

|

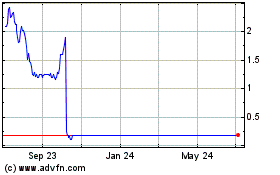

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Apr 2023 to Apr 2024