Starbucks Posts Its Worst Loss in Years -- WSJ

July 29 2020 - 3:02AM

Dow Jones News

By Heather Haddon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 29, 2020).

The coronavirus is still weighing on Starbucks Corp., but the

coffee giant expects to narrow its losses as the pandemic marches

on.

The coffee giant on Tuesday reported its steepest

earnings-per-share losses in more than a decade as a result of

lower sales and higher costs stemming from the pandemic. Global

same-store sales plunged by 40% in the quarter ending in June, and

the Seattle-based chain reported an operating-income loss of $704

million.

But that was better than many analysts expected given the

severity of the blow the pandemic has dealt to Starbucks, first in

China, then across Asia, Europe and the U.S. The chain said it

expects the worst effects of the virus to moderate in its current

quarter and believes same-store sales will recover in the U.S. and

China by its next fiscal year.

The chain hopes to have opened hundreds of stores by the end of

its fiscal year. Same-store sales are improving as the crisis

continues, executives said.

Shares of Starbucks rose 6% to $79 in after-hours trading.

Big chains have generally performed better than independent

restaurants during the pandemic due to their drive-throughs and

established takeout operations. But chains have also notched big

sales hits. McDonald's Corp. on Tuesday said its same-store sales

fell 24% globally in its most recent quarter, and it expects the

virus and resulting economic downtown to depress consumer spending

for some time.

Starbucks was early among chains to close stores as a result of

the coronavirus and to pay employees bonuses or allow them to stay

home if they weren't comfortable working during the pandemic. It

said it lost $3.1 billion in sales during the third quarter due to

store closures, limited hours and fewer customer visits.

Starbucks said 96% of its company-owned U.S. stores are now open

with at least to-go and limited dine-in service. The company has

beefed up delivery and pickup services that it intends to keep. It

also is building more to-go-only stores in the U.S.

Executives said more customers have shifted purchases to

suburban locations from urban ones as traffic remains light in

commercial corridors. Average orders are also up 25% as more

customers get drinks and food for their families during the

pandemic. Packaged coffee sales are also up for Starbucks as

workers remain at home.

"I believe this is one of those rare opportunities to move

aggressively and further differentiate Starbucks from our

competition," Chief Executive Kevin Johnson told investors.

The coffee chain said it expects global same-store sales

declines of 12% to 17% for its fourth-quarter and full year and for

revenue to decline by 10% to 15% compared with the previous

quarter. Starbucks said it expects earnings of 6 cents to 21 cents

a share for its fourth quarter.

For the third quarter, spending on worker pay, benefits and

protective equipment hurt margins. Starbucks said it spent $350

million during the quarter on virus-related benefits and pay for

workers, royalty deferments for international licensees and

payments to suppliers needing a cash infusion.

The company said it had $4.2 billion in sales in the quarter,

down 38% from the prior year's period but better than expectations

of analysts' polled by FactSet.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

July 29, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

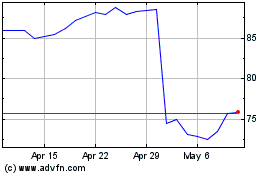

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

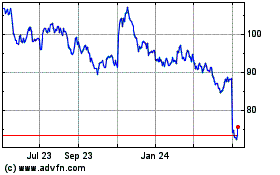

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024