Current Report Filing (8-k)

December 09 2019 - 4:16PM

Edgar (US Regulatory)

false 0000829224 0000829224 2019-12-09 2019-12-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 9, 2019

Starbucks Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Washington

|

|

0-20322

|

|

91-1325671

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

2401 Utah Avenue South, Seattle, Washington 98134

(Address of principal executive offices) (Zip Code)

(206) 447-1575

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

|

Common Stock, $0.001 par value per share

|

|

SBUX

|

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 9, 2019, the Board of Directors (“Board”) of Starbucks Corporation (the “Company”) approved one-time long-term cash performance-based awards tied to relative total shareholder return (“TSR”) over a three-year performance period (“Awards”) to Kevin R. Johnson, the Company’s president and chief executive officer (“ceo”), and Rosalind G. (Roz) Brewer, the Company’s group president, Americas and chief operating officer (“coo”). The Awards primarily support the Company’s leadership retention process and reflect the Board’s commitment to building an organization with long-term leadership continuity.

The Awards are designed to retain Starbucks key leaders in their roles for at least the next three years by providing compelling upside reward opportunity beyond the Company’s regular compensation program for continuing to achieve exceptional shareholder returns through the transformational “Growth at Scale” agenda. Myron E. (Mike) Ullman, III, Chair of the Starbucks Board, stated that “Since assuming the role of ceo, Kevin has led a transformation at Starbucks that has resulted in extraordinary performance and value to all stakeholders. His ‘Growth at Scale’ agenda has led to a dramatic turnaround in the business, while staying true to Starbucks unique mission and values. As part of our annual enterprise review and governance responsibility to retain top leadership talent, the Starbucks Board is offering Kevin and Roz these three-year, performance-based, incentive grants for recognition and continuity of their high caliber leadership.”

The ceo’s Award has a target value of $25 million, and the coo’s Award has a target value of $5 million, with the possibility of payment between zero to two times the target amount. Each Award will be paid out at 100% of target if the Company’s TSR performance relative to the companies comprising the S&P 500 index is at the 65th percentile, zero at the 40th percentile, and 200% of target at the 80th percentile, with linear interpolation between. The performance period will be measured from October 1, 2019 to September 30, 2022. Payment will be made shortly following the end of the performance period. Pro rata payments are required at 100% of target in the event of death or disability prior to the end of the performance period. Payments will be accelerated and made on a pro rata basis applied to actual performance through the termination date in the event of involuntary termination or voluntary termination for good reason. Payments will be accelerated and made based on actual performance in the event of involuntary termination or voluntary termination for good reason in connection with a change of control.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

STARBUCKS CORPORATION

|

|

|

|

|

|

Dated: December 9, 2019

|

|

|

|

|

|

By:

|

|

/s/ Rachel Gonzalez

|

|

|

|

|

|

Rachel Gonzalez

|

|

|

|

|

|

executive vice president, general counsel and secretary

|

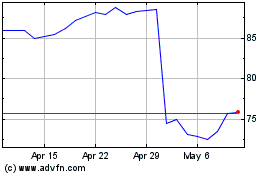

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

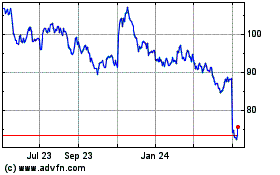

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024