Stocks Fall Amid Uncertainty on U.S.-China Trade Deal

October 31 2019 - 7:37AM

Dow Jones News

By Caitlin Ostroff

U.S. stock futures and European equities fell Thursday amid

investor concerns around the likelihood of Chinese officials

reaching a long-term trade deal with President Trump.

Futures linked to the S&P 500 index dipped 0.4% and the

pan-continental Stoxx Europe 600 gauge dropped 0.7%. Chinese

officials have warned that they won't budge on some of the most

difficult issues that need to be negotiated with the U.S., and

expressed concerns that Mr. Trump may back out of even the initial

deal they hope to reach in coming weeks, according to

Bloomberg.

"It shows you that both sides are very suspicious," said Chris

Beauchamp, chief market analyst at U.K. online broker IG Group.

Global stocks wavered earlier in the day, as investors weighed

the Federal Reserve's signaling of a pause in further interest-rate

easing, following its third cut this year.

The WSJ Dollar Index, which tracks the greenback against a

basket of 16 currencies, fell 0.2% Thursday following the Fed's

policy statement, which signaled a higher hurdle for rate

reductions after the latest move.

Early U.S. trading saw major moves in blue-chip stocks.

Facebook jumped 4.7% in offhours trading after the social-media

giant's quarterly profit and sales exceeded Wall Street's

expectations. Starbucks climbed 3.3% after stronger U.S. sales of

iced coffee and other cold drinks bolstered revenue in the latest

quarter for the world's largest coffee chain. Apple ticked up 2%

after it reported growth in gadgets and services that helped offset

a decline in iPhone sales.

Shares of Western Digital dropped 7.5% before the opening bell

after the data-storage device company swung to a loss in the latest

quarter.

Peugeot maker PSA Group was the worst performer in Europe,

dropping 12.4% following its agreement to merge with Fiat Chrysler

Automobiles in a deal that will create one of the world's largest

auto makers by volume.

Fiat shares climbed 8.7% in Milan, while shares of rival Renault

slumped 3.4%.

Royal Dutch Shell shares trimmed 3.4% after the oil giant

expressed uncertainty over the pace of it completing its $25

billion share buyback, raising doubt over whether the program would

be finished by the end of 2020.

More third-quarter earnings are due later, with Apollo Global

Management and Kraft Heinz among the companies set to report.

Earlier Thursday, data showed Chinese manufacturing activity

fell to an eight-month low in October, in another signal that the

world's second-largest economy is under pressure from the trade

tensions. The Shanghai Composite Index fell 0.4%.

Write to Caitlin Ostroff at caitlin.ostroff@wsj.com

(END) Dow Jones Newswires

October 31, 2019 07:22 ET (11:22 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

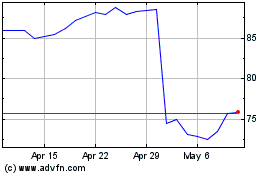

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

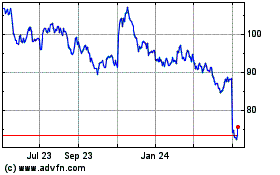

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024