By Micah Maidenberg

The cocoa that Mondelez International Inc. used to make the last

Oreo you ate might have come from a farm about the size of a

football field about 5 miles southwest of a wildlife sanctuary in

Ghana.

It is possible to know this because Mondelez publishes online

relatively granular data about its cocoa supply chain. On a company

website, a map with satellite views pinpoints the locations of more

than 93,000 farms in Ghana, Ivory Coast and Indonesia that it

tapped last year, through suppliers, to get some of the raw

material it needs to make chocolate products.

"What the consumer really wants to understand is that we have

provenance of our supply," says Jonathan Horrell, global director

of sustainability at Mondelez.

Big food companies, from Mondelez and General Mills Inc. to

Unilever PLC and Nestlé SA, face rising pressure to address

problems across agricultural regions as shoppers pay more attention

to where their food comes from and how it is produced. As huge

buyers of ingredients like cocoa, palm oil and coffee, food

companies must do more, for example, to stop deforestation carried

out by suppliers and encourage farmers to stop using child labor,

regulators, advocacy groups and consumers say.

Companies are responding in part by serving up new information

online about the commodities they buy around the world. The data,

once the domain of purchasing specialists and transportation

planners, is starting to give investors and the public a glimpse

into the sprawling supply chains the companies have spent years

developing.

For advocacy groups, the information is welcome, even if they

lament that it took this long and that it isn't enough.

"It's a first step that should have been taken a long time ago,"

says Diana Ruiz, senior campaigner focused on palm oil at

Greenpeace USA.

The most information being made available covers palm oil, an

ingredient companies use in everything from frozen pizza to soap.

For years, environmental organizations have implicated palm oil in

the clearing of tropical forests and demanded buyers do more to

halt that. Now, they are using company disclosures in their

campaigns. Rainforest Action Network used palm-oil-mill lists

published by major U.S. and European consumer-product companies in

a September report that said those firms may be using palm oil

produced in an ecologically sensitive wildlife preserve in

Indonesia. Slash-and-burn farming practices are a major problem in

the country.

Mondelez, General Mills and Kellogg Co. are among the food

manufacturers now posting lists online of companies that mill the

palm oil they buy from traders. Unilever discloses on its website

the location of its palm-oil mills and refineries. Nestlé makes

available online lists of slaughterhouses it has tapped to get

beef, pork and lamb, palm-oil mills and other suppliers.

"We wanted to stop this kind of negative perception of the food

industry, Nestlé, everybody, that this is a black box that nobody

understands, " says Benjamin Ware, global head of responsible

sourcing at Nestlé.

By their nature, commodities are undifferentiated products that

are meant to be easily aggregated, traded and shipped. For decades,

finding detailed information about supply chains was challenging.

Sourcing and transactions were often considered trade secrets, and

problems were largely kept out of public view.

That it is now possible to know where food makers bought some of

their ingredients represents a degree of progress, environmental

and human-rights groups say, allowing them to more easily look into

commercial relationships and whether suppliers are meeting company

goals and industry standards. Computing power, including satellite

mapping, has made it easier to collate information and track

conditions in farming areas.

"We're living in an age of data and information in every aspect

of our lives," says Luiz Amaral, a director focused on commodities

and finance for the World Resources Institute, a Washington,

D.C.-based research organization focused on the environment. "It

isn't going to be any different in commodity supply chains," Mr.

Amaral says.

The shift toward more disclosure in supply chains has its roots

in the 1990s, when consumers in wealthier countries started to

become more aware of labor conditions in developing-world factories

producing shoes and apparel.

Legislators have since pressed to boost laws governing supply

chains. The U.K., California and other places have passed laws

requiring companies to disclose information about what they are

doing to eradicate slavery from supply chains. Sens. Sherrod Brown

(D., Ohio) and Ron Wyden (D., Ore.) in July called on Department of

Homeland Security officials to use an existing law to stop

companies from importing cocoa produced with forced child

labor.

At the same time, more consumers say they care about where their

food comes from and how it is made, a trend connected to heightened

expectations from shoppers about the healthfulness and

environmental impact of what they eat. The ubiquity of digital

devices and spread of social media, meanwhile, allows consumers to

quickly learn more about conditions in agricultural regions, such

as earlier this year when forest fires in the Amazon region of

Brazil drew global attention.

"When empowered individuals have the ability to search and learn

more information, we were forced to up our game and to understand

the complexity and intricacies of supply chain in a way we hadn't

before," says John Church, chief supply-chain officer at General

Mills.

About 60% of shoppers in the U.S., China and three major

European markets said they place a strong emphasis on the source of

ingredients when purchasing healthier products, according to a

survey conducted last year by the consulting firm AlixPartners.

Starbucks Corp., which buys coffee from more than 400,000 mostly

small farmers who sell to nearby mills, plans to offer information

about the country of origin for its bagged coffees via its mobile

app. It's still deciding how detailed to make that information.

Both coffee farmers and consumers are interested in knowing more

about how coffee makes it from farm to store, says Kelly Goodejohn,

director of ethical sourcing and traceability at the company.

Farmers could potentially use that information for commercial

purposes, according to Starbucks.

Still, more disclosure doesn't necessarily mean deeper insight

into business practices. For most shoppers, sorting through

suppliers of agricultural commodities offers little in the way of

context or ideas for taking any action.

"It's extraordinarily difficult to know, if you're not in the

industry, which processes are more likely to produce good results,"

says Adam Chilton, a University of Chicago law professor who has

written about supply-chain transparency. And while consumers say

they want information about ingredients, only 14% selected

supply-chain transparency as an important factor when looking at

food-product labels, according to a survey that consumer-research

firm Euromonitor conducted earlier this year of shoppers in major

countries around the world.

Publishing lists of suppliers doesn't necessarily change

conditions on the ground either.

Social and environmental advocates say companies must do more

than release data about suppliers. Such groups want makers of

well-known consumer products to use their economic clout as

purchasers of vast quantities of agricultural products to force

change by cutting off farmers and producers who break commitments

on issues like deforestation and human rights.

"We can tell them they shouldn't be buying from supplier X,

because they're in violation," says Marcus Colchester, senior

policy adviser at British group Forest Peoples Program, which works

with indigenous people. "And we can hope they'll tell supplier X,

unless they quickly change, they'll stop buying from them. It's

that last part that's not so clear yet."

Mr. Maidenberg is a reporter for The Wall Street Journal in New

York. He can be reached at micah.maidenberg@wsj.com.

(END) Dow Jones Newswires

October 09, 2019 19:17 ET (23:17 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

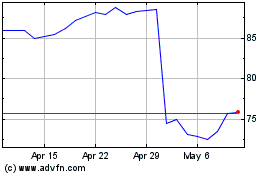

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

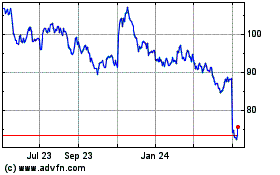

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024