Filed pursuant to Rule

424(b)(3)

Under the Securities Act of 1933, as amended

Registration No. 333-263998

PROSPECTUS

7,207,208 Shares of Common Stock

Pursuant to this prospectus,

the selling stockholders identified herein are offering on a resale basis an aggregate of 7,207,208 shares of common stock, par value

$0.001 per share, of Sunshine Biopharma, Inc., of which (i) 2,301,353 shares are issued and outstanding, (ii) 1,302,251 shares are issuable

upon exercise of pre-funded warrants, or the Pre-Funded Warrants, each exercisable into one share of common stock at an exercise price

per share of $0.001, without expiration, and (iii) 3,603,604 shares are issuable upon exercise of common warrants, or the Common Warrants,

each exercisable into one share of common stock at an exercise price per share of $2.22, expiring on March 14, 2027. We refer to the Pre-Funded

Warrants and the Common Warrants, collectively, as the Private Placement Warrants. The outstanding shares of common stock and the Private

Placement Warrants were issued to the selling stockholders in connection with a private placement we completed on March 14, 2022, or the

Private Placement. We will not receive any of the proceeds from the sale by the selling stockholders of the common stock. Upon any exercise

of the Private Placement Warrants by payment of cash, however, we will receive the exercise price of the Private Placement Warrants.

The selling stockholders may

sell or otherwise dispose of the common stock covered by this prospectus in a number of different ways and at varying prices. We provide

more information about how the selling stockholders may sell or otherwise dispose of the common stock covered by this prospectus in the

section entitled “Plan of Distribution” on page 9. Discounts, concessions, commissions and similar selling expenses

attributable to the sale of common stock covered by this prospectus will be borne by the selling stockholders. We will pay all expenses

(other than discounts, concessions, commissions and similar selling expenses) relating to the registration of the common stock with the

Securities and Exchange Commission, or the SEC.

You should carefully read

this prospectus and any accompanying prospectus supplement, together with the documents we incorporate by reference, before you invest

in our common stock.

Our common stock is listed

on The Nasdaq Capital Market under the symbol “SBFM.” On March 29, 2022, the last reported sale price for our common stock

was $2.51 per share.

Investing in our common

stock involves substantial risk. Please read “Risk Factors” beginning on page 4 of this prospectus and in the documents we

incorporate by reference.

Neither the SEC nor any

state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is

April 8, 2022.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is a part

of a registration statement that we filed with the SEC utilizing a “shelf” registration process. Under this shelf registration

process, the selling stockholders may sell the securities described in this prospectus in one or more offerings. A prospectus supplement

may add to, update or change the information contained in this prospectus. You should read this prospectus and any applicable prospectus

supplement, together with the information incorporated herein by reference as described under the heading “Information Incorporated

by Reference.”

You should rely only on the

information that we have provided or incorporated by reference in this prospectus and any applicable prospectus supplement. We have not

authorized, nor has any selling stockholder authorized, any dealer, salesman or other person to give any information or to make any representation

other than those contained or incorporated by reference in this prospectus or any applicable prospectus supplement. You should not rely

upon any information or representation not contained or incorporated by reference in this prospectus or the accompanying prospectus supplement.

We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

This prospectus and any accompanying

prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered

securities to which they relate, nor do this prospectus and any accompanying prospectus supplement constitute an offer to sell or the

solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation

in such jurisdiction. You should not assume that the information contained in this prospectus or any applicable prospectus supplement

is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by

reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus or any

applicable prospectus supplement is delivered or securities are sold on a later date.

As used in this prospectus

and unless otherwise indicated, the terms “we,” “us,” “our,” “Sunshine Biopharma,” or

the “Company” refer to Sunshine Biopharma, Inc. and its wholly owned subsidiaries.

SUMMARY

This summary highlights

certain information appearing elsewhere in this prospectus and in the documents we incorporate by reference into this prospectus. The

summary is not complete and does not contain all of the information that you should consider before investing in our common stock. After

you read this summary, you should read and consider carefully the entire prospectus and any prospectus supplement and the more detailed

information and financial statements and related notes that are incorporated by reference into this prospectus and any prospectus supplement.

If you invest in our shares, you are assuming a high degree of risk.

About Us—Business Overview

We are a pharmaceutical and

nutritional supplement company focusing on the research and development of proprietary drugs including our anti-cancer compound Adva-27a,

and anti-coronavirus lead compound, SBFM-PL4.

We also, through our wholly

owned Canadian subsidiary, Sunshine Biopharma Canada Inc. (“Sunshine Canada”), develop science-based nutritional supplements,

and currently sell one nutritional supplement product.

Corporate Information

Our principal executive offices

are located at 6500 Trans-Canada Highway, 4th Floor, Pointe-Claire, Quebec, Canada H9R 0A5, and our telephone number is (514) 426-6161.

Our website address is www.sunshinebiopharma.com. Information on our website is not part of this prospectus.

Private Placement

On March 10, 2022, the

Company entered into a securities purchase agreement, or the Purchase Agreement, with the selling stockholders, pursuant to which

the Company issued and sold, (i) an aggregate of 2,301,353 shares of common stock, (ii) Pre-Funded Warrants to purchase up to an

aggregate of 1,302,251 shares of common stock and (iii) Common Warrants to purchase up to an aggregate of 3,603,604 shares of common

stock. Each share of common stock and accompanying Common Warrant were sold together at a combined offering price of $2.22, and each

Pre-Funded Warrant and accompanying Common Warrant were sold together at a combined offering price of $2.219. Subject to certain

ownership limitations, the Private Placement Warrants are exercisable upon issuance. Each Pre-Funded Warrant is exercisable into one

share of common stock at an exercise price per share of $0.001 (as adjusted from time to time in accordance with the terms thereof)

and does not expire. Each Common Warrant is exercisable into one share of common stock at an exercise price per share of $2.22 (as

adjusted from time to time in accordance with the terms thereof) and will expire on the fifth anniversary of the date of issuance.

In connection with the Private Placement, the Company engaged Aegis Capital Corp. to serve as exclusive placement agent. The Private

Placement closed on March 14, 2022.

The issuance and sale of the

shares of common stock and the Private Placement Warrants pursuant to the Purchase Agreement and the issuance and sale of the shares of

common stock issuable upon exercise of the Private Placement Warrants were not registered under the Securities Act of 1933, as amended,

or the Securities Act, and were offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Regulation

D promulgated thereunder.

In connection with the Purchase

Agreement, on March 10, 2022, the Company entered into a registration rights agreement, with the selling stockholders. Pursuant to the

registration rights agreement, the Company agreed to file a registration statement on Form S-3 for the resale by the selling stockholders

of the outstanding shares of common stock that were issued in connection with the closing of the Private Placement, and the shares of

common stock issuable upon exercise of the Private Placement Warrants, within the earlier of (a) 15 days after the filing of the Company’s

annual report for the year ended December 31, 2021 (which occurred on March 21, 2022) or (b) 30 days after the date of the registration

rights agreement. .

We are filing the registration

statement of which this prospectus forms a part to satisfy our obligations under the registration rights agreement.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, or

the Exchange Act. Forward-looking statements give current expectations or forecasts of future events or our future financial or operating

performance. We may, in some cases, use words such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “will,” “would” or the negative of those terms, and similar expressions that convey uncertainty

of future events or outcomes to identify these forward-looking statements.

These forward-looking statements

reflect our management’s beliefs and views with respect to future events, are based on estimates and assumptions as of the date

of this prospectus and are subject to risks and uncertainties, many of which are beyond our control, that could cause our actual results

to differ materially from those in these forward-looking statements. We discuss many of these risks in greater detail in this prospectus

under “Risk Factors” and in our Annual Report on Form 10-K filed with the SEC on March 21, 2022, as well as those described

in the other documents we file with the SEC. Moreover, new risks emerge from time to time. It is not possible for our management to predict

all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties,

you should not place undue reliance on these forward-looking statements.

We undertake no obligation

to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as

may be required by applicable laws or regulations.

RISK

FACTORS

An investment in our securities

involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties

discussed below, as well as those under the heading “Risk Factors” contained in our Annual Report on Form 10-K for the year

ended December 31, 2021 as filed with the SEC, and as incorporated by reference in this prospectus, as the same may be amended, supplemented

or superseded by the risks and uncertainties described under similar headings in the other documents that are filed by us after the date

hereof and incorporated by reference into this prospectus. Please also read carefully the section above titled “Special Note Regarding

Forward-Looking Statements.”

The sale of a substantial

amount of our common stock, including resale of the shares of common stock held by the selling stockholders in the public market, could

adversely affect the prevailing market price of our common stock.

We are registering for resale

7,207,208 shares of common stock, including 4,905,855 shares of common stock issuable upon the exercise of Private Placement Warrants

held by the selling stockholders. Sales of substantial amounts of our common stock in the public market, or the perception that such sales

might occur, could adversely affect the market price of our common stock. We cannot predict if and when selling stockholders may sell

such shares in the public market.

USE OF PROCEEDS

We will not receive any of the proceeds from any sale or other disposition of the common stock covered by this prospectus.

All proceeds from the sale of the common stock will be paid directly to the selling stockholders. We will receive proceeds upon the cash

exercise of the Private Placement Warrants, however. Assuming full cash exercise of the Private Placement Warrants, we would receive

proceeds of approximately $8 million. We currently intend to use any cash proceeds from Private Placement Warrant exercises for our drug

development activities and general corporate purposes, including working capital.

To the extent the resale

of the shares of common stock underlying the Common Warrants is registered under the Securities Act and there is a prospectus available

for such registered resale, holders of Common Warrants are required to pay the exercise price for the Common Warrants in cash. If no

such registration statement and prospectus are available following September 14, 2022, the Common Warrants may be exercised through cashless

exercise, where the holder of the Common Warrant receives fewer shares upon exercise of its Common Warrant, but does not pay the Company

any cash to exercise the Common Warrant.

SELLING STOCKHOLDERS

The common stock being offered

by the selling stockholders are those previously issued to the selling stockholders, and those issuable to the selling stockholders, upon

exercise of the Private Placement Warrants. For additional information regarding the issuances of those shares of common stock and Private

Placement Warrants, see the description of the Private Placement in “Summary - Private Placement” above. We are registering

the shares of common stock in order to permit the selling stockholders to offer the shares for resale from time to time. None of the selling

stockholders have had any material relationship with us within the past three years. None of the selling stockholders is a broker-dealer

or an affiliate of a broker-dealer.

The table below lists the

selling stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the selling stockholders.

The second column lists the number of shares of common stock beneficially owned by each selling stockholder, based on its ownership of

the shares of common stock and warrants, as of March 28, 2022, assuming exercise of the warrants (including the Private Placement Warrants)

held by the selling stockholders on that date, without regard to any limitations on exercises.

The third column lists the

shares of common stock being offered by this prospectus by the selling stockholders.

In accordance with the terms

of a registration rights agreement with the selling stockholders, this prospectus generally covers the resale of the sum of (i) the number

of shares of common stock issued to the selling stockholders in the description of the Private Placement referenced above and (ii) the

maximum number of shares of common stock issuable upon exercise of the related Private Placement Warrants, determined as if the outstanding

Private Placement Warrants were exercised in full as of the trading day immediately preceding the date this registration statement was

initially filed with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to

adjustment as provided in the registration rights agreement, without regard to any limitations on the exercise of the Private Placement

Warrants. The fourth column assumes the sale of all of the shares offered by the selling stockholders pursuant to this prospectus.

Under the terms of the Private

Placement Warrants, a selling stockholder may not exercise the Private Placement Warrants to the extent such exercise would cause such

selling stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which

would exceed 4.99% or 9.99% of our then outstanding common stock following such exercise, excluding for purposes of such determination

shares of common stock issuable upon exercise of the Private Placement Warrants which have not been exercised. The number of shares in

the second column does not reflect this limitation. The selling stockholders may sell all, some or none of their shares in this offering.

See “Plan of Distribution.”

| Name of Selling stockholder |

Number of Shares of Common Stock Owned

Prior to Offering

(1) |

|

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus |

|

Number of Shares of

Common Stock Owned

After Offering

(2) |

|

Percentage of Outstanding Common Stock Owned After the Offering (30) |

| Armistice Capital Master Fund Ltd. (3) |

4,488,206 |

(4) |

3,603,606 |

(5) |

632,120 (31) |

|

4.99 |

| Iroquois Capital Investment Group LLC (6) |

738,466 |

(7) |

585,586 |

(8) |

152,880 |

|

1.3 |

| Iroquois Master Fund Ltd. (9) |

419,900 |

(10) |

315,316 |

(11) |

104,584 |

|

* |

| Bigger Capital Fund LP (12) |

700,133 |

(13) |

562,900 |

(14) |

137,233 |

|

1.1 |

| District 2 Capital Fund LP (15) |

338,000 |

(16) |

338,000 |

(17) |

0 |

|

- |

| Empery Asset Master, LTD (18) |

688,200 |

(19) |

542,096 |

(20) |

146,104 |

|

1.2 |

| Empery Tax Efficient, LP (21) |

191,250 |

(22) |

154,944 |

(23) |

36,306 |

|

* |

| Empery Tax Efficient III, LP (24) |

256,650 |

(25) |

203,860 |

(26) |

52,790 |

|

* |

| Hudson Bay Master Fund Ltd. (27) |

960,900 |

(28) |

900,900 |

(29) |

60,000 |

|

* |

___________________

| * |

Denotes less than 1%. |

| |

|

| (1) |

Under applicable SEC rules, a person is deemed to beneficially own securities which the person has the right to acquire within 60 days through the exercise of any option or warrant or through the conversion of a convertible security. Also under applicable SEC rules, a person is deemed to be the “beneficial owner” of a security with regard to which the person directly or indirectly, has or shares (a) voting power, which includes the power to vote or direct the voting of the security, or (b) investment power, which includes the power to dispose, or direct the disposition, of the security, in each case, irrespective of the person’s economic interest in the security. To our knowledge, subject to community property laws where applicable, each person named in the table has sole voting and investment power with respect to the common stock shown as beneficially owned by such selling stockholder, except as otherwise indicated in the footnotes to the table. |

| (2) |

Represents the amount of shares that will be held by the selling stockholder after completion of this offering based on the assumptions that (a) all common stock underlying Private Placement Warrants registered for sale by the registration statement of which this prospectus is part will be sold and (b) no other shares of common stock are acquired or sold by the selling stockholder prior to completion of this offering. However, each selling stockholder may sell all, some or none of the such shares offered pursuant to this prospectus and may sell other shares of common stock that they may own pursuant to another registration statement under the Securities Act or sell some or all of their shares pursuant to an exemption from the registration provisions of the Securities Act, including under Rule 144. |

| (3) |

The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”), and may be deemed to be indirectly beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. Armistice Capital and Steven Boyd disclaim beneficial ownership of the securities except to the extent of their respective pecuniary interests therein. The address of the Master Fund and Armistice Capital is 510 Madison Ave, 7th Floor, New York, NY 10022. |

| (4) |

Ownership prior to the offering represents (i) 635,002 shares of common stock, (ii) 1,166,801 shares of common stock issuable upon exercise of Pre-Funded Warrants (subject to a 9.99% beneficial ownership limitation), (iii) 1,801,803 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iv) 884,600 shares of common stock issuable upon exercise of other warrants (subject to a 4.99% beneficial ownership limitation). |

| (5) |

Represents (i) 635,002 shares of common stock, (ii) 1,166,801 shares of common stock issuable upon exercise of Pre-Warrants (subject to a 9.99% beneficial ownership limitation), and (iii) 1,801,803 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (6) |

Richard Abbe is the Managing Member of Iroquois Capital

Investment Group, LLC and may be deemed to have voting and dispositive power with respect to the shares. The business address of Iroquois

Capital Investment Group, LLC is 2 Overhill Road, Scarsdale, New York 10583. |

| (7) |

Ownership prior to the offering represents (i) 292,793 shares of common stock, (ii) 292,793 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iii) 152,880 shares of common stock issuable upon exercise of other warrants. |

| (8) |

Represents (i) 292,793 shares of common stock and (ii) 292,793 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (9) |

Richard Abbe and Kim Page are Managing Members of Iroquois Capital Management

LLC, investment advisor to Iroquois Master Fund, Ltd and may be deemed to have voting and dispositive power with respect to the shares.

The business address of Iroquois Master Fund Ltd is 2 Overhill Road, Scarsdale, New York 10583. |

| (10) |

Ownership prior to the offering represents (i) 157,658 shares of common stock, (ii) 157,658 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iii) 104,584 shares of common stock issuable upon exercise of other warrants (subject to a 4.99% beneficial ownership limitation). |

| (11) |

Represents (i) 157,658 shares of common stock and (ii) 157,658 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (12) |

Michael Bigger, the authorized agent of Bigger Capital Fund, LP (“Bigger

Capital”), has discretionary authority to vote and dispose of the securities held by Bigger Capital. Michael Bigger may be deemed

to be the beneficial owner of these securities. The business address of Bigger Capital Fund, LP is 11700 West Charleston Blvd., #170-659,

Las Vegas, NV 89135. |

| (13) |

Ownership prior to the offering represents (i) 281,450 shares of common stock, (ii) 281,450 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation) and (iii) 137,233 shares of common stock issuable upon exercise of other warrants. |

| (14) |

Represents (i) 281,450 shares of common stock and (ii) 281,450 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (15) |

Michael Bigger, the authorized agent of District 2 Capital Fund (“District”),

has discretionary authority to vote and dispose of the securities held by District. Michael Bigger may be deemed to be the beneficial

owner of these securities. The business address of District 2 Capital Fund LP is 14 Wall Street, Suite 200, Huntington, NY 11743. |

| (16) |

Ownership prior to the offering represents (i) 169,000 shares of common stock and (ii) 169,000 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (17) |

Represents (i) 169,000 shares of common stock and (ii) 169,000 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (18) |

Empery Asset Management LP, the authorized agent of Empery Asset Master Ltd (“EAM”), has discretionary authority to vote and dispose of the shares held by EAM and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by EAM. EAM, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares. |

| (19) |

Ownership prior to the offering represents (i) 271,048 shares of common stock, (ii) 271,048 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iii) 146,104 shares of common stock issuable upon exercise of other warrants (subject to a 4.99% beneficial ownership limitation). |

| (20) |

Represents (i) 271,048 shares of common stock and (ii) 271,048 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (21) |

Empery Asset Management LP, the authorized agent of Empery Tax Efficient, LP (“ETE”), has discretionary authority to vote and dispose of the shares held by ETE and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by ETE. ETE, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares. |

| (22) |

Ownership prior to the offering represents (i) 77,472 shares of common stock, (ii) 77,472 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iii) 36,306 shares of common stock issuable upon exercise of other warrants (subject to a 4.99% beneficial ownership limitation). |

| (23) |

Represents (i) 77,472 shares of common stock and (ii) 77,472 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (24) |

Empery Asset Management LP, the authorized agent of Empery Tax Efficient III, LP (“ETE III”), has discretionary authority to vote and dispose of the shares held by ETE III and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by ETE III. ETE III, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares. |

| (25) |

Ownership prior to the offering represents (i) 101,930 shares of common stock, (ii) 101,930 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iii) 52,790 shares of common stock issuable upon exercise of other warrants (subject to a 4.99% beneficial ownership limitation). |

| (26) |

Represents (i) 101,930 shares of common stock and (ii) 101,930 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (27) |

Hudson Bay Capital Management LP, the investment manager of Hudson Bay Master Fund Ltd., has voting and investment power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Hudson Bay Master Fund Ltd. and Sander Gerber disclaims beneficial ownership over these securities. The address for Hudson Bay Master Fund Ltd. Is c/o Hudson Bay Capital Management LP, 28 Havemeyer Place, 2nd Floor, Greenwich, Connecticut 06830. |

| (28) |

Ownership prior to the offering represents (i) 315,000 shares of common stock, (ii) 135,450 shares of common stock issuable upon exercise of Pre-Funded Warrants (subject to a 4.99% beneficial ownership limitation), (iii) 450,450 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iv) 60,000 shares of common stock issuable upon exercise of other warrants (subject to a 4.99% beneficial ownership limitation). |

| (29) |

Represents (i) 315,000 shares of common stock, (ii) 135,450 shares of common stock issuable upon exercise of Pre-Funded Warrants (subject to a 4.99% beneficial ownership limitation), and (iii) 450,450 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (30) |

Based on 7,129,778 shares of common stock outstanding as of March 28, 2022, and assumes that following the offering all of the 4,905,855

Private Placement Warrants will have been exercised (such that 12,035,633 shares of common stock will be outstanding), and all of the

shares offered by the selling stockholders hereunder will have been sold. |

| (31) | Following the offering, the selling stockholder will own 884,600 warrants. Such warrants

are subject to a 4.99% beneficial ownership limitation and the number of shares deemed beneficially following the offering is limited

accordingly. |

PLAN OF DISTRIBUTION

Each selling stockholder of

the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities

covered hereby on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded

or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may use any one or more of the following

methods when selling securities:

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the broker-dealer will attempt to sell the securities as agent but may position

and resell a portion of the block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | an exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | settlement of short sales; |

| · | in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number

of such securities at a stipulated price per security; |

| · | through the writing or settlement of options or other hedging transactions, whether through an options

exchange or otherwise; |

| · | a combination of any such methods of sale; or |

| · | any other method permitted pursuant to applicable law. |

The selling stockholders may

also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under

this prospectus.

Broker-dealers engaged by

the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts

to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a

customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in

compliance with FINRA IM-2440.

In connection with the sale

of the securities or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling

stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities

to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with

broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer

or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholders and

any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning

of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any

profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act. Each selling stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly

or indirectly, with any person to distribute the securities.

The Company is required to

pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify

the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus

effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholders without registration and

without regard to any volume or manner-of-sale limitations by reason of Rule 144, and provided the Company is in compliance with the current

public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities have been

sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities will

be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain

states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable

state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and

regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market

making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement

of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules

and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the Selling

Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them

of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule

172 under the Securities Act).

LEGAL MATTERS

The validity of the shares

of common stock offered hereby will be passed upon for us by Andrew I. Telsey, P.C.

EXPERTS

The consolidated financial

statements of Sunshine Biopharma, Inc. at December 31, 2021 and 2020 appearing in our Annual Report on From 10-K for the year ended December

31, 2021 have been audited by of B F Borgers CPA PC, independent registered public accountants, as set forth in its report thereon, included

therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance upon such report

given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC

a registration statement on Form S-3 under the Securities Act that registers the shares of our common stock covered by this prospectus.

This prospectus does not contain all of the information set forth in the registration statement and the exhibits thereto. For further

information with respect to us and our common stock, you should refer to the registration statement and the exhibits filed as a part of

the registration statement. Statements contained in or incorporated by reference into this prospectus concerning the contents of any contract

or any other document are not necessarily complete. If a contract or document has been filed as an exhibit to the registration statement

or one of our filings with the SEC that is incorporated by reference into the registration statement, we refer you to the copy of the

contract or document that has been filed. Each statement contained in or incorporated by reference into this prospectus relating to a

contract or document filed as an exhibit is qualified in all respects by the filed exhibit.

We are subject to the informational

reporting requirements of the Exchange Act. We file reports, proxy statements and other information with the SEC. Our SEC filings are

available over the Internet at the SEC’s website at http://www.sec.gov.

We make available, free of charge, on our website

at www.sunshinebiopharma.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments

to those reports and statements as soon as reasonably practicable after they are filed with the SEC. The contents of our website are

not part of this prospectus, and the reference to our website does not constitute incorporation by reference into this prospectus of

the information contained on or through that site, other than documents we file with the SEC that are specifically incorporated by reference

into this prospectus.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus the information in documents we file with it, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and

information that we file later with the SEC will automatically update and supersede this information. Any statement contained in any document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus

to the extent that a statement contained in or omitted from this prospectus or any accompanying prospectus supplement, or in any other

subsequently filed document which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement.

Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We incorporate by reference

the documents listed below and any future documents that we file with the SEC (excluding any portion of such documents that are furnished

and not filed with the SEC) under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) after the date of the initial filing of the

registration statement of which this prospectus forms a part prior to the effectiveness of the registration statement and (ii) after the

date of this prospectus until the offering of the securities is terminated:

| · | our Annual Report on Form 10-K for our fiscal year ended December 31, 2021, filed with the SEC on March

21, 2022; |

| · | our Current Reports on Form 8-K filed with the SEC on February 10, 2022, February 17, 2022, February 25,

2022, March 15, 2022 and March 24, 2022; and |

| · | the description of our common stock contained in our Registration Statement on Form 8-A, registering our

common stock under Section 12(b) under the Exchange Act, filed with the SEC on February 10, 2022. |

You may request a copy of

these filings, at no cost, by writing or telephoning us at the following address: Sunshine Biopharma, Inc., 6500 Trans-Canada Highway,

4th Floor, Pointe-Claire, Quebec, Canada H9R 0A5; telephone number (514) 426-6161.

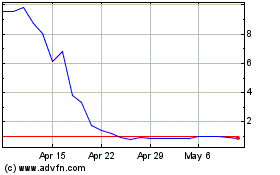

Sunshine Biopharma (NASDAQ:SBFM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sunshine Biopharma (NASDAQ:SBFM)

Historical Stock Chart

From Apr 2023 to Apr 2024