Current Report Filing (8-k)

May 20 2020 - 6:04AM

Edgar (US Regulatory)

SBA COMMUNICATIONS CORP false 0001034054 0001034054 2020-05-19 2020-05-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) May 19, 2020

SBA Communications Corporation

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Florida

|

|

001-16853

|

|

65-0716501

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

8051 Congress Avenue

Boca Raton, FL

|

|

33487

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (561) 995-7670

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Class A Common Stock, $0.01 par value per share

|

|

SBAC

|

|

The NASDAQ Stock Market LLC

(NASDAQ Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

☐

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On May 19, 2020, SBA Communications Corporation (“SBA”) entered into a Purchase Agreement (the “Purchase Agreement”) under which SBA agreed to sell $500 million aggregate principal amount of its 3.875% senior notes due 2027 (the “Notes”) to Citigroup Global Markets Inc., as representative of the several initial purchasers named therein. SBA expects the closing of the Notes to occur on May 26, 2020.

The Notes have an interest rate of 3.875% and will be issued at a price of 99.50% of their face value plus accrued interest from February 4, 2020. The Notes will be issued as additional notes under a supplement to an existing indenture dated as of February 4, 2020, and will constitute the same series of securities as the $1.0 billion 3.875% Senior Notes due 2027 issued on February 4, 2020 (the “Existing Notes”). Other than with respect to the date of issuance and the offering price, the Notes will have the same terms as the Existing Notes and the Notes and the Existing Notes will be treated as a single class for all purposes under the indenture. Except with respect to Notes offered pursuant to Regulation S, the Notes will have the same CUSIP number as, and will be fungible with, the Existing Notes immediately upon issuance. SBA intends to use the net proceeds from the offering to repay amounts outstanding under its Revolving Credit Facility (the “Revolving Credit Facility”) under its Senior Credit Agreement (the “Senior Credit Agreement”), which as of May 18, 2020 had an outstanding balance of $295 million. All remaining net proceeds will be used for general corporate purposes.

The Purchase Agreement contains customary representations, warranties, conditions to closing, indemnification rights and obligations of the parties.

Certain of the initial purchasers and their affiliates have engaged, and may in the future engage, in investment banking, commercial banking and other financial advisory and commercial dealings with SBA and its affiliates. In addition, certain of the initial purchasers or their affiliates serve in various roles under SBA’s Senior Credit Agreement, including as lenders under the Revolving Credit Facility. Accordingly, such lenders will receive a portion of the net proceeds from the offering.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth under Item 1.01 is incorporated by reference herein.

On May 19, 2020, SBA issued a press release announcing its intention to offer $400 million aggregate principal amount of Notes. A copy of the press release is filed herewith as Exhibit 99.1.

On May 19, 2020, SBA issued a press release announcing the upsizing of its previously announced offering of $400 million aggregate principal amount of Notes to $500 million aggregate principal amount of Notes and the pricing of its $500 million aggregate principal amount of Notes. A copy of the press release is filed herewith as Exhibit 99.2.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

SBA COMMUNICATIONS CORPORATION

|

|

|

|

|

|

By:

|

|

/s/ Brendan T. Cavanagh

|

|

|

|

Brendan T. Cavanagh

|

|

|

|

Executive Vice President and Chief Financial Officer

|

Date: May 19, 2020

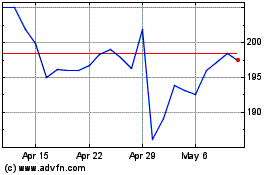

SBA Communications (NASDAQ:SBAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

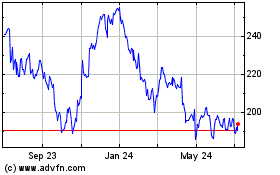

SBA Communications (NASDAQ:SBAC)

Historical Stock Chart

From Apr 2023 to Apr 2024