ABOUT

THIS PROSPECTUS

This prospectus is

part of a registration statement on Form S-3 that we filed with the

Securities and Exchange Commission, or the SEC, using a

“shelf” registration process for the delayed offering

and sale of securities pursuant to Rule 415 under the Securities

Act of 1933, as amended (the “Securities Act”). Under

the shelf process, the selling stockholders may, from time to time,

sell the offered securities described in this prospectus in one or

more offerings. Additionally, under the shelf process, in certain

circumstances, we may provide a prospectus supplement that will

contain specific information about the terms of a particular

offering by one or more of the selling stockholders. We may also

provide a prospectus supplement to add information to, or update or

change information contained in, this prospectus.

This prospectus

does not contain all of the information set forth in the

registration statement, portions of which we have omitted as

permitted by the rules and regulations of the SEC. Statements

contained in this prospectus as to the contents of any contract or

other document are not necessarily complete. You should refer to

the copy of each contract or document filed as an exhibit to the

registration statement for a complete description.

You should rely

only on the information contained in or incorporated by reference

into this prospectus and any applicable prospectus supplements.

Such documents contain important information you should consider

when making your investment decision. We have not authorized anyone

to provide you with different or additional information. The

selling stockholders are offering to sell and seeking offers to buy

shares of our Class B Common Stock only in jurisdictions in which

offers and sales are permitted. The information contained in this

prospectus is accurate only as of the date of this prospectus,

regardless of the time of delivery of this prospectus or any sale

of Class B Common Stock.

Unless the context

otherwise requires, all references to “RumbleOn,”

“RMBL,” the “Company,”

“registrant,” “we,” “us,”

“our” and similar names refer to RumbleOn, Inc.,

formerly Smart Server, Inc., and its consolidated

subsidiaries.

|

|

|

|

|

|

PROSPECTUS

SUMMARY

This summary does not contain all of the information that is

important to you. You should read the entire prospectus carefully,

including the “Risk Factors” section and the

consolidated financial statements and related notes included in

this prospectus or incorporated by reference into this prospectus,

before making an investment decision.

Overview

RumbleOn, Inc. is a

technology driven, motor vehicle dealer and e-commerce platform

provider disrupting the vehicle supply chain using innovative

technology that aggregates, processes and distributes inventory in

a faster and more cost-efficient manner.

We operate an

infrastructure-light platform that facilitates the ability of all

participants in the supply chain, including RumbleOn, other dealers

and consumers to Buy-Sell-Trade-Finance-Transport preowned

vehicles. Our goal is to transform the way VIN-specific pre-owned

vehicles are bought and sold by providing users with the most

comprehensive, efficient, timely and transparent transaction

experiences. While our initial customer facing emphasis through

most of 2018 was on motorcycles and other powersports, we continue

to enhance our platform to accommodate nearly any VIN-specific

vehicle including motorcycles, ATVs, boats, RVs, cars and trucks,

and via our acquisitions of Wholesale, Inc. in October 2018 and

Autosport USA, Inc. in February 2019 we are making a concerted

effort to grow our cars and light truck categories.

Recent Developments

Acquisition of Autosport

On

February 3, 2019 (the “Closing Date”), the Company

completed the acquisition (the “Acquisition”) of all of

the equity interests of Autosport USA, Inc.

(“Autosport”), an independent pre-owned vehicle

distributor, pursuant to a Stock Purchase Agreement, dated February

1, 2019 (the “Stock Purchase Agreement”), by and among

RMBL Express, LLC (the “Buyer”), a wholly owned

subsidiary of Company, Scott Bennie (the “Seller”) and

Autosport. Aggregate consideration for the Acquisition consisted of

(i) a closing cash payment of $600,000, plus (ii) a fifteen-month

$500,000 promissory note (the “Promissory Note”) in

favor of the Seller, plus (iii) a three-year $1,536,000 convertible

promissory note (the “Convertible Note”) in favor of

the Seller, plus (iv) contingent earn-out payments payable in the

form of cash and/or the Company’s Class B Common Stock for up

to an additional $787,500 if Autosport achieves certain performance

thresholds. The number of shares of the Company's Class B Common

Stock issuable pursuant to these earn-out payments is currently

estimated to be 150,000 (the “Earn-Out Shares”).In

connection with the Acquisition, the Buyer also paid outstanding

debt of Autosport of $235,000 and assumed additional debt of

$257,933 pursuant to a promissory note payable to Seller (the

"Second Convertible Note").

The

Promissory Note has a term of fifteen months and will accrue

interest at a simple rate of 5% per annum. Interest under the

Promissory Note is payable upon maturity. Any interest and

principal due under the Promissory Note is convertible, at the

Buyer’s option into shares of the Company’s Class B

Common Stock at a conversion price equal to the weighted average

trading price of the Company’s Class B Common Stock on the

Nasdaq Stock Exchange for the twenty (20) consecutive trading days

preceding the conversion date. The number of shares of the

Company’s Class B Common Stock issuable pursuant to the

Promissory Note is currently estimated to be 78,370 (the

"Promissory Note Shares").

The

Convertible Note has a term of three years and will accrue interest

at a rate of 6.5% per annum. Interest under the Convertible Note is

payable monthly for the first 12 months, and thereafter monthly

payments of amortized principal and interest will be due. Any

interest and principal due under the Convertible Note is

convertible into shares of the Company’s Class B Common Stock

at a conversion price of $5.75 per share, (i) at the Seller’s

option, or (ii) at the Buyer’s option, on any day that (a)

any portion of the principal of the Convertible Note remains unpaid

and (b) the weighted average trading price of the Company’s

Class B Common Stock on Nasdaq for the twenty (20) consecutive

trading days preceding such day has exceeded $7.00 per share. The

maximum number of shares issuable pursuant to the Convertible Note

is 319,221 shares of the Company’s Class B Common Stock. The

number of shares of the Company’s Class B Common Stock

issuable pursuant to the Convertible Note is currently estimated to

be 267,130 (the "Convertible Note Shares").

|

|

|

|

|

|

|

|

|

|

|

|

The

Second Convertible Note has a term of one year and will accrue

interest at a simple rate of 5% per annum. Monthly payments of

amortized principal and interest will be due under the Second

Convertible Note. Any interest and principal due under the Second

Convertible Note is convertible into shares of the Company’s

Class B Common Stock at a conversion price of $5.75 per share, (i)

at the Seller’s option, or (ii) at the Buyer’s option,

on any day that (a) any portion of the principal of the Second

Convertible Note remains unpaid and (b) the weighted average

trading price of the Company’s Class B Common Stock on Nasdaq

for the twenty (20) consecutive trading days preceding such day has

exceeded $7.00 per share. The maximum number of shares issuable

pursuant to the Second Convertible Note is 47,101 shares of the

Company’s Class B Common Stock. The number of shares of the

Company’s Class B Common Stock issuable pursuant to the

Second Convertible Note is currently estimated to be 44,858 (the

"Second Convertible Note Shares," together with the Promissory Note

Shares and the Convertible Note Shares, the "Autosport Note

Shares").

February 2019 Public Offering

On February 11,

2019, the Company completed an underwritten public offering of

1,276,500 shares of its Class B Common Stock at a price of $5.55

per share for net proceeds to the Company of approximately $6.5

million. The completed offering included 166,500 shares of Class B

Common Stock issued upon the underwriter's exercise in full of its

over-allotment option. The Company intends to use the net proceeds

from the offering for working capital and general corporate

purposes, which may include purchases of additional inventory held

for sale, increased spending on marketing and advertising and

capital expenditures necessary to grow the business.

In connection with

the February 2019 offering, the exercise price of the warrant,

dated October 30, 2018, issued to Hercules Capital, Inc. (the

"October 2018 Warrant") was adjusted to $5.55 and the number of

shares of Class B Common Stock underlying the October 2018 Warrant

was adjusted to 27,026. The October 2018 Warrant is immediately

exercisable and expires on October 30, 2023.

Notes Offering

On May 9, 2019, the

Company entered into a purchase agreement (the "Purchase

Agreement") with JMP Securities LLC (“JMP Securities”)

to issue and sell $30.0 million in aggregate principal amount of

its 6.75% Convertible Senior Notes due 2024 (the

“Notes”) in a private placement to qualified

institutional buyers pursuant to Rule 144A under the Securities Act

of 1933, as amended (the "Note Offering").

The Company paid JMP Securities a fee

of 7% of the gross proceeds in the Note Offering. The net

proceeds for the Note Offering were approximately $27.3

million.

The Notes were issued

on

May 14, 2019 pursuant to an Indenture (the

“Indenture”), by and between the Company and Wilmington

Trust, National Association, as trustee (the

“Trustee”). The Purchase Agreement includes customary

representations, warranties and covenants by the Company and

customary closing conditions. Under the terms of the Purchase

Agreement, the Company has agreed to indemnify JMP Securities

against certain liabilities. The Notes will bear interest at 6.75%

per annum, payable semiannually on May 1 and November 1 of each

year, beginning on November 1, 2019. The Notes may bear additional

interest under specified circumstances relating to the

Company’s failure to comply with its reporting obligations

under the Indenture or if the Notes are not freely tradeable as

required by the Indenture. The Notes will mature on May 1, 2024,

unless earlier converted, redeemed or repurchased pursuant to their

terms.

The initial

conversion rate of the Notes is 173.9130 shares of Class B Common

Stock, par value $0.001 per share (the “Class B Common

Stock”), per $1,000 principal amount of the Notes, subject to

adjustment (which is equivalent to an initial conversion price of

approximately $5.75 per share, subject to adjustment). The

conversion rate will be subject to adjustment in some events but

will not be adjusted for any accrued and unpaid interest. In

addition, upon the occurrence of a make-whole fundamental change

(as defined in the Indenture), the Company will, in certain

circumstances, increase the conversion rate by a number of

additional shares for a holder that elects to convert its Notes in

connection with such make-whole fundamental change.

The Notes are not redeemable by the

Company prior to the May 6, 2022.

The

Company

may redeem for

cash all or any portion of the Notes, at its option, on or after

May 6, 2022 if the last reported sale price of our Class B Common

Stock has been at least 150% of the conversion price then in effect

for at least 20 trading days (whether or not consecutive),

including the trading day immediately preceding the date on which

we provide notice of redemption, during any 30 consecutive trading

day period ending on, and including, the trading day immediately

preceding the date on which we provide notice of redemption at a

redemption price equal to 100% of the principal amount of the notes

to be redeemed, plus accrued and unpaid interest to, but excluding,

the redemption date. No sinking fund is provided for the

notes.

|

|

|

|

|

|

|

|

|

|

|

|

In connection with

the Note Offering, the Company entered into a registration rights

agreement with JMP Securities, pursuant to which the Company has

agreed to file with the SEC an automatic shelf registration

statement, if the Company is eligible to do so and has not already

done so, and, if the Company is not eligible for an automatic shelf

registration statement, then in lieu of the foregoing the Company

shall file a shelf registration statement for the registration of,

and the sale on a continuous or delayed basis by the holders of,

all of the Notes pursuant to Rule 415 or any similar rule

that may be adopted by the Commission, and use its commercially

reasonable efforts to cause the shelf registration statement to

become or be declared effective under the Securities Act on the day

that is 120 days after the May 9, 2019.

Class B Common Stock Offering

On May 9, 2019, the

Company also entered into a Securities Purchase Agreement (the

“Securities Purchase Agreement”) with certain

accredited investors (the “Investors”) pursuant to

which the Company agreed to sell in a private placement (the

“Private Placement”) an aggregate of 1,900,000 shares

of its Class B Common Stock (the “Private Placement

Shares”), at a purchase price of $5.00 per share. JMP

Securities served as the placement agent for the Private Placement.

The Company paid JMP Securities a fee of 7% of the gross proceeds

in the Private Placement. The net proceeds for the Private

Placement were approximately $8.8 million.

Pursuant to the

Securities Purchase Agreement, the Company has agreed to file with

the SEC a registration statement with respect to the resale of the

Private Placement Shares purchased by the Investors under the

Securities Purchase Agreement no later than 30 days after the

Placement Date, and to have such registration statement declared

effective by the SEC no later than (i) 90 days after the Placement

Date in the event the SEC does not review such registration

statement, or, if earlier, five business days after a determination

by the SEC that it will not review such registration statement, or

(ii) 180 days after the Placement Date in the event the SEC does

review such registration statement. In the event the Company does

not file such registration statement or does not cause such

registration statement to become effective by the applicable

deadline or after such registration statement becomes effective it

is suspended or ceases to be effective, then the Company will be

required to make certain payments as liquidated damages to the

Investors under the Securities Purchase Agreement.

The Private

Placement Shares were issued in reliance on the exemption from

registration provided by Rule 506 of Regulation D of the Securities

Act of 1933, as amended, as a sale not involving any public

offering. The Private Placement and Note Offering are collectively

referred to in this report as the Offerings.

This prospectus

includes the Private Placement Shares to be offered by the selling

stockholders.

In connection with

the Private Placement, the exercise price of the warrant, dated

April 30, 2018, issued to Hercules Capital, Inc. (the "April 2018

Warrant") was adjusted to $5.4648 and the number of shares of Class

B Common Stock underlying the April 2018 Warrant was adjusted to

82,342. The April 2018 Warrant is immediately exercisable and

expires on April 30, 2023. Also in connection with the

Private Placement, the exercise price of the October 2018 Warrant

was further adjusted to $5.00 and the number of shares of Class B

Common Stock underlying October 2018 Warrant was adjusted to

29,999.

Corporate Information

We were incorporated as a development stage

company in the State of Nevada as Smart Server, Inc. in October

2013. In February 2017, we changed our name to RumbleOn, Inc. Our

principal executive offices are located at 1350 Lakeshore Drive,

Suite 160, Coppell, Texas 75019 and our telephone number is (469)

250-1185. Our Internet website is

www.rumbleon.com

.

Our Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and

amendments to reports filed or furnished pursuant to Sections 13(a)

and 15(d) of the Exchange Act are available, free of charge, under

the Investor Relations tab of our website as soon as reasonably

practicable after we electronically file such material with, or

furnish it to, the SEC. The information on our website, however, is

not, and should not be, considered part of this prospectus, is not

incorporated by reference into this prospectus, and should not be

relied upon in connection with making any investment decision with

respect to our securities. The SEC also maintains an Internet

website located at

www.sec.

gov

that contains the information we file

or furnish electronically with the SEC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THE

OFFERING

|

|

|

|

|

|

|

|

|

|

Class B Common

Stock outstanding prior to the offering:

|

|

21,987,120

shares

|

|

|

|

|

|

|

|

|

|

Class B Common

Stock to be issued upon exercise of the Warrants:

|

|

9,573

shares

|

|

|

|

|

|

|

|

|

|

Class B Common

Stock to be issued as Earn-out Shares:

|

|

150,000

shares

|

|

|

|

|

|

|

|

|

|

Class B Common

Stock to be issued upon conversion of the Autosport

Notes:

|

|

390,358

shares

|

|

|

|

|

|

|

|

|

|

Class B Common

Stock to be offered by the selling stockholders:

|

|

2,449,931

shares

|

|

|

|

|

|

|

|

|

|

Class B Common

Stock outstanding immediately following the offering:

|

|

24,437,051

shares

(1)

|

|

|

|

|

|

|

|

|

|

Use of

proceeds:

|

|

We will not receive

any proceeds from the sale of the shares of Class B Common Stock by

the selling stockholders but will receive proceeds from the

exercise of the Warrants if the Warrants are exercised, which

proceeds will be used for working capital and other general

corporate purposes. See “Use of Proceeds.”

|

|

|

|

|

|

|

|

|

|

Risk

Factors:

|

|

See “Risk

Factors” beginning on page

5

of this prospectus for a discussion of

factors you should carefully consider before deciding to invest in

shares of our Class B Common Stock.

|

|

|

|

|

|

|

|

|

|

Stock

Symbol:

|

|

|

|

|

|

|

|

|

|

|

|

(1)

The

number of shares of our Class B Common Stock outstanding

excludes:

●

5,217,390

shares of Class B Common Stock underlying the

Notes;

●

1,521,816 shares of

Class B Common Stock underlying outstanding restricted stock units

granted under the RumbleOn, Inc. 2017 Stock Incentive Plan, as

amended (the “2017 Stock Incentive Plan”);

●

279,184 shares of

Class B Common Stock reserved for issuance under the 2017 Stock

Incentive Plan; and

●

321,018 shares of

Class B Common Stock underlying outstanding warrants.

|

|

|

|

|

|

|

|

RISK

FACTORS

Investing in our

securities involves significant risks. Before making an investment

decision, you should consider carefully the risks, uncertainties

and other factors described under "Risk Factors" in our most recent

Annual Report on Form 10-K, as supplemented and updated by

subsequent quarterly reports on Form 10-Q and current reports on

Form 8-K that we have filed or will file with the SEC, and in other

documents which are incorporated by reference into this

prospectus.

If any of these

risks were to occur, our business, affairs, prospects, assets,

financial condition, results of operations and cash flow could be

materially and adversely affected. If this occurs, the market or

trading price of our securities could decline, and you could lose

all or part of your investment. In addition, please read

“Cautionary Statement Regarding Forward-Looking

Statements” in this prospectus, where we describe additional

uncertainties associated with our business and the forward-looking

statements included or incorporated by reference into this

prospectus.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Our business,

financial condition, results of operations, cash flows and

prospects, and the prevailing market price and performance of our

securities, may be adversely affected by a number of factors,

including the matters discussed below. Certain statements and

information set forth in this registration statement, as well as

other written or oral statements made from time to time by us or by

our authorized executive officers on our behalf, constitute

“forward-looking statements” within the meaning of the

Federal Private Securities Litigation Reform Act of 1995. We intend

for our forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and we set forth this

statement and these risk factors in order to comply with such safe

harbor provisions. You should note that our forward-looking

statements speak only as of the date of this registration statement

or when made and we undertake no duty or obligation to update or

revise our forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by law.

Although we believe that the expectations, plans, intentions and

projections reflected in our forward-looking statements are

reasonable, such statements are subject to risks, uncertainties and

other factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. The risks, uncertainties and other

factors that our stockholders and prospective investors should

consider include the following:

●

We have a limited

operating history and we cannot assure you we will achieve or

maintain profitability;

●

Our annual and

quarterly operating results may fluctuate significantly or may fall

below the expectations of investors or securities analysts, each of

which may cause our stock price to fluctuate or

decline;

●

The initial

development and progress of our business to date may not be

indicative of our future growth prospects and, if we continue to

grow rapidly, we may not be able to manage our growth

effectively;

●

We may require

additional capital to pursue our business objectives and respond to

business opportunities, challenges or unforeseen circumstances. If

capital is not available on terms acceptable to us or at all, we

may not be able to develop and grow our business as anticipated and

our business, operating results and financial condition may be

harmed;

●

The success of our

business relies heavily on our marketing and branding efforts,

especially with respect to the RumbleOn website and our branded

mobile applications, and these efforts may not be

successful;

●

The failure to

develop and maintain our brand could harm our ability to grow

unique visitor traffic and to expand our regional partner

network;

●

We rely on Internet

search engines to drive traffic to our website, and if we fail to

appear prominently in the search results, our traffic would

decline, and our business would be adversely affected;

●

A significant

disruption in service on our website or of our mobile applications

could damage our reputation and result in a loss of consumers,

which could harm our business, brand, operating results, and

financial condition;

●

We may be unable to

maintain or grow relationships with information data providers or

may experience interruptions in the data feeds they provide, which

may limit the information that we are able to provide to our users

and regional partners as well as adversely affect the timeliness of

such information and may impair our ability to attract or retain

consumers and our regional partners and to timely invoice all

parties;

●

If we are unable to

provide a compelling vehicle buying experience to our users, the

number of transactions between our users, RumbleOn and dealers will

decline, and our revenue and results of operations will suffer

harm;

●

If key industry

participants, including powersports and recreation vehicle dealers

and regional auctions, perceive us in a negative light or our

relationships with them suffer harm, our ability to operate and

grow our business and our financial performance may be

damaged;

●

The growth of our

business relies significantly on our ability to increase the number

of regional partners in our network such that we are able to

increase the number of transactions between our users and regional

partners. Failure to do so would limit our growth;

●

Our ability to grow

our complementary product offerings may be limited, which could

negatively impact our development, growth, revenue and financial

performance;

●

We rely on

third-party financing providers to finance a portion of our

customers' vehicle purchases;

●

Our sales of

powersports/recreation vehicles may be adversely impacted by

increased supply of and/or declining prices for pre-owned vehicles

and excess supply of new vehicles;

●

We rely on a number

of third parties to perform certain operating and administrative

functions for the Company;

●

We participate in a

highly competitive market, and pressure from existing and new

companies may adversely affect our business and operating

results;

●

Seasonality or

weather trends may cause fluctuations in our unique visitors,

revenue and operating results;

●

We collect,

process, store, share, disclose and use personal information and

other data, and our actual or perceived failure to protect such

information and data could damage our reputation and brand and harm

our business and operating results;

●

Failure to

adequately protect our intellectual property could harm our

business and operating results;

●

We may in the

future be subject to intellectual property disputes, which are

costly to defend and could harm our business and operating

results;

●

We operate in a

highly regulated industry and are subject to a wide range of

federal, state and local laws and regulations. Failure to comply

with these laws and regulations could have a material adverse

effect on our business, results of operations and financial

condition;

●

We provide

transportation services and rely on external logistics to transport

vehicles. Thus, we are subject to business risks and costs

associated with the transportation industry. Many of these risks

and costs are out of our control, and any of them could have a

material adverse effect on our business, financial condition and

results of operations;

●

We depend on key

personnel to operate our business, and if we are unable to retain,

attract and integrate qualified personnel, our ability to develop

and successfully grow our business could be harmed;

●

We may acquire

other companies or technologies, which could divert our

management's attention, result in additional dilution to our

stockholders and otherwise disrupt our operations and harm our

operating results;

●

We may be unable to

realize the anticipated synergies related to the acquisition of the

Wholesale Entities(as defined below) (the "Acquisitions), which

could have a material adverse effect on our business, financial

condition and results of operations;

●

We may be unable to

successfully integrate Wholesale, Inc.'s and Wholesale Express,

LLC's (together, the "Wholesale Entities") business and realize the

anticipated benefits of the Acquisitions;

●

Our business

relationships, those of the Wholesale Entities or the combined

company may be subject to disruption due to uncertainty associated

with the Acquisitions;

●

If we are unable to

maintain effective internal control over financial reporting for

the combined companies, we may fail to prevent or detect material

misstatements in our financial statements, in which case investors

may lose confidence in the accuracy and completeness of our

financial statements;

●

The Wholesale

Entities may have liabilities that are not known, probable or

estimable at this time;

●

As a result of the

Acquisitions, we and the Wholesale Entities may be unable to retain

key employees;

●

The trading price

for our Class B Common Stock may be volatile and could be subject

to wide fluctuations in per share price;

●

Our principal

stockholders and management own a significant percentage of our

stock and an even greater percentage of the Company's voting power

and will be able to exert significant control over matters subject

to stockholder approval;

●

If securities or

industry analysts do not publish research or reports about our

business, or if they issue an adverse or misleading opinion

regarding our stock, our stock price and trading volume could

decline;

●

Because our Class B

Common Stock may be deemed a low-priced "penny" stock, an

investment in our Class B Common Stock should be considered high

risk and subject to marketability restrictions;

●

A significant

portion of our total outstanding shares of Class B Common Stock is

restricted from immediate resale but may be sold into the market in

the near future. This could cause the market price of our Class B

Common Stock to drop significantly, even if our business is doing

well;

●

We do not currently

or for the foreseeable future intend to pay dividends on our common

stock;

●

We are an "emerging

growth company" under the JOBS Act of 2012, and we cannot be

certain if the reduced disclosure requirements applicable to

emerging growth companies will make our common stock less

attractive to investors;

●

Even if we no

longer qualify as an "emerging growth company," we may still be

subject to reduced reporting requirements so long as we are

considered a "smaller reporting company";

●

If we fail to

maintain an effective system of internal control over financial

reporting, we may not be able to accurately report our financial

results or prevent fraud. As a result, stockholders could lose

confidence in our financial and other public reporting, which would

harm our business and the trading price of our common

stock;

●

Anti-takeover

provisions may limit the ability of another party to acquire us,

which could cause our stock price to decline; and

●

other

risks and uncertainties detailed in this report;

Forward-looking

statements may appear throughout this prospectus, including without

limitation, the following sections: “Risk Factors” and

“Overview”. Forward-looking statements generally can be

identified by words such as “anticipates,”

“believes,” “estimates,”

“expects,” “intends,” “plans,”

“predicts,” “projects,” “will

be,” “will continue,” “will likely

result,” and similar expressions. These forward-looking

statements are based on current expectations and assumptions that

are subject to risks and uncertainties, which could cause our

actual results to differ materially from those reflected in the

forward-looking statements. Factors that could cause or contribute

to such differences include, those discussed in this Registration

Statement on Form S-3, and in particular, the risks discussed under

the caption “Risk Factors” and those discussed in other

documents we file with the SEC. We undertake no obligation to

revise or publicly release the results of any revision to these

forward-looking statements, except as required by law. Given these

risks and uncertainties, readers are cautioned not to place undue

reliance on such forward-looking statements.

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of the shares of Class

B Common Stock by the selling stockholders but will receive

proceeds from the exercise of the Warrants if the Warrants are

exercised, which proceeds will be used for working capital and

other general corporate purposes.

SELLING

STOCKHOLDERS

The

following table provides information about the selling

stockholders, listing how many shares of our Class B Common Stock

the selling stockholders own on the date of this prospectus, how

many shares may be offered by this prospectus, and the number and

percentage of outstanding shares the selling stockholders will own

after the offering, assuming all shares covered by this prospectus

are sold. The information concerning beneficial ownership has been

provided by the selling stockholders. Information concerning the

selling stockholders may change from time to time, and any changed

information will be set forth if and when required in prospectus

supplements or other appropriate forms permitted to be used by the

SEC.

We

do not know when or in what amounts the selling stockholders may

offer shares for sale. The selling stockholders may choose not to

sell any or all of the shares offered by this prospectus. Because

the selling stockholders may offer all or some of the shares, and

because there are currently no agreements, arrangements or

understandings with respect to the sale of any of the shares, we

cannot accurately report the number of the shares that will be held

by the selling stockholders after completion of the offering.

However, for purposes of this table, we have assumed that, after

completion of the offering, all of the shares covered by this

prospectus will be sold by the selling stockholders.

The number of shares outstanding, and the

percentage of beneficial ownership, post-offering are based on

24,437,051

shares of Class B

Common Stock issued and outstanding as of the conclusion of the

offering, calculated on the basis of (i) 21,987,120 shares of

Class B Common Stock issued and outstanding as of May 23, 2019

prior to the offering, (ii) assuming the exercise and sale by the

selling stockholders of the 9,573 shares of Class B Common Stock

underlying the Warrants, (iii) assuming the conversion and sale by

the selling stockholders of the 390,358 shares of Class B Common

Stock underlying the Autosport Notes and (iv) assuming the issuance

of the 150,000 Earn-out Shares. For the purposes of the following

table, the number of shares of Class B Common Stock beneficially

owned has been determined in accordance with Rule 13d-3 under the

Securities Exchange Act of 1934 (the “Exchange Act”),

and such information is not necessarily indicative of beneficial

ownership for any other purpose. Under Rule 13d-3, beneficial

ownership includes any shares as to which the selling stockholders

have sole or shared voting power or investment power and also any

shares which each selling shareholder, respectively, has the right

to acquire within 60 days of the date of this prospectus through

the exercise of any stock option, warrant or other

rights.

|

Name

of Selling Stockholders

|

Shares

of Class B Common Stock Owned Before the Offering

|

Shares

of Class B

Common

Stock to be Offered

for

the Selling Stockholder’s

Account

|

Shares

of Class B Common Stock Owned by the Selling Stockholder after the

Offering

|

Percent

of Class B Common Stock to be Owned by the Selling Stockholder

after the Offering

|

|

Beja,

Andrew

|

4,532

|

4,532

|

-

|

*

|

|

Bennie, Scott

.

(1)

|

540,358

|

540,358

|

-

|

*

|

|

BIV-Granahan

|

9,376

|

9,376

|

-

|

*

|

|

Black,

Archie

|

6,116

|

6,116

|

-

|

*

|

|

Chilton

Trust Select Equity Fund, LP

|

25,810

|

25,810

|

-

|

*

|

|

Chrispus

Holdings III LLC

|

917

|

917

|

-

|

*

|

|

European

Organization for Nuclear Research (CERN)

|

239,700

|

239,700

|

-

|

*

|

|

GIM

Small Cap Advantage Strategy

|

674,700

|

674,700

|

-

|

*

|

|

Granahan

US Focused Growth Fund UCITS

|

425,800

|

425,800

|

-

|

*

|

|

GSD

Revocable Trust 2011

|

7,082

|

7,082

|

-

|

*

|

|

Guava

Plum Ltd.

|

8,326

|

8,326

|

-

|

*

|

|

Hardacre

Holdings II LLC

|

1,184

|

1,184

|

-

|

*

|

|

Hazard

Family Foundation

|

749

|

749

|

-

|

*

|

|

Hazard

Limited Partnership

|

6,504

|

6,504

|

-

|

*

|

|

Hercules Capital, Inc

.

(2)

|

9,573

|

9,573

|

-

|

*

|

|

Hoehl

Family Foundation

|

4,387

|

4,387

|

-

|

*

|

|

IRIS,

Inc.

|

261,500

|

261,500

|

-

|

*

|

|

Momentum

Global Investment Management, Ltd

|

115,050

|

115,050

|

-

|

*

|

|

National

Insurance Board, Barbados

|

10,667

|

10,667

|

-

|

*

|

|

USAA

Small Cap Stock Fund

|

97,600

|

97,600

|

-

|

*

|

*

Less than one percent.

(1)

Represents shares of Class B Common Stock underlying Autosport

Notes and the Earn-out Shares, as described below.

(2)

Represents shares of Class B Common Stock underlying the Warrant,

as described below.

None

of the selling stockholders has, or within the past three years has

had, any position, office or material relationship with us or any

of our predecessors or affiliates, except as follows:

●

On

April 30, 2018, the Company, Existing Borrowers, Lender and Agent,

entered into the Loan and Security Agreement pursuant to

which Hercules may provide one or more term loans in an aggregate

principal amount of up to $15 million (the "Loan"). Under the terms

of the Loan Agreement, $5.0 million was funded at closing with the

balance available in two additional tranches over the term of the

Loan Agreement, subject to certain operating targets and otherwise

as set forth in the Loan Agreement. On May 14, 2019, the Company

made a payment to Hercules of $11,134,696, representing the

principal, accrued and unpaid interest, fees, costs and expenses

outstanding under the Loan and Security Agreement. Upon the

payment, all outstanding indebtedness and obligations of the

Company owed to Hercules under the Loan and Security Agreement were

paid in full, and the Loan and Security Agreement has been

terminated.

Under

the Loan Agreement, on April 30, 2018, the Company issued Hercules

the April 2018 Warrant to purchase 81,818 (increasing to 109,091 if

a fourth tranche in the principal amount of up to $5.0 million is

advanced at the parties agreement) shares of the Company’s

Class B Common Stock at an exercise price of $5.50 per share. In

connection with the Private Placement, the exercise price of the

warrant, dated April 30, 2018, issued to Hercules Capital, Inc.

(the "April 2018 Warrant") was adjusted to $5.4648 and the number

of shares of Class B Common Stock underlying the April 2018 Warrant

was adjusted to 82,342. The April 2018 Warrant is immediately

exercisable and expires on April 30, 2023.

If at any time

before April 30, 2019, the Company made a New Issuance (as defined

below) for no consideration or for a consideration per share less

than the warrant price in effect immediately before the New

Issuance or the consideration for an issuance is later adjusted

downward with certain exceptions as set forth in the April 2018

Warrant, then the warrant price would have been reduced to an

amount equal to the lower consideration price or adjusted exercise

price or conversion price (the “New Issuance

Price”). If at any time after April 30, 2019, the

Company makes a Dilutive Issuance (as defined below), then the

warrant price will be reduced to the amount computed using the

following formula: A*[(C+D)/B]. For purposes of this

formula, (i) A represents the warrant price in effect immediately

before the Dilutive Issuance, (ii) B represents the number of

shares of common stock outstanding immediately after the New

Issuance (on a fully-diluted basis), (iii) C represents the number

of shares of common stock outstanding immediately before the New

Issuance (on a fully-diluted basis), and (iv) D represents the

number of shares of common stock that would be issuable for total

consideration to be received for the New Issuance if the purchaser

paid the warrant price in effect immediately prior to the New

Issuance. New Issuance shall mean (A) any issuance or sale by

the Company of any class of shares of the Company (including the

issuance or sale of any shares owned or held by or for the account

of the Company) other than certain excluded securities as set forth

in the April 2018 Warrant, (B) any issuance or sale by the Company

of any options, rights or warrants to subscribe for any class of

shares of the Company other than certain excluded securities as set

forth in the April 2018 Warrant, or (C) the issuance or sale of any

securities convertible into or exchangeable for any class of shares

of the Company other than certain excluded securities as set forth

in the April 2018 Warrant.

●

On

October 30, 2018 (the “Closing Date”), the Company,

Borrowers, Lender, and Agent, entered into the Amendment, amending

the Loan and Security Agreement, by and among the Existing

Borrowers, Lender and Agent. On May 14, 2019, the Company made a

payment to Hercules of $11,134,696, representing the principal,

accrued and unpaid interest, fees, costs and expenses outstanding

under the Loan and Security Agreement. Upon the payment, all

outstanding indebtedness and obligations of the Company owed to

Hercules under the Loan and Security Agreement were paid in full,

and the Loan and Security Agreement has been

terminated.

On the Closing Date, the Company issued to Lender

the warrant to purchase 20,950 shares of the Company’s Class

B Common Stock at an exercise price of $7.16 per share. In

connection with the February 2019 offering, the exercise price of

the October 2018 Warrant was adjusted to $5.55 and the number of

shares of Class B Common Stock underlying the October 2018 Warrant

was adjusted to 27,026.

In connection with the Private

Placement, the exercise price of the October 2018 Warrant was

further adjusted to $5.00 and the number of shares of Class B

Common Stock underlying October 2018 Warrant was adjusted to

29,999.

The October 2018 Warrant is

immediately exercisable and expires on October 30,

2023.

If at any time

before October 30, 2019, the Company makes a New Issuance (as

defined below) for no consideration or for a consideration per

share less than the warrant price in effect immediately before the

New Issuance (a “Dilutive Issuance”) or the

consideration for an issuance is later adjusted downward with

certain exceptions as set forth in the October 2018 Warrant, then

the warrant price will be reduced to an amount equal to the lower

consideration price or adjusted exercise price or conversion price

(the “New Issuance Price”). If at any time after

October 30, 2019, the Company makes a Dilutive Issuance, then the

warrant price will be reduced to the amount computed using the

following formula: A*[(C+D)/B]. For purposes of this formula, (i) A

represents the warrant price in effect immediately before the

Dilutive Issuance, (ii) B represents the number of shares of common

stock outstanding immediately after the New Issuance (on a

fully-diluted basis), (iii) C represents the number of shares of

common stock outstanding immediately before the New Issuance (on a

fully-diluted basis), and (iv) D represents the number of shares of

common stock that wouldbe issuable for total consideration to be

received for the New Issuance if the purchaser paid the warrant

price in effect immediately prior to the New Issuance. New Issuance

shall mean (A) any issuance or sale by the Company of any class of

shares of the Company (including the issuance or sale of any shares

owned or held by or for the account of the Company) other than

certain excluded securities as set forth in the October 2018

Warrant, (B) any issuance or sale by the Company of any options,

rights or warrants to subscribe for any class of shares of the

Company other than certain excluded securities as set forth in the

October 2018 Warrant, or (C) the issuance or sale of any securities

convertible into or exchangeable for any class of shares of the

Company other than certain excluded securities as set forth in the

October 2018 Warrant.

●

As

discussed in the Recent Developments section of this prospectus,

Scott Bennie was the Seller in the Acquisition of

Autosport.

PLAN

OF DISTRIBUTION

Selling Stockholders

We are registering

the shares of Class B Common Stock to permit the resale of these

shares of Class B Common Stock by the holders of the Class B Common

Stock from time to time after the date of this prospectus. We will

not receive any of the proceeds from the sale by the selling

stockholders of the shares of Class B Common Stock but will receive

proceeds from the exercise of the Warrants if the Warrants are

exercised, which proceeds will be used for working capital and

other general corporate purposes. We will bear all fees and

expenses incident to our obligation to register the shares of Class

B Common Stock.

The selling

stockholders, or their pledgees, donees, transferees, or any of

their successors in interest selling shares received from a named

selling stockholder as a gift, partnership distribution or other

non-sale-related transfer after the date of this prospectus (all of

whom may be selling stockholders), may sell the securities from

time to time on any stock exchange or automated interdealer

quotation system on which the securities are listed, in the

over-the-counter market, in privately negotiated transactions or

otherwise, at fixed prices that may be changed, at market prices

prevailing at the time of sale, at prices related to prevailing

market prices or at prices otherwise negotiated. The selling

stockholders may sell the securities by one or more of the

following methods, without limitation:

(a)

block

trades in which the broker or dealer so engaged will attempt to

sell the securities as agent but may position and resell a portion

of the block as principal to facilitate the

transaction;

(b)

underwritten

transactions;

(c)

purchases

by a broker or dealer as principal and resale by the broker or

dealer for its own account pursuant to this

prospectus;

(d)

an

exchange distribution in accordance with the rules of any stock

exchange on which the securities are listed;

(e)

ordinary

brokerage transactions and transactions in which the broker

solicits purchases;

(f)

privately

negotiated transactions;

(h)

through

the writing of options on the securities, whether or not the

options are listed on an option exchange;

(i)

through

the distribution of the securities by any selling stockholder to

its partners, members or stockholders;

(j)

one

or more underwritten offerings on a firm commitment or best efforts

basis; or

(k)

any

combination of any of these methods of sale.

The selling

stockholders may also transfer the securities by gift. We do not

know of any arrangements by the selling stockholders for the sale

of any of the securities. The selling stockholders may engage

brokers and dealers, and any brokers or dealers may arrange for

other brokers or dealers to participate in effecting sales of the

securities. These brokers, dealers or underwriters may act as

principals, or as an agent of a selling stockholder. Broker-dealers

may agree with a selling stockholder to sell a specified number of

the securities at a stipulated price per security. If the

broker-dealer is unable to sell securities acting as agent for a

selling stockholder, it may purchase as principal any unsold

securities at the stipulated price. Broker-dealers who acquire

securities as principals may thereafter resell the securities from

time to time in transactions in any stock exchange or automated

interdealer quotation system on which the securities are then

listed, at prices and on terms then prevailing at the time of sale,

at prices related to the then-current market price or in negotiated

transactions. Broker-dealers may use block transactions and sales

to and through broker-dealers, including transactions of the nature

described above. The selling stockholders may also sell the

securities in accordance with Rule 144 under the Securities Act of

1933, as amended, rather than pursuant to this prospectus,

regardless of whether the securities are covered by this

prospectus.

From time to time,

one or more of the selling stockholders may pledge, hypothecate or

grant a security interest in some or all of the securities owned by

them. The pledgees, secured parties or persons to whom the

securities have been hypothecated will, upon foreclosure in the

event of default, be deemed to be selling stockholders. The number

of a selling stockholder’s securities offered under this

prospectus will decrease as and when it takes such actions. The

plan of distribution for that selling stockholder’s

securities will otherwise remain unchanged. In addition, a selling

stockholder may, from time to time, sell the securities short, and,

in those instances, this prospectus may be delivered in connection

with the short sales and the securities offered under this

prospectus may be used to cover short sales.

To the extent

required under the Securities Act of 1933, the aggregate amount of

selling stockholders’ securities being offered and the terms

of the offering, the names of any agents, brokers, dealers or

underwriters and any applicable commission with respect to a

particular offer will be set forth in an accompanying prospectus

supplement. Any underwriters, dealers, brokers or agents

participating in the distribution of the securities may receive

compensation in the form of underwriting discounts, concessions,

commissions or fees from a selling stockholder and/or purchasers of

selling stockholders’ securities of securities, for whom they

may act (which compensation as to a particular broker-dealer might

be in excess of customary commissions).

The selling

stockholders and any underwriters, brokers, dealers or agents that

participate in the distribution of the securities may be deemed to

be “underwriters” within the meaning of the Securities

Act of 1933, and any discounts, concessions, commissions or fees

received by them and any profit on the resale of the securities

sold by them may be deemed to be underwriting discounts and

commissions.

We have entered

into registration rights agreements for the benefit of the selling

stockholders to register the shares of Class B Common Stock under

applicable federal and state securities laws under specific

circumstances and at specific times. The registration rights

agreements provide for indemnification of the selling stockholders

against specific liabilities in connection with the offer and sale

of the shares of Class B Common Stock, including liabilities under

the Securities Act of 1933.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information

into this prospectus, which means that we can disclose important

information about us by referring to another document filed

separately with the SEC. The information incorporated by reference

is considered to be a part of this prospectus. This prospectus

incorporates by reference the documents and reports listed below

other than portions of these documents that are furnished under

Item 2.02 or Item 7.01 of a Current Report on Form

8–K:

●

The Annual Report

on Form 10–K for the fiscal year ended December 31, 2018,

filed on April 1, 2019, 2019;

●

Our Quarterly

Report on Form 10-Q for the quarter ended March 31, 2019, filed

with the SEC on May 15, 2019;

●

The Current Reports

on Form 8–K filed on January 14, 2019 (Form 8-K/A), January

28, 2019, February 4, 2019, February 6, 2019, February 7, 2019,

February 11, 2019, May 9, 2019, May 10, 2019, May 15, 2019 and May

22, 2019; and

●

The description of

the Company’s common stock contained in the Company’s

Registration Statement on Form 8-A, filed with the SEC on October

18, 2017.

In

addition, all documents subsequently filed by us pursuant to

Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, shall be

deemed to be incorporated by reference in this prospectus and to be

a part hereof from the date of filing of such documents. In

addition, all reports and other documents filed by us pursuant to

the Exchange Act after the date of the initial registration

statement and prior to effectiveness of the registration statement

shall be deemed to be incorporated by reference into this

prospectus. Any statement contained in a document incorporated or

deemed to be incorporated by reference herein shall be deemed to be

modified or superseded for purposes of this prospectus to the

extent that a statement contained herein or in any subsequently

filed document that also is or is deemed to be incorporated by

reference herein, as the case may be, modifies or supersedes such

statement. Any such statement so modified or superseded shall not

be deemed, except as so modified or superseded, to constitute a

part of this prospectus.

We

will provide, without charge, to any person, including any

beneficial owner, to whom a copy of this prospectus is delivered,

upon oral or written request of such person, a copy of any or all

of the documents that have been incorporated by reference in this

prospectus but not delivered with the prospectus, including any

exhibits to such documents that are specifically incorporated by

reference in those documents.

Please

make your request by writing or telephoning us at the following

address or telephone number:

RumbleOn,

Inc.

1350

Lakeshore Drive, Suite 160

Coppell,

Texas 75019

Attention:

Investor Relations

Tel:

(469) 250-1185

WHERE

YOU CAN FIND MORE INFORMATION

We are currently subject to the information

requirements of the Exchange Act and in accordance therewith file

periodic reports, proxy statements and other information with the

Securities and Exchange Commission. Our SEC filings will also be

available to you on the SEC’s website at

htt

p://www.sec.gov

.

We have filed with the SEC a

registration statement on Form S–3 under the Securities Act

for the shares of Class B Common Stock being offered by the selling

stockholders. This prospectus does not contain all of the

information in the registration statement and the exhibits and

schedules that were filed with the registration statement. For

further information with respect to us and our common stock, we

refer you to the registration statement and the exhibits that were

filed with the registration statement. Anyone may obtain the

registration statement and its exhibits and schedules from the SEC

as described above.

LEGAL

MATTERS

The

validity of the shares of Class B Common Stock offered through this

prospectus has been passed on by Akerman LLP, Fort Lauderdale,

Florida.

EXPERTS

The

consolidated financial statements and schedule of RumbleOn, Inc. as

of December 31, 2018 and December 31, 2017 and for the years then

ended incorporated by reference in this prospectus have been so

incorporated in reliance on the report of Scharf Pera & Co.,

PLLC, an independent registered public accounting firm,

incorporated herein by reference, given on the authority of said

firm as experts in auditing and accounting.

The

combined financial statements of Wholesale, Inc., which comprise

the combined balance sheets as of December 31, 2017, 2016, and 2015

and the related combined statements of income, stockholder’s

equity, and cash flows for the years then ended, and the related

notes to the combined financial statements incorporated by

reference in this prospectus have been so incorporated in reliance

on the report of Henderson, Hutcherson & McCullough, PLLC, an

independent registered public accounting firm, incorporated herein

by reference, given on the authority of said firm as experts in

auditing and accounting.

The

financial statements of Wholesale Express, LLC, which comprise the

balance sheets as of December 31, 2017 and 2016, and the related

statements of income and member’s equity, and cash flows for

the years then ended, and the related notes to the financial

statements incorporated by reference in this prospectus have been

so incorporated in reliance on the report of Henderson, Hutcherson

& McCullough, PLLC, an independent registered public accounting

firm, incorporated herein by reference, given on the authority of

said firm as experts in auditing and accounting.

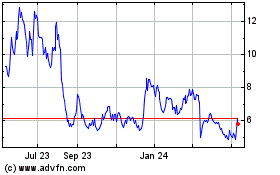

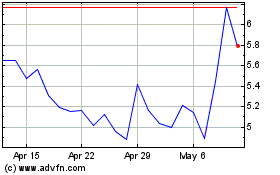

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024